Global situation of undertakings for collective investment at the end of May 2019

Press release 19/30

I. Overall situation

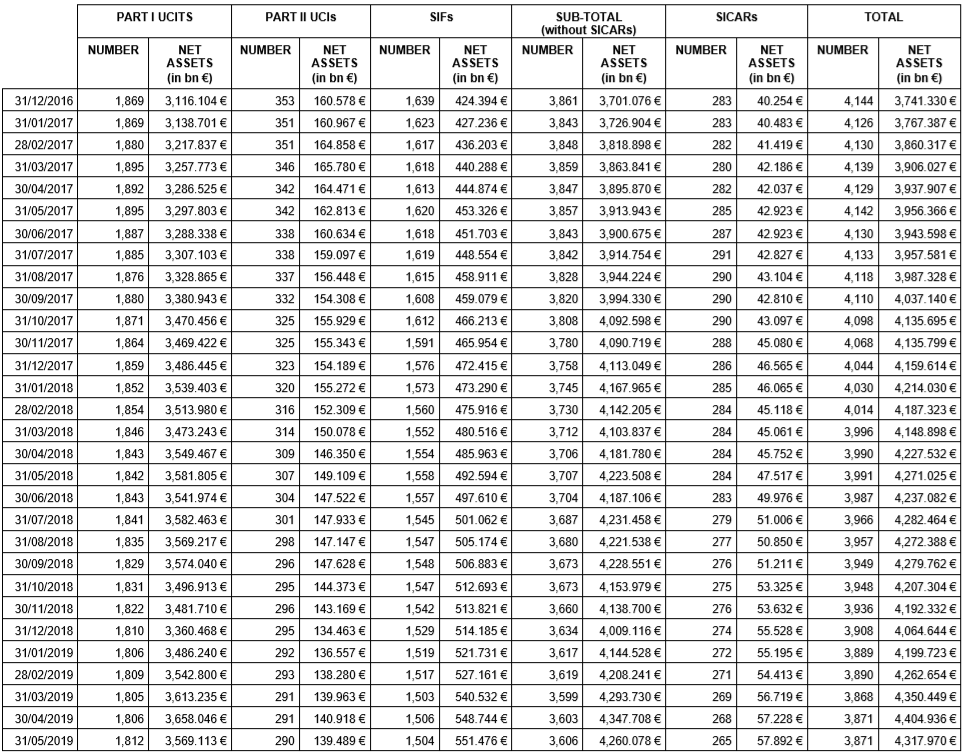

As at 31 May 2019, total net assets of undertakings for collective investment, including UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 4,317.970 billion compared to EUR 4,404.936 billion as at 30 April 2019, i.e. a 1.97% decrease over one month. Over the last twelve months, the volume of net assets rose by 1.10%.

The Luxembourg UCI industry thus registered a negative variation amounting to EUR 86.966 billion during the month of May. This decrease represents the sum of negative net issues of EUR 4.048 billion (-0.09%) and the negative development in financial markets amounting to EUR 82.918 billion (-1.88%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,871 as against 3,871 in the previous month. A total of 2,517 entities adopted an umbrella structure, which represented 13,548 sub-funds. When adding the 1,354 entities with a traditional structure to that figure, a total of 14,902 fund units were active in the financial centre.

As regards, on the one hand, the impact of financial markets on the main categories of undertakings for collective investment and, on the other hand, the net capital investment in these UCIs, the following can be said about May.

The trade tensions between China and the United States and the signs of the global growth slowdown overshadowed the financial markets, resulting in falling prices for almost all equity UCI categories.

As regards developed countries, the category of European equity UCIs also recorded a negative performance in a context of mitigated macroeconomic figures in the euro area, the risk of a no-deal Brexit and the threat of US customs duties on the European automotive industry. In light of the risks related to Sino-American trade tensions and signs of growth slowdown in the United States, the category of US equity UCIs also ended the month in negative territory. The trade tensions, the mitigated leading indicators in Japan and the appreciation of the JPY in its quality as ‘safe haven’, explain the losses registered in the Japanese equity UCIs.

As regards emerging countries, Sino-American trade tensions led to an overall fall in prices of the categories of Asian and Latin American equity UCIs. The positive development on the Russian stock exchange has, more or less, offset the negative performance of other Eastern European stock exchanges, so that the category of Eastern European equity UCIs remained almost unchanged.

In May, equity UCI categories registered an overall negative net capital investment.

Development of equity UCIs during the month of May 2019*

* Variation in % of Net Assets in EUR as compared to the previous month

As regards the bond markets of developed countries, the government bond yields of high-rated countries, in view of their status of ‘safe haven’, decreased on both sides of the Atlantic as a result mainly of uncertainties with respect to international trade and signs of a global growth slowdown, whereas risk premiums of corporate bonds increased. All in all, the EUR-denominated and USD-denominated bond UCIs ended the month in positive territory.

As for emerging markets, the category of emerging market bond UCIs stagnated during the month under review, due to a drop in yields of some segments of the emerging countries, on the one hand, and trade tensions and the depreciation of the main emerging currencies, on the other.

In May, fixed-income UCIs registered an overall positive net capital investment.

Development of fixed-income UCIs during the month of May 2019*

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of May 2019*

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following 14 undertakings for collective investment have been registered on the official list:

1) UCITS Part I 2010 Law:

- AIA INVESTMENT FUNDS, 16, boulevard d’Avranches, L-1160 Luxembourg

- BANKIA AM INTERNATIONAL FUNDS SICAV, 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- CENTRICA, 5, rue Jean Monnet, L-2180 Luxembourg

- CONVERGENCE LUX, 106, route d’Arlon, L-8210 Mamer

- DAIWA GLOBAL FUNDS, 106, route d’Arlon, L-8210 Mamer

- DEUTSCHE AKTIEN SYSTEMATIC INVEST, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- DWS CONCEPT DJE RESPONSIBLE INVEST, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- KYRON UCITS SICAV, 5, allée Scheffer, L-2520 Luxembourg

- STOREBRAND SICAV, 6, rue Lou Hemmer, L-1748 Senningerberg

- WORLD IMPACT SICAV, 44, rue de la Vallée, L-2661 Luxembourg

2) UCIs Part II 2010 Law:

- –

3) SIFs:

- AZ ESKATOS, 35, avenue Monterey, L-2163 Luxembourg

- HINES EUROPEAN REAL ESTATE OPPORTUNITIES MUTUAL FUND FCP SIF, 35F, avenue J-F Kennedy, L-1855 Luxembourg

- HORIZON FUND, 28-32, place de la Gare, L-1616 Luxembourg

- INSTITUTIONAL SOLUTIONS FUND FCP-SIF, 8, avenue de la Liberté, L-1930 Luxembourg

4) SICARs:

- –

The following 14 undertakings for collective investment have been deregistered from the official list during the month under review:

1) UCITS Part I 2010 Law:

- C WORLDWIDE GROWTH, 1, rue Schiller, L-2519 Luxembourg

- CAPITAL INTERNATIONAL PORTFOLIOS, 6C, route de Trèves, L-2633 Senningerberg

- TRENDCONCEPT FUND MULTI ASSET ALLOCATOR, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- UNIEURORENTA CORPORATES DEUTSCHLAND 2019, 308, route d’Esch, L-1471 Luxembourg

2) UCI Part II 2010 Law:

- PERMAL MULTI-MANAGER FUNDS (LUX), 20, rue de la Poste, L-2346 Luxembourg

3) SIFs:

- AQUILA GAM FUND S.A., 5, Heienhaff, L-1736 Senningerberg

- DMC FUND FCP SIF, 15, rue du Fort Bourbon, L-1249 Luxembourg

- EUROPEAN REAL ESTATE OPPORTUNITIES FUND, 15, boulevard Friedrich Wilhelm Raiffeisen, L-2411 Luxembourg

- PRADERA CENTRAL & EASTERN FUND, 11-13, boulevard de la Foire, L-1528 Luxembourg

- SATURNE SICAV, 12, rue Eugène Ruppert, L-2453 Luxembourg

- WMC GEM SYSTEMATIC EQUITY FUND, 287-289, route d’Arlon, L-1150 Luxembourg

4) SICARs:

- EDMOND DE ROTHSCHILD PRIVATE EQUITY CHINA S.C.A., SICAR, 20, boulevard Emmanuel Servais, L-2535 Luxembourg

- ORLANDO ITALY SPECIAL SITUATIONS SICAR (SCA), 16, rue Jean l’Aveugle, L-1148 Luxembourg

- TRILANTIC CAPITAL PARTNERS IV (EUROPE) S.C.A., SICAR, 20, rue de la Poste, L-2346 Luxembourg