Global situation of undertakings for collective investment at the end of August 2019

Press release 19/44

I. Overall situation

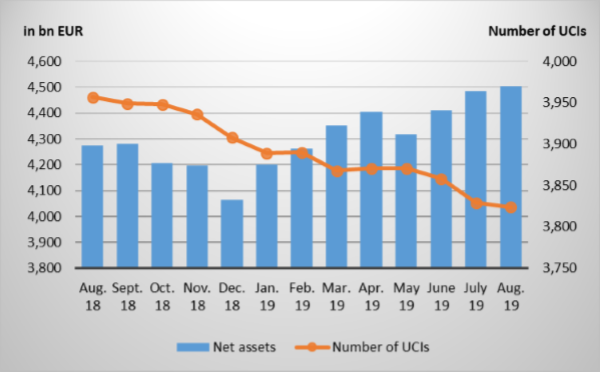

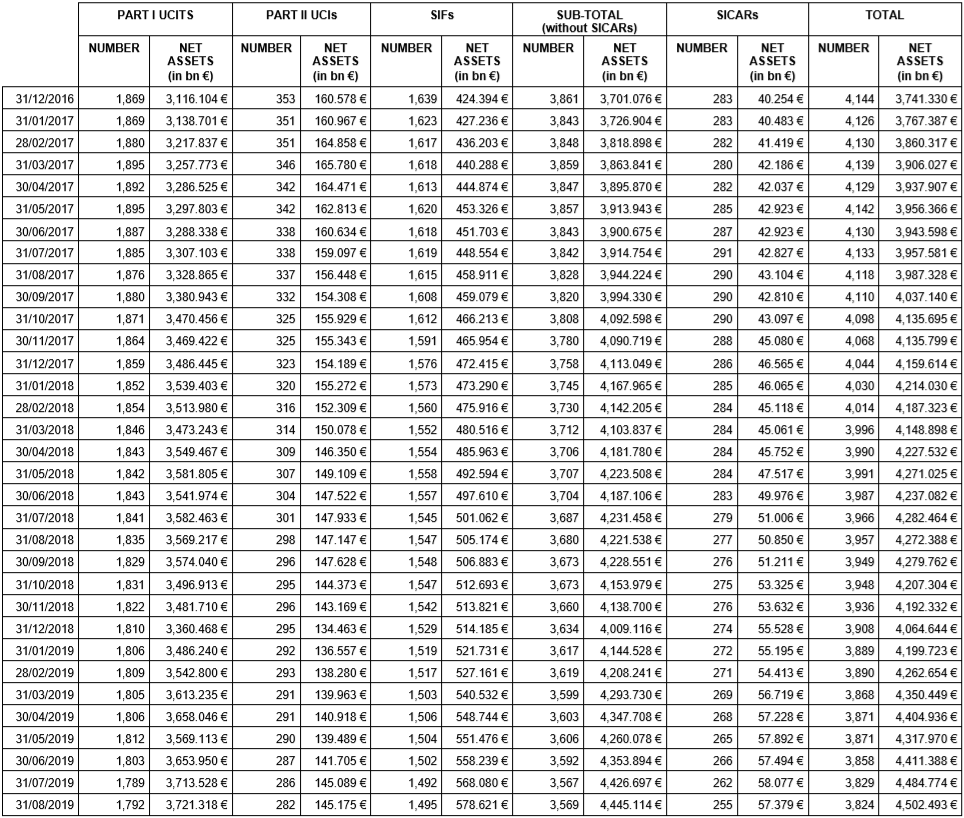

As at 31 August 2019, total net assets of undertakings for collective investment, including UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 4,502.493 billion compared to EUR 4,484.774 billion as at 31 July 2019, i.e. a 0.40% increase over one month. Over the last twelve months, the volume of net assets rose by 5.39%.

Consequently, the Luxembourg UCI industry registered a positive variation amounting to EUR 17.719 billion in August. This increase represents the balance of positive net issues amounting to EUR 28.616 billion (+0.64%) and a negative development in financial markets amounting to EUR 10.897 billion (-0.24%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,824 as against 3,829 in the previous month. A total of 2,499 entities adopted an umbrella structure, which represented 13,497 sub-funds. When adding the 1,325 entities with a traditional structure to that figure, a total of 14,822 fund units were active in the financial centre.

As regards, on the one hand, the impact of financial markets on the main categories of undertakings for collective investment and, on the other hand, the net capital investment in these UCIs, the following can be said about August.

In view of the rise in trade tensions and the risks for global economic growth, equity markets recorded an overall negative performance.

As regards developed countries, the category of European equity UCIs registered a negative performance against the background of mitigated macroeconomic figures and the possibility of a no-deal Brexit. The resurgence of the trade conflict between China and the United States combined with less favourable macroeconomic data in the United States contributed to the downward trend of the US equity UCI category. The category of Japanese equity UCIs also ended the month in negative territory in a context of mitigated economic figures in Japan, the strong appreciation of the yen and the conflict between Japan and South Korea.

As far as emerging countries are concerned, all categories of emerging market equity UCIs recorded price losses as a result of the deceleration in global growth, the escalation of trade tensions, price losses of the main commodities and the strong depreciation of most emerging currencies against the EUR despite the easing of the monetary policies in many emerging countries.

In August, equity UCI categories registered an overall negative net capital investment.

Development of equity UCIs during the month of August 2019*

* Variation in % of Net Assets in EUR as compared to the previous month

In Europe, the less favourable global economic environment, trade tensions and the risk of a hard Brexit led to price increases of government bonds which were sought after by investors as ‘safe haven’. The prices of corporate bonds, despite an increase in risk premiums, followed this upward trend supported by the prospect of a more expansive monetary policy. All in all, EUR-denominated bond UCIs ended the month in positive territory.

In the United States, Sino-American trade tensions and expectations of new decreases of key interest rates by the US Federal Reserve resulted in a significant drop of long-term government bond yields spurring price increases in the category of USD-denominated bond UCIs.

Despite the downward trend of yields, the category of emerging market bond UCIs developed negatively in a context of rising risk premiums based on the escalation of trade tensions and idiosyncratic events. The significant depreciation of most emerging currencies against the EUR emphasised this negative performance.

In August, fixed-income UCI categories registered an overall positive net capital investment.

Development of fixed-income UCIs during the month of August 2019*

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of August 2019*

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following 14 undertakings for collective investment have been registered on the official list:

1) UCITS Part I 2010 Law:

- DEKA-LIQUID ALTERNATIVE STRATEGIES, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- FRANKLIN TEMPLETON ALTERNATIVE FUNDS, 8A, rue Albert Borschette, L-1246 Luxembourg

- LUCELEN, 14, boulevard Royal, L-2449 Luxembourg

- MIX-FONDS INDEX:, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- UNIINSTITUTIONAL INTEREST RATES MARKET NEUTRAL, 308, route d’Esch, L-1471 Luxembourg

2) UCIs Part II 2010 Law:

- –

3) SIFs:

- ALBULUS UMBRELLA FUND SCS, SICAV-SIF, 17, rue de Flaxweiler, L-6776 Grevenmacher

- BB PRIVATE STRATEGIES (LUX), 11-13, boulevard de la Foire – Centre Etoile, L-1528 Luxembourg

- CARPITAL LEGEND CARS FUND S.C.A SICAV-SIF, 68-70, boulevard de la Pétrusse, L-2320 Luxembourg

- CATELLA S.A., SICAV-SIF, 33, rue de Gasperich, L-5826 Hesperange

- CATELLA WINNING REGIONS EUROPE SCA SICAV-SIF, 11, rue Beaumont, L-1219 Luxembourg

- MONEDA SIF, 106, route d’Arlon, L-8210 Mamer

- PRIVACCESS X, 50, avenue J-F Kennedy, L-1855 Luxembourg

- KY HARBOR GLOBAL LOAN OPPORTUNITIES FUND SICAV-SIF, 6, route de Trèves, L-2633 Senningerberg

- SWISSCANTO (LU) PRIVATE DEBT FUND, FCP-SIF, 19, rue de Bitbourg, L-1273 Luxembourg

4) SICARs:

- –

The following 19 undertakings for collective investment have been deregistered from the official list during the month under review:

1) UCITS Part I 2010 Law:

- AMUNDI FUNDS II, 5, allée Scheffer, L-2520 Luxembourg

- ELLIPSIS FUNDS, 28-32, place de la Gare, L-1616 Luxembourg

- HOTTINGER INTERNATIONAL FUND, 15, avenue J-F Kennedy, L-1855 Luxembourg

- PRIVATE BANKING WORLD INVEST, 9A, rue Gabriel Lippmann, L-5365 Munsbach

2) UCIs Part II 2010 Law:

- DB PWM III, 1c, rue Gabriel Lippmann, L-5365 Munsbach

- PRIVATE PLACEMENT FUND, 11, rue Aldringen, L-1118 Luxembourg

- WHITELAKE, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

3) SIFs:

- IRIS FUND SICAV-FIS, 10, rue Antoine Jans, L-1820 Luxembourg

- MANAGED INVESTORS, 80, route d’Esch, L-1470 Luxembourg

- RIVA ABSOLUTE RETURNS S.C.A. SICAV-SIF, 9, allée Scheffer, L-2520 Luxembourg

- UNIVERSAL STRATEGY FUND, 20, boulevard Emmanuel Servais, L-2535 Luxembourg

- VERSAILLES III, 153-155, rue du Kiem, L-8030 Strassen

4) SICARs:

- EUROPE CAPITAL PARTNERS V S.C.A., SICAR, 42, rue de la Vallée, L-2661 Luxembourg

- FONDATIONS CAPITAL I S.C.A. SICAR, 75, Parc d’Activités, L-8303 Capellen

- PRIVATE EQUITY ASIA SELECT III S.C.A., SICAR, 2, boulevard de la Foire, L-1528 Luxembourg

- PRIVATE EQUITY GLOBAL SELECT II, SICAR S.C.A., 2, boulevard de la Foire, L-1528 Luxembourg

- PRIVATE EQUITY GLOBAL SELECT IV, SICAR S.C.A., 2, boulevard de la Foire, L-1528 Luxembourg

- PRIVATE EQUITY GLOBAL SELECT V S.C.A., SICAR, 2, boulevard de la Foire, L-1528 Luxembourg

- PRIVATE EQUITY SELECT S.C.A., SICAR, 2, boulevard de la Foire, L-1528 Luxembourg