Global situation of undertakings for collective investment at the end of May 2018

Press release 18/21

I. Overall situation

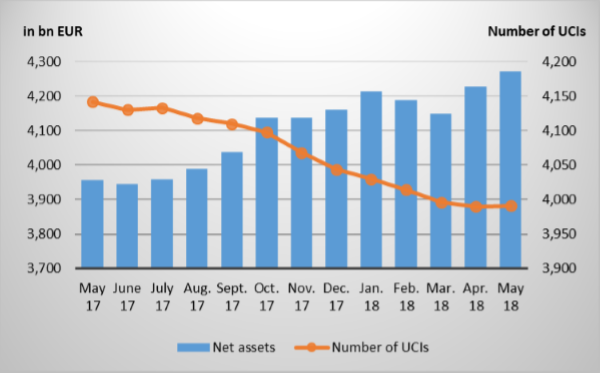

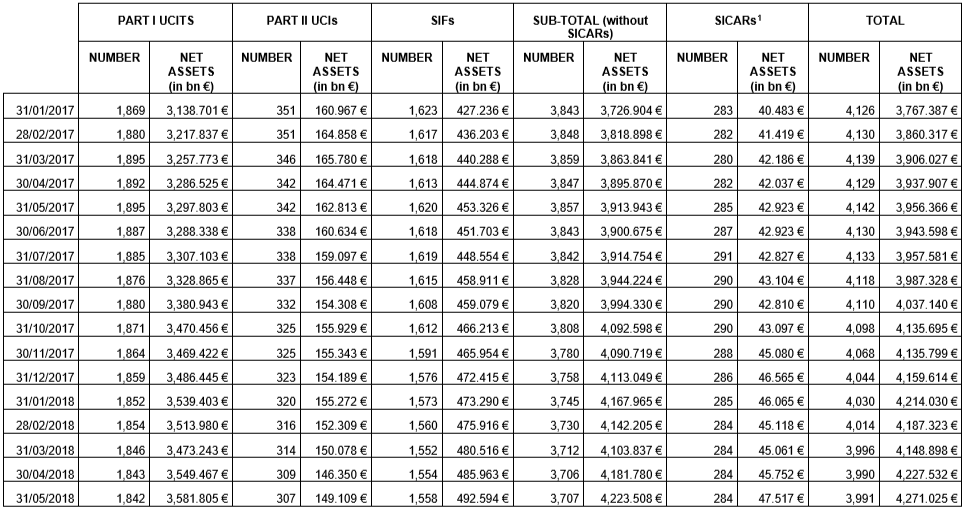

As at 31 May 2018, total net assets of undertakings for collective investment, including UCIs subject to the 2010 Law, specialised investment funds and SICARs amounted to EUR 4,271.025 billion compared to EUR 4,227.532 billion as at 30 April 2018, i.e. a 1.03% increase over one month. Over the last twelve months, the volume of net assets rose by 7.95%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 43.493 billion in May. This increase represents the balance of negative net issues of EUR 8.358 billion (-0.20%) and a positive development in the financial markets amounting to EUR 51.851 billion (1.23%).

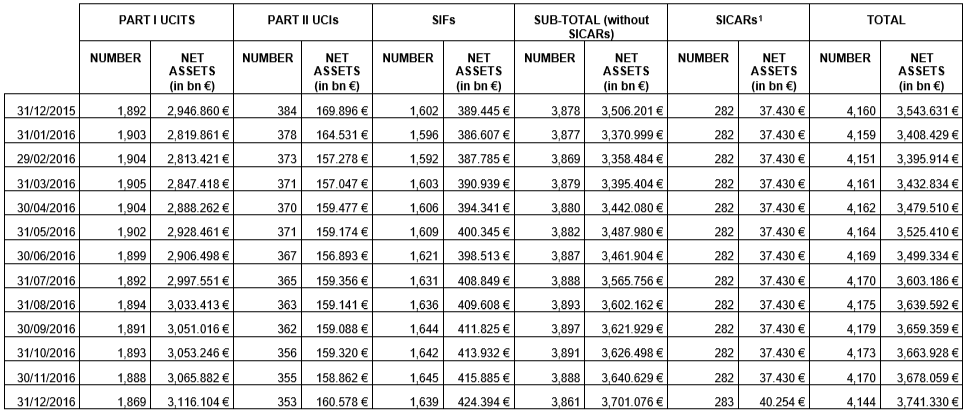

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,991 as against 3,990 in the previous month. A total of 2,582 entities adopted an umbrella structure, which represented 13,354 sub-funds. When adding the 1,409 entities with a traditional structure to that figure, a total of 14,763 fund units were active in the financial centre.

As regards, on the one hand, the impact of financial markets on the main categories of undertakings for collective investment and, on the other hand, the net capital investment in these UCIs, the following can be said about May.

As regards developed countries, the European equity UCIs recorded a slight upward trend despite the resurgence of the political risk in the euro area. The publication of the results of undertakings which exceeded the expectations, stable economic indicators and the appreciation of the USD against the EUR explain the increase of US equity UCIs. Although Japanese equities registered price losses in the light of weak macroeconomic data, the appreciation of the YEN against the EUR led the category of Japanese equity UCIs to end in positive territory.

With respect to emerging countries, Asian equity UCIs showed a positive performance amid an overall positive economic environment, positive economic indicators in China and the appreciation of the main Asian currencies against the EUR despite divergent developments in several Asian countries and the ongoing trade tensions between China and the United States. The negative development of most of the equity markets in Eastern Europe explains the negative performance of the category of Eastern European equity UCIs. The category of Latin American equity UCIs experienced a sharp decline due notably to the persisting political and economic problems in Brazil and Mexico and the depreciation of the main South American currencies. In May, variable-yield UCI categories registered an overall negative net capital investment.

Development of equity UCIs during the month of May 2018*

* Variation in % of Net Assets in EUR as compared to the previous month

The political uncertainties in Italy and the monetary policy normalisation process in Europe resulted in an increase of yields and in a new widening of the yield spread between the bonds of the euro area countries with high rating and those with lower rating. Consequently, EUR-denominated bond UCIs recorded price decreases.

The USD-denominated bond yields increased during the month under review due to the upward revision of inflation anticipations in a context of the rise in oil prices, good macroeconomic data and the ongoing monetary tightening by the Fed. This increase in yields which resulted in price losses of USD-denominated bonds was, however, more than offset by the appreciation of the USD against the EUR. Consequently, USD-denominated bond UCIs ended in positive territory.

The rise of the US bond yields, the monetary problems in some emerging countries as well as the persisting trade tensions with the United States led to higher risk premiums and consequently to a price drop of emerging market bond UCIs.

In May, fixed-income UCIs registered an overall negative net capital investment.

Development of fixed-income UCIs during the month of May 2018*

* Variation in % of Net Assets in EUR as compared to the previous month

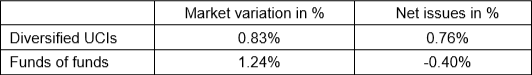

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of May 2018*

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following 15 undertakings for collective investment have been registered on the official list:

1) UCITS Part I 2010 Law:

- EDR FUND II, 20, boulevard Emmanuel Servais, L-2535 Luxembourg

- GENESIS LIQUID ALTERNATIVE STRATEGIES FUND, 4, rue Thomas Edison, L-1445 Strassen

- IIFL FUND, 2, rue d’Alsace, L-1122 Luxembourg

- MIX-FONDS HNI:, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- RIVERFIELD SICAV, 106, route d’Arlon, L-8210 Mamer

- SUMI TRUST INVESTMENT FUNDS (LUXEMBOURG), 33, rue de Gasperich, L-5826 Hesperange

2) UCIs Part II 2010 Law:

- PARTNERS GROUP GLOBAL SENIOR LOAN MASTER FUND SICAV, 2-4, rue Eugène Ruppert, L-2453 Luxembourg

3) SIFs:

- ALLIANZ DEBT FUND SCSP SICAV-SIF, 14, boulevard F-D Roosevelt, L-2450 Luxembourg

- CHEYNE EUROPEAN STRATEGIC VALUE CREDIT FUND SCS SICAV-SIF, 11-13, boulevard de la Foire, L-1528 Luxembourg

- FAP FEEDER FUND SCA, SICAV-SIF, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- FAP FUND S.C.SP.-SIF, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- LENDINVEST S.C.A. SICAV SIF, 2, boulevard de la Foire, L-1528 Luxembourg

- POLAR SIF, 12, rue Eugène Ruppert, L-2453 Luxembourg

- REPE UMBRELLA FUND S.A., SICAV-SIF, 17, rue de Flaxweiler, L-6776 Grevenmacher

- TUNGSTEN AYCON, 2, place François-Joseph Dargent, L-1413 Luxembourg

4) SICARs:

- –

The following 14 undertakings for collective investment have been deregistered from the official list during the month under review:

1) UCITS Part I 2010 Law:

- AXA INSURANCE FUND, 49, avenue J-F Kennedy, L-1855 Luxembourg

- DWS RENDITE, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- F&C PORTFOLIOS FUND II, 5, allée Scheffer, L-2520 Luxembourg

- IVY GLOBAL INVESTORS FUND, 106, route d’Arlon, L-8210 Mamer

- SOP GLOBALEAKTIENALLOKATION, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- TAGES CAPITAL SICAV, 60, avenue J-F Kennedy, L-1855 Luxembourg

- THESAN SICAV, 5, allée Scheffer, L-2520 Luxembourg

- WMP I SICAV, 17, rue de Flaxweiler, L-6776 Grevenmacher

2) UCIs Part II 2010 Law:

- MONTHLY INCOME ABS INVESTMENT, 33, rue de Gasperich, L-5826 Howald-Hesperange

- VESCORE FONDS, 3, rue Jean Monnet, L-2180 Luxembourg

3) SIFs:

- BPA INTERNATIONAL S.C.A., SICAV-FIS, 2, rue d’Alsace, L-1122 Luxembourg

- INVESCO REAL ESTATE – UK III FUND, 37A, avenue J-F Kennedy, L-1855 Luxembourg

- INVESCO REAL ESTATE-EUROPEAN HOTEL REAL ESTATE FUND II FCP-SIF, 37A, avenue J-F Kennedy, L1855 Luxembourg

- PLEXUS, 12, rue Eugène Ruppert, L-2453 Luxembourg

4) SICARs:

- –

1 Before 31 December 2016, the statistical data of SICARs were only published on an annual basis.