Global situation of undertakings for collective investment at the end of November 2020

Press release 20/31

I. Overall situation

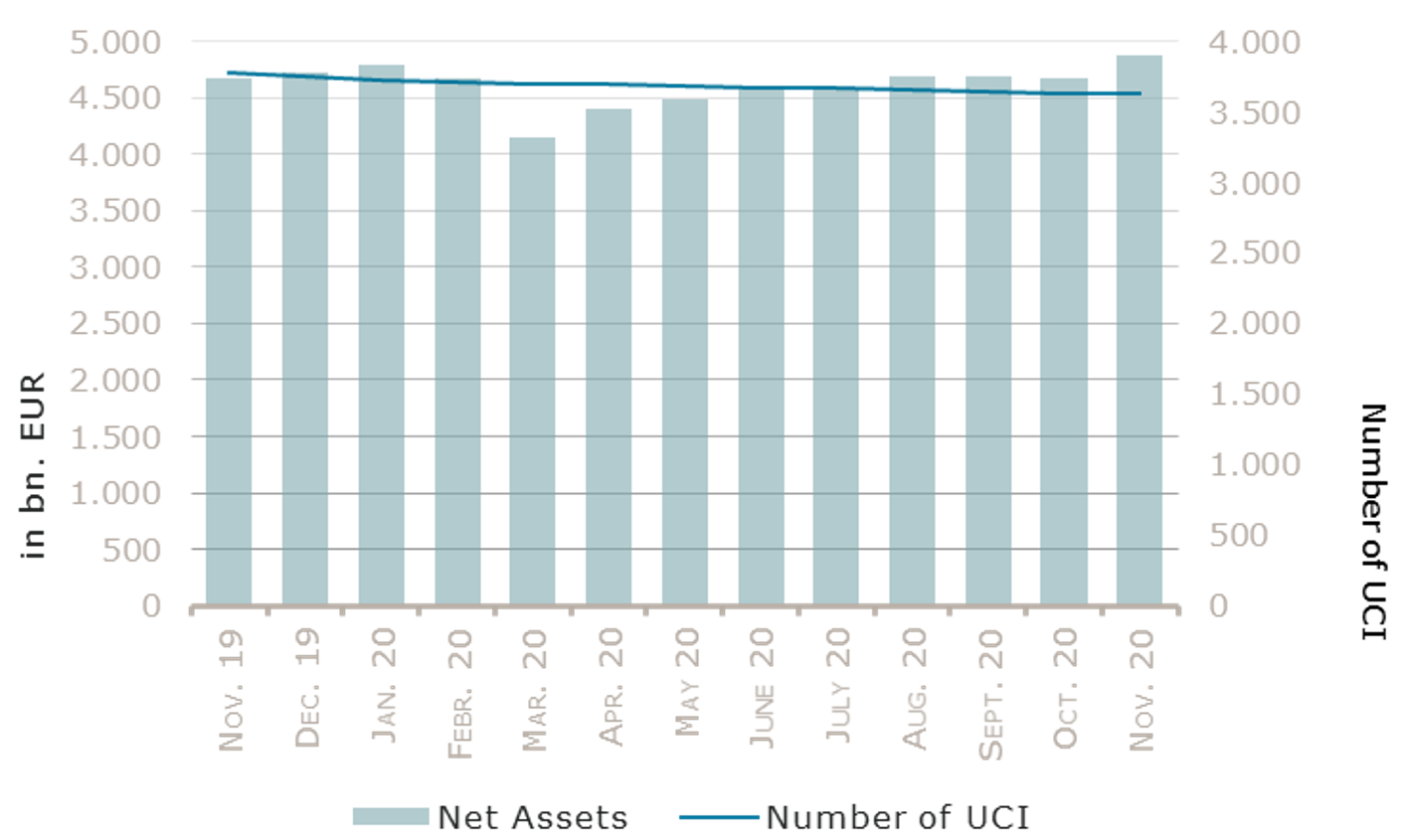

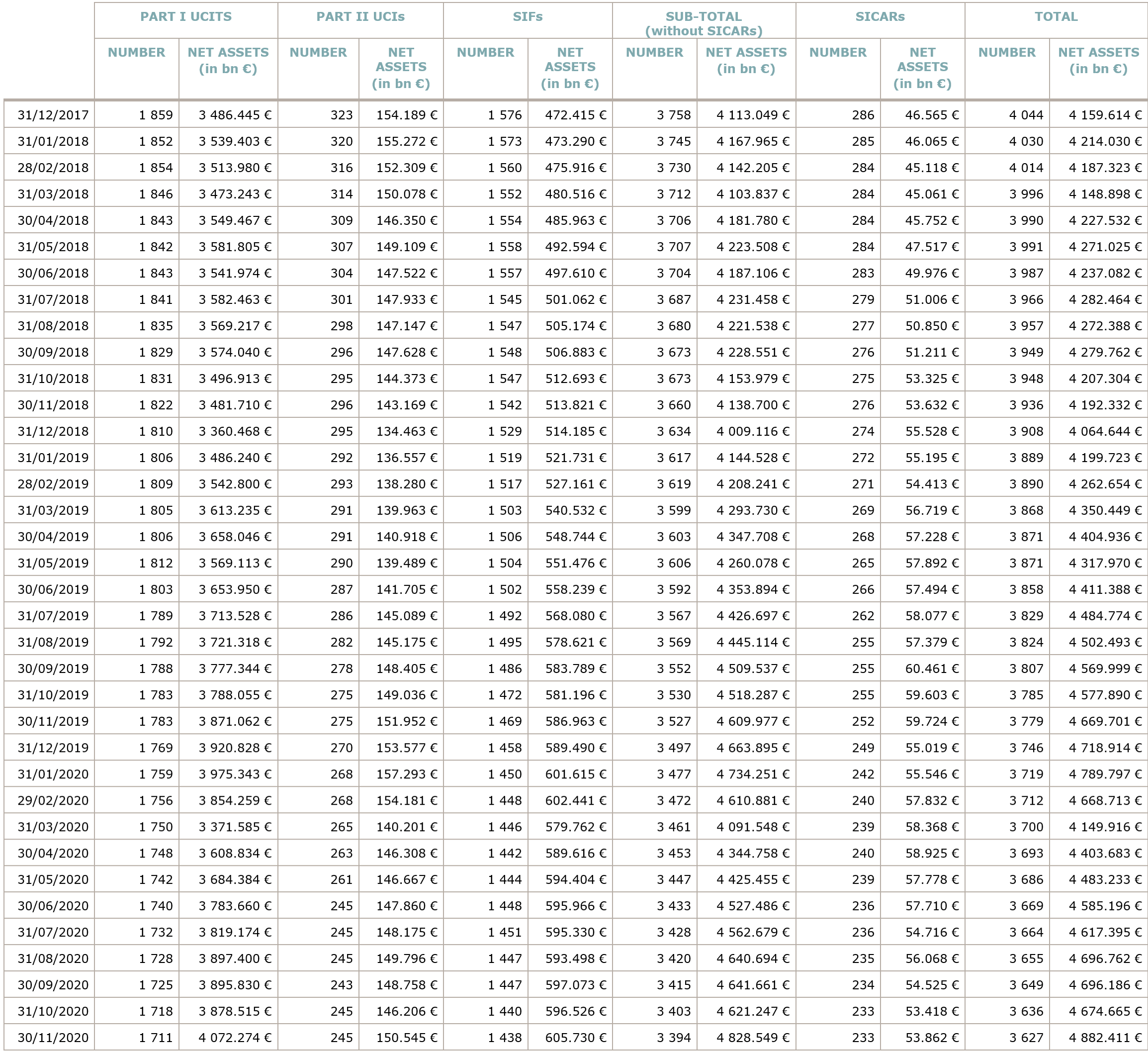

As at 30 November 2020, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 4,882.411 billion compared to EUR 4,674.665 billion as at 31 October 2020, i.e. an increase of 4.44% over one month. Over the last twelve months, the volume of net assets rose by 4.56%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 207.746 billion in November. This increase represents the sum of positive net capital investments of EUR 22.185 billion (+0.47%) and of the positive development of financial markets amounting to EUR 185.561 billion (+3.97%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,627, against 3,636 the previous month. A total of 2,384 entities adopted an umbrella structure representing 13,328 sub-funds. Adding the 1,243 entities with a traditional UCI structure to that figure, a total of 14,571 fund units were active in the financial centre.

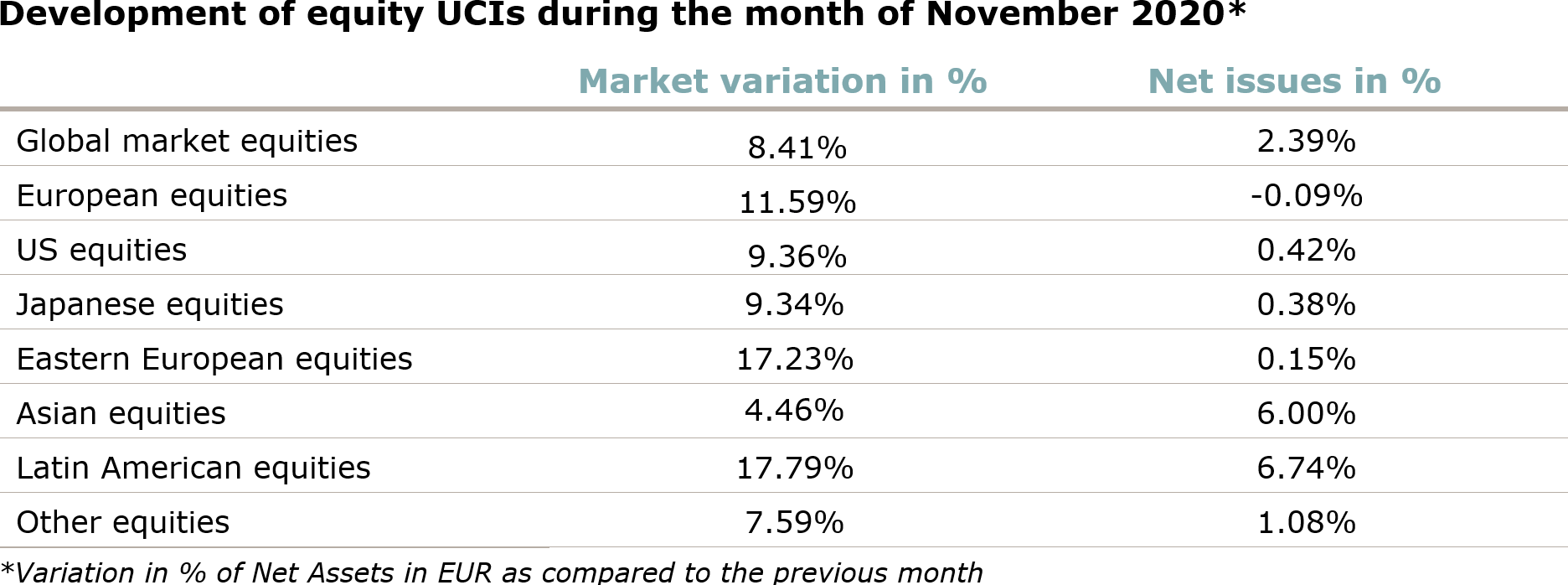

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of November:

Global equity markets rallied strongly in November shifting all the equity UCI categories into positive territory, mainly due to several successful Covid-19 vaccine trials and the end of the uncertainties surrounding the US presidential election outcome.

Against this backdrop, the European equity UCI category registered strong positive returns supported by a better than expected reporting season, despite a resurgence in COVID-19 infection rates and the reintroduction of partial lockdown measures in several European countries. The US equity UCI category also saw a rebound of equity prices, aided by an increasing internal demand and improving international trade figures. The Japanese equity UCI category followed the strong upward trend on the grounds of better economic data and the new free trade agreement Regional Comprehensive Economic Partnership (RCEP) signed by 15 Asian nations, while the development of the pandemic remained more contained in Japan.

As for emerging countries, the Asian equity UCI category generated a robust return amid better economic data, the above mentioned RCEP agreement, the outcome of the US elections and a comparatively moderate development of the Covid-19 pandemic. The Eastern European equity UCI category enjoyed strong gains in November in the context of the Covid-19 vaccine breakthroughs and rising oil prices, despite rising infection rates in several Eastern Europe countries. Overall, Latin America’s equity markets followed the upward trend on global equity markets, pushing the Latin American equity UCI category into positive territory.

In November, equity UCI categories registered an overall positive net capital investment.

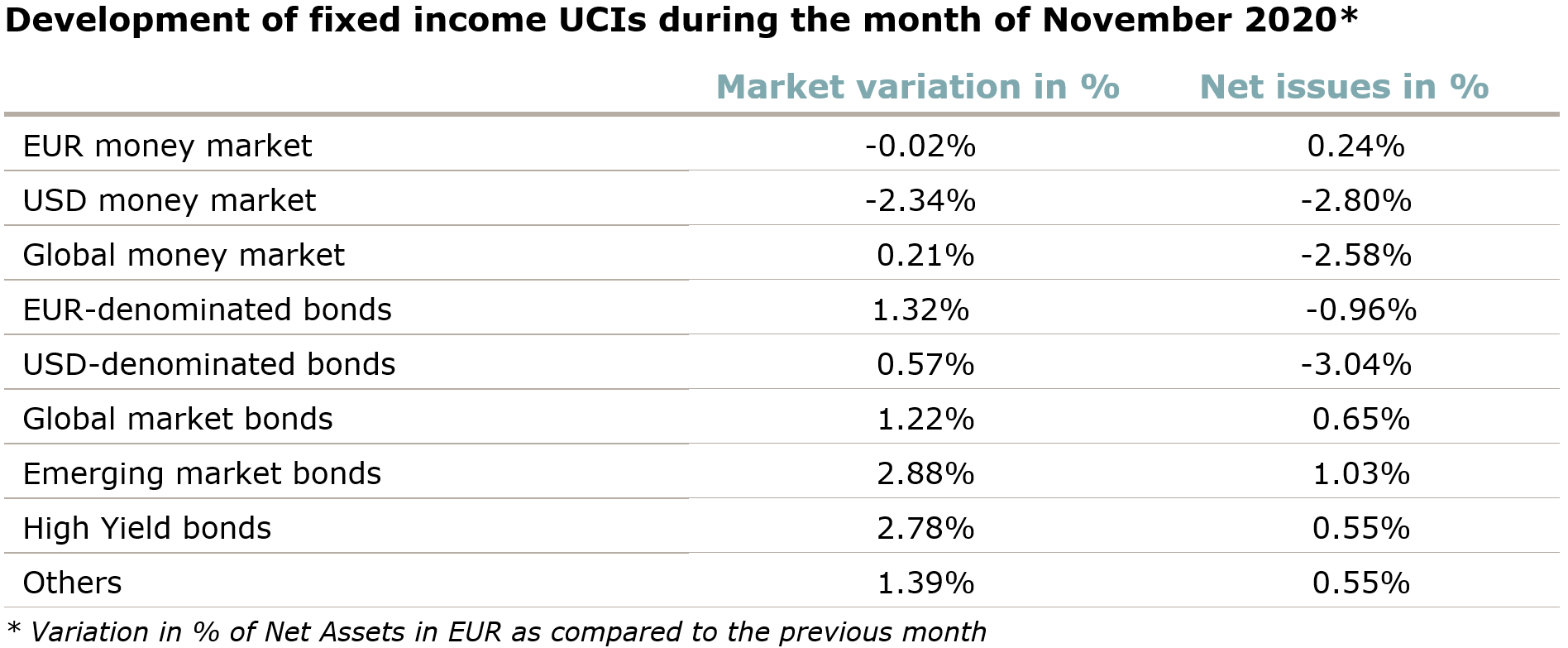

As far as EUR-denominated bonds are concerned, the increased risk appetite in reaction to the successful Covid-19 vaccine trials and expectations that the European Central Bank could increase its bond purchases led to a decrease of the yields on lower-rated government bonds and corporate bonds (i.e. prices increased), while the yields of long term highly rated government bonds moved slightly upwards. On balance, the EUR-denominated bond UCIs category rose in November.

In the United States, the yields of USD-denominated government bonds moved sideways after large swings in November around the US elections leaving doubts as to the implementation of an extensive fiscal stimulus package and the encouraging news on the successful Covid-19 vaccine trials. In this market environment, USD-denominated investment grade corporate bonds enjoyed strong gains. Against this background, the USD-denominated bonds UCI category registered a positive performance, compensated in large part by a depreciation of the USD against the EUR of more than 2%.

The Emerging market bonds UCI category recorded a positive performance in a context marked by a growing demand for riskier assets, the outcome of the US elections and the divergent evolution of emerging market currencies.

In November fixed income UCI categories registered an overall negative net capital investment, mainly driven by outflows in the USD money market and the Global money market UCI categories.

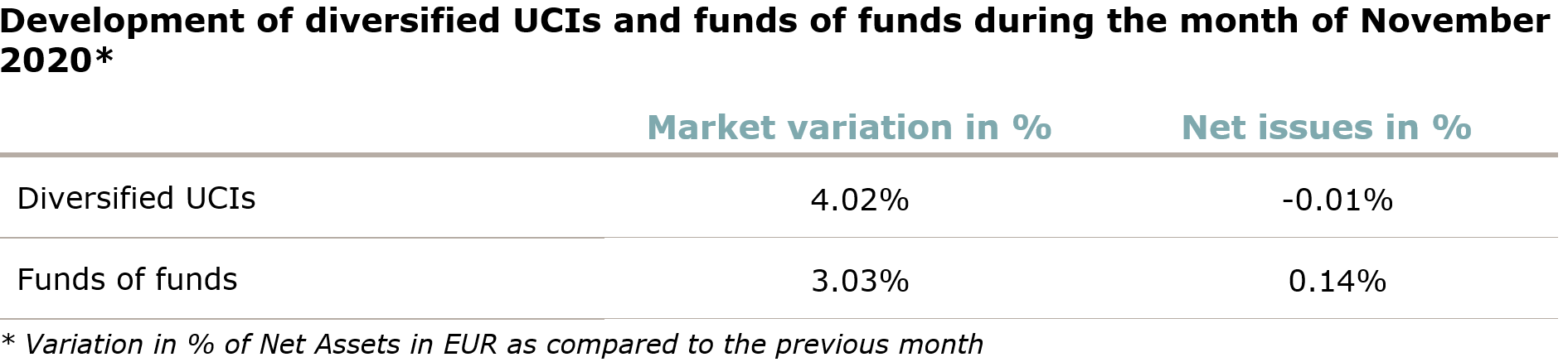

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

II. Breakdown of the number and net assets of UCIs

During the month under review, the following eight undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- ASTERIA FUNDS, 11-13, boulevard de la Foire, L-1528 Luxembourg

- DEKA-EUROPAGARANT 90, 6, rue Lou Hemmer, L-1748 Findel

UCIs Part II 2010 Law:

- CRESCO PARTNERSHIP, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

SIFs:

- FONDACO PINTURICCHIO, 146, boulevard de la Pétrusse, L-2330 Luxembourg

- PALLADIUM FUND 1870 MANAGEMENT S.C.A. SICAV SIF, 58, rue Charles Martel, L-2134 Luxembourg

- SODERIVA, 26, avenue de la Liberté, L-1930 Luxembourg

- UI MASTERFONDS IMMOBILIEN INTERNATIONAL S.C.S., SICAV-FIS, 15, rue de Flaxweiler, L-6776 Grevenmacher

SICARs:

- CETP IV PARTICIPATIONS S.À R.L., SICAR, 2, avenue Charles de Gaulle, 4th floor, L-1653 Luxembourg

The following seventeen undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- BEAUREGARD CAPITAL SICAV, 5, Heienhaff, L-1736 Senningerberg

- CAPITAL INVESTMENT, 5, allée Scheffer, L-2520 Luxembourg

- DIAMAN SICAV, 12, rue Eugène Ruppert, L-2453 Luxembourg

- DWS EMERGING MARKETS BONDS (SHORT), 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- DWS QI EURO CORPORATE BONDS, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- LA FINANCIERE CONSTANCE SICAV, 2, rue d’Arlon, L-8399 Windhof

- MULTIADVISOR SICAV, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- PEACOCK EUROPEAN ALPHA BUILDER UI, 15, rue de Flaxweiler, L-6776 Grevenmacher

- SENTAT GLOBAL FUND SICAV, 1C, rue Gabriel Lippmann, L-5365 Munsbach

UCIs Part II 2010 Law:

- C WORLDWIDE HEDGE, 1, rue Schiller, L-2519 Luxembourg

SIFs:

- CARDEA INTERNATIONAL FUND S.C.A., SICAV, 2, boulevard de la Foire, L-1528 Luxembourg

- COMMODITY STRATEGIES FUND FCP-FIS, 8-10, rue Jean Monnet, L-2180 Luxembourg

- METIS SIF, 287, route d’Arlon, L-1150 Luxembourg

- ÖKORENTA – NEUE ENERGIEN PORTFOLIO S.C.S., SICAV-FIS, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- SPECIALIZED INVESTMENT MANAGEMENT SICAV-SIF, 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- ZEPHYRA INVEST, 15, avenue J-F Kennedy, L-1855 Luxembourg

SICARs:

- QUREINVEST II INVESTMENTS (SCA) SICAR, 51, avenue J-F Kennedy, L-1855 Luxembourg