Global situation of undertakings for collective investment at the end of October 2016

Press release 17/02

I. Overall situation

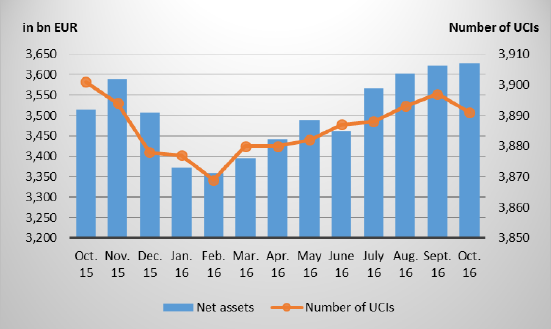

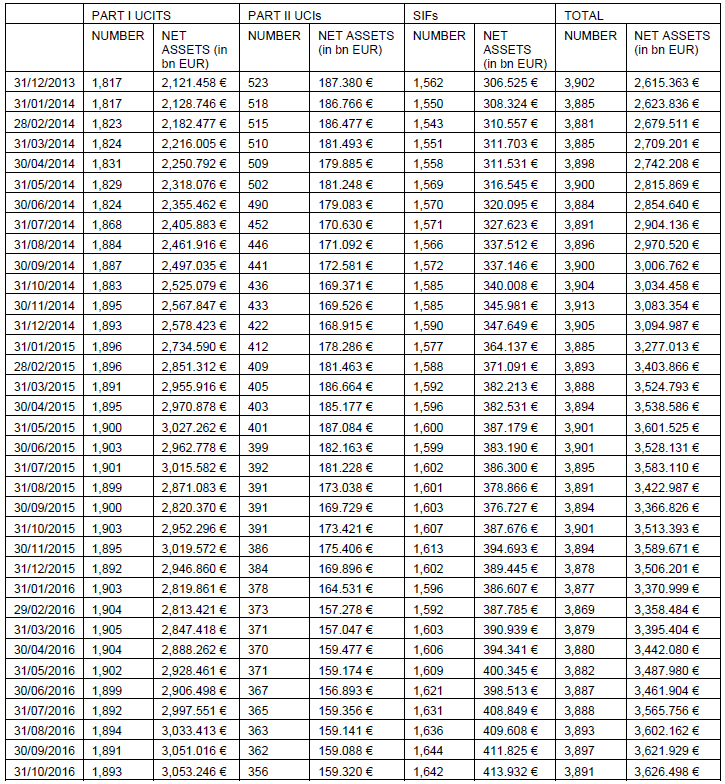

As at 31 October 2016, total net assets of undertakings for collective investment and specialised investment funds amounted to EUR 3,626.498 billion compared to EUR 3,621.929 billion as at 30 September 2016, i.e. a 0.13% increase over one month. Over the last twelve months, the volume of net assets rose by 3.22%.

Consequently, the Luxembourg UCI industry registered a positive variation amounting to EUR 4.569 billion in October. This increase represents the balance of positive net issues of EUR 7.012 billion (0.19%) and of the negative development in the financial markets amounting to EUR 2.443 billion (- 0.06%).

The number of undertakings for collective investment (UCIs) and specialised investment funds (SIFs) taken into consideration totalled 3,891 as against 3,897 in the previous month. 2,595 entities have adopted an umbrella structure, which represents 13,011 sub-funds. When adding the 1,296 entities with a traditional structure to that figure, a total of 14,307 fund units are active in the financial centre.

As regards, on the one hand, the impact of financial markets on Luxembourg UCIs and SIFs (hereafter “UCIs”) and, on the other hand, the net capital investment in these UCIs, the following can be said about October 2016.

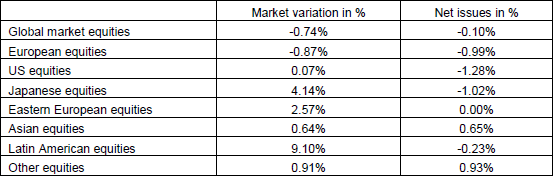

The categories of equity UCIs developed differently during the month under review.

As far as developed markets are concerned, given the political uncertainties in Europe, the category of European equity UCIs recorded a negative performance in October despite positive economic data in Europe. While equity markets in the United States closed the month in negative territory due mainly to the uncertainties surrounding the presidential elections, the category of US equity UCIs recorded nevertheless a slight increase following the USD appreciation against the EUR by almost 2%. The stock prices for the category of Japanese equity UCIs grew significantly during the month under review, mainly as a result of a depreciation of the YEN against the USD by over 4% and Japanese economic indicators that are better than expected.

As for emerging countries, the category of Asian equity UCIs recorded overall a positive performance following positive growth data and the upward trend of the economic indicators in China. The category of Eastern equity UCIs also registered price increases in October 2016 as a consequence of the deceleration of the Russian recession and the stabilisation of oil prices despite persisting geopolitical problems in the region. The strong appreciation of South American shares and main currencies against the EUR explains the positive performance of Latin American equity UCIs.

During October 2016, the category of equity UCIs registered an overall negative net capital investment.

Development of equity UCIs during the month of October 2016*

* Variation in % of Net Assets in EUR as compared to the previous month.

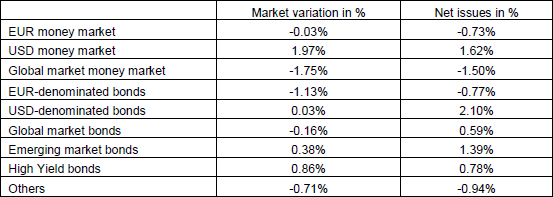

In October, the bond yields recorded an upward trend on both sides of the Atlantic.

In Europe, government bond yields increased amidst rumours of a reduction in the ECB’s asset buy-back programme, positive economic data and a slight increase of general inflation indices in Europe. Corporate bonds also followed the upward trend in yields, whereas risk premiums of corporate bonds remained more or less stable. Consequently, EUR-denominated bond UCIs registered price losses during the month under review.

As regards USD-denominated bond UCIs, economic data exceeding expectations as well as the rise of the inflation anticipations led to a growth in USD-denominated bonds. This increase in yields was more than offset by the USD appreciation against the EUR so that the category of USD-denominated bond UCIs ended the month under review slightly up.

A high demand for emerging market bonds and the stabilisation of the commodity prices resulted in price increases for emerging bond UCIs.

In October, the categories of fixed-income UCIs registered an overall positive net capital investment.

Development of fixed-income UCIs during the month of October 2016*

* Variation in % of Net Assets in EUR as compared to the previous month.

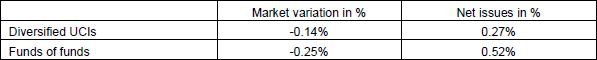

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Diversified UCIs and funds of funds during the month of October 2016*

* Variation in % of Net Assets in EUR as compared to the previous month.

II. Breakdown of the number and the net assets of UCIs according to Parts I and II of the 2010 Law and of SIFs, respectively, according to the 2007 Law

During the month under review, the following 21 undertakings for collective investment and specialised investment funds have been registered on the official list:

1) UCITS Part I 2010 Law:

- AMBER FUND SICAV, 12, rue Eugène Ruppert, L-2453 Luxembourg

- BCDI-AKTIENFONDS, 4, rue Thomas Edison, L-1445 Strassen

- M.M. WARBURG STRUCTURED EQUITY INVEST, 2, place François-Joseph Dargent, L-1413 Luxembourg

- SUMUS FUND, 12, rue Eugène Ruppert, L-2453 Luxembourg

- WATERLOO SICAV, 6A, rue Gabriel Lippmann, L-5365 Munsbach

2) SIFs:

- ALFA CAPITAL LUXEMBOURG SA, SICAV-FIS, 42, rue de la Vallée, L-2661 Luxembourg

- AQUILA CAPITAL RENEWABLES AND INFRASTRUCTURE FUND IV S.A., SICAV-SIF, 5, Heienhaff, L-1736 Senningerberg

- ATLAS AI SICAV-FIS, S.A., 5, rue des Labours, L-1912 Luxembourg

- BPI STRATEGIES CAPITAL SICAV-SIF, 15, avenue J-F Kennedy, L-1855 Luxembourg

- CORPUS SIREO HEALTH CARE IV SICAV-FIS, 4A, rue Albert Borschette, L-1246 Luxembourg

- CREON ENERGY FUND S.C.A., SICAV-SIF, 5, allée Scheffer, L-2520 Luxembourg

- CULROSS FUNDS S.A., SICAV-SIF, 58, rue Charles Martel, L-2134 Luxembourg

- DOMBLICK S.A. SICAV-FIS, 15, rue de Flaxweiler, L-6776 Grevenmacher

- FYSIS FUND II SICAV-SIF S.C.A, 412F, route d’Esch, L-1471 Luxembourg

- INFRASTRUCTURE FINANCE SCS-SIF, 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- LOOP U.S. MUNICIPAL BONDS FUND, 287-289, route d’Arlon, L-1150 Luxembourg

- NAXOS SCA SICAV SIF, 5, allée Scheffer, L-2520 Luxembourg

- PARTNERS GROUP PRIVATE LOANS S.A., SICAV-SIF, 2, place François-Joseph Dargent, L-1413 Luxembourg

- PRIME PROPERTIES S.C.A. SICAV-SIF, 12, rue Eugène Ruppert, L-2453 Luxembourg

- SHAFTESBURY REAL ESTATE PARTNERS 1, 23, boulevard Grande-Duchesse Charlotte, L-1331 Luxembourg

- SKHGP-AI, 5, rue des Labours, L-1912 Luxembourg

The following 27 undertakings for collective investment and specialised investment funds have been deregistered from the official list during the month under review:

1) UCITS Part I 2010 Law:

- ARTESIS MARKET OPPORTUNITIES, 9A, rue Gabriel Lippmann, L-5365 Munsbach

- AVOCADO FONDS, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- DWS MEGATREND PERFORMANCE 2016, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- DWS PERFORMANCE RAINBOW 2015, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- RINASCIMENTO SICAV, 60, avenue J.F. Kennedy, L-1855 Luxembourg

2) UCIs Part II 2010 Law:

- AGCM II SICAV, 4, rue Peternelchen, L-2370 Howald

- CAPITALATWORK ALTERNATIVE FUND, 11-13, boulevard de la Foire, L-1528 Luxembourg

- FIDELITY MULTI MANAGER FUNDS FCP, 2A, rue Albert Borschette, L-1246 Luxembourg

- NOBILIS INVESTMENT FUNDS, 15, rue Edward Steichen, L-2540 Luxembourg

3) SIFs:

- ABERDEEN EUROPEAN SHOPPING PROPERTY FUND, 35A, avenue J-F Kennedy, L-1855 Luxembourg

- ATCM III, 4, rue Peternelchen, L-2370 Howald

- BLUEHIVE OPPORTUNITIES, 6, rue Lou Hemmer, L-1748 Senningerberg

- CAPMAN PUBLIC MARKET FUND FCP-SIF, 5, rue Guillaume Kroll, L-1882 Luxembourg

- CF SPEZIAL FIS, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- CORDEA SAVILLS NORDIC RETAIL FUND, 26, boulevard Royal, L-2449 Luxembourg

- FORST INVEST – WALDFONDS S.C.A. SICAV-SIF, 61, Gruuss-Strooss, L-9991 Weiswampach

- GENERALI CHINA, 4, rue Jean Monnet, L-2180 Luxembourg

- INVESCO EUROPEAN HOTEL REAL ESTATE FUND, 37A, avenue J-F Kennedy, L-1855 Luxembourg

- IPC – M.M. STRATEGIE FUND, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- IPC-CAPITAL STRATEGY IX, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- IPC-CAPITAL STRATEGY XII, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- PENOLA INVESTO CAPITAL SIF FCP, 10, rue Antoine Jans, L-1820 Luxembourg

- S. U. P. LEO SICAV-FIS, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- SCHRODER PROPERTY, 5, rue Höhenhof, L-1736 Senningerberg

- SECURITAS2007, 534, rue de Neudorf, L-2220 Luxembourg

- SENSUS CAPITAL S.A. – SICAV-SIF, 20, boulevard Emmanuel Servais, L-2535 Luxembourg

- VAUBAN INVESTMENTS, 44, avenue J-F Kennedy, L-1855 Luxembourg