Global situation of undertakings for collective investment at the end of December 2016

Press release 17/12

I. Preliminary observation

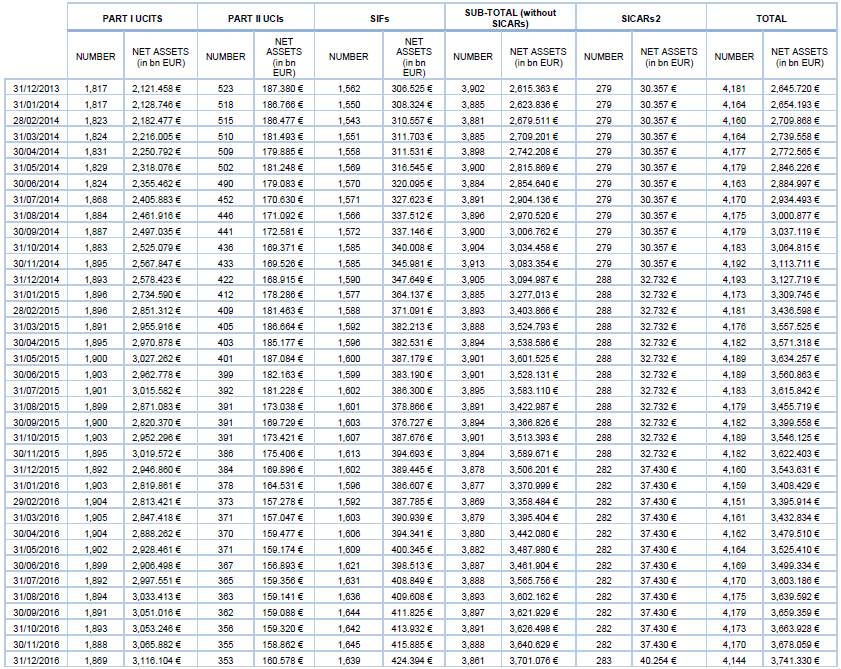

Following the extension of the scope for the monthly financial information to investment companies in risk capital (SICARs), the publication of the statistics regarding undertakings for collective investment will include, as from December 2016, data on UCIs subject to the 2010 Law, on specialised investment funds and on SICARs.

II. Overall situation

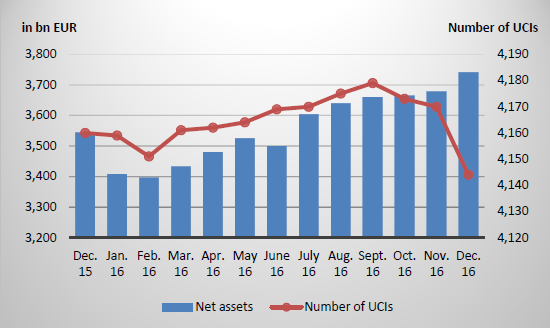

Total net assets of undertakings for collective investment reached EUR 3,741.330 billion as at 31 December 2016.

Not including SICARs, total net assets reached EUR 3,701.076 billion compared to EUR 3,640.629 billion as at 30 November 2016, i.e. a 1.66% growth over one month. Over the last twelve months, the volume of net assets, not including the net assets of SICARs, rose by 5.56%.

The Luxembourg UCI industry (not including SICARs), thus registered a positive variation amounting to EUR 60.447 billion in December. This increase represents the balance of positive net issues of EUR 4.549 billion (0.12%) and of the positive development in the financial markets amounting to EUR 55.898 billion (1.54%).

The development of undertakings for collective investment is as follows1:

The number of undertakings for collective investment (UCIs) taken into consideration totals 4,144 (3,861 without SICARs) as against 4,170 in the previous month (3,888 without SICARs). 2,656 entities have adopted an umbrella structure, which represents 13,107 sub-funds. When adding the 1,488 entities with a traditional structure to that figure, a total of 14,595 fund units are active in the financial centre.

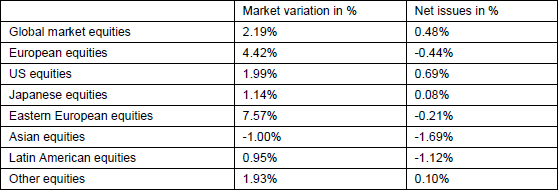

As regards, on the one hand, the impact of financial markets on the main categories of undertakings for collective investment and, on the other hand, the net capital investment in these UCIs, the following can be said about December:

All categories of equity UCIs, except the category of Asian equity UCIs, recorded positive performances during the month under review.

As far as developed countries are concerned, the category of European equity UCIs ended the month in positive territory following, notably, the prolongation of the asset buy-back programme of the ECB and the sound economic data, despite the persistent political uncertainties in Europe. In a context of positive economic indicators and expansive tax measures announced by the future president of the United States, the category of American equity UCIs delivered a positive performance. The category of Japanese equity UCIs continued to benefit from a weakening yen compared to the USD.

As regards emerging countries, the uncertainty concerning the future economic policy of the United States together with the increase of the American interest rates affected the Asian equity UCI category. In this context, the category of Latin American equity UCIs, however, was able to register slight price increases. The significant rise of oil prices and encouraging economic figures in Russia, strongly supported the Eastern European equity UCIs.

During December, the equity UCI categories registered an overall positive net capital investment.

Development of equity UCIs during the month of December 2016*

*Variation in % of Net Assets in EUR as compared to the previous month

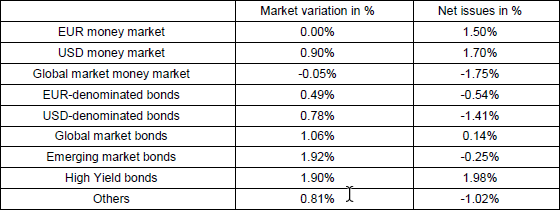

As regards bond markets, December was characterised mainly by diverging monetary directions on both sides of the Atlantic.

In Europe, the prolongation of the ECB’s asset buy-back programmes resulted, overall, in a decline of government bond yields and in yield spreads between the high-rated countries and low-rated countries in the euro area. In this context, risk premiums of corporate bonds also tightened, so that, all in all, EUR-denominated bond UCIs recorded price increases.

As a consequence of the rise of the inflation anticipations, of the decrease of the key interest rates decided by the Fed in December and of the expectation of other future increases, yields rose again in the United States leading to a fall in prices of the USD-denominated bonds. This increase in yields was more than offset by the USD appreciation against the EUR so that the category ended the month under review up.

The sound fundamentals and the anticipation of an increase in emerging currencies have fuelled the resurgence of the emerging countries bond markets, after a month of November characterised by substantial uncertainties about the presidential election results in the United States. The reduction of the subsequent risk premiums explains the good performance of the category.

In December, the category of fixed-income UCIs registered an overall positive net capital investment.

Development of fixed-income UCIs during the month of December 2016*

*Variation in % of Net Assets in EUR as compared to the previous month

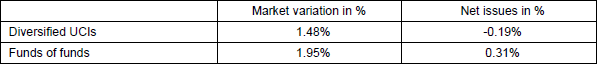

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of December 2016*

*Variation in % of Net Assets in EUR as compared to the previous month

III. Breakdown of the number and net assets of UCIs

During the month under review, the following 28 undertakings for collective investment have been registered on the

official list:

1) UCITS Part I 2010 Law:

- BINCKBANK FUND FCP, 42, rue de la Vallée, L-2661 Luxembourg

- DEKA-INDUSTRIE 4.0, 5, rue des Labours, L-1912 Luxembourg

- KAIROS ALPHA SICAV, 60, avenue J-F Kennedy, L-1855 Luxembourg

- M&G (LUX) INVESTMENT FUNDS 1, 49, avenue J-F Kennedy, L-1855 Luxembourg

- OFI FUND, 28-32, place de la Gare, L-1616 Luxembourg

- TRUSTEAM FUNDS, 14, boulevard Royal, L-2449 Luxembourg

- UNIPROINVEST: STRUKTUR, 308, route d’Esch, L-1471 Luxembourg

- UNISTRUKTUR, 308, route d’Esch, L-1471 Luxembourg

2) UCIs Part II Law 2010:

- /

3) SIFs:

- ALX SICAV-SIF, 15, avenue J-F Kennedy, L-1855 Luxembourg

- AM ALPHA PRINCIPAL INVESTMENT S.A. SICAV SIF, 20, Rue Philippe II, L-2340 Luxembourg

- ANDBANK REAL ESTATE INVESTMENT FUND S.C.A. SICAV-SIF, 5, allée Scheffer, L-2520 Luxembourg

- CORNUCOPIA SICAV-SIF, 15, avenue J-F Kennedy, L-1855 Luxembourg

- COURANT SICAV-SIF, 2, boulevard de la Foire, L-1528 Luxembourg

- DELTA LLOYD INVESTMENT SOLUTIONS, 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- EXOR FINANCIAL INVESTMENTS SICAV-SIF, 5, allée Scheffer, L-2520 Luxembourg

- GUTMANN PRIVATE MARKETS S.C.S, SICAV-FIS, 5, rue Heienhaff, L-1736 Senningerberg

- HAYFIN UMBRELLA FUND SICAV-SIF, 80, route d’Esch, L-1470 Luxembourg

- INNEXTO S.C.A., SICAV SIF, 2, rue d’Alsace, L-1122 Luxembourg

- IST GLOBAL REAL ESTATE PROGRAMME SCS, SICAV-SIF, 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- LAICORN FUND, 121, avenue de la Faïencerie, L-1511 Luxembourg

- LUX INVESTMENT, SICAV-SIF, 30, boulevard Royal, L-2449 Luxembourg

- MALIBU U.S. CORPORATE BONDS FUND, 287-289, route d’Arlon, L-1150 Luxembourg

- PATRIZIA S-REAL ESTATE INVEST SCS SICAV-SIF, 2-4, rue Beck, L-1222 Luxembourg

- PRIME ENERGY S.A., SICAV-FIS, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- REGIONAL EDUCATION FINANCE FUND FOR AFRICA (REFFA), 2, rue d’Alsace, L-1122 Luxembourg

- REGIUM INVEST SICAV-SIF, 2b, rue Albert Borschette, L-1246 Luxembourg

- TESEO CAPITAL SICAV-SIF, 60, avenue J-F Kennedy, L-1855 Luxembourg

- ZOBEL SCSP SICAV-FIS, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

4) SICARs:

- /

The following 55 undertakings for collective investment have been withdrawn from the official list in December:

1) UCITS Part I 2010 Law:

- ACTIVE EARTH FUND, 106, route d’Arlon, L-8210 Mamer

- ALEPH, 26, avenue de la Liberté, L-1930 Luxembourg

- BALLISTA SICAV, 5, Heienhaff, L-1736 Senningerberg

- CARNEGIE FUND IV, 15, rue Bender, L-1229 Luxembourg

- CATHAY UCITS FUND, 31, Z.A. Bourmicht, L-8070 Bertrange

- CF EQUITIES HAIG, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- CF ZINSSTRATEGIE I, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- DWS VERMÖGENSBILDUNGSFONDS I (LUX), 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- EMERGING ASIA SELECT, 26, avenue de la Liberté, L-1930 Luxembourg

- EURO RENTEN HY, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- FALCON MULTILABEL SICAV, 11-13, boulevard de la Foire, L-1528 Luxembourg

- FONDMARKNADEN FUND, 4, rue Peternelchen, L-2370 Howald

- GODMODETRADER.DE STRATEGIE I, 9A, rue Gabriel Lippmann, L-5365 Munsbach

- GOTTEX SICAV, 20, rue de la Poste, L-2346 Luxembourg

- HASPA PB STRATEGIE SW, 3, rue des Labours, L-1912 Luxembourg

- HSBC INTERNATIONAL SELECT FUND, 16, boulevard d’Avranches, L-1160 Luxembourg

- JRS SICAV, 4, rue Peternelchen, L-2370 Howald

- LINGOHR VIKING CONSTRAINED, 5, Heienhaff, L-1736 Senningerberg

- MAINFIRST SICAV II, 6C, route de Trèves, L-2633 Senningerberg

- MORGENSTERN SOLID PERFORMER, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- MYRA GERMAN ALLOCATION FUND, 15, rue de Flaxweiler, L-6776 Grevenmacher

- MYRA SOLIDUS GLOBAL FUND, 15, rue de Flaxweiler, L-6776 Grevenmacher

- UNIEURORENTA CORPORATES 2016, 308, route d’Esch, L-1471 Luxembourg

- UNIVARIO POINT: CHANCE, 308, route d’Esch, L-1471 Luxembourg

- UNIVARIO POINT: ERTRAG, 308, route d’Esch, L-1471 Luxembourg

- UNIVARIO POINT: SICHERHEIT, 308, route d’Esch, L-1471 Luxembourg

- UNIVARIO POINT: WACHSTUM, 308, route d’Esch, L-1471 Luxembourg

- YAPI KREDI SICAV, 31, Z.A. Bourmicht, L-8070 Bertrange

2) UCIs Part II 2010 Law:

- BANQUE CARNEGIE FUND SICAV, 5, place de la Gare, L-1616 Luxembourg

- NORDEA MULTI LABEL, 562, rue de Neudorf, L-2220 Luxembourg

3) SIFs:

- ADAUCTUS MULTI ASSET FONDS, 534, rue de Neudorf, L-2220 Luxembourg

- A-DGZ 13-FONDS, 5, rue des Labours, L-1912 Luxembourg

- A-DKBANKLUX1-FONDS, 5, rue des Labours, L-1912 Luxembourg

- AL OPPORTUNITIES, 5, allée Scheffer, L-2520 Luxembourg

- ALPINA REAL ESTATE FUND SCA SICAV-FIS, 13, rue Aldringen, L-1118 Luxembourg

- DWS EMERGING NEW DEAL FUND, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- ENTERPRISE, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- EQUI SICAV SIF SCA, 2, boulevard de la Foire, L-1528 Luxembourg

- GOTTEX SICAV SIF, 20, rue de la Poste, L-2346 Luxembourg

- INVESTMENT SELECT FUND SICAV-SIF, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- IPC -WERU GROW UP, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- IPC-CAPITAL STRATEGY IV, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- IPC-CAPITAL STRATEGY XI, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- IPC-CAPITAL STRATEGY XVIII, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- IPC-FUTURE PROJEKT FUND, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- IPC-PORTFOLIO INVEST XI, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- IPC-PORTFOLIO INVEST XII, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- KANT CAPITAL FUND S.C.A. SICAV-SIF, 412F, route d’Esch, L-1471 Luxembourg

- MASSENA WEALTH MANAGEMENT 2 S.C.A./FIS, 28-32, place de la Gare, L-1616 Luxembourg

- OPPORTUNITY UMBRELLA FUND, 19, rue de Bitbourg, L-1273 Luxembourg

- PHILAE FUND, 15, avenue J-F Kennedy, L-1855 Luxembourg

- SDP SIF, 5, allée Scheffer, L-2520 Luxembourg

- STORM FUND, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- VELSHEDA, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- YCAP OPPORTUNITY INVESTMENT SICAV-SIF, 80, route d’Esch, L-1470 Luxembourg

4) SICARs:

- /

1 Since the statistical data of SICARs were published on an annual basis before December 2016, the chart includes the number and net assets of SICARs as at 31 December 2015 for the previous months, resulting in constant figures until November 2016 for these vehicles.

2 Before 31 December 2016, the statistical data of SICARs were only published on an annual basis.