Global situation of undertakings for collective investment at the end of January 2016

Press release 16/12

I. Overall situation

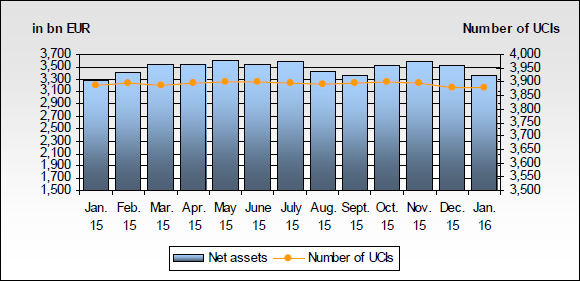

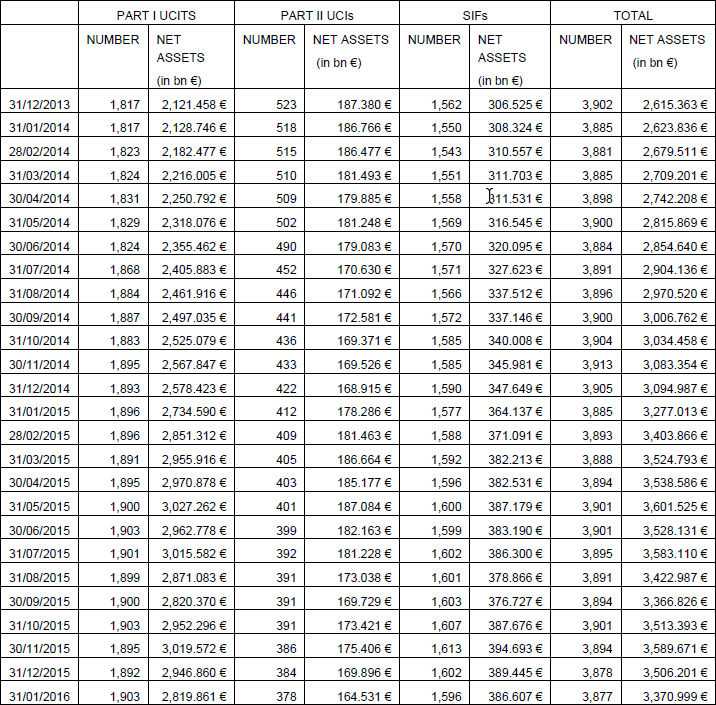

As at 31 January 2016, total net assets of undertakings for collective investment and specialised investment funds amounted to EUR 3,370.999 billion compared to EUR 3,506.201 billion as at 31 December 2015, i.e. a 3.86% decrease over one month. Over the last twelve months, the volume of net assets rose by 2.87%.

The Luxembourg UCI industry thus registered a negative variation amounting to EUR 135.202 billion in January 2016. This decrease represents the balance of the negative net issues of EUR 20.779 billion (-0.59%) and the negative development in financial markets amounting to EUR 114.423 billion (-3.27%).

The number of undertakings for collective investment (UCIs) and specialised investment funds (SIFs) taken into consideration totalled 3,877 as against 3,878 in the previous month. A total of 2,553 entities have adopted an umbrella structure, which represents 12,801 sub-funds. When adding the 1,324 entities with a traditional structure to that figure, a total of 14,125 fund units are active in the financial centre.

As regards, on the one hand, the impact of financial markets on Luxembourg UCIs and SIFs (hereafter “UCIs”) and, on the other hand, the net capital investment in these UCIs, the following can be said about January.

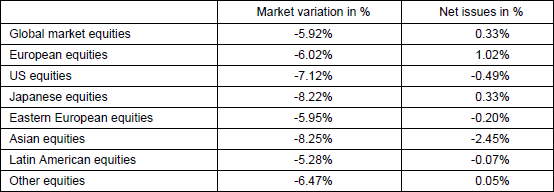

As a result of the uncertain economic development in China, which fed concerns about global economic growth, and of the substantial decrease in oil prices, all equity UCI categories registered a negative trend during the month of January. As a consequence, equity UCIs of both developed and emerging countries registered price losses, as none of these categories could avoid the impact of the developments on the international equity markets.

In January, the equity UCI categories registered an overall positive net capital investment.

Development of equity UCIs during the month of January 2016*

* Variation in % of Net Assets in EUR as compared to the previous month

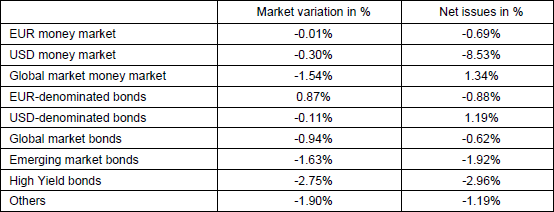

As concerns EUR-denominated bond UCIs, investors were looking for safe-haven assets (high-rated government bonds) in view of the developments on the international financial markets, as a reaction to the uncertainties linked to global economic growth. Hence, EUR-denominated government bond yields decreased and the return spreads widened between high-rated euro area countries and countries with a weak credit rating. Private bond returns followed the declining trend in government bond yields allowing an overall appreciation of EUR-denominated bond UCIs.

As concerns USD-denominated bond UCIs, investors’ risk appetite fell and the expectations of increasing key interest rates by the Fed rose due to the uncertainties linked to economic growth in China and the fears of a possible economic slowdown in the US. The strong demand for US government bonds globally led to a decrease

in returns. Considering the USD vs. EUR depreciation, USD-denominated bond UCIs nevertheless registered a slight price decrease.

The problematic economic situation of countries like China, Russia and Brazil, falling commodity prices, deteriorating credit ratings of certain countries, the depreciation of some emerging market countries as well as political and geopolitical issues generated an increase in risk premiums for the emerging countries bond UCI category, and made it close lower.

In January, fixed-income UCIs registered an overall negative net capital investment.

Development of fixed-income UCIs during the month of January 2016*

* Variation in % of Net Assets in EUR as compared to the previous month

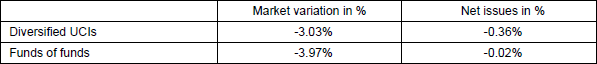

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Diversified income UCIs and funds of funds during the month of January 2016*

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and the net assets of UCIs according to Parts I and II, respectively, of the 2010 Law and of SIFs according to the 2007 Law

During the month of January, the following 39 undertakings for collective investment and specialised investment funds have been registered on the official list:

1) UCITS Part I 2010 Law:

- BARMENIA MULTI ASSET, 18, boulevard de la Foire, L-1528 Luxembourg

- BOC (EUROPE) UCITS SICAV, 5, allée Scheffer, L-2520 Luxembourg

- CANDRIAM SRI, 14, Porte de France, L-4360 Esch-sur-Alzette

- DMS UCITS PLATFORM FUND, 25-28, North Wall Quay, Dublin 1

- EMERALD EURO INVESTMENT GRADE BOND, 5, allée Scheffer, L-2520 Luxembourg

- FT ALPHA EUROPE MARKET NEUTRAL, 534, rue de Neudorf, L-2220 Luxembourg

- INVESTIN SICAV, 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- KB STAR FUNDS, 6B, route de Trèves, L-2633 Senningerberg

- MARATHON STIFTUNGSFONDS, 2, place Dargent, L-1413 Luxembourg

- MIMOSA CAPITAL SICAV, 15, avenue J-F Kennedy, L-1855 Luxembourg

- NISSAY UCITS FUNDS, 19, rue de Bitbourg, L-1273 Luxembourg

- OPAL FONDS, 2, place Dargent, L-1413 Luxembourg

- PALLADIUM FCP, 2, boulevard de la Foire, L-1528 Luxembourg

- SPARKASSE WUPPERTAL DEFENSIV, 3, rue des Labours, L-1912 Luxembourg

- TAGES INTERNATIONAL FUNDS, 60, avenue J-F Kennedy, L-1855 Luxembourg

- THE INDEPENDENT UCITS PLATFORM (LUXEMBOURG) II, 11, rue Aldringen, L-1118 Luxembourg

- TWELVE CAPITAL FUND, 5, rue Jean Monnet, L-2180 Luxembourg

- TYNDARIS INVESTMENTS, 106, route d’Arlon, L-8210 Mamer

- UNIINSTITUTIONAL EM CORPORATE BONDS LOW DURATION SUSTAINABLE, 308, route d’Esch, L-1471 Luxembourg

- WOODMAN SICAV, 5, rue Jean Monnet, L-2180 Luxembourg

2) UCIs Part II 2010 Law:

- SCHRODER GAIA II, 5, rue Höhenhof, L-1736 Senningerberg

3) SIFs:

- ALLIANZ RENEWABLE ENERGY FUND II, S.A. SICAV-SIF, 6A, route de Trèves, L-2633 Senningerberg

- AXA CORE EUROPE FUND S.C.S., SICAV-SIF, 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- BAR AI (ALTERNATIVE INVESTMENTS) 1 S.C.S, SICAV-FIS, 15, rue de Flaxweiler, L-6776 Grevenmacher

- BOSTON CAPITAL INCOME AND VALUE U.S. APARTMENT FUND, 5, rue Heienhaff, L-1736 Senningerberg

- D&L FINE ARTS S.A. SICAV-SIF, 76-78, rue de Merl, L-2146 Luxembourg

- EQUITA PRIVATE DEBT FUND, 106, route d’Arlon, L-8210 Mamer

- FONDACO LUX ALTERNATIVE S.A. SICAV SIF, 5, Allée Scheffer, L-2520 Luxembourg

- GWO SIF, 1, avenue du Bois, L-1251 Luxembourg

- HQ CAPITAL II SCS SICAV-SIF, 5, rue Heienhaff, L-1736 Senningerberg

- KARMA VENTURES I SICAV-SIF, SCS, 9, allée Scheffer, L-2520 Luxembourg

- LOMBARD ODIER FUNDS IV, 5, Allée Scheffer, L-2520 Luxembourg

- NEXT GATE FUND, 33A, avenue J-F Kennedy, L-1855 Luxembourg

- PRIVACCESS II, 50, avenue J-F Kennedy, L-1855 Luxembourg

- SILUX INVESTORS FCP-FIS, 14, rue Gabriel Lippmann, L-5365 Munsbach

- SWISS LIFE REF (LUX) GERMAN CORE REAL ESTATE SCS, SICAV-SIF, 4A, rue Albert Borschette, L-1246 Luxembourg

- SYMPHONY ALTERNATIVE INVESTMENT FUNDS SICAV-SIF, 49, avenue J-F Kennedy, L-1855 Luxembourg

- VIRTUS SICAV-SIF S.A., 5, rue Heienhaff, L-1736 Senningerberg

- VIZEO (S.A.) SICAV-SIF, 28-32, place de la Gare, L-1616 Luxembourg

The following 40 undertakings for collective investment and specialised investment funds have been deregistered from the official list in January:

1) UCITS Part I 2010 Law:

- ARTEN SICAV, 19-21, boulevard du Prince Henri, L-1724 Luxembourg

- AVIVA INVESTORS II, 2, rue du Fort Bourbon, L-1249 Luxembourg

- BCV DYNAMIC FUND, 2, place de Metz, L-1930 Luxembourg

- BCV STRATEGIC FUND, 2, place de Metz, L-1930 Luxembourg

- EASYETF, 33, rue de Gasperich, L-5826 Howald-Hesperange

- EURIZON FOCUS FORMULA AZIONI 2015 – 3, 8, avenue de la Liberté, L-1930 Luxembourg

- EURIZON FOCUS FORMULA AZIONI 2015 – 4, 8, avenue de la Liberté, L-1930 Luxembourg

- EURIZON FOCUS FORMULA AZIONI 2015 – 5, 8, avenue de la Liberté, L-1930 Luxembourg

- EURIZON FOCUS RISERVA DOC, 8, avenue de la Liberté, L-1930 Luxembourg

- PATRIMONIA INVEST, 33A, avenue J-F Kennedy, L-1855 Luxembourg

- PIMCO FUNDS: GLOBAL INVESTORS SERIES (LUXEMBOURG), 2-8, avenue Charles de Gaulle, L-1653 Luxembourg

- ROVERE SICAV, 6, place de Nancy, L-2212 Luxembourg

2) UCIs Part II 2010 Law:

- ALLIANZ PIMCO LAUFZEITFONDS EXTRA 2015, 6A, route de Trèves, L-2633 Senningerberg

- AZURE GLOBAL MICROFINANCE FUND, 5, allée Scheffer, L-2520 Luxembourg

- CENTROBANK SICAV, 11, rue Aldringen, L-1118 Luxembourg

- CORECOMMODITY STRATEGY FUND, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- GOLDEN OPPORTUNITIES, 8, rue Lou Hemmer, L-1748 Findel-Golf

- PARTNER SELECT, 4, rue Dicks, L-1417 Luxembourg

3) SIFs:

- AAA ALTERNATIVE FUND, 15, avenue J-F Kennedy, L-1855 Luxembourg

- BSI & VENTURE PARTNERS CAPITAL MANAGEMENT SCA SICAV-FIS, 412F, route d’Esch, L-1471 Luxembourg

- CAPITAL PLUS SICAV-SIF, 26, avenue de la Liberté, L-1930 Luxembourg

- CROWN PREMIUM PRIVATE EQUITY TECHNOLOGY VENTURES, 2, place Dargent, L-1413 Luxembourg

- EQUI FUTURE CHAMPIONS, 412F, route d’Esch, L-1471 Luxembourg

- ESM FUND, 64, rue Principale, L-5367 Schuttrange

- EUREKA SIF, 19-21, boulevard du Prince Henri, L-1724 Luxembourg

- EURO INVEST FUND, SICAV-FIS S.A., 11, rue Aldringen, L-1118 Luxembourg

- EUROPEAN COMMERCIAL REAL ESTATE LOANS SCS SICAF-SIF, 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- FAIR PLAY CAPITAL SICAV SIF S.A., 11, rue Aldringen, L-1118 Luxembourg

- FONDS VIAGER LIFE SA, SICAV-SIF, 42, rue de la Vallée, L-2661 Luxembourg

- IMC ASSET MANAGEMENT FUNDS, 15, rue Edward Steichen, L-2540 Luxembourg

- INCUBATION CAPITAL I, 5, rue Jean Monnet, L-2180 Luxembourg

- IPC-CAPITAL STRATEGY VII, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- IPC-CAPITAL STRATEGY XV, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- NORIS MULTI INVEST, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- PB INVEST, 5, allée Scheffer, L-2520 Luxembourg

- PRISM ASIA FUND, 64, rue Principale, L-5367 Schuttrange

- TANGIBLE ASSETS INVESTMENTS S.C.A., SICAV-SIF, 28-32, place de la Gare, L-1616 Luxembourg

- THREADNEEDLE STRATEGIC PROPERTY FUND IV LUXEMBOURG SA SICAV-SIF, 69, route d’Esch, L-1470 Luxembourg

- U.RG RENEWABLE GENERATION FUND S.C.A. SICAV-SIF, 5, rue Guillaume Kroll, L-1882 Luxembourg

- WS INVEST S.C.A., SICAV-FIS, 1C, rue Gabriel Lippmann, L-5365 Munsbach