Global situation of undertakings for collective investment at the end of July 2019

Press release 19/42

I. Overall situation

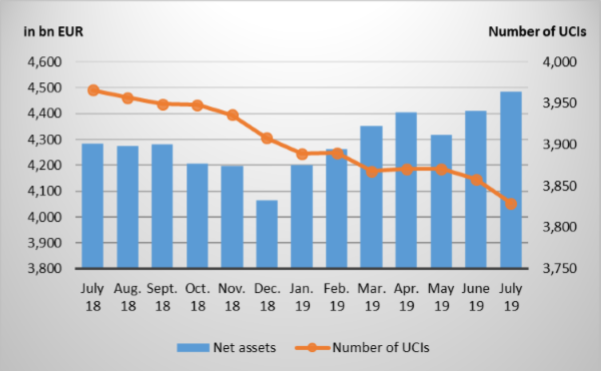

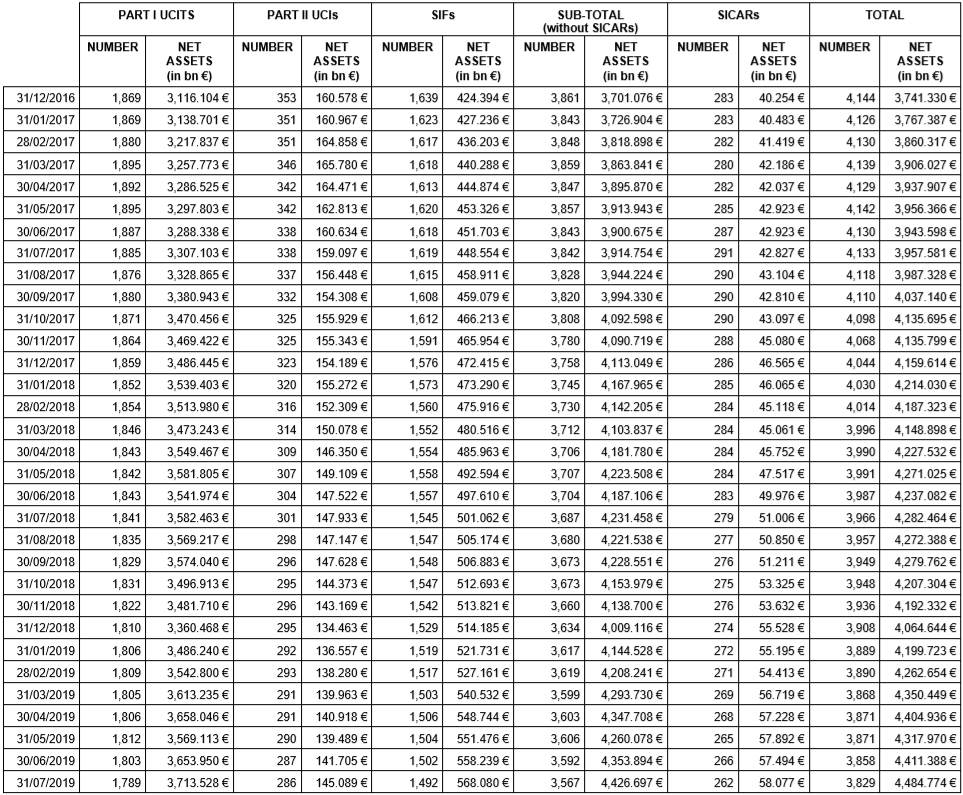

As at 31 July 2019, total net assets of undertakings for collective investment, including UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 4,484.774 billion compared to EUR 4,411.388 billion as at 30 June 2019, i.e. a 1.66% increase over one month. Over the last twelve months, the volume of net assets rose by 4.72%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 73.386 billion in July. This increase represents the balance of positive net issues of EUR 14.589 billion (+0.33%) and of the positive development in the financial markets amounting to EUR 58.797 billion (+1.33%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,829 as against 3,858 in the previous month. A total of 2,504 entities adopted an umbrella structure, which represented 13,494 sub-funds. When adding the 1,325 entities with a traditional structure to that figure, a total of 14,819 fund units were active in the financial centre.

As regards, on the one hand, the impact of financial markets on the main categories of undertakings for collective investment and, on the other hand, the net capital investment in these UCIs, the following can be said about July.

In view of the persisting trade tensions and the risks for global economic growth, the central banks of developed countries returned to more accommodating monetary policies in July which supported overall the financial markets.

As regards developed countries, the category of European equity UCIs remained almost unchanged against the background of mitigated macroeconomic figures, the possibility of a no-deal Brexit and the announcement of a more expansionary monetary policy by the European Central Bank (ECB). In light of the anticipations of key interest rates being decreased by the Federal Reserve (Fed), the signs of a convergence in Sino-American trade negotiations and the announcement of positive business results, the category of US equity UCIs ended the month in positive territory. Encouraging macroeconomic figures in Japan as well as an ongoing accommodating monetary policy also led the category of Japanese equity UCIs to perform well, this movement being emphasised by the appreciation of the JPY against the EUR.

Regarding emerging countries, even if the different equity markets recorded diverging developments, the different categories of emerging market equity UCIs registered price increases in a context of more expansionary monetary policies, despite persisting trade tensions, geopolitical conflicts and the drop in oil prices.

In July, equity UCI categories registered an overall negative net capital investment.

Development of equity UCIs during the month of July 2019*

* Variation in % of Net Assets in EUR as compared to the previous month

In Europe, in view of an inflation which remained below the ECB’s objectives and weak economic indicators in the euro area, the announcement of the ECB, at the end of July, to pursue a more expansionary monetary policy at the key interest rate and asset purchase level triggered price increases of EUR-denominated bonds comprising both, government and corporate bonds. Consequently, EUR-denominated bond UCIs ended the month up.

In the United States, the Fed reduced, at the end of the month, the key interest rates and ended the programme to reduce the size of its balance sheet in view of the macroeconomic risks linked to trade tensions and a deceleration of the global economic growth. The rates of return on USD-denominated government bonds remained almost unchanged, the appreciation of the USD against the EUR having led to increases in the category of USDdenominated bond UCIs. The more accommodating orientations in monetary policy of most of the central banks as well as the appreciation of several emerging currencies explain the positive development of the category of emerging market bond UCIs.

In July, the category of fixed-income UCIs registered an overall positive net capital investment.

Development of fixed-income UCIs during the month of July 2019*

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of July 2019*

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following nine undertakings for collective investment have been registered on the official list:

1) UCITS Part I 2010 Law:

- AEQUITAS, 5, allée Scheffer, L-2520 Luxembourg

- KEYNOTE, 15, rue de Flaxweiler, L-6776 Grevenmacher

- QTRON STOCK BOOSTER EQUITY, 15, rue de Flaxweiler, L-6776 Grevenmacher

2) UCIs Part II 2010 Law:

- –

3) SIFs:

- DWS JAPAN SELECT, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- EVC-REDF UMBRELLA FUND S.A., SICAV-SIF, 17, rue Flaxweiler, L-6776 Grevenmacher

- GENERALI SHOPPING CENTRE FUND S.C.S. SICAV-SIF, 15, boulevard Friedrich Wilhelm Raiffeisen, L-2411 Luxembourg

- IWOCA SCSP SICAV-SIF, 6, rue Eugène Ruppert, L-2453 Luxembourg

- MIRABAUD PRIVATE ASSETS S.C.A. SICAV-SIF, 15, avenue J-F Kennedy, L-1855 Luxembourg

- QBLUE LUXEMBOURG, SICAV SIF, 2-4, rue Eugène Ruppert, L-2453 Luxembourg

4) SICARs:

- –

The following 38 undertakings for collective investment have been deregistered from the official list during the month under review:

1) UCITS Part I 2010 Law:

- 2PERFORM, 12, rue Eugène Ruppert, L-2453 Luxembourg

- ALLIANZ EMERGING MARKETS EQUITY DIVIDEND, Bockenheimer Landstraße 42-44, D-60232 Frankfurt am Main1

- ALTERNATIVE RISK PREMIA INVESTMENT FUND, 2, rue d’Alsace, L-1122 Luxembourg

- AMUNDI SICAV II, 5, allée Scheffer, L-2520 Luxembourg

- ARKESS SICAV, 44, rue de la Vallée, L-2661 Luxembourg

- COMMERZBANK FLEXIBLE VOLATILITY STRATEGY FUND, 25, rue Edward Steichen, L-2540 Luxembourg

- GLOBAL FUNDS, 6, rue Lou Hemmer, L-1748 Findel

- JAPAN DYNAMIC FUND, 11-13, boulevard de la Foire, L-1528 Luxembourg

- MILLEIS INVESTISSEMENTS FUNDS, 5, allée Scheffer, L-2520 Luxembourg

- THE STRALEM FUND, 11, rue Aldringen, L-1118 Luxembourg

- TIMBERLAND, SICAV, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- TUNGSTEN ACTIVE RISK PREMIA, 2, place François-Joseph Dargent, L-1413 Luxembourg

- UNIGARANT95: CHANCENVIELFALT (2019), 308, route d’Esch, L-1471 Luxembourg

- UNIGARANTEXTRA: DEUTSCHLAND (2019) II, 308, route d’Esch, L-1471 Luxembourg

- UNIINSTITUTIONAL EURO CREDIT 2025, 308, route d’Esch, L-1471 Luxembourg

- NIPROFIANLAGE (2019/II), 308, route d’Esch, L-1471 Luxembourg

- WORLD PERFORMANCE PORTFOLIOS, 44, rue de la Vallée, L-2661 Luxembourg

2) UCIs Part II 2010 Law:

- AXA EURO BOND INCOME, 33, rue de Gasperich, L-5826 Howald-Hesperange

3) SIFs:

- 964 SICAV-SIF, 20, rue de la Poste, L-2346 Luxembourg

- AMADABLUM PAN EUROPEAN EQUITY FUND, 287-289, route d’Arlon, L-1150 Luxembourg

- ANCHOR GLOBAL EMERGING MARKETS EQUITY FUND, 287-289, route d’Arlon, L-1150 Luxembourg

- CHAHINE SIF 2, 12, rue Eugène Ruppert, L-2453 Luxembourg

- CORPUS SIREO RETAILCENTER-FONDS DEUTSCHLAND SICAV-FIS, 4A, rue Albert Borschette, L-1246 Luxembourg

- EUROPEAN IMPACT INVESTING PLATFORM S.C.A. SICAV-SIF, 11-13, boulevard de la Foire, L-1528 Luxembourg

- GOODMAN JAPAN CORE FUND FCP-FIS, 28, boulevard d’Avranches, L-1160 Luxembourg

- INVESTEC GLL GLOBAL SPECIAL OPPORTUNITIES REAL ESTATE FUND, 15, rue Bender, L-1229 Luxembourg

- KEYSTONE HOSPITALITY FUND S.C.A., SICAV-FIS, 15, boulevard Friedrich Wilhelm Raiffeisen, L-2411 Luxembourg

- KJK FUND SICAV-SIF, 412F, route d’Esch, L-1471 Luxembourg

- LFP I SICAV-SIF S.A., 16, rue Erasme, L-1468 Luxembourg

- LIC US REAL ESTATE FUND NO.1 SICAV-FIS, 80, route d’Esch, L-1470 Luxembourg

- LOG CAPITAL MANAGEMENT SIF-SICAV, 2, boulevard de la Foire, L-1528 Luxembourg

- TALOS INVESTMENT FUND, 15, avenue J-F Kennedy, L-1855 Luxembourg

- ULTIMATE PORTFOLIO FUND-FIS, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- YOUNG, 20, boulevard Emmanuel Servais, L-2535 Luxembourg

4) SICARs:

- GAMMA III S.C.A., SICAR, 7, avenue Gaston Diderich, L-1420 Luxembourg

- OPEN MIND INVESTMENTS S.C.A. SICAR, 10, rue Antoine Jans, L-1820 Luxembourg

- PARTNERS GROUP EUROPEAN MEZZANINE 2005 S.C.A., SICAR, 35D, avenue J-F Kennedy, L-1855 Luxembourg

- PARTNERS GROUP GLOBAL MEZZANINE 2005 S.C.A., SICAR, 35D, avenue J-F Kennedy, L-1855 Luxembourg

1 Undertaking for collective investment for which the designated management company was authorised by the competent authorities of another Member State in accordance with Directive 2009/65/EC.