Global situation of undertakings for collective investment at the end of November 2016

Press release 17/05

I. Overall situation

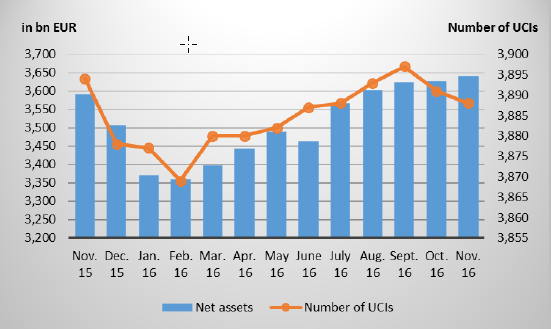

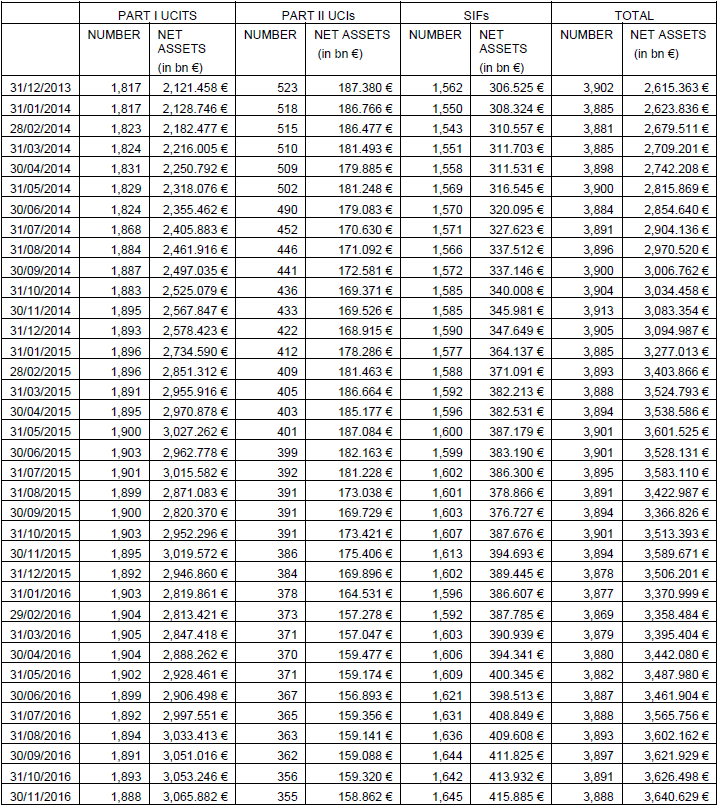

As at 30 November 2016, total net assets of undertakings for collective investment and specialised investment funds amounted to EUR 3,640.629 billion compared to EUR 3,626.498 billion as at 31 October 2016, i.e. a 0.39% increase over one month. Over the last twelve months, the volume of net assets rose by 1.42%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 14.131 billion in November. This increase represents the balance of negative net issues of EUR -6.534 billion (-0.18%) and a positive development in the financial markets amounting to EUR 20.665 billion (0.57%).

The number of undertakings for collective investment (UCIs) and specialised investment funds (SIFs) taken into consideration totalled 3,888 as against 3,891 in the previous month. 2,598 entities have adopted an umbrella structure, which represents 12,942 sub-funds. When adding the 1,290 entities with a traditional structure to that figure, a total of 14,232 fund units are active in the financial centre.

As regards the impact of financial markets on Luxembourg UCIs and SIFs (hereafter “UCIs”) on the one hand and the net capital investment in these UCIs on the other hand, the following can be said about November 2016.

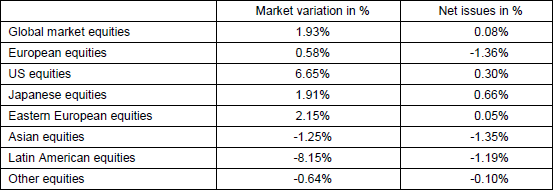

The result of the presidential election in the United States dominated the financial markets, thus leading, among other things, to a rise in equity prices and bond yields of the developed countries as well as of the dollar.

Anticipating a more expansive tax policy in the United States, the category of US equity UCIs, recorded in this context price increases amplified by a USD appreciation against the EUR by almost 3%. Even if the positive performance was less marked due to political uncertainties surrounding, among others, the referendum in Italy, the category of European equity UCIs followed an upward trend. The category of Japanese equity UCIs also ended the month in positive territory influenced, notably, by the depreciation of the JPY against the USD by about 8% and figures of economic growth beyond the investors’ expectations.

As far as emerging countries are concerned, the increase in interest rates, a strong dollar and the anticipation of a review of business relation arrangements of the United States with some emerging countries, following the result of the presidential election in the United States, explain the negative performance of the categories of Asian and Latin American equity UCIs despite stable growth data in China. However, the category of Eastern European equity UCIs recorded a general upward trend backed by the increase of oil prices following the agreement of the Organization of the Petroleum Exporting Countries (OPEC) on a decrease of the production quotas.

In November, equity UCI categories registered an overall negative net capital investment.

Development of equity UCIs during the month of November 2016*

* Variation in % of Net Assets in EUR as compared to the previous month.

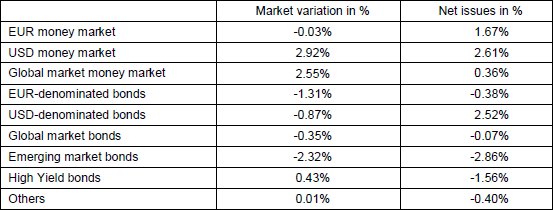

On the bond markets of developed countries, the yields continued their positive development due, in particular, to the increase in inflation anticipations linked to the rise in oil prices and the measures of expansive tax policy expected after the presidential elections in the United States. Thus, the category of EUR-denominated bond UCIs registered price losses, amplified by economic data which were better than expected in Europe, whereas for the category of USD-denominated bond UCIs, the USD appreciation against the EUR partially offset the negative performance.

The statements of the new president of the United States on the future of the business relations with certain emerging countries as well as the significant depreciation of some emerging currencies led to a steeper upward movement of bond yields of the emerging countries bonds. On such basis, this UCI category recorded price losses in the month under review.

Overall, fixed-income UCIs registered negative net capital investment during November.

Development of fixed-income UCIs during the month of November 2016*

* Variation in % of Net Assets in EUR as compared to the previous month.

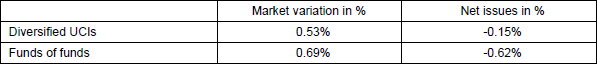

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of November 2016*

* Variation in % of Net Assets in EUR as compared to the previous month.

II. Breakdown of the number and the net assets of UCIs according to Parts I and II of the 2010 Law and of SIFs, respectively, according to the 2007 Law

During the month under review, the following 27 undertakings for collective investment and specialised investment funds have been registered on the official list:

1) UCITS Part I 2010 Law:

- BANTLEON SELECT SICAV, 33A, avenue J-F Kennedy, L-1855 Luxembourg

- DEKA-MULTI ASSET ERTRAG, 5, rue des Labours, L-1912 Luxembourg

- FLOWERFIELD, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- GF INTERNATIONAL, 49, avenue J-F Kennedy, L-1855 Luxembourg

- HQT GLOBAL QUALITY DIVIDEND, 15, rue de Flaxweiler, L-6776 Grevenmacher

- ONE1797, 287, route d’Arlon, L-1150 Luxembourg

- TIBERIUS PANGEA, 2, place François-Joseph Dargent, L-1413 Luxembourg

- WERTE & SICHERHEIT NR. 2 – GLOBALE STABILITÄT, 4, rue Thomas Edison, L-1445 Strassen

- WR STRATEGIE, 4, rue Thomas Edison, L-1445 Strassen

2) UCIs Part II 2010 Law:

- UBP PG, 287-289, route d’Arlon, L-1150 Luxembourg

3) SIFs:

- AB COMMERCIAL REAL ESTATE DEBT SECONDARY MARKET FUND III, SICAV-SIF S.C.SP., 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- ALTIN2016 S.A., SICAV-FIS, 15, rue de Flaxweiler, L-6776 Grevenmacher

- APOLLO REAL ESTATE INVESTMENT, SICAV-SIF S.C.S., 1C, rue Gabriel Lippmann, L-5365 Munsbach

- BARINGS EUROPEAN CORE PROPERTY FUND SCSP SICAV-SIF, 19, rue Eugène Ruppert, L-2453 Luxembourg

- CARTESIAN RE ILS SICAV SIF, 412F, route d’Esch, L-1471 Luxembourg

- CHEYNE REAL ESTATE CREDIT (CRECH) FUND V – OPPORTUNISTIC SCS SICAV-SIF, 20, rue de la Poste, L-2346 Luxembourg

- CORPUS SIREO HEALTH CARE IV FEEDER SCA SICAV-FIS, 4A, rue Albert Borschette, L-1246 Luxembourg

- ELSINORE CREDIT INVESTMENT FUND I S.C.A. SICAV-SIF, 5, rue Guillaume Kroll, L-1882 Luxembourg

- ESPANTAXIN INVESTMENTS S.À R.L. – SIF, 68-70, boulevard de la Pétrusse, L-2320 Luxembourg

- MALUBI INVESTMENT FUND S.A., SICAV-SIF, 58, rue Charles Martel, L-2134 Luxembourg

- PARTNERS GROUP ACTIVE INCOME S.C.A., SICAV-SIF, 2, place François-Joseph Dargent, L-1413 Luxembourg

- PARTNERS GROUP CREDIT OPPORTUNITIES 2017 (EUR) S.C.A., SICAV-SIF, 2, rue Jean Monnet, L-2180 Luxembourg

- PARTNERS GROUP GLOBAL VALUE 2017 S.C.A., SICAV-SIF, 2, rue Jean Monnet, L-2180 Luxembourg

- PORTMAN SQUARE PRIVATE FUNDS SICAV-SIF, 15, avenue J-F Kennedy, L-1855 Luxembourg

- PRIDE FCP-SIF 2016-3, 5, rue Aldringen, L-1118 Luxembourg

- QS REAL ESTATE SELECT EUROPEAN OPPORTUNITIES SLP SICAV-SIF, 3, boulevard Royal, L-2449 Luxembourg

- VICTOR RESOURCES EUROPE S.À R.L, 49, avenue J-F Kennedy, L-1855 Luxembourg

The following 30 undertakings for collective investment and specialised investment funds have been deregistered from the official list during the month under review:

1) UCITS Part I 2010 Law:

- ALIAS INVESTMENT, 5, allée Scheffer, L-2520 Luxembourg

- ALLIANZ PIMCO LAUFZEITFONDS EXTRA 2016, Bockenheimer Landstraße 42-44, D-60232 Frankfurt am Main

- ANIMA SICAV, 60, avenue J-F Kennedy, L-1855 Luxembourg

- BERENBERG GLOBAL EQUITY SELECTION PROTECT, 15, rue de Flaxweiler, L-6776 Grevenmacher

- DEKA-TOTALRETURN STRATEGIE 94, 5, rue des Labours, L-1912 Luxembourg

- JRS LUXEMBOURG UCITS, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- UNIGARANT: 3 CHANCEN (2016) II, 308, route d’Esch, L-1471 Luxembourg

- UNIGARANT: 3 CHANCEN (2016), 308, route d’Esch, L-1471 Luxembourg

- UNIGARANT: BEST OF WORLD (2016) II, 308, route d’Esch, L-1471 Luxembourg

- UNIGARANT: COMMODITIES (2016), 308, route d’Esch, L-1471 Luxembourg

- UNIGARANT: DEUTSCHLAND (2016) III, 308, route d’Esch, L-1471 Luxembourg

- UNIGARANT: EUROPA (2016) II, 308, route d’Esch, L-1471 Luxembourg

- USM, 15, rue de Flaxweiler, L-6776 Grevenmacher

- VERMÖGENSMANAGEMENT 2027 PLUS, Bockenheimer Landstraße 42-44, D-60232 Frankfurt am Main

2) UCIs Part II 2010 Law:

- FRANKLIN TEMPLETON SELECTED MARKETS FUNDS, 8A, rue Albert Borschette, L-1246 Luxembourg

- PUILAETCO DEWAAY SELECTION, 11, rue Aldringen, L-1118 Luxembourg

3) SIFs:

- 1. SIF-SCS, 3, boulevard Royal, L-2449 Luxembourg

- ABX, 4, rue Peternelchen, L-2370 Howald

- ACRON REAL ESTATE PORTFOLIO SICAV-FIS, 121, avenue de la Faïencerie, L-1511 Luxembourg

- ALLIANZ TOTAL RETURN PLUS, 6B, route de Trèves, L-2633 Senningerberg

- AQUANTUM GLOBAL FUTURES FCP-SIF, 15, rue de Flaxweiler, L-6776 Grevenmacher

- BM FUND COMPANY, 28-32, place de la Gare, L-1616 Luxembourg

- DBM BALANCED INVEST, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- ENHANCED LOAN INVESTMENT STRATEGY, 49, avenue J-F Kennedy, L-1855 Luxembourg

- GLOBAL OPPORTUNITIES SICAV-FIS, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- IPC-PORTFOLIO INVEST VII, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- IPC-PORTFOLIO INVEST VIII, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- IPC-PORTFOLIO INVEST XIX, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- LOGOS VENTURES, 75, Parc d’activités, L-8308 Capellen

- MSK SICAV-SIF, 2, rue Jean Monnet, L-2180 Luxembourg