Global situation of undertakings for collective investment at the end of February 2021

Press release 21/07

I. Overall situation

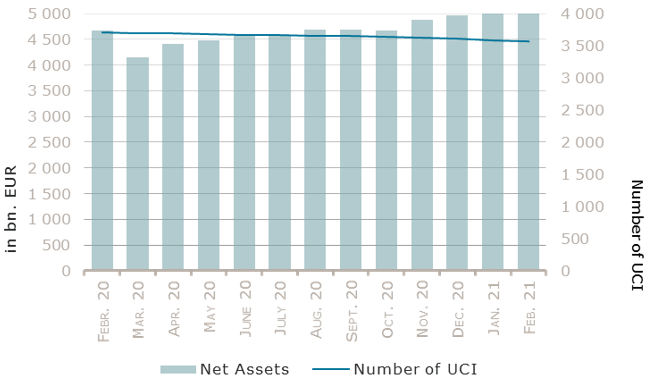

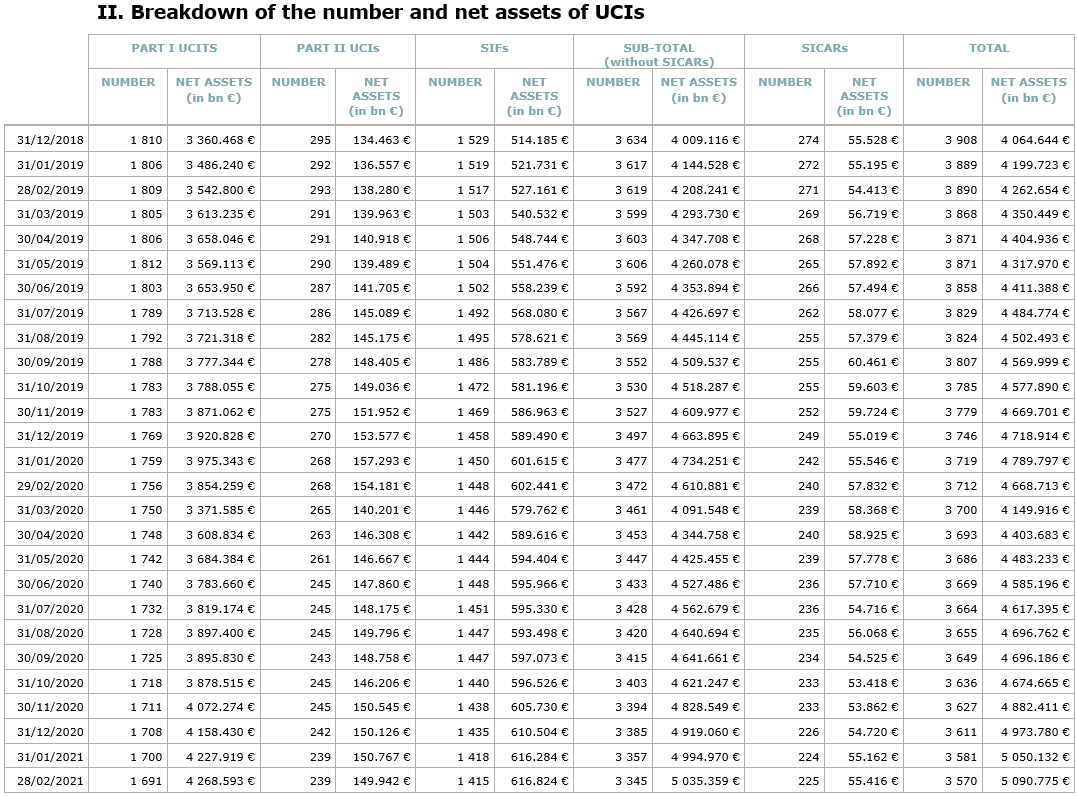

As at 28 February 2021, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 5,090.775 billion compared to EUR 5,050.132 billion as at 31 January 2021, i.e. an increase of 0.80% over one month. Over the last twelve months, the volume of net assets rose by 9.04%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 40.643 billion in February. This increase represents the sum of positive net capital investments of EUR 24.025 billion (+0.47%) and of the positive development of financial markets amounting to EUR 16.618 billion (+0.33%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,570, against 3,581 the previous month. A total of 2,350 entities adopted an umbrella structure representing 13,353 sub-funds. Adding the 1,220 entities with a traditional UCI structure to that figure, a total of 14,573 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of February:

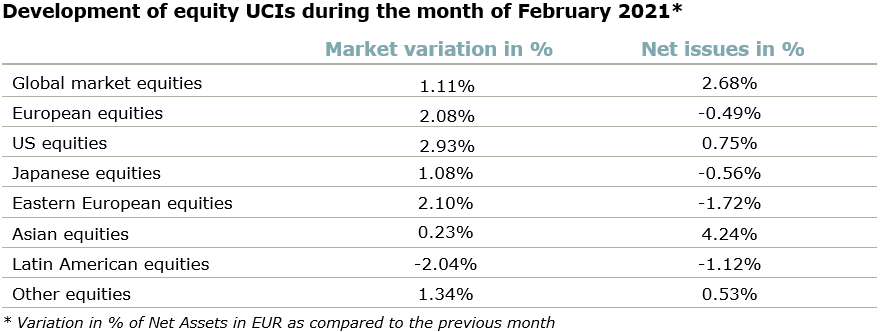

Equity markets globally rose during the month under review in the context of improved global macroeconomic data and continuous policy support, whereas government and investment grade bond yields increased in reaction to higher inflation anticipations.

Concerning developed markets, the European equity UCI category recorded a positive performance induced by positive macroeconomic indicators, better than expected corporate results and the continuing accommodative monetary policy. Better economic indicators in the US, a rapid vaccination roll-out and the prospect of an extensive fiscal stimulus package shifted the US equity UCI category in positive territory. The Japanese equity UCI category rose during the month of February amid lower infection rates, the progress made in the COVID19 vaccine roll-out, stronger than expected corporate earnings and good economic data.

As for emerging countries, the Asian equity UCI category slightly rose in a context marked on one hand by the progress on the worldwide roll-out of vaccines and on the other hand by rising US yields, concerns around possible renewed trade tensions between the United States and China and profit-taking operations. The Eastern European equity UCI category registered a positive performance, supported by brightened economic prospects and rising oil prices. Despite increasing commodity prices, the Latin American equity UCI category fell in February on the grounds notably of a weaker Brazilian economy and the depreciation of some domestic currencies.

In February, the equity UCI categories registered an overall positive net capital investment.

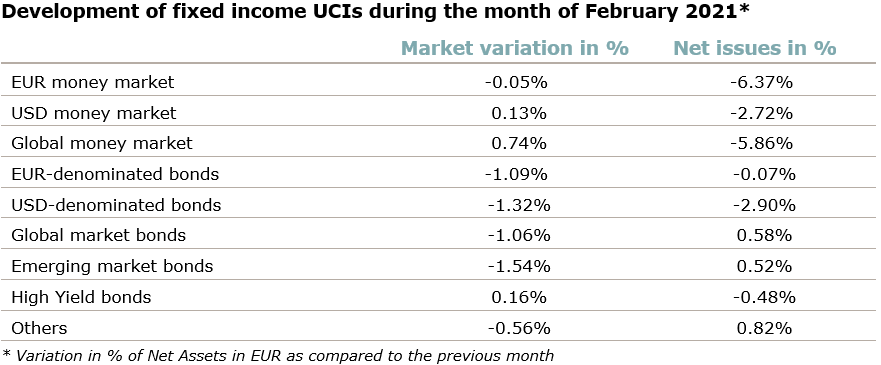

As for EUR-denominated bonds, the yields of government bonds globally increased (i.e. bond prices fell) under the impulse of increased inflation anticipations and improving macroeconomic data. The yields of investment grade corporate bonds followed this upward trend despite a compression of risk premiums, while the European Central Bank signalled the pursuit of its expansive monetary policy. Overall the EUR-denominated bond UCI category realized a negative performance in February.

Concerning the USD-denominated bond UCI category, the substantial fiscal programme planned by the US government led to higher inflation anticipations and as a result rising long-term US government bonds yields, despite the announcement of a continued loose monetary policy by the Federal Reserve (Fed). With US corporate bond yields following this trend, the USD-denominated bond UCI category finished the month in negative territory.

The Emerging market bond UCI category saw a decline in the context of rising US government bond yields, higher inflation expectations, idiosyncratic risks in some emerging markets and a divergent evolution of emerging market currencies.

In February fixed income UCI categories registered an overall negative net capital investment. The largest outflows were recorded in the money market UCI categories.

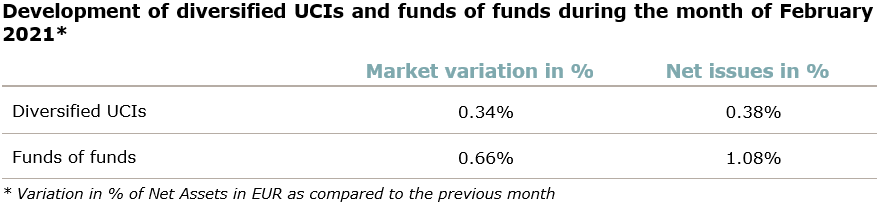

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

II. Breakdown of the number and net assets of UCIs

During the month under review, the following five undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- MULTI FUND, 15, rue de Flaxweiler, L-6776 Grevenmacher

SIFs:

- CLBRM MULTI STRATEGY, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- NOX CORE RE FUND SICAV-SIF, 1C, rue Gabriel Lippmann, L-5365 Munsbach

SICARs:

- CP VII PARTICIPATIONS S.À R.L., SICAR, 2, avenue Charles de Gaulle, 4th floor, L-1653 Luxembourg

- CAPE CAPITAL SCSP, SICAR, 5, rue Jean Monnet, L-2180 Luxembourg

The following sixteen undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- BERENBERG DIVERSIFIED UI, 15, rue de Flaxweiler, L-6776 Grevenmacher

- BRIGHTSPHERE GLOBAL FUNDS, 15, avenue J-F Kennedy, L-1855 Luxembourg

- DPAM ASYMMETRIC L, 12, rue Eugène Ruppert, L-2453 Luxembourg

- EBN FUND, 30, boulevard Royal, L-2449 Luxembourg

- IIFL FUND, 2, rue d’Alsace, L-1122 Luxembourg

- KAIROS ALPHA SICAV, 60, avenue J-F Kennedy, L-1855 Luxembourg

- PREMIUM FONDS ERLANGEN, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- RACE ONE, 49, avenue J-F Kennedy, L-1855 Luxembourg

- SAM – STRATEGIC SOLUTION FUND, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- SILK, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

SIFs:

- AIPP ASIA SELECT, 35A, avenue J-F Kennedy, L-1855 Luxembourg

- DPAM PHENIX INSTIT L (SIF), 12, rue Eugène Ruppert, L-2453 Luxembourg

- EIFFEL ECAPITAL, 5, rue Jean Monnet, L-2180 Luxembourg

- LUX INVESTMENT, SICAV-SIF, 30, boulevard Royal, L-2449 Luxembourg

- VBV-PENSIONSKASSE FCP-SIF, 9A, rue Gabriel Lippmann, L-5365 Munsbach

SICARs:

- B-TO-V ENTREPRENEURIAL GROWTH II (B-TO-V II S.C.S., SICAR), 1C, rue Gabriel Lippmann, L-5365 Munsbach