Situation globale des organismes de placement collectif à la fin du mois de mai 2022 (uniquement en anglais)

Communiqué de presse 22/15

I. Overall situation

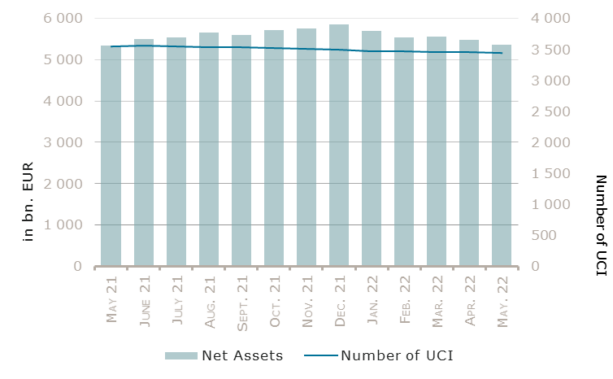

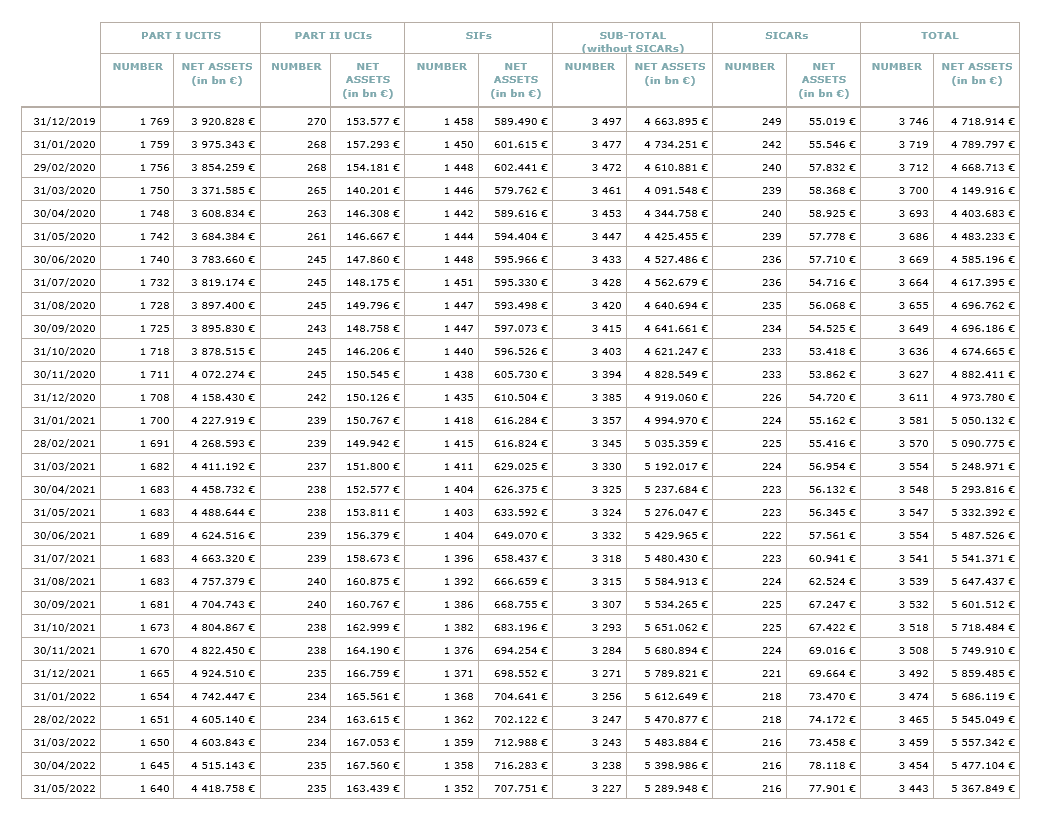

As at 31 May 2022, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 5,367.849 billion compared to EUR 5,477.104 billion as at 30 April 2022, i.e. a decrease of 1.99% over one month. Over the last twelve months, the volume of net assets rose by 0.66%.

The Luxembourg UCI industry thus registered a negative variation amounting to EUR 109.255 billion in May. This decrease represents the sum of negative net capital investments of EUR 17.346 billion (-0.32%) and of the negative development of financial markets amounting to EUR 91.909 billion (-1.68%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,443, against 3,454 the previous month. A total of 2,256 entities adopted an umbrella structure representing 13,205 sub-funds. Adding the 1,187 entities with a traditional UCI structure to that figure, a total of 14,392 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of May.

The financial market activity was weakened by the persistence of the inflation tensions, the continuing Ukraine crisis, the Chinese lockdown policy and its impact on supply chains.

Concerning developed markets, the European equity UCI category registered a negative performance, reflecting the fall-back of most confidence indicators, the uncertainty associated to the still rising inflation, the potential consequences of the European partial ban on imports of Russian oil. The US equity UCI category similarly receded, due to the decline in consumer confidence, a deceleration of the activity in both industry and services, and to record inflation. The Japanese equity UCI category, on the basis of positive corporate results recorded a slightly positive performance which was offset by the depreciation of the JPY against the EUR.

As for emerging countries, the Asian equity UCI category overall realised a negative performance in May in consequence of market decline in India, Indonesia, Malaysia and Singapore, despite the positive market performances in China and South Korea in a context of progressive easing of the COVID-19 restrictions.

The Eastern European equity UCI category realised a negative performance due to the lasting Ukraine crisis and due to the negative performance of some equity markets, like Hungary and despite the positive market performances in Poland and Czech Republic, and the appreciation of the Russian rouble of about 10%. The Latin American equity UCI category was the best-performing equity category in May, driven in Brazil, Peru, Chile mainly by currency appreciation and commodity export revenues.

In May, the equity UCI categories registered a negative net capital investment, mainly driven by outflows in the European and US equity UCI categories.

Development of equity UCIs during the month of May 2022*

| Market variation in % | Net issues in % | |

| Global market equities | -2.69% | -0.06% |

| European equities | -1.45% | -0.56% |

| US equities | -3.84% | -0.86% |

| Japanese equities | 0.00% | -1.60% |

| Eastern European equities | -0.80% | -0.39% |

| Asian equities | -1.11% | -0.44% |

| Latin American equities | 2.18% | -2.47% |

| Other equities | -0.18% | -0.20% |

* Variation in % of Net Assets in EUR as compared to the previous month

Although the inflation figures remained high and the monetary policy stances got relatively hawkish on both sides of the Atlantic, we could observe in May some divergence in the evolution of the yields: further rising in Europe, declining in the US.

Concerning the EUR denominated bond UCI category, government bond yields rose as the ECB confirmed that QE net purchases are likely to end in the third quarter, allowing a rate hike in July, in line with forward guidance. As for corporate markets, European Investment Grade bonds declined and the EUR denominated bond UCI category in May overall registered a negative performance.

Concerning the USD denominated bond UCI category, the Federal Reserve (“Fed”) raised its target rate by 50bp at 1 percent and announced that the downsizing of its balance sheet would start as from June. As this rate hike was to some extent anticipated by the markets, and given the deceleration of the activity, the bond price increased (the yields decreased). Overall, due to the depreciation of the USD against the EUR, the US denominated bond UCI category registered a negative performance.

The Emerging Markets bond category finished the month in negative territory in the context of persistent high inflation rates, rising interest rates and geopolitical tensions.

In May, fixed income UCI categories registered an overall negative net capital investment. The Global market bonds category recorded the highest outflows.

Development of fixed income UCIs during the month of May 2022*

| Market variation in % | Net issues in % | |

| EUR money market | -0.08% | -1.20 % |

| USD money market | -1.60% | -0.43% |

| Global money market | -0.98% | -2.18% |

| EUR-denominated bonds | -1.40% | -0.45% |

| USD-denominated bonds | -1.06% | 4.56% |

| Global market bonds | -1.71% | -0.74% |

| Emerging market bonds | -1.18% | -1.34% |

| High Yield bonds | -1.85% | -2.06% |

| Others | -1.71% | 0.69% |

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of May 2022*

| Market variation in % | Net issues in % | |

| Diversified UCIs | -1.56% | -0.27% |

| Funds of funds | -1.46% | 0.59% |

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following eight undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- ATLAS RESPONSIBLE INVESTORS SICAV, 12, rue Eugène Ruppert, L-2453 Luxembourg

- FRANKFURTER UCITS ETF, 15, rue de Flaxweiler, L-6776 Grevenmacher

- RESPONSABILITY IMPACT UCITS (LUX), 5, rue Jean Monnet, L-2180 Luxembourg

- UNINACHHALTIG AKTIEN INFRASTRUKTUR, 3, Heienhaff, L-1736 Senningerberg

- UNIZUKUNFT WELT, 3, Heienhaff, L-1736 Senningerberg

UCIs Part II 2010 Law:

- BLACKSTONE EUROPEAN PRIVATE CREDIT FUND (MASTER) FCP, 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- BLACKSTONE EUROPEAN PRIVATE CREDIT FUND SICAV, 11-13, boulevard de la Foire, L-1528 Luxembourg

SIFs:

- MGG STRATEGIC SICAF SIF S.A., 18 avenue de la Porte Neuve, L-2227 Luxembourg

The following nineteen undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- AKROBAT FUND, 15, rue de Flaxweiler, L-6776 Grevenmacher

- BNP PARIBAS PLAN, 10, rue Edward Steichen, L-2540 Luxembourg

- CIRCLE FUND, 94, rue du Kiem, L-1857 Luxembourg

- DONATELLO SICAV, 49, avenue J-F Kennedy, L-1855 Luxembourg

- EURIZON MULTIMANAGER STARS FUND, 28, boulevard Kockelscheuer, L-1821 Luxembourg

- LUXICAV, 19-21, boulevard du Prince Henri, L-1724 Luxembourg

- OLB-FONDSCONCEPTPLUS CHANCE, Bockenheimer Landstraße 42-44, 60323 Frankfurt am Main1

- OLB-FONDSCONCEPTPLUS ERTRAG, Bockenheimer Landstraße 42-44, 60323 Frankfurt am Main1

- TRUSTEAM FUNDS, 14, boulevard Royal, L-2449 Luxembourg

- YELLOW FUNDS SICAV, 60, avenue J-F Kennedy, L-1855 Luxembourg

UCIs Part II 2010 Law:

- LUXICAV PLUS, 28, boulevard Kockelscheuer, L-1821 Luxembourg

- MPF SINO, 15, rue de Flaxweiler, L-6776 Grevenmacher

SIFs:

- 4IP EUROPEAN REAL ESTATE FUND OF FUNDS, 11-13, boulevard de la Foire, L-1528 Luxembourg

- CORPORATE XII, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- EYNAV OPPORTUNITY SCA, SICAV-SIF, 111, route d’Arlon, L-8009 Strassen

- KIBO AFRICA FUND, 2, boulevard de la Foire, L-1528 Luxembourg

- ROTHORN, 12, rue Eugène Ruppert, L-2453 Luxembourg

- SICAV-FIS EUROPE LBO V PORTE NEUVE, 50, avenue J-F Kennedy, L-1855 Luxembourg

- SWISSCANTO (LU) PRIVATE DEBT FUND, FCP-SIF, 19, rue de Bitbourg, L-1273 Luxembourg

1 Undertaking for collective investment for which the designated management company was authorised by the competent authorities of another Member State in accordance with Directive 2009/65/EC.