Entities

Access the database

With Regulation of the European Parliament and of the Council on Markets in Crypto-assets, and amending Regulations (EU) No 1093/2010 and (EU) No 1095/2010 and Directives 2013/36/EU and (EU) 2019/1937 (“MiCAR”), the European Union is adopting for the first time a harmonised regulatory framework for the crypto-asset market which applies to both traditional institutions of the financial sector and new players emerging in the crypto ecosystem. These entities must meet a set of specific requirements to benefit from a regulated status recognised at European level.

MiCAR is part of the Digital Finance Package published by the European Commission on 24 September 2020 which includes other regulatory initiatives such as the Pilot Regime for market infrastructures based on distributed ledger technology (Regulation (EU) 2022/858) and DORA (Regulation (EU) 2022/2554).

By adopting MiCAR, the EU aims to bring legal certainty to the crypto-asset ecosystem and support innovation while safeguarding consumer protection, markets integrity and financial stability.

To this end, the EU establishes a harmonised framework for the issuance, offer to the public, admission to trading and provision of services related to crypto-assets in the Union.

MiCAR creates a bespoke regime for crypto-assets that are not already covered in European financial services legislation and groups them into three main categories: asset-referenced tokens (“ART”), e-money tokens (“EMT”), and other crypto-assets.

The extent of the requirements to which issuers of crypto-assets are subject depends on this classification. For example, all tokens require the notification of a white paper, whilst only ART and EMT issuers require prior approval.

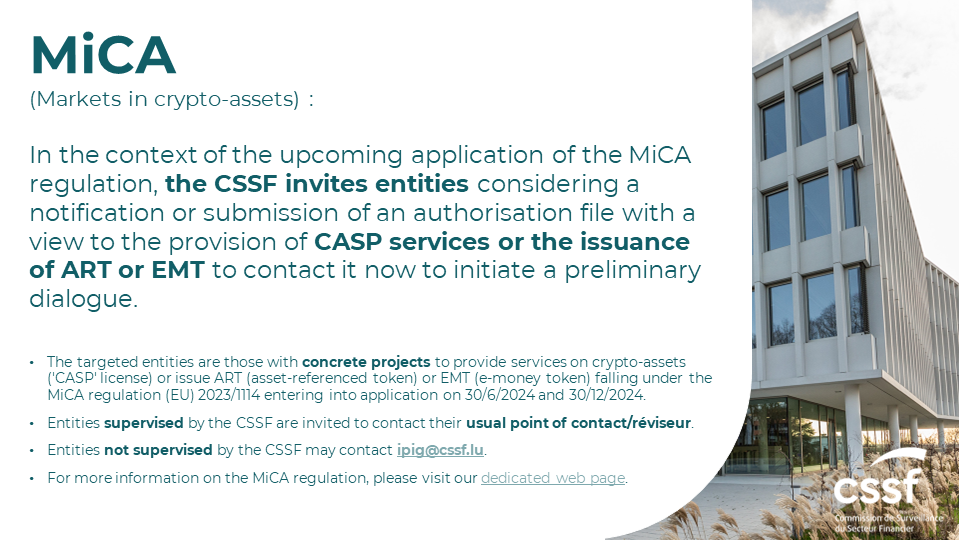

Crypto-asset service providers (“CASP”) are subject to an authorisation regime involving notably prudential and organisational requirements and consequently will be subject to a supervisory regime by the CSSF. Certain categories of entities that already have a regulated status (e.g. credit institutions, investment firms) can provide certain services on crypto-assets upon a simple notification.

The types of services that fall under the scope of MiCAR are:

MiCAR entered into force on 29 June 2023 and it will apply:

The CSSF is closely following the final steps of the adoption of MiCAR and will keep the financial sector informed of the practical implications including the procedures resulting from the regulation.

The CSSF encourages credit institutions, e-money institutions and any other undertaking (the “Issuers”) wishing to issue EMT or ART before the entry into force of MiCAR (i.e. 30 June 2024), to familiarise themselves with the provisions of Titles III and IV of MiCAR relating to the authorisation and supervision of ART/EMT by their national competent authority.

The EBA published, on 12 July 2023, a Statement on timely preparatory steps towards the application of MiCAR to asset-referenced and e-money tokens (the “EBA Statement”). For Issuers carrying out or planning to carry out ART/EMT activities before the entry into force of the relevant Titles of MiCAR, the CSSF draws such Issuers’ attention to the Annex of the EBA Statement setting out 5 guiding principles and a template for information transmission. The CSSF strongly encourages such Issuers to follow the guiding principles when offering to the public or seeking admission to trading of ART/EMT and to use the template for information transmission in order to notify the CSSF of their intention to carry out these ART/EMT activities.

In addition, the CSSF also draws the attention of such Issuers to the development by the EBA of ‘Level 2’ regulation in the form of technical standards and ‘Level 3’ guidelines and related public consultations, and in particular to the publication by the EBA, on 12 July 2023, of the following consultation papers:

Credit institutions planning to carry out ART/EMT activities before the entry into force of Titles III and IV of MiCAR are strongly encouraged to use the template above for information transmission and to send the template, along with any supporting documentation, to the email address banque@cssf.lu.

Financial institutions, other than credit institutions, planning to carry out ART/EMT activities before the entry into force of MiCAR are strongly encouraged to use the template above for information transmission and to send the template, along with any supporting documentation, to the email address ipig@cssf.lu.