Global situation of undertakings for collective investment at the end of September 2018

Press release 18/36

I. Overall situation

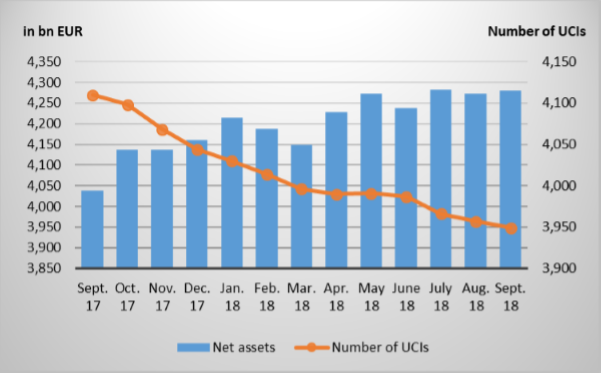

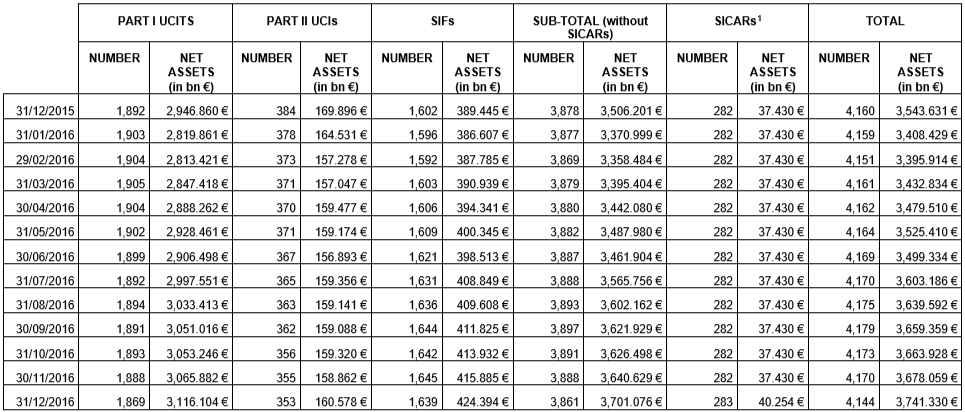

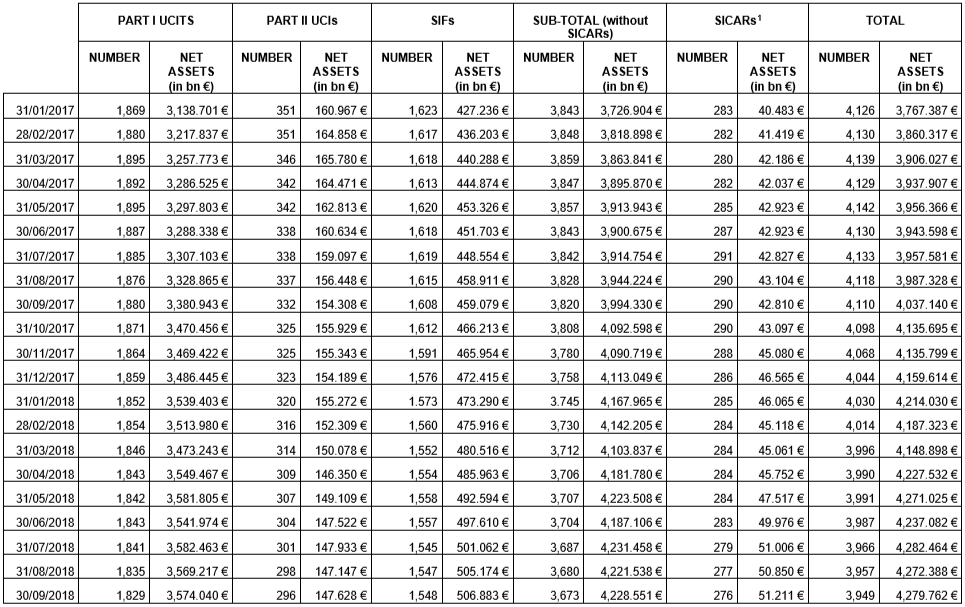

As at 30 September 2018, total net assets of undertakings for collective investment, including UCIs subject to the 2010 Law, specialised investment funds and SICARs amounted to EUR 4,279.762 billion compared to EUR 4,272.388 billion as at 31 August 2018, i.e. a 0.17% increase over one month. Over the last twelve months, the volume of net assets rose by 6.01%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 7.374 billion in September. This increase represents the balance of negative net issues of EUR 1,777 billion (-0.04%) and a positive development in the financial markets amounting to EUR 9.151 billion (0.21%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,949 as against 3,957 in the previous month. A total of 2,567 entities adopted an umbrella structure, which represented 13,414 sub-funds. When adding the 1,382 entities with a traditional structure to that figure, a total of 14,796 fund units were active in the financial centre.

As regards, on the one hand, the impact of financial markets on the main categories of undertakings for collective investment and, on the other hand, the net capital investment in these UCIs, the following can be said about September.

The equity markets developed differently during the month under review.

As regards developed countries, the category of European equity UCIs recorded a negative performance due, notably, to the ongoing trade tensions between the Unites States and China as well as the uncertainties related to the Italian budget and Brexit. The economic growth which is still solid in the United States continued to support the US equity UCIs which also benefitted from the appreciation of the USD against the EUR. In Japan, the equity markets ended the month with an increase amid an ongoing positive economic growth and a persistent depreciation of the YEN.

As regards emerging countries, the ongoing trade tensions between the United States and China as well as the divergent developments in different regions in Asia resulted in a negative development of the Asian equity UCIs. The stabilisation measures decided by Russia and Turkey as well as the rise of oil prices resulted in price increases for Eastern European equity UCIs. The finalisation of the new free trade agreement between Mexico, Canada and the United States, the increased support of the International Monetary Fund to Argentina as well as the appreciation of most South American currencies led to a rise in prices of South American equity UCIs.

In September, equity UCI categories registered an overall positive net capital investment.

Development of equity UCIs during the month of September 2018*

* Variation in % of Net Assets in EUR as compared to the previous month

In Europe, the confirmation of the European Central Bank to end its asset-purchase programme at the end of 2018 together with the uncertainties related to the Italian budget resulted in an increase of yields of EUR-denominated government bonds. There were few changes in corporate bonds and the EUR-denominated bond UCI category recorded slight price losses.

In the United States, the rise of the key interest rates by the Fed, the increase of the inflation and the solid economic growth led to the expansion of government bond yields resulting in the decrease of bond prices. This movement was more than offset by the USD appreciation against the EUR so that the category of USD-denominated bond UCIs ended the month under review slightly up.

As regards emerging countries, the developments in Turkey and Argentina, the agreement negotiated between Mexico, Canada and the United States and the upward trend of oil prices contributed to the increase in the emerging country bond UCI category emphasised by the appreciation of many emerging currencies.

In September, fixed-income UCI categories registered an overall negative net capital investment.

Development of fixed-income UCIs during the month of September 2018*

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of September 2018*

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following 8 undertakings for collective investment have been registered on the official list:

1) UCITS Part I 2010 Law:

- BOERSE.DE-WELTFONDS, 4, rue Thomas Edison, L-1445 Strassen

2) UCIs Part II 2010 Law:

- –

3) SIFs:

- MWM II SICAV-SIF, 5, rue Jean Monnet, L-2180 Luxembourg

- PRIVACCESS VIII, 50, avenue J-F Kennedy, L-1855 Luxembourg

- SF AVENIR, 20, boulevard Emmanuel Servais, L-2535 Luxembourg

- SQUARE CAPITAL ASSET SICAV-SIF, S.C.A., 5, rue Jean Monnet, L-2180 Luxembourg

- SWISS LIFE FUNDS (LUX) GIO FEEDER UMBRELLA, FCP-SIF, 4A, rue Albert Borschette, L-1246 Luxembourg

- SWISS LIFE REAL ESTATE FUNDS (LUX) S.A. SICAV-SIF, 4A, rue Albert Borschette, L1246 Luxembourg

- WATERLOO SICAV-SIF, 2, rue d’Alsace, L-1122 Luxembourg

4) SICARs:

- –

The following 16 undertakings for collective investment have been deregistered from the official list during the month under review:

1) UCITS Part I 2010 Law:

- ATCM I, 4, rue Peternelchen, L-2370 Howald

- PHARMA/WHEALTH, 1c, rue Gabriel Lippmann, L-5365 Munsbach

- RAS LUX FUND, Bockenheimer Landstraße 42-44, D-60232 Frankfurt am Main2

- UNIGARANTPLUS: ERNEUERBARE ENERGIEN (2018), 308, route d’Esch, L-1471 Luxembourg

- UNIGARANTPLUS: EUROPA (2018), 308, route d’Esch, L-1471 Luxembourg

- UNIINSTITUTIONAL EURO COVERED BONDS 2019, 308, route d’Esch, L-1471 Luxembourg

- UNIPROTECT: EUROPA II, 308, route d’Esch, L-1471 Luxembourg

2) UCIs Part II 2010 Law:

- FIDELITY GLOBAL BOND SERIES, 2A, rue Albert Borschette, L-1246 Luxembourg

- NOMURA US LOAN INCOME, 33, rue de Gasperich, L-5826 Howald-Hesperange

3) SIFs:

- CIS CLO SELECT I SICAV-SIF, S.A., 80, route de Luxembourg, L-6633 Wasserbillig

- CORUM FUND, 10, rue Antoine Jans, L-1820 Luxembourg

- DIAM FUND, 1B, rue Gabriel Lippmann, L-5365 Munsbach

- IVALDI ALPHA SICAV-FIS, 2, rue Jean Monnet, L-2180 Luxembourg

- IVALDI MASTER SICAV-FIS, 2, rue Jean Monnet, L-2180 Luxembourg

- MONT-ROYAL FUNDS S.C.A. SICAV-SIF, 2, rue d’Arlon, L-8399 Windhof

4) SICARs:

- DIGITAL INVESTMENTS S.C.A., SICAR, 30, boulevard Royal, L-2449 Luxembourg

1 Before 31 December 2016, the statistical data of SICARs were only published on an annual basis.

2 Undertaking for collective investment for which the designated management company was authorised by the competent authorities of another Member State in accordance with Directive 2009/65/EC.