Global situation of undertakings for collective investment at the end of June 2016

Press release 16/33

I. Overall situation

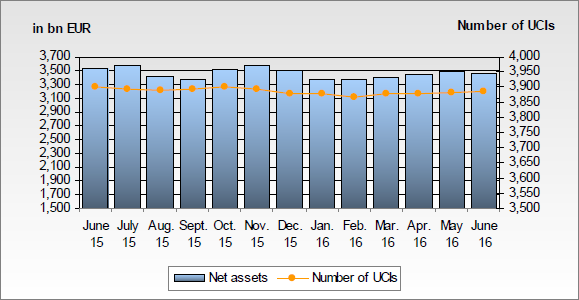

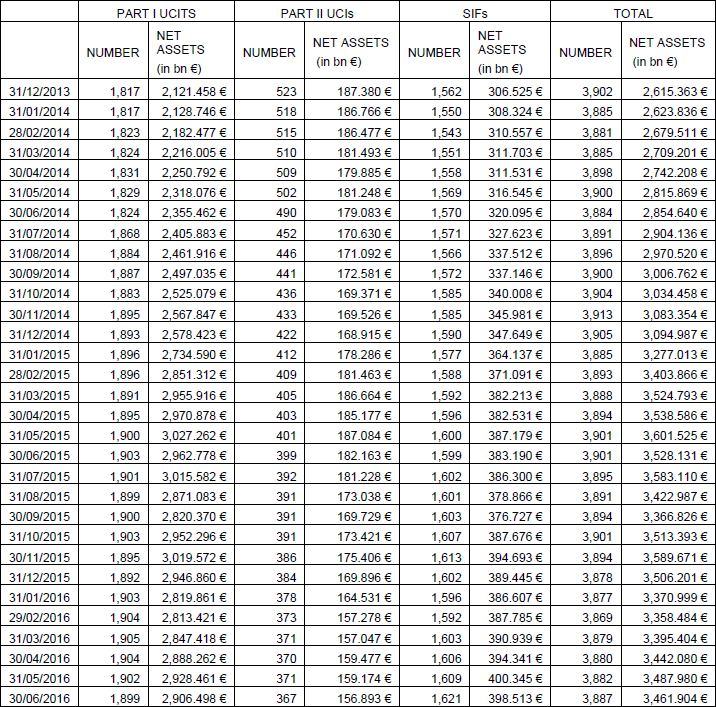

As at 30 June 2016, total net assets of undertakings for collective investment and specialised investment funds amounted to EUR 3,461.904 billion compared to EUR 3,487.980 billion as at 31 May 2016, i.e. a 0.75% decrease over one month. Over the last twelve months, the volume of net assets decreased by 1.88%.

The Luxembourg UCI industry registered a negative variation amounting to EUR 26.076 billion during the month of June. This decrease results from the positive net issues of EUR 1.047 billion (0.03%) combined with the negative development in financial markets amounting to EUR 27.123 billion (-0.78%).

The number of undertakings for collective investment (UCIs) and specialised investment funds (SIFs) taken into consideration totalled 3,887 as against 3,882 in the previous month. A total of 2,577 entities have adopted an umbrella structure, which represents 12,898 sub-funds. When adding the 1,310 entities with a traditional structure to that figure, a total of 14,208 fund units are active in the financial centre.

As regards, on the one hand, the impact of financial markets on Luxembourg UCIs and SIFs (hereafter “UCIs”) and, on the other hand, the net capital investment in these UCIs, the following can be said about June 2016.

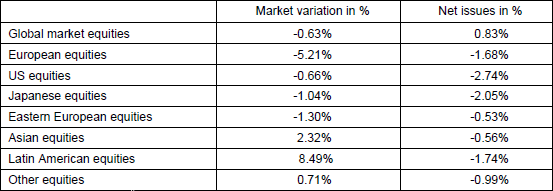

The British referendum and the unexpected result on the exit of Great Britain from the European Union heavily weighed on equity markets during the month under review although, ultimately, performance was heterogeneous from one region to another.

As far as developed countries are concerned, the European equity UCI category realised a strongly negative performance mainly due to substantial uncertainties in Europe regarding the result of the British referendum. This referendum had also an impact on American equity UCIs ending down slightly. The strong appreciation of the YEN associated with mixed economic indicators severely affected the Japanese equity UCI category, whereby stock market losses, however, were partly offset by the appreciation of the YEN against the EUR.

As regards emerging countries, the Asian equity UCI category, overall, experienced price rises due, in particular, to a stabilisation of the economic figures in China. If the Eastern European equity UCI category, against the backdrop of the British referendum result and ongoing geopolitical issues in the region, closed the month down,

the Latin American equity UCI category, for its part, strongly appreciated by taking advantage of the recovery in commodity prices and currencies of certain Latin American countries as well as improving economic data.

In June, the equity UCI categories registered an overall negative net capital investment.

Development of equity UCIs during the month of June 2016*

* Variation in % of Net Assets in EUR as compared to the previous month

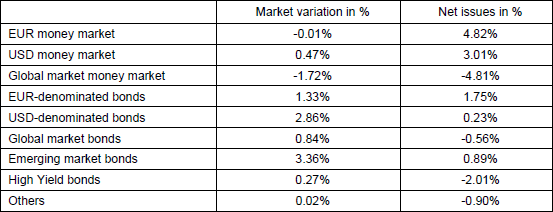

Overall, bond yields from both sides of the Atlantic decreased significantly in June.

Uncertainties in Europe regarding the British referendum, the continuation of the expansive monetary policy of the European Central Bank (ECB) with the beginning of the expansion of the asset purchase programme to debt securities issued by non-financial corporations and the first round of targeted longer-term refinancing operations, overall backed the demand for EUR-denominated government and corporate bonds entailing an increase of EUR-denominated bond UCIs.

The cautious speech of the Fed on the future rise in key interest rates in the United States and the overall mounting economic uncertainties following the British referendum led to the flattening of the rate curve in the United States and consequently to the appreciation of the USD-denominated bond UCIs during the month under review.

The bond UCI category of emerging countries developed positively in relation to the increase in commodity prices, the appreciation of certain emerging currencies as well as the unchanged key interest rates in the United States.

In June, the category of fixed-income UCIs registered an overall positive net capital investment.

Development of fixed-income UCIs during the month of June 2016*

* Variation in % of Net Assets in EUR as compared to the previous month

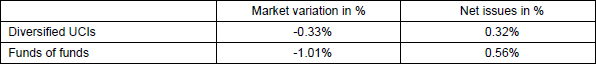

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Diversified UCIs and funds of funds during the month of June 2016*

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and the net assets of UCIs according to Parts I and II of the 2010 Law and of SIFs, respectively, according to the 2007 Law

During the month of June, the following 24 undertakings for collective investment and specialised investment funds have been registered on the official list:

1) UCITS Part I 2010 Law:

- AMUNDI INDEX SOLUTIONS, 5, allée Scheffer, L-2520 Luxembourg

- CBRE CLARION FUNDS SICAV, 5, Heienhaff, L-1736 Senningerberg

- DIAM UCITS FUND, 6B, route de Trèves, L-2633 Senningerberg

2) SIFs:

- ALPHA 4 S.A., SICAV-SIF, 15, avenue J-F Kennedy, L-1855 Luxembourg

- BCB & PARTNERS FUND, 33A, avenue J-F Kennedy, L-1855 Luxembourg

- BVK-PAN-ASIEN-IMMOBILIENFONDS, 15, rue de Flaxweiler, L-6776 Grevenmacher

- CHENAVARI EUROPEAN PRIVATE DEBT OPPORTUNITIES FUND SCS SICAV SIF, 2, boulevard de la Foire, L-1528 Luxembourg

- CHINA TECH SICAV-SIF SCSP, 412F, route d’Esch, L-1471 Luxembourg

- DEVON GLOBAL ALLOCATION FUND, 33A, avenue J-F Kennedy, L-1855 Luxembourg

- DRED SICAV-FIS, 4A, rue Albert Borschette, L-1246 Luxembourg

- FIPA II S.C.A., SICAV-SIF, 75, Parc d’activités, L-8308 Capellen

- FRANKLIN TEMPLETON SPECIALISED INVESTMENT FUNDS, 8A, rue Albert Borschette, L-1246 Luxembourg

- INTERLAGOS, 15, rue de Flaxweiler, L-6776 Grevenmacher

- LBBW KF FCP-FIS, 15, rue de Flaxweiler, L-6776 Grevenmacher

- LUXRA SCS, SICAV-FIS, 15, rue de Flaxweiler, L-6776 Grevenmacher

- NIAM NORDIC CORE-PLUS II, 1, rue Jean-Pierre Brasseur, L-1258 Luxembourg

- PANTHEON ACCESS (LUXEMBOURG) SLP SICAV SIF, 47, avenue J-F Kennedy, L-1855 Luxembourg

- PARTNERS GROUP GENERATIONS S.A. SICAV-SIF, 2, rue Jean Monnet, L-2180 Luxembourg

- PHILAE FUND, 15, avenue J-F Kennedy, L-1855 Luxembourg

- QUARTZ CAPITAL FUND S.A., 6A, rue Gabriel Lippmann, L-5365 Munsbach

- SOLUTIO PREMIUM PRIVATE EQUITY VI FEEDER S.C.A., SICAV – SIF, 47, avenue J-F Kennedy, L-1855 Luxembourg

- THE DIRECT LENDING S.C.A. SICAV-SIF, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- UPT GLOBAL ALTERNATIVES S.C.S., 11, rue Beaumont, L-1219 Luxembourg

- VISCONTI FUND I, SLP-SIF, 412F, route d’Esch, L-1471 Luxembourg

The following 19 undertakings for collective investment and specialised investment funds have been deregistered from the official list during the month of June:

1) UCITS Part I 2010 Law:

- ALLIANZ GLOBAL INVESTORS FUND IX, 6A, route de Trèves, L-2633 Senningerberg

- ALTAIRA FUNDS, 26, avenue de la Liberté, L-1930 Luxembourg

- DWS RENTEN DIREKT SELECT 2016, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- SPI BANGLADESH FUND, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- SWISSCANTO (LU) SMARTCORE, 19, rue de Bitbourg, L-1273 Luxembourg

- TIDEWAY UCITS FUNDS, 5, Heienhaff, L-1736 Senningerberg

2) UCIs Part II Law 2010:

- GIM PORTFOLIO STRATEGIES FUNDS II, 6, route de Trèves, L-2633 Senningerberg

- LUX-WORLD FUND, 1, place de Metz, L-1930 Luxembourg

- RAMIUS FOF EUROPEAN PLATFORM INDEX, 11, rue Aldringen, L-1118 Luxembourg

- RAMIUS FOF EUROPEAN PLATFORM, 11, rue Aldringen, L-1118 Luxembourg

3) SIFs:

- AURIO SICAV-FIS, 2, place François-Joseph Dargent, L-1413 Luxembourg

- BAPE S.C.A., SICAV-SIF, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- CHIMATO-FONDS, 3, rue des Labours, L-1912 Luxembourg

- GPIM THEMIS, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- IPC-PORTFOLIO INVEST XX, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- ITAU SPECIALISED INVESTMENT FUNDS, 49, avenue J-F Kennedy, L-1855 Luxembourg

- R COMMODITY FINANCE FUND, 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- SEB CREDIT OPPORTUNITY III, 4, rue Peternelchen, L-2370 Howald

- ZED ECO INVESTMENTS I S.A., 2, boulevard Konrad Adenauer, L-1115 Luxembourg