Global situation of undertakings for collective investment at the end of June 2018

Press release 18/26

I. Overall situation

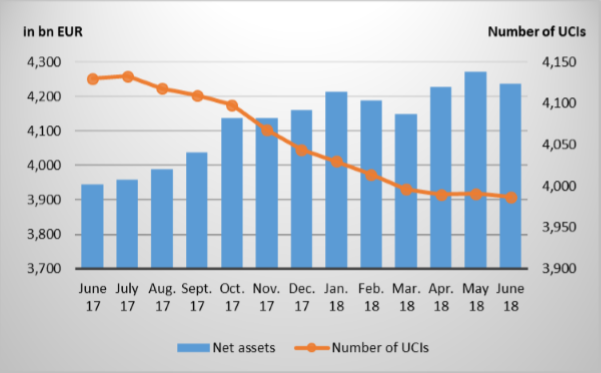

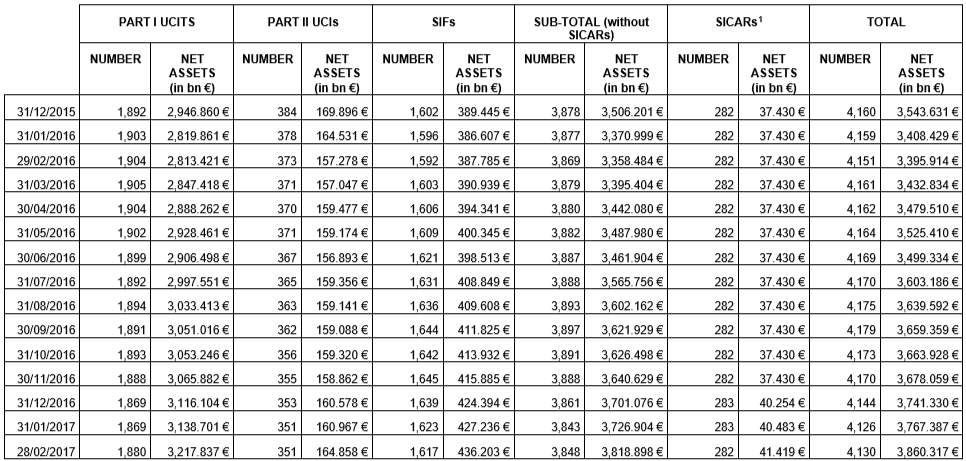

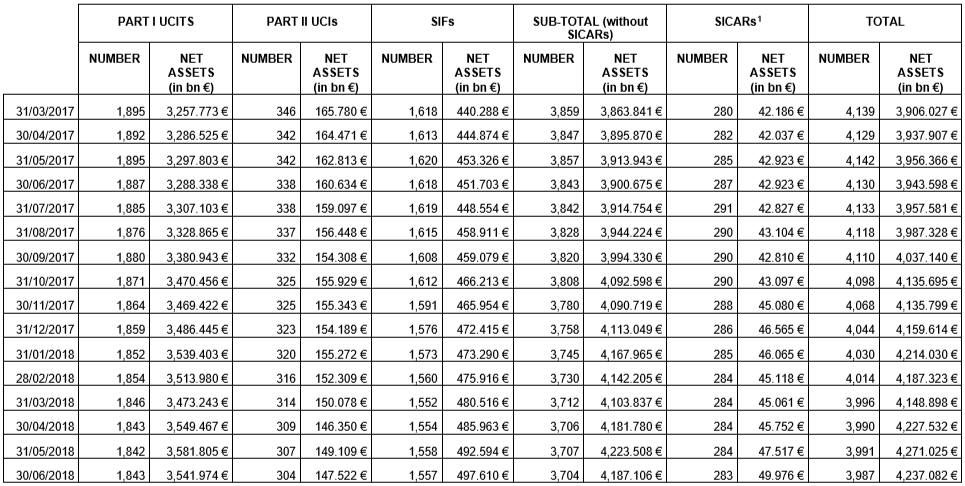

As at 30 June 2018, total net assets of undertakings for collective investment, including UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 4,237.082 billion compared to EUR 4,271.025 billion as at 31 May 2018, i.e. a -0.79% decrease over one month. Over the last twelve months, the volume of net assets rose by 7.44%.

The Luxembourg UCI industry thus registered a negative variation amounting to EUR -33.943 billion during the month of June. This decrease results from the sum of the negative net issues of EUR -3.602 billion (-0.08%) and the negative development in financial markets amounting to EUR -30.341 billion (-0.71%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,987 as against 3,991 in the previous month. A total of 2,581 entities adopted an umbrella structure, which represented 13,356 sub-funds. When adding the 1,406 entities with a traditional structure to that figure, a total of 14,762 fund units were active in the financial centre.

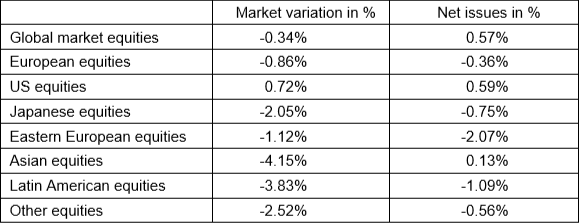

As regards, on the one hand, the impact of financial markets on the main categories of undertakings for collective investment and, on the other hand, the net capital investment in these UCIs, the following can be said about June.

The commercial tensions between the US and several other countries overshadowed the financial markets, resulting in falling prices for almost all equity UCI categories.

In developed countries, the European equity UCI categories thus fell at the end of June in negative territory. Japanese equity UCIs registered a negative impact accentuated by the depreciation of the JPY against the EUR. By contrast, the US equity UCI category recorded slight price increases despite these tensions, sustained by a positive economic development and the appreciation of the USD against the EUR.

As far as emerging markets are concerned, the uncertainties linked to the commercial tensions and the potential effects on global trade and growth implied a drop in the prices of all emerging market equity UCI categories, aggravated by the persisting economic and political issues in some of these emerging countries. The depreciation of the main emerging currencies further accentuated this declining trend.

In June, the variable-yield UCI categories registered a slight positive net capital investment.

Development of equity UCIs during the month of June 2018*

* Variation in % of Net Assets in EUR as compared to the previous month

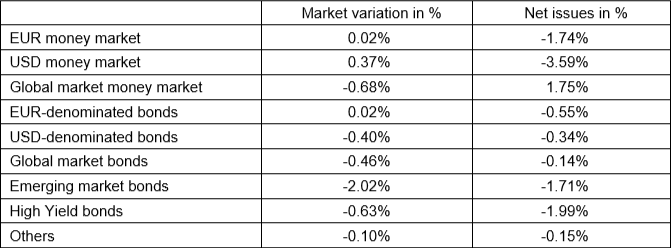

In Europe, the European bond UCI category remained rather unchanged during the month under review, considering the European Central Bank announcement to stop, as expected, its asset purchase programme at the end of 2018, whilst indicating that interest rates will probably remain at low levels until summer 2019 in a context of weak basis inflation rates.

As regards USD-denominated bond UCI categories, the continuing monetary tightening by the Fed, the positive economic figures and the anticipations of an inflation increase had an impact on the US bond prices. By contrast, US government bonds attracted investors looking for safe heavens in a context of commercial tensions between the US and several other countries. All in all, USD-denominated bond UCI categories ended the month down.

As regards emerging countries, the monetary tightening policy by the Fed, the commercial tensions with the US and the appreciation of the USD against most emerging currencies resulted in an increase in the emerging country bond yields, implying for the emerging country bond UCI category to end up in negative territory.

In June, fixed-income UCI categories registered an overall negative net capital investment.

Development of fixed-income UCIs during the month of June 2018*

* Variation in % of Net Assets in EUR as compared to the previous month

* Variation in % of Net Assets in EUR as compared to the previous month

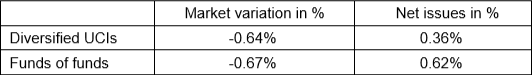

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of June 2018*

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following 18 undertakings for collective investment have been registered on the official list:

1) UCITS Part I 2010 Law:

- DEMOGRAPHIC CHANGE, 15, avenue J-F Kennedy, L-1855 Luxembourg

- GALILEO, 4, rue Thomas Edison, L-1445 Strassen

- GESTION PRIVEE, 16, boulevard Royal, L-2449 Luxembourg

- NORDEA MARKETS ETF, 11-13, boulevard de la Foire, L-1528 Luxembourg

- SATELLITE EVENT-DRIVEN UCITS FUND, 5, allée Scheffer, L-2520 Luxembourg

- SOLVECON, 9A, rue Gabriel Lippmann, L-5365 Munsbach

- TUNGSTEN ACTIVE RISK PREMIA, 2, place François-Joseph Dargent, L-1413 Luxembourg

2) SIFs:

- ALTHELIA SUSTAINABLE OCEAN FUND, 5, rue Guillaume Kroll, L-1882 Luxembourg

- B CAPITAL ENERGY TRANSITION INFRASTRUCTURE SICAV-SIF, 2, place François-Joseph Dargent, L1413 Luxembourg

- CL MULTI-STRATEGY SICAV-SIF, 5, allée Scheffer, L-2520 Luxembourg

- CS ENERGY INFRASTRUCTURE SICAV-SIF, 5, rue Jean Monnet, L-2180 Luxembourg

- EB SUSTAINABLE FUNDS LUXEMBOURG S.A., SICAV-SIF, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- EUROPEAN FINANCE OPPORTUNITIES S.C.A. SICAV-SIF, 287-289, route d’Arlon, L-1150 Luxembourg

- GLOBAL INTERNET LEADERS SICAV-FIS, 4, rue Thomas Edison, L-1445 Strassen

- INVESTEC GLOBAL ALTERNATIVE FUND 1, 49, avenue J-F Kennedy, L-1855 Luxembourg

- SWISS LIFE REF (LUX) EUROPEAN RETAIL SCS, SICAV-SIF, 4A, rue Albert Borschette, L-1246 Luxembourg

3) SICARs:

- ELIKONOS 2, S.C.A. SICAR, 68-70, boulevard de la Pétrusse, L-2320 Luxembourg

- VERNY INTERNATIONAL S.A. SICAR, 1, rue Hildegard von Bingen, L-1282 Luxembourg

The following 22 undertakings for collective investment have been deregistered from the official list during the month under review:

1) UCITS Part I 2010 Law:

- ABERDEEN GLOBAL II, 35A, avenue J-F Kennedy, L-1855 Luxembourg

- ALLIANCEBERNSTEIN FUND II, 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- RP, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- SOLIDAR SICAV, 106, route d’Arlon, L-8210 Mamer

- TRANQUILO MULTI ASSET FUND, 15, rue de Flaxweiler, L-6776 Grevenmacher

- UNIGARANT: EMERGING MARKETS (2018), 308, route d’Esch, L-1471 Luxembourg

- UNIGARANT: ERNEUERBARE ENERGIEN (2018), 308, route d’Esch, L-1471 Luxembourg

2) UCIs Part II 2010 Law:

- ING PRIVATE EQUITY SICAV, 14, rue Edward Steichen, L-2540 Luxembourg

- UNIGARANT: COMMODITIES (2018), 308, route d’Esch, L-1471 Luxembourg

3) SIFs:

- AL MASAH CAPITAL FUND FCP-SIF, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- AUSTRIAN REAL ESTATE FUND SA, SICAV-FIS, 121, avenue de la Faïencerie, L-1511 Luxembourg

- BANKMED CEDAR FUNDS, 5, allée Scheffer, L-2520 Luxembourg

- BCS MULTIFIZ S.C.A., SICAV-SIF, 42, rue de la Vallée, L-2661 Luxembourg

- FAMAURY, 20, boulevard Emmanuel Servais, L-2535 Luxembourg

- KINGSWAY FUND, 15, avenue J-F Kennedy, L-1855 Luxembourg

- M&A CAPITAL FUND SICAV SIF S.A., 66, avenue de la Liberté, L-1930 Luxembourg

- NIKKO AM INVESTMENT TRUST (LUXEMBOURG), 1B, rue Gabriel Lippmann, L-5365 Munsbach

- SOVEREIGN FUND, 5, Heienhaff, L-1736 Senningerberg

- WINDFALL LUX SA SICAV-SIF, 11, rue Aldringen, L-1118 Luxembourg

4) SICARs:

- AERIS TECHNOLOGY INVESTMENT COMPANY S.A., SICAR, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- NEREO GREENCAPITAL (SCA) SICAR, 19-21, boulevard du Prince Henri, L-1724 Luxembourg

- OQUENDO (SCA) SICAR, 20 rue de la poste, L-2346 Luxembourg

1 Before 31 December 2016, the statistical data of SICARs were only published on an annual basis.