Global situation of undertakings for collective investment at the end of March 2017

Press release 17/19

I. Overall situation

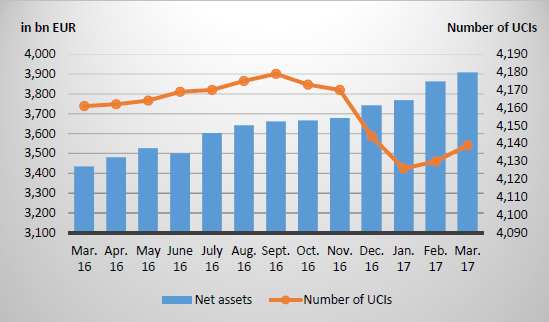

As at 31 March 2017, total net assets of undertakings for collective investment, including UCIs subject to the 2010 Law, specialised investment funds and SICARs amounted to EUR 3,906.027 billion compared to EUR 3,860.317 billion as at 28 February 2017, i.e. a 1.18% increase over one month. Over the last twelve months, the volume of net assets rose by 13.78%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 45.710 billion in March. This increase represents the balance of positive net issues amounting to EUR 31.804 billion (0.82%) and a positive development in financial markets amounting to EUR 13.906 billion (0.36%).

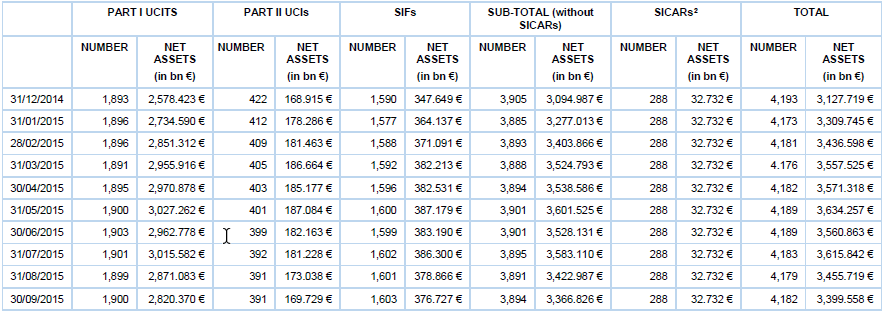

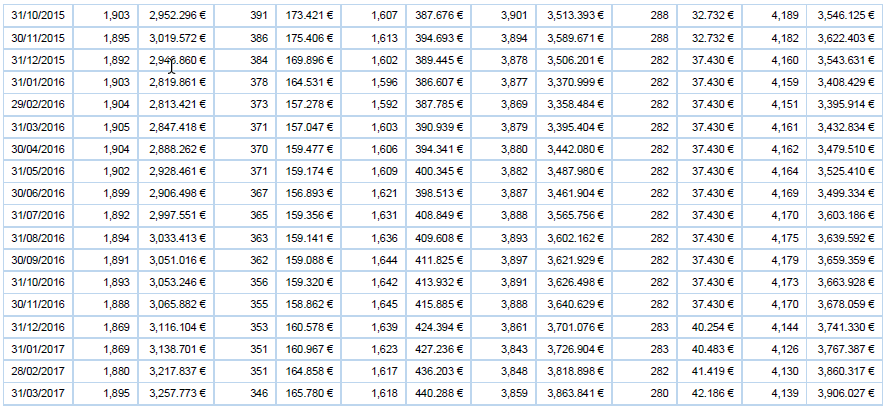

The development of undertakings for collective investment is as follows1:

The number of undertakings for collective investment (UCIs) taken into consideration totals 4,139 as against 4,130 in the previous month. A total of 2,650 entities have adopted an umbrella structure, which represents 13,097 sub-funds. When adding the 1,489 entities with a traditional structure to that figure, a total of 14,586 fund units are active in the financial centre.

As regards, on the one hand, the impact of financial markets on the main categories of undertakings for collective investment and, on the other hand, the net capital investment in these UCIs, the following can be said about March.

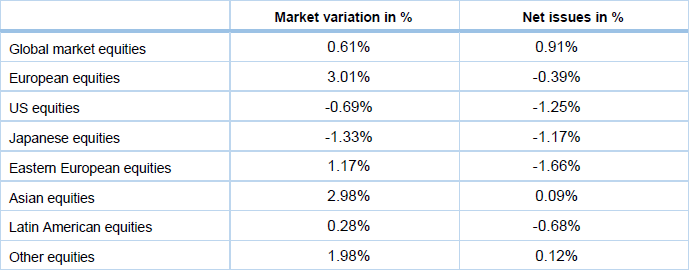

The categories of equity UCIs developed differently during the month under review.

As far as developed countries are concerned, the European equity UCIs registered high price increases in a context of continuing economic recovery in the euro area, reduction of political risks in Europe and maintenance of the monetary policy accommodation by the European Central Bank. US equity experienced sideways movements in relation to uncertainties as to the implementation of the expansive tax measures announced by the president of the United States, while the USD vs. EUR depreciation made US equity UCIs finish the month negatively. In view of mixed economic indicators in Japan and the YEN vs. EUR depreciation, the Japanese equity UCIs recorded price decreases.

As far as emerging countries are concerned, the Asian equity UCI category ended with price increases notably in a context of an improvement in the global economic climate. A predominantly negative development of the stock markets of Eastern Europe countries was more than offset by the appreciation of the main currencies of this region against the EUR, so that the Eastern European equity UCIs appreciated. Against the background of widely divergent developments of the stock markets and currencies of various South American countries, the Latin American equity UCIs closed the month with a slight overall increase.

In March, the equity UCI categories registered overall slightly positive net capital investment.

Development of equity UCIs during the month of March 2017*

* Variation in % of Net Assets in EUR as compared to the previous month

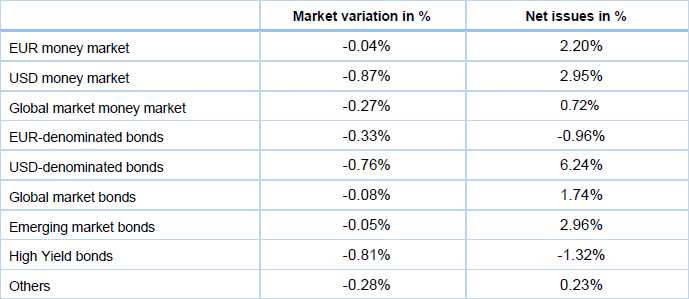

In Europe, the favourable economic environment as well as the reduction of political risks brought the US government bond yields slightly up while, at the same time, yield differences among euro area countries decreased. Yields of corporate bonds followed that trend, entailing price decreases of EUR-denominated bond UCIs.

In the United States, the key interest rate rise by the US Federal Reserve as well as the positive economic data were counterbalanced by uncertainties surrounding the implementation of the stimulus measures planned by the president of the United States so that, all in all, the USD-denominated bond market showed little change. As a result of the USD vs. EUR depreciation, USD-denominated bond UCIs turned loss-making.

The strong demand from investors for emerging countries bonds, offset by the rise of bond issues and the oil price reduction, resulted in an almost status quo for emerging countries’ bond UCIs.

In March, the category of fixed-income UCIs registered an overall positive net capital investment.

Development of fixed income UCIs during the month of March 2017*

* Variation in % of Net Assets in EUR as compared to the previous month

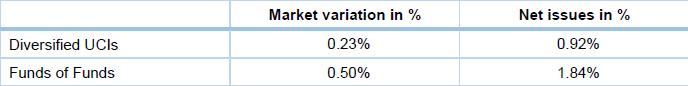

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of March 2017*

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and the net assets of UCIs according to Parts I and II, respectively, of the 2010 Law and of SIFs according to the 2007 Law

During the month under review, the following 29 undertakings for collective investment have been registered on the official list:

1) UCITS Part I 2010 Law:

- ADRIZA INVESTMENT FUND, 6A, rue Gabriel Lippmann, L-5365 Munsbach

- ALPHA (LUX) GLOBAL FUNDS, 25-29, Karneadou Street, Lemou Building, GR – Athens 106753

- BOSS CONCEPT 2, 4, rue Thomas Edison, L-1445 Strassen

- CLAY FUNDS, 5, allée Scheffer, L-2520 Luxembourg

- HARMONIUM SICAV, 12, rue Eugène Ruppert, L-2453 Luxembourg

- UNIFAVORIT: AKTIEN EUROPA, 308, route d’Esch, L-1471 Luxembourg

- UNIGLOBAL DIVIDENDE, 308, route d’Esch, L-1471 Luxembourg

- UNIPACIFIC AKTIEN, 308, route d’Esch, L-1471 Luxembourg

- UNIPREMIUM EVOLUTION 100, 308, route d’Esch, L-1471 Luxembourg

- UNIPREMIUM EVOLUTION 25, 308, route d’Esch, L-1471 Luxembourg

- UNIRAK NACHHALTIG KONSERVATIV, 308, route d’Esch, L-1471 Luxembourg

- UNIRAK NORDAMERIKA, 308, route d’Esch, L-1471 Luxembourg

- UNIRENT EUROPA, 308, route d’Esch, L-1471 Luxembourg

- UNIRENT GLOBAL, 308, route d’Esch, L-1471 Luxembourg

- UNIRENT MÜNDEL FLEX, 308, route d’Esch, L-1471 Luxembourg

- UNIRENT MÜNDEL, 308, route d’Esch, L-1471 Luxembourg

- UNIRENTEURO MIX, 308, route d’Esch, L-1471 Luxembourg

- UNIRENTEURO STAATSANLEIHEN FLEX, 308, route d’Esch, L-1471 Luxembourg

2) UCIs Part II Law 2010:

- –

3) SIFs:

- AQR LUX FUNDS II, 33, rue de Gasperich, L-5826 Hesperange

- BARGELLA REAL ESTATE S.A., SICAV-FIS, 4, rue Thomas Edison, L-1445 Strassen

- CONFLUENCE CAPITAL, 5, allée Scheffer, L-2520 Luxembourg

- ELUXEM SICAV-SIF S.A., 25A, boulevard Royal, L-2449 Luxembourg

- INDUSTRIAL PRIVATE MARKETS SCS SICAV-FIS, 5, Heienhaff, L-1736 Senningerberg

- INVESCO GLOBAL DIRECT REAL ESTATE FEEDER FUND S.À R.L. SICAV-SIF, 37A, avenue J-F Kennedy, L-1855 Luxembourg

- INVESCO GLOBAL DIRECT REAL ESTATE FUND FCP-SIF, 37A, avenue J-F Kennedy, L-1855 Luxembourg

- PENSIONS SCSP – SICAV-SIF, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- PRIVATE MARKET OPPORTUNITIES FUND OPEN-ENDED SICAV SIF S.A., 56, rue d’Anvers, L-1130 Luxembourg

- THE DIVERSIFIED RISK PREMIA FUND SICAV FIS, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

4) SICARs:

- WAGNER CAPITAL S.A. SICAR, 2-4, avenue Marie-Thérèse, L-2132 Luxembourg

The following 21 undertakings for collective investment have been deregistered from the official list during the month under review:

1) UCITS Part I 2010 Law:

- ANLAGESTRUKTUR, 25, rue Edward Steichen, L-2540 Luxembourg

- BOSS CONCEPT IPC SICAV, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- DEKA-EUROCASH, 5, rue des Labours, L-1912 Luxembourg

- TOWER FUND, 31, Z.A. Bourmicht, L-8070 Bertrange

2) UCIs Part II Law 2010:

- ECAN GLOBAL OPPORTUNITIES, 534, rue de Neudorf, L-2220 Luxembourg

- KEOPS OPPORTUNITIES FUND, 20, boulevard Emmanuel Servais, L-2535 Luxembourg

- LYXOR SYNOPSIS FUND, 28-32, place de la Gare, L-1616 Luxembourg

- MULTI OPPORTUNITY SICAV, 33A, avenue J-F Kennedy, L-1855 Luxembourg

- MUWM PRIVATE FUND, 287-289, route d’Arlon, L-1150 Luxembourg

3) SIFs:

- EUROPE LOGISTICS VENTURE 1, FCP-FIS, 34-38, avenue de la Liberté, L-1930 Luxembourg

- I.D.S. UMBRELLA FUND S.A. SIF-SICAV, 33A, avenue J-F Kennedy, L-1855 Luxembourg

- MUGC/WA U.S. HIGH YIELD CREDIT FUND, 287-289, route d’Arlon, L-1150 Luxembourg

- PIONEER INSTITUTIONAL SOLUTIONS, 8-10, rue Jean Monnet, L-2180 Luxembourg

- SK PROPERTY FUND SICAV-SIF, 5, rue Guillaume Kroll, L-1882 Luxembourg

- UGA (QII) US CORPORATE 1-5 YEAR BOND FUND, 287-289, route d’Arlon, L-1150 Luxembourg

- VANDERBILT S.C.A. SICAV-SIF, 2, boulevard de la Foire, L-1528 Luxembourg

- WT 9 – SICAV-FIS, 26, avenue de la Liberté, L-1930 Luxembourg

4) SICARs:

- ABN AMRO CONVERGING EUROPE INVESTMENTS, S.C.A., SICAR, 20, rue de la Poste, L-2346 Luxembourg

- AZTIQ PHARMA PARTNERS S.C.A., SICAR, 20, boulevard Emmanuel Servais, L-2535 Luxembourg

- ICG MINORITY PARTNERS FUND 2008 S.A. SICAR, 5, allée Scheffer, L-2520 Luxembourg

- JILIN S.C.A., SICAR, 1C, rue Gabriel Lippmann, L-5365 Munsbach

1 Since the statistical data of SICARs were published on an annual basis before December 2016, the chart includes the number and net assets of SICARs as at 31 December 2015 for the previous months, resulting in constant figures until November 2016 for these vehicles.

2 Before 31 December 2016, the statistical data of SICARs were only published on an annual basis.

3 Undertaking for collective investment for which the designated management company was authorised by the competent authorities of another Member State in accordance with Directive 2009/65/EC.