Global situation of undertakings for collective investment at the end of July 2016

Press release 16/38

I. Overall situation

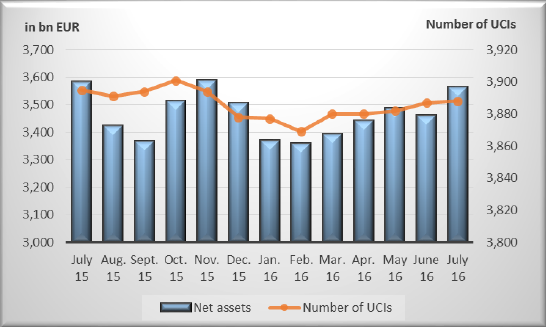

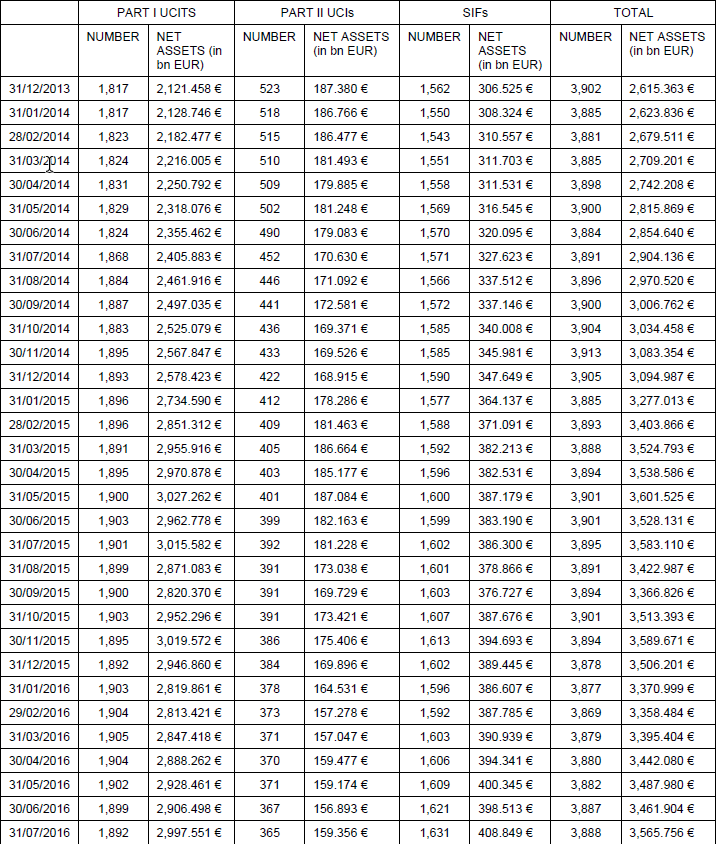

As at 31 July 2016, total net assets of undertakings for collective investment and specialised investment funds amounted to EUR 3,565.756 billion compared to EUR 3,461.904 billion as at 30 June 2016, i.e. a 3.00% increase over one month. Over the last twelve months, the volume of net assets decreased by 0.48%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 103.852 billion in July. This increase represents the balance of positive net issues of EUR 33.743 billion (0.97%) and of the positive development in the financial markets amounting to EUR 70.109 billion (2.03%).

The number of undertakings for collective investment (UCIs) and specialised investment funds (SIFs) taken into consideration totalled 3,888 as against 3,887 in the previous month. 2,578 entities have adopted an umbrella structure, which represents 12,932 sub-funds. When adding the 1,310 entities with a traditional structure to that figure, a total of 14,242 fund units are active in the financial centre.

As regards the impact of financial markets on Luxembourg UCIs and SIFs (hereafter “UCIs”) on the one hand and the net capital investment in these UCIs on the other hand, the following can be said about July 2016.

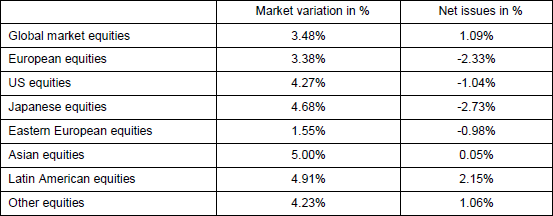

All the categories of equity UCIs registered price increases in the month under review, despite the persistent uncertainty about Great Britain leaving the European Union.

As regards developed countries, European and US equity UCIs realised a positive performance in a context, notably, of sound economic data on both sides of the Atlantic.

The announcement of a fiscal stimulus package sustained Japanese equity UCIs while economic indicators remain mixed.

As regards emerging countries, the Asian equity UCI category developed positively notably in relation to mostly positive economic indicators for the region. Sustained by encouraging economic forecasts for Russia, Eastern European equity UCIs saw a positive development, as the attempted coup d’état in Turkey did not impact the equity

markets of the other Eastern European countries. In a context of reforms in many countries of the region and a general upward trend in commodity prices, the Latin American UCI category improved.

In July, equity UCI categories registered an overall negative net capital investment.

Development of equity UCIs during the month of July 2016*

* Variation in % of Net Assets in EUR as compared to the previous month.

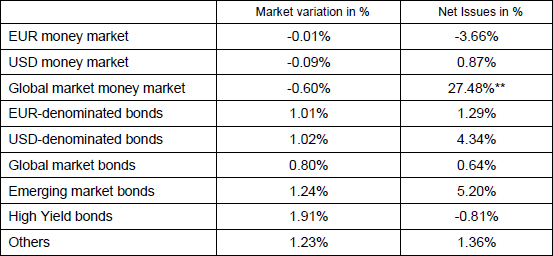

Overall, bond yields fell on both sides of the Atlantic in the period under review.

Under the effect of persistently weak inflation in Europe, the result of the British referendum and the expansive monetary policy of the European Central Bank (ECB), the yields of EUR-denominated government and corporate bonds fell, entailing an increase of EUR-denominated bond UCIs.

The USD-denominated bond UCIs, for their part, profited from the wait-and-see attitude of the Fed as regards the rise of key interest rates which resulted in a fall in US bond yields.

The persisting interest of investors in emerging market bonds, despite uncertainties at a global level, resulted in a decrease in risk premiums and, as a consequence, allowed emerging bond UCIs to close the month in positive territory.

In July, the category of fixed-income UCIs registered an overall positive net capital investment.

Development of fixed income UCIs during the month of July 2016*

* Variation in % of Net Assets in EUR as compared to the previous month.

** Significant variation relating to a merger of several foreign UCITS into a Luxembourg UCITS.

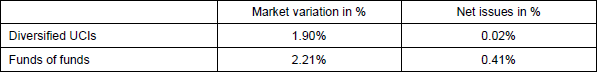

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Diversified income UCIs and funds of funds during the month of July 2016*

* Variation in % of Net Assets in EUR as compared to the previous month.

II. Breakdown of the number and the net assets of UCIs according to Parts I and II of the 2010 Law and of SIFs, respectively, according to the 2007 Law

During the month of July, the following 27 undertakings for collective investment and specialised investment funds have been registered on the official list:

1) UCITS Part I 2010 Law:

- ALICANTO SICAV I, 5, allée Scheffer, L-2520 Luxembourg

- AXXION REVOLUTION FUND, 15, rue de Flaxweiler, L-6776 Grevenmacher

- BETHMANN VERMÖGENSVERWALTUNG DEFENSIV AUSGEWOGEN, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- DEKA-INSTITUTIONELL LIQUIDITÄTSPLAN, 5, rue des Labours, L-1912 Luxembourg

- ICBC CREDIT SUISSE UCITS ETF SICAV, 49, avenue J-F Kennedy, L-1855 Luxembourg

- LVR STIFTUNGSFONDS, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- STANDARD LIFE INVESTMENTS GLOBAL SICAV II, 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- VALUE TREE UMBRELLA SICAV, 11, rue Aldringen, L-1118 Luxembourg

2) UCIs Part II 2010 Law:

- MPF SINO, 534, rue de Neudorf, L-2220 Luxembourg

3) SIFs:

- ANLAGE EUROPA GARANTIE, 5, rue des Labours, L-1912 Luxembourg

- ANLAGE WELT GARANTIE, 5, rue des Labours, L-1912 Luxembourg

- BERENBERG ALTERNATIVE ASSETS FUND S. A., SICAV-FIS, 15, rue de Flaxweiler, L-6776 Grevenmacher

- BVK-RESIDENTIAL EUROPE-IMMOBILIENFONDS, 15, rue de Flaxweiler, L-6776 Grevenmacher

- CEE TIMBA USA FUND S.C.S., SICAV-FIS, 15, rue de Flaxweiler, L-6776 Grevenmacher

- EUROPEAN IMPACT INVESTING PLATFORM S.C.A. SICAV-SIF, 11-13, boulevard de la Foire, L-1528 Luxembourg

- GEODETICA S.C.A. SICAV-SIF, 11-13, boulevard de la Foire, L-1528 Luxembourg

- LO GLOBAL PRIVATE EQUITY, 291, route d’Arlon, L-1150 Luxembourg

- LO GLOBAL REAL ESTATE FUND, 291, route d’Arlon, L-1150 Luxembourg

- LYNX CG SICAV SIF, 1B, rue Jean Piret, L-2350 Luxembourg

- MAIN UNIVERSAL SCSP, SICAV-SIF, 15, rue de Flaxweiler, L-6776 Grevenmacher

- MH FUND S.C.A., SICAV-SIF, 58, rue Charles Martel, L-2134 Luxembourg

- PFA INVESTMENT FUND, 2, rue Jean Monnet, L-2180 Luxembourg

- PRELIOS GERMAN RETAIL PROPERTY FUND, 11, rue Beaumont, L-1219 Luxembourg

- PRIVATE MARKETS FUND SCSP-SIF, 5, rue Heienhaff, L-1736 Senningerberg

- SEGETIA FUND, 20, boulevard Emmanuel Servais, L-2535 Luxembourg

- SWISS REAL ESTATE PERFORMANCE S.C.A. SICAV-SIF, 42, rue de la Vallée, L-2661 Luxembourg

- UOI REAL ESTATE SICAV-SIF, 6A, rue Gabriel Lippmann, L-5365 Munsbach

The following 26 undertakings for collective investment and specialised investment funds have been deregistered from the official list during the month of July:

1) UCITS Part I 2010 Law:

- ASIA REAL, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- CAM, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- DEKALUX-INSTITUTIONELL RENTEN EUROPA, 5, rue des Labours, L-1912 Luxembourg

- DEKA-TREASURY AKTIENSTRATEGIE, 5, rue des Labours, L-1912 Luxembourg

- EURIZON STRATEGIA FLESSIBILE, 8, avenue de la Liberté, L-1930 Luxembourg

- INTELLIGENT RECOMMENDATIONS, 15, rue de Flaxweiler, L-6776 Grevenmacher

- JULIUS BAER SPECIAL FUNDS, 25, Grand-rue, L-1661 Luxembourg

- LUX-EURO-STOCKS, 1, place de Metz, L-1930 Luxembourg

- LUX-INDEX US, 1, place de Metz, L-1930 Luxembourg

- LUX-SECTORS, 1, place de Metz, L-1930 Luxembourg

- LUX-TOP 50, 1, place de Metz, L-1930 Luxembourg

- POSTBANK STRATEGIE, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- SMART-INVEST GLOBAL, 15, rue de Flaxweiler, L-6776 Grevenmacher

- TRITON STOCKPICKER WORLD, 534, rue de Neudorf, L-2220 Luxembourg

- UMF, 15, rue de Flaxweiler, L-6776 Grevenmacher

2) UCIs Part II 2010 Law:

- LUX-AVANTAGE, 1, place de Metz, L-1930 Luxembourg

- LUX-PROTECT FUND, 1, place de Metz, L-1930 Luxembourg

- PETERCAM CAPITAL, 5, allée Scheffer, L-2520 Luxembourg

3) SIFs:

- ALTERNA DIVERSIFIED S.A. SICAF SIF, 5, place de la Gare, L-1616 Luxembourg

- BELTONE MIDCAP S.C.A., SICAV-SIF, 5, allée Scheffer, L-2520 Luxembourg

- BNP PARIBAS FLEXI IV, 33, rue de Gasperich, L-5826 Howald-Hesperange

- CHURCHGATE CAPITAL SCA-SICAV-SIF, 2, boulevard de la Foire, L-1528 Luxembourg

- FOLEA S.A. SICAV-FIS I, 44, avenue J-F Kennedy, L-1855 Luxembourg

- LEO CAPITAL (LUX) FCP-FIS, 23, avenue Monterey, L-2163 Luxembourg

- NAEV-IMMOBILIEN S.A., SICAV-FIS, 15, rue de Flaxweiler, L-6776 Grevenmacher

- SEB ALTERNATIVE INVESTMENT FUND S.C.A. SICAV-SIF, 4, rue Peternelchen, L-2370 Howald