Global situation of undertakings for collective investment at the end of February 2020

Press release 20/10

I. Overall situation

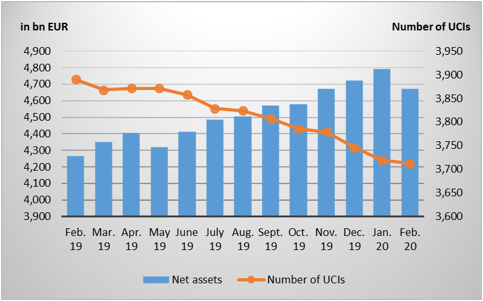

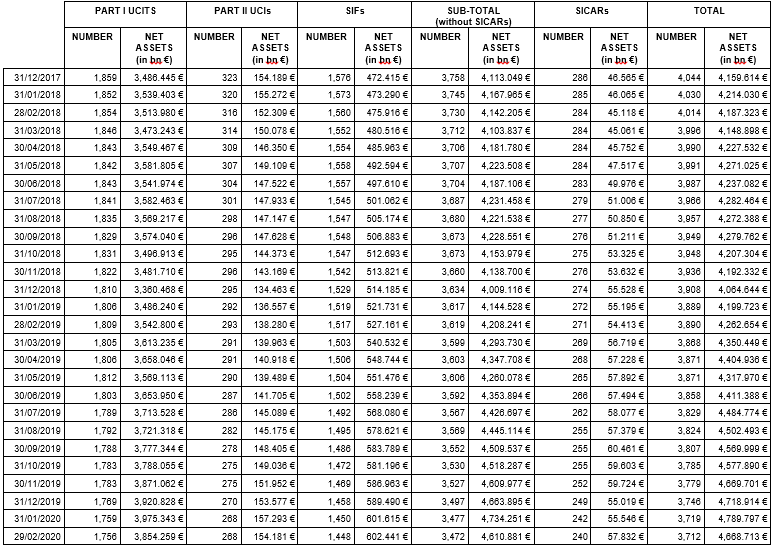

As at 29 February 2020, total net assets of undertakings for collective investment, including UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 4,668.713 billion compared to EUR 4,789.797 billion as at 31 January 2020, i.e. a 2.53% decrease over one month. Over the last twelve months, the volume of net assets rose by 9.53%.

The Luxembourg UCI industry registered a negative variation amounting to EUR 121.084 billion during the month of February. This decrease results from the balance of positive net issues of EUR 13.284 billion (+0.28%) and a negative development in financial markets of EUR 134.368 billion (2.81%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,712 as against 3,719 in the previous month. A total of 2,432 entities adopted an umbrella structure, which represented 13,518 sub-funds. When adding the 1,280 entities with a traditional structure to that figure, a total of 14,798 fund units were active in the financial centre.

As regards, on the one hand, the impact of financial markets on the main categories of undertakings for collective investment and, on the other hand, the net capital investment in these UCIs, the following can be said about January.

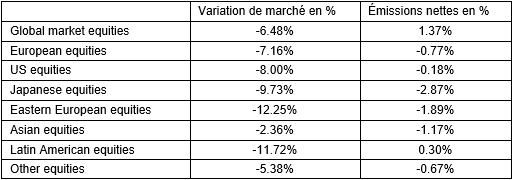

The spread of the coronavirus outside China and the attendant risks for the global growth depressed the financial markets, with all equity UCI categories decreasing.

As far as developed countries are concerned, the European equity UCI category slipped into the red amid fear that the epidemic could plunge the euro area economies into recession in a context of fragile macroeconomic figures. Concerns among investors about the risks of global spread of the coronavirus for international supply chains and global growth have manifested themselves in price losses in US equity UCIs. Within the context of COVID-19 and disappointing Japanese macroeconomic figures in the fourth quarter, Japanese equity UCIs recorded a highly negative performance during the month under review.

In respect of emerging countries, concerns regarding the possible impact that the spread of the coronavirus epidemic could have on the global growth, the fall in raw material prices, the depreciation of most emerging currencies as well as specific problems of some emerging countries account for the heavy losses in Eastern European and Latin American equity UCIs. All in all, Asian equity UCIs registered a more moderate price decline, mainly due to the slowing of the epidemic spread in China and to the support measures initiated by the Chinese government.

In February, the equity UCI categories registered overall slightly positive net capital investment.

Development of equity UCIs during the month of February 2020*

* Variation in % of Net Assets in EUR as compared to the previous month

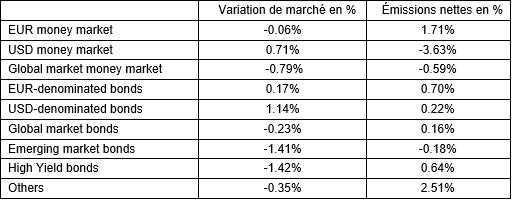

On both sides of the Atlantic, high-rated government bonds have appreciated as a consequence of a rising risk aversion by investors looking for safe-haven investments in a context marked by concerns about the potential impact of the coronavirus epidemic on the global growth and global supply chains. However, the prices of low-rated euro area government bonds dropped, so that in the euro area the yield spreads widened between high-rated government bonds and low-rated government bonds. Risk premiums of private corporate bonds also increased overall. In short, the EUR-denominated and USD-denominated bond UCIs performed positively as the appreciation of the USD against the EUR has led to increases in the category of USD-denominated bond UCIs.

Emerging countries bond UCIs depreciated in the face of investors’ preferences for safe-haven assets, the rise in risk premiums and the depreciation of most emerging currencies.

In February, fixed-income UCIs registered an overall positive net capital investment. It should be noted that USD-denominated money market funds experienced large redemptions during the month under review.

Development of fixed-income UCIs during the month of February 2020*

* Variation in % of Net Assets in EUR as compared to the previous month

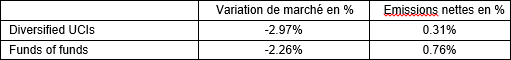

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of February 2020*

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following 11 undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- ELEVATION FUND SICAV, 6, rue Lou Hemmer, L-1748 Senningerberg

UCIs Part II 2010 Law:

- AZ ELTIF, 35, avenue Monterey, L-2163 Luxembourg

SIFs:

- AB COMMERCIAL REAL ESTATE DEBT FEEDER FUND IV, SICAV-SIF S.C.SP., 2-4 rue Eugène Ruppert, L-2453 Luxembourg

- AB COMMERCIAL REAL ESTATE DEBT FUND IV, SICAV-SIF S.C.SP., 2-4 rue Eugène Ruppert, L-2453 Luxembourg

- AB COMMERCIAL REAL ESTATE DEBT SECONDARY MARKET FUND IV, SICAV-SIF S.C.SP., 2-4 rue Eugène Ruppert, L-2453 Luxembourg

- ATLANTE INFRA LUX SCA SICAV-SIF, 4, rue Jean-Pierre Brasseur, L-1258 Luxembourg

- IRAF S.C.A. SICAV-SIF, 6, rue Adolphe, L-1116 Luxembourg

- OREIMA III, 1, rue Hildegard von Bingen, L-1282 Luxembourg

- UC GROUP WEALTH MANAGEMENT OPPORTUNITIES SCS SICAV-SIF, 8, rue Lou Hemmer, L-1748 Senningerberg

SICARs:

- CAPMAN LYNX SCA, SICAR, 15, boulevard F.W. Raiffeisen, L-2411 Luxembourg

- CEP V PARTICIPATIONS S.À R.L., SICAR, 2, avenue Charles de Gaulle, L-1653 Luxembourg

The following 18 undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- ALLIANZ GLOBAL INVESTORS OPPORTUNITIES, 6A, route de Trèves, L-2633 Senningerberg

- ALLTRUST 50, 15, rue de Flaxweiler, L-6776 Grevenmacher

- ARCAM SICAV, 44, rue de la Vallée, L-2661 Luxembourg

- CMM, 14, Porte de France, L-4360 Esch-sur-Alzette

UCIs Part II 2010 Law:

- UNICAPITAL INVESTMENTS IV, 40, avenue Monterey, L-2163 Luxembourg

SIFs:

- ASSENAGON GLOBAL VOLATILITY, 1B, Heienhaff, L-1736 Senningerberg

- ASTER GROWTH SICAV-SIF S.A., 2-8, avenue Charles de Gaulle, L-1653 Luxembourg

- AUGUR FIS, 9A, rue Gabriel Lippmann, L-5365 Munsbach

- BAXKET FUND S.A. SICAV-SIF, 25A, boulevard Royal, L-2449 Luxembourg

- ELARA GLOBAL FUNDS, 2, boulevard de la Foire, L-1528 Luxembourg

- GAMLA LIV INTERNATIONAL REAL ESTATE FUND, 33, rue de Gasperich, L-5826 Howald-Hesperange

- HARRISON STREET CORE PROPERTY FUND B S.C.S., SICAV-SIF, 5, rue Heienhaff, L-1736 Senningerberg

- SCHRODER REAL ESTATE FUND OF FUNDS, 5, Heienhaff, L-1736 Senningerberg

- SEB PRIVATE EQUITY FUND SICAV-SIF, 4, rue Peternelchen, L-2370 Howald

SICARs:

- ELEMENT POWER CAPITAL S.C.A. SICAR, 2, boulevard de la Foire, L-1528 Luxembourg

- MAT S.A., SICAR, 42, rue de la Vallée, L-2661 Luxembourg

- VESALIUS BIOCAPITAL I INVESTMENTS S.A. SICAR, 8, rue Lou Hemmer, L-1748 Luxembourg-Findel

- VESALIUS BIOCAPITAL I S.A. SICAR, 8, rue Lou Hemmer, L-1748 Luxembourg-Findel