Global situation of undertakings for collective investment at the end of March 2019

Press release 19/19

I. Overall situation

As at 31 March 2019, total net assets of undertakings for collective investment, including UCIs subject to the 2010 Law, specialised investment funds and SICARs amounted to EUR 4,350.449 billion compared to EUR 4,262.654 billion as at 28 February 2019, i.e. a 2.06% increase over one month. Over the last twelve months, the volume of net assets rose by 4.86%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 87.795 billion in March. This increase represents the sum of positive net issues amounting to EUR 18.335 billion (+0.43%) and of a positive development in financial markets amounting to EUR 69.460 billion (+1.63%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,868 as against 3,890 in the previous month. A total of 2,513 entities adopted an umbrella structure, which represented 13,562 sub-funds. When adding the 1,355 entities with a traditional structure to that figure, a total of 14,917 fund units were active in the financial centre.

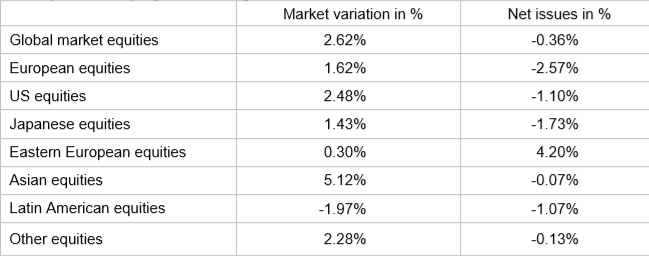

As regards, on the one hand, the impact of financial markets on the main categories of undertakings for collective investment and, on the other hand, the net capital investment in these UCIs, the following can be said about March.

The equity markets developed differently during the month under review.

As regards developed countries, the European equity UCIs recorded a positive performance in view of the more accommodating monetary policy of the European Central Bank despite the slowdown of the global economy, the trade tensions between the United States and Europe and the political problems in the euro area. As a result of the progress in the Sino-American trade negotiations and the prudent monetary policy of the Federal Reserve, the category of US equity UCIs recorded an increase enhanced by the appreciation of the USD against the EUR. Although Japanese equities registered price losses against the backdrop of uncertainties concerning the future international trade relations which negatively impacted Japan’s foreign trade and the less favourable global economic environment, the appreciation of the JPY against the EUR led the category of Japanese equity UCIs to close in positive territory.

As regards emerging countries, the Asian equity UCIs performed overall well based on the positive effect of the progress in the Sino-American trade negotiations, despite the diverging developments in the different Asian countries. As regards the category of Eastern European equity UCIs, in view of the heterogeneous developments in the different countries of the region, this category recorded a slight price increase due, among others, to the positive development of oil prices. Following the political problems in many South American countries and the depreciation of some South American currencies, the category of Latin American equity UCIs registered a downward trend during the month under review.

In March, the equity UCI categories registered an overall negative net capital investment.

Development of equity UCIs during the month of March 2019*

* Variation in % of Net Assets in EUR as compared to the previous month

In Europe, the announcement by the European Central Bank of the key interest rates remaining at the current level and a new series of targeted longer-term refinancing operations of banks in a context of weaker macroeconomic data in the euro area supported the prices of EUR-denominated bonds so that, all in all, the category of EUR-denominated bond UCIs performed well.

In the United States, the long-term government bond yields denominated in USD also decreased due to the more prudent speech of the Federal Reserve regarding the future orientation of its monetary policy, in view of signs showing growth deceleration. This decrease in yields, reflected by an appreciation of prices of USD bonds, explains the rise in the category of USD-denominated bond UCIs.

In emerging countries, the more accommodating speech regarding monetary policy of the Federal Reserve and the reduction of risk premiums prompted the upward movement of the category of emerging market bond UCIs, despite the idiosyncratic risks for some countries.

In March the category of fixed-income UCIs registered an overall positive net capital investment.

Development of fixed-income UCIs during the month of March 2019*

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of March 2019*

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following eight undertakings for collective investment have been registered on the official list:

1) UCITS Part I 2010 Law:

- DJE GESTIÓN PATRIMONIAL 2026, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- METIS AM UCITS, 60, avenue J-F Kennedy, L-1855 Luxembourg

- SIMAG INVESTMENT FUNDS, 5, rue Jean Monnet, L-2180 Luxembourg

- UNIANLAGEMIX: KONSERVATIV, 308, route d’Esch, L-1471 Luxembourg

2) SIFs:

- ALLIANZ DEFENSIVE MIX FCP-FIS, 6B, route de Trèves, L-2633 Senningerberg

- ARCHO FCP-SIF, 10, rue Edward Steichen, L-2540 Luxembourg

- SPLENDID INSIGHT S.A. SICAV-SIF, 15, avenue J-F Kennedy, L-1855 Luxembourg

- UNIINSTITUTIONAL SACHWERTE SCS SICAV-SIF, 308, route d’Esch, L-1471 Luxembourg

3) SICARs:

- –

The following 30 undertakings for collective investment have been deregistered from the official list during the month under review:

1) UCITS Part I 2010 Law:

- CBRE CLARION FUNDS SICAV, 80, route d’Esch, L-1470 Luxembourg

- CROSS COMMODITY LONG/SHORT FUND, 8-10, rue Jean Monnet, L-2180 Luxembourg

- LUX SELECTION 100SI, 8-10, rue Jean Monnet, L-2180 Luxembourg

- POLAR INVESTMENTS, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- PULSE INVEST, 2, place François-Joseph Dargent, L-1413 Luxembourg

- RAVEL INVESTMENT SICAV, 12, rue Eugène Ruppert, L-2453 Luxembourg

- UNIGARANT95: NORDAMERIKA (2019), 308, route d’Esch, L-1471 Luxembourg

- UNIGARANTEXTRA: DEUTSCHLAND (2019), 308, route d’Esch, L-1471 Luxembourg

- UNIPROFIANLAGE (2019), 308, route d’Esch, L-1471 Luxembourg

2) UCIs Part II 2010 Law:

- LAZARD WORLD TRUST FUND, 49, avenue J-F Kennedy, L-1855 Luxembourg

3) SIFs:

- ALLIANCE SICAV-SIF S.A., 2, rue d’Alsace, L-1122 Luxembourg

- BNP PARIBAS PRIVATE REAL ESTATE FUND OF FUNDS, 10, rue Edward Steichen, L-2540 Luxembourg

- BPI STRATEGIES CAPITAL SICAV-SIF, 15, avenue J-F Kennedy, L-1855 Luxembourg

- CBRE ASIA ALPHA PLUS FUND II FCP-SIF, 177, rue de Luxembourg, L-8077 Bertrange

- CHENAVARI EUROPEAN PRIVATE DEBT OPPORTUNITIES FUND SCS SICAV SIF, 2, boulevard de la Foire, L-1528 Luxembourg

- DZ PRIVATBANK (SCHWEIZ) PORTFOLIO, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- FINAS REAL ESTATE FUND SCA SICAV SIF, 5, allée Scheffer, L-2520 Luxembourg

- HAIG AAFIE BOND FUND-FIS, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- HILUX SV SIF, 2, place François-Joseph Dargent, L-1413 Luxembourg

- JURBISE SICAV, 12, rue Eugène Ruppert, L-2453 Luxembourg

- MBM, 163, rue du Kiem, L-8030 Strassen

- MUGC-IG US CORPORATE BOND, 287-289, route d’Arlon, L-1150 Luxembourg

- MULTI ASSET PROTECT 1780, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- S. U. P. CAPRICORN SICAV-FIS, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- THE DIVERSIFIED RISK PREMIA FUND SICAV FIS, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- VARUNA INFINITY FUND, 6, rue Eugène Ruppert, L-2453 Luxembourg

- VCM GOLDING MEZZANINE SICAV, 9A, rue Gabriel Lippmann, L-5365 Munsbach

- XEON FUND SICAV SIF S.C.A., 68-70, boulevard de la Pétrusse, L-2320 Luxembourg

4) SICARs:

- AXA MEZZANINE I S.A., SICAR, 24, avenue Emile Reuter, L-2420 Luxembourg

- INCUBATION CAPITAL I, SICAR, 5, rue Jean Monnet, L-2180 Luxembourg

1 Before 31 December 2016, the statistical data of SICARs were only published on an annual basis.