Global situation of undertakings for collective investment at the end of August 2017

Press release 17/34

I. Overall situation

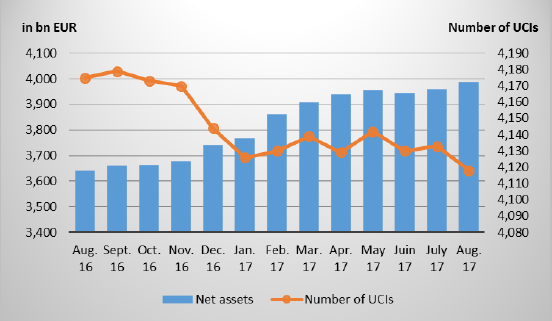

As at 31 August 2017, total net assets of undertakings for collective investment, including UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 3,987.328 billion compared to EUR 3,957.581 billion as at 31 July 2017, i.e. a 0.75% increase over one month. Over the last twelve months, the volume of net assets rose by 9.55%.

Consequently, the Luxembourg UCI industry registered a positive variation amounting to EUR 29.747 billion in August. This increase represents the balance of positive net issues of EUR 33.298 billion (0.84%) and a negative development in financial markets amounting to EUR 3.551 billion (-0.09%).

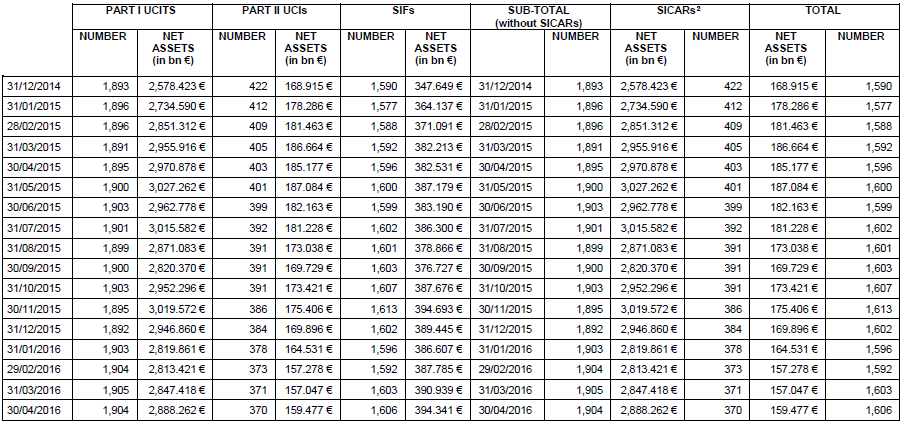

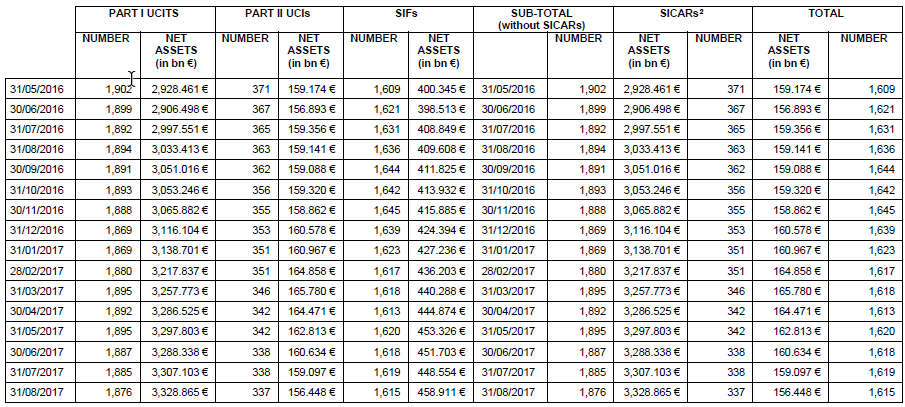

The development of undertakings for collective investment is as follows1:

The number of undertakings for collective investment (UCIs) taken into consideration totals 4,118 as against 4,133 in the previous month. A total of 2,638 entities have adopted an umbrella structure, which represents 13,218 sub-funds. When adding the 1,480 entities with a traditional structure to that figure, a total of 14,698 fund units are active in the financial centre.

As regards, on the one hand, the impact of financial markets on the main categories of undertakings for collective investment and, on the other hand, the net capital investment within these UCIs, the following can be said about August.

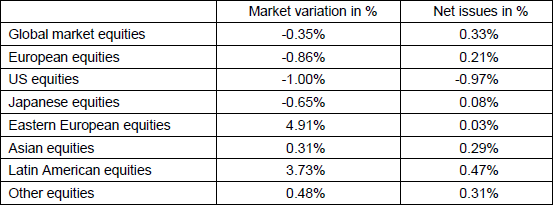

The categories of equity UCIs developed differently during the month under review.

As far as developed countries are concerned, August was marked, on the one hand, by geopolitical tensions related to North Korea and, on the other hand, by good economic news in Europe, the United States and Japan. In the light of the above and in view of the EUR appreciation against the main currencies which weighed on the markets, the category of European equity UCIs performed negatively. Although the American and Japanese equity prices remained more or less stable, the depreciation of USD and JPY against EUR caused the US and Japanese equity UCI categories to end the month in negative territory.

As regards emerging countries, all categories of equity UCIs improved despite the geopolitical tensions in relation to North Korea. The Asian equity UCI category registered price increases amidst stable economic data in China and an overall favourable economic environment. Russia’s and Brazil’s recovery from the recession and good economic figures in several other Eastern European and Latin American countries as well as the stabilisation of oil and primary commodity prices sustained the positive performance of the Eastern European and Latin American equity UCIs.

During August, the equity UCI categories recorded, overall, a positive net capital investment.

Development of equity UCIs during the month of August 2017*

* Variation in % of Net Assets in EUR as compared to the previous month.

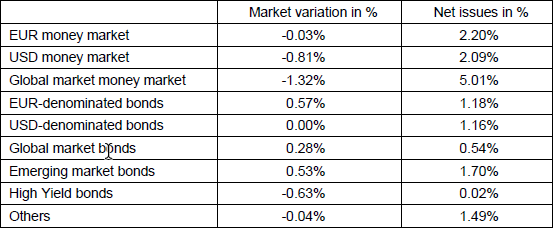

In Europe, due to their safe-haven status, high-rated euro area government bond yields declined amid geopolitical tensions linked to North Korea. Lower-rated euro area countries recorded a more moderate decline in their government bond yields which widened the yield spreads between them and higher-rated euro area countries. In the wake of the rise in government bond yields, corporate bonds also registered price increases, so that EUR-denominated bond UCIs slightly appreciated.

In the United States, US government bond yields also decreased as a result of low inflation and the search by investors for safe-haven assets in the context of geopolitical tensions and uncertainties as regards US economic policy. Combined with the USD vs. EUR depreciation, the USD-denominated bond UCI category remained unchanged.

Overall, emerging countries bonds recorded price increases due to economic fundamentals which were stable on average, the recovery of world trade and the stabilisation of primary commodity prices. Consequently, the emerging countries bond UCIs ended the month up.

In August, fixed-income UCI categories registered an overall positive net capital investment.

Development of fixed-income UCIs during the month of August 2017*

* Variation in % of Net Assets in EUR as compared to the previous month.

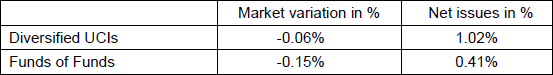

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below.

Development of diversified UCIs and Funds of Funds during the month of August 2017*

* Variation in % of Net Assets in EUR as compared to the previous month.

II. Breakdown of the number and net assets of UCIs

During the month under review, the following 10 undertakings for collective investment have been registered on the official list:

1) UCITS Part I 2010 Law:

- DEUTSCHE AM MULTI ASSET PIR FUND, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- INDOSUEZ ESTRATEGIA, 31-33, avenue Pasteur, L-2311 Luxembourg

- ITI FUNDS UCITS ETF SICAV, 20, boulevard Emmanuel Servais, L-2535 Luxembourg

- MASAYUME FUND, 49, boulevard du Prince Henri, L-1724 Luxembourg

2) UCIs Part II 2010 Law:

- FRANKFURTER, 15, rue de Flaxweiler, L-6776 Grevenmacher

3) SIFs:

- BANTLEON SIF SICAV, 33A, avenue J-F Kennedy, L-1855 Luxembourg

- BOUWFONDS EUROPEAN STUDENT HOUSING FUND II, 2, place François-Joseph Dargent, L-1413 Luxembourg

- FRANKLIN TEMPLETON ALTERNATIVE INVESTMENT FUNDS FCP-SIF, 8A, rue Albert Borschette, L-1246 Luxembourg

- NUCLEAR INVESTMENT FUND S.A. SICAV-SIF, 5, allée Scheffer, L-2520 Luxembourg

- OCEAN GROUP CAPITAL II, S.A. SICAV-SIF, 30, boulevard Royal, L-2449 Luxembourg

4) SICARs:

- –

The following 25 undertakings for collective investment have been deregistered from the official list during the month under review:

1) UCITS Part I 2010 Law :

- ACE ASSET MANAGEMENT – SICAV, 106, route d’Arlon, L-8210 Mamer

- CANDRIAM TOTAL RETURN II, 136, route d’Arlon, L-1150 Luxembourg

- CASTELL CONCEPT, 15, avenue J-F Kennedy, L-1855 Luxembourg

- DB OPPORTUNITY, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- DIAPASON COMMODITIES, 6, route de Trèves, L-2633 Senningerberg

- DMS UCITS PLATFORM FUND, 25-28, North Wall Quay, Dublin 13

- EUROSWITCH DEFENSIVE CONCEPTS OP, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- FIDELITY ALPHA FUNDS SICAV, 2A, rue Albert Borschette, L-1246 Luxembourg

- GLOCAP HAIG, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- H & A STABILITÄTSWÄHRUNGEN, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- PIONEER INSTITUTIONAL FUNDS, 8-10, rue Jean Monnet, L-2180 Luxembourg

- UNIPROFIANLAGE (2017), 308, route d’Esch, L-1471 Luxembourg

- UNIPROFIANLAGE (2017/II), 308, route d’Esch, L-1471 Luxembourg

- VAN ECK, 49, avenue J-F Kennedy, L-1855 Luxembourg

2) UCIs Part II 2010 Law:

- ALBERGO, 15, rue de Flaxweiler, L-6776 Grevenmacher

- UNIGARANT: COMMODITIES (2017) II, 308, route d’Esch, L-1471 Luxembourg

3) SIFs:

- AVIVA INVESTORS INTERNATIONAL FUND, 2, rue du Fort Bourbon, L-1249 Luxembourg

- FENICE SICAV-SIF SCA, 6A, rue Gabriel Lippmann, L-5365 Munsbach

- GLL EUROPA FONDS DES VERSORGUNGSWERKS DER RAE NRW, 15, rue Bender, L-1229 Luxembourg

- ICG ALTERNATIVE CREDIT (LUXEMBOURG) SICAV-SIF SCA, 5, allée Scheffer, L-2520 Luxembourg

- NORDIC RETAIL FUND, 2-8, avenue Charles de Gaulle, L-1653 Luxembourg

- RURAL IMPULSE FUND S.A., SICAV-FIS, 11, rue Aldringen, L-1118 Luxembourg

- TAURUS INVEST FCP-FIS, 26, avenue de la Liberté, L-1930 Luxembourg

- VALPIC, 15, avenue J-F Kennedy, L-1855 Luxembourg

4) SICARs:

- OPTIMUM IMMO S.A., SICAR, 12, rue Eugène Ruppert, L-2453 Luxembourg

1 Since the statistical data of SICARs were published only on an annual basis before December 2016, the chart includes the number and net assets of SICARs as at 31 December 2015 for the previous months, resulting in constant figures until November 2016 for these vehicles.

2 Before 31 December 2016, the statistical data of SICARs were published on an annual basis only.

3 Undertaking for collective investment, the designated management company of which was authorised by the competent authorities of another Member State in accordance with Directive 2009/65/EC.