Global situation of undertakings for collective investment at the end of September 2020

Press release 20/21

I. Overall situation

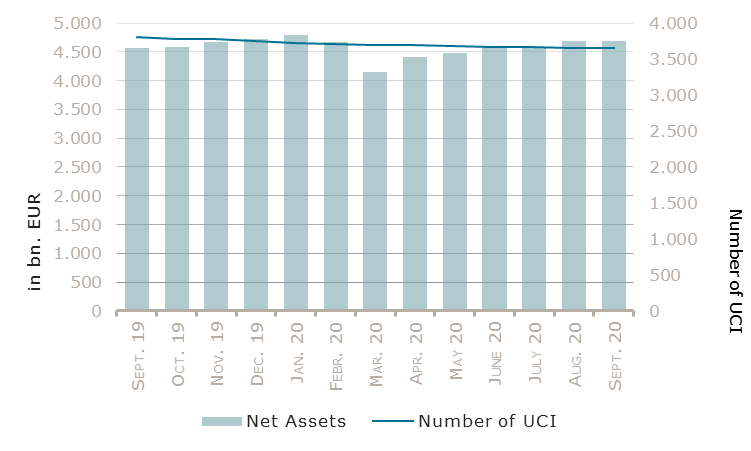

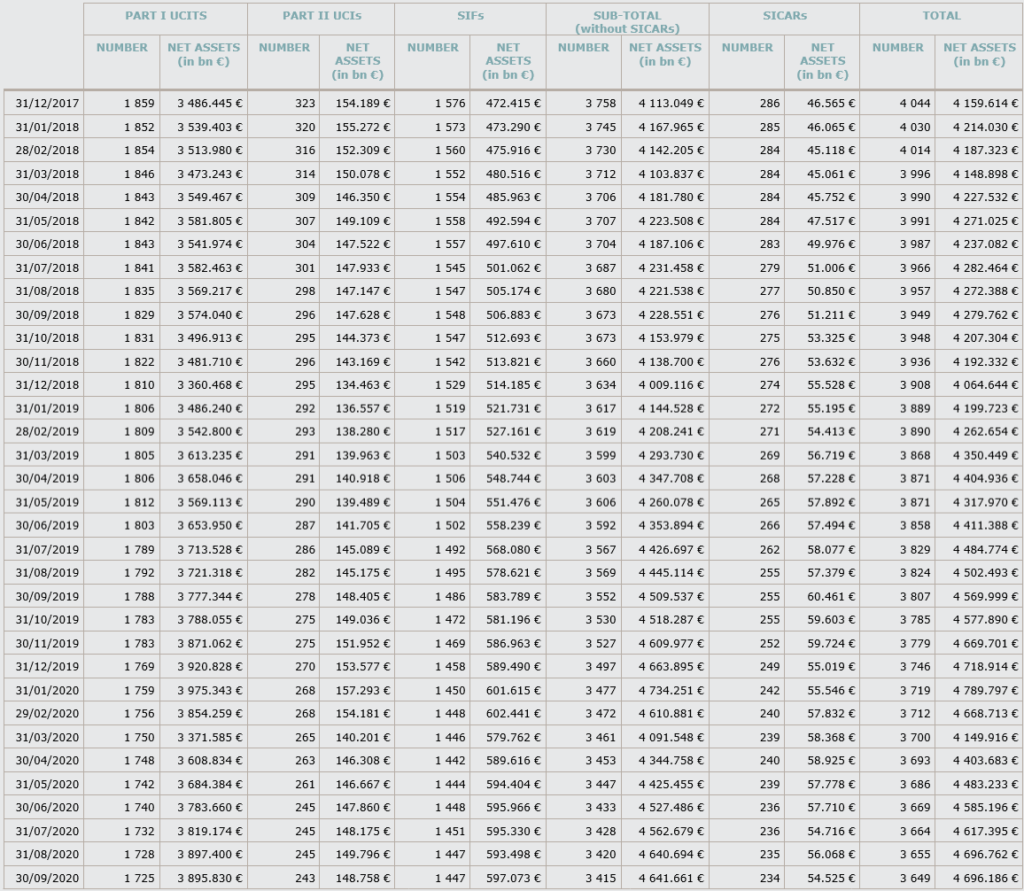

As at 30 September 2020, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 4,696.186 billion compared to EUR 4,696.762 billion as at 31 August 2020, i.e. a decrease of 0.01% over one month. Over the last twelve months, the volume of net assets rose by 2.76%.

The Luxembourg UCI industry thus registered a negative variation amounting to EUR 0.576 billion in September. This decrease represents the sum of positive net capital investments of EUR 8.039 billion (+0.17%) and of the negative development of financial markets amounting to EUR 8.615 billion (-0.18%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,649, against 3,655 the previous month. A total of 2,399 entities adopted an umbrella structure representing 13,389 sub-funds. Adding the 1,250 entities with a traditional UCI structure to that figure, a total of 14,639 fund units were active in the financial centre.

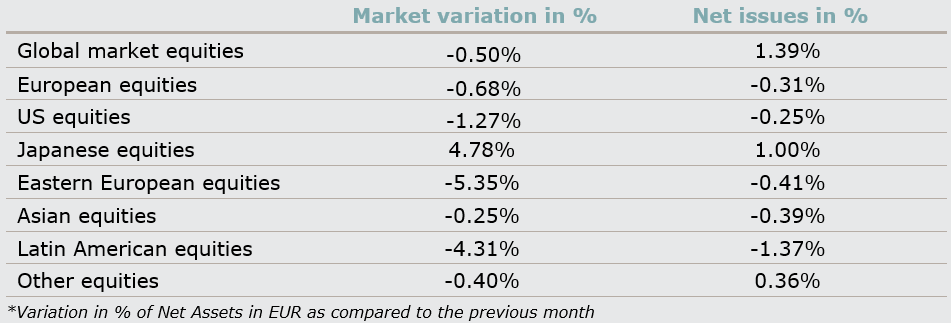

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of September:

As far as developed countries are concerned, the European equity UCI category has registered negative returns in consequence of a resurgence in infection rates across several countries and the possible delay of the European recovery fund. The US equity UCI category fell as well during the period, mainly driven by the political disagreement on new economic stimulus measures and profit-taking in technology stocks. Supported by an economic stabilisation in Japan and decreasing infection rates, the Japanese equity UCI category rose in September.

As for emerging countries, the Asian equity UCI category developed sideways amid concerns that economic support measures might fall short of expectations and the ongoing US – China trade tensions, despite a V-shaped recovery of the Chinese economy. The Eastern European equity UCI category fell sharply overall on the grounds of a weakening economic recovery and the increase of COVID-19 cases in this region. The Latin American equity UCI category followed the negative trend of equity markets around the globe, in a context marked by political uncertainty, concerns relating to the weak global demand which continues to weigh on the region and depreciating domestic currencies.

In September, equity UCI categories registered an overall positive net capital investment.

Development of equity UCIs during the month of September 2020*

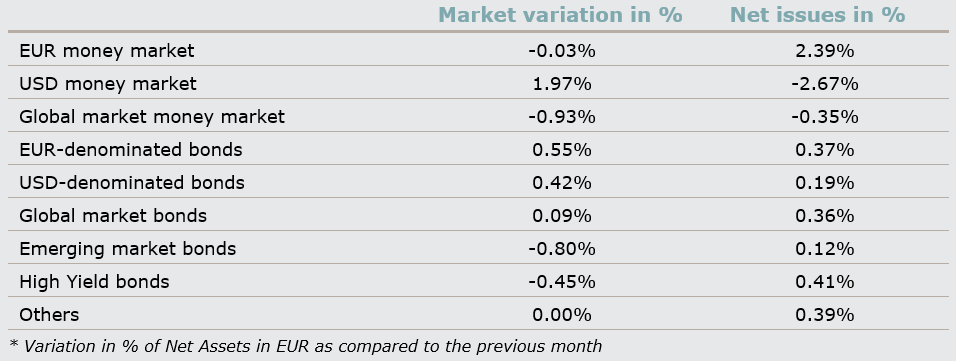

In Europe, the yields of high-rated government bonds fell under the impulse of growing uncertainty generated mostly by rising infection rates and possible regional lockdowns. Aided by the continuing monetary support, the yields of corporate bonds followed this downward trend despite a slight increase of risk premiums. In the face of decreasing yields and hence increasing bond prices, the EUR-denominated bond UCI category gained during the period.

US government bonds tracked fairly sideways as a consequence mainly of the political disagreement in the United States concerning the economic stimulus package and the absence of new monetary policy impulses. While US corporate bonds followed a similar pattern, the appreciation of the USD against the EUR shifted the USD-denominated bonds UCI category into positive territory.

September saw a decline of the Emerging market bonds UCI category in a context marked by rising pandemic worries, a decreasing oil price, the appreciation of the USD, higher risk premiums for emerging market bonds and the mixed performances of emerging market currencies.

In September, fixed income UCI categories registered an overall positive net capital investment. While the EUR money market UCI category registered the highest inflows (+2.39%), the USD money market UCI category faced the largest outflows (-2.67%).

Development of fixed income UCIs during the month of September 2020*

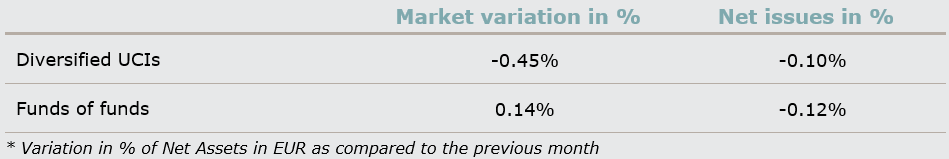

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of September 2020*

II. Breakdown of the number and net assets of UCIs

During the month under review, the following eight undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- AIP SICAV, 3, rue Gabriel Lippmann, L-5365 Munsbach

- ETHNA-CARES, 16, rue Gabriel Lippmann, L-5365 Munsbach

- GYRA FUNDS LUX, 2A, rue Albert Borschette, L-1246 Luxembourg

- KIEGER UCITS FUND, 33, rue de Gasperich, L-5826 Howald-Hesperange

- MERCHBANC FCP, 4, rue Jean Monnet, L-2180 Luxembourg

SIFs:

- CBRE LOGISTICS VENTURE S.C.A. SICAV-SIF, 4, rue du Fort Wallis, L-2714 Luxembourg

- SCHRODER REAL ESTATE SICAV-SIF, 5, rue Heienhaff, L-1736 Senningerberg

SICARs:

- CIEP II PARTICIPATIONS S.À R.L., SICAR, 2, avenue Charles de Gaulle (4th floor), L-1653 Luxembourg

The following fourteen undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- DEKA-EUROGARANT 4, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- DEKA-WORLDGARANT 4, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- HAC WORLD TOP-INVESTORS, Kapstadtring 8, D-22297 Hamburg1

- ONEFUND SICAV, 2, place François-Joseph Dargent, L-1413 Luxembourg

- REACTOR ELITE FLEXIBLE, 15, avenue J-F Kennedy, L-1855 Luxembourg

- UNIGARANT: AKTIEN WELT (2020), 308, route d’Esch, L-1471 Luxembourg

- UNIGARANT: CHANCENVIELFALT (2020) II, 308, route d’Esch, L-1471 Luxembourg

- UNIGARANT95: AKTIEN WELT (2020), 308, route d’Esch, L-1471 Luxembourg

- UNIGARANT95: CHANCENVIELFALT (2020), 308, route d’Esch, L-1471 Luxembourg

UCIs Part II 2010 Law:

- CARNEGIE FUND II, 2, rue Edward Steichen, L-2540 Luxembourg

SIFs:

- KRAICHGAU – FONDS, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- NUMERAIRE FUND S.A., SICAV SIF, 75, Parc d’activités, L-8308 Capellen

SICARs:

- ILP III S.C.A., SICAR, 3/A, rue Guillaume Kroll, L-1882 Luxembourg

- MONITOR CLIPPER PARTNERS INVESTMENTS (SARL) SICAR, 15, boulevard F.W. Raiffeisen, L-2411 Luxembourg

1 Undertaking for collective investment for which the designated management company was authorised by the competent authorities of another Member State in accordance with Directive 2009/65/EC.