Global situation of undertakings for collective investment at the end of May 2021

Press release 21/16

I. Overall situation

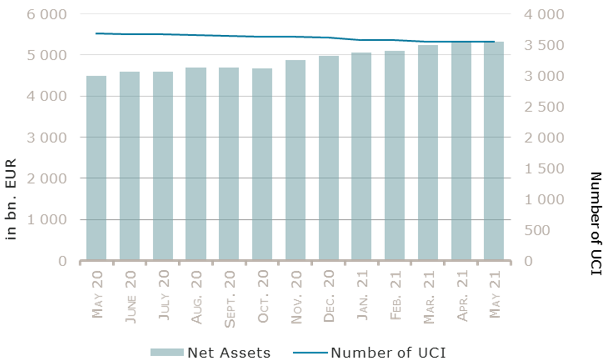

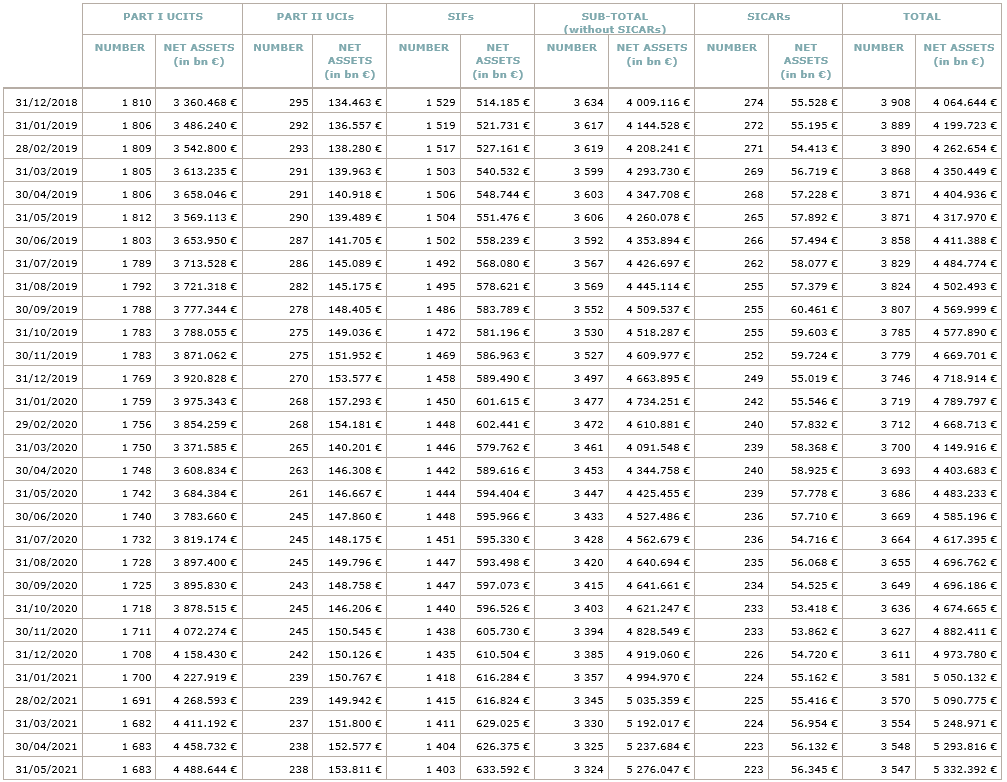

As at 31 May 2021, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialized investment funds and SICARs, amounted to EUR 5,332.392 billion compared to EUR 5,293.816 billion as at 30 April 2021, i.e. an increase of 0.73% over one month. Over the last twelve months, the volume of net assets rose by 18.94%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 38.576 billion in May. This increase represents the sum of positive net capital investments of EUR 23.240 billion (+0.44%) and of the positive development of financial markets amounting to EUR 15.336 billion (+0.29%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,547, against 3,548 the previous month. A total of 2,340 entities adopted an umbrella structure representing 13,257 sub-funds. Adding the 1,207 entities with a traditional UCI structure to that figure, a total of 14,464 fund units were active in the financial centre.

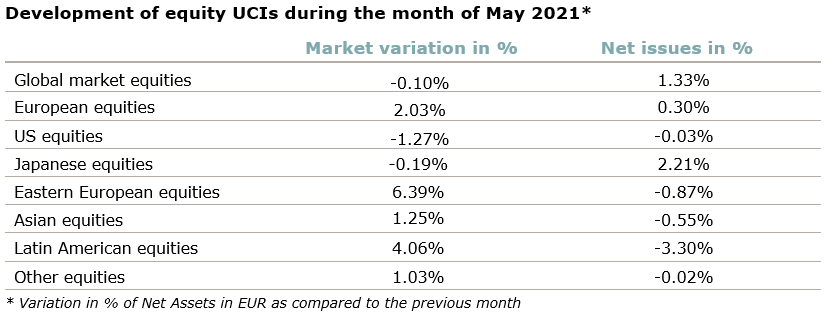

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of May:

Concerning developed markets, the European equity UCI category recorded a positive performance supported by the steady progress made in the vaccination rollout, the continuing strong corporate earnings season exceeding expectations and improved economic indicators. Despite better-than-anticipated US corporate results, the US equity UCI category declined in May amid higher inflation rates prompting concerns that monetary policy could be tightened and the depreciation of the USD against the EUR. While Japanese equities generated modest gains against the backdrop of the continued monetary policy support measures and a weakening of the yen providing some support for export-oriented companies, the depreciation of the Yen against the EUR shifted the Japanese equity UCI category in negative territory.

As for emerging countries, the Asian equity UCI category enjoyed modest returns on the back of a positive development of the Chinese and Indian equity markets, despite an uneven market sentiment across the region. Overall, the Eastern European and Latin American equity UCI categories performed well in May, on the grounds of an improving global outlook and higher commodity prices supporting the equity markets in these regions.

In May, the equity UCI categories registered an overall positive net capital investment.

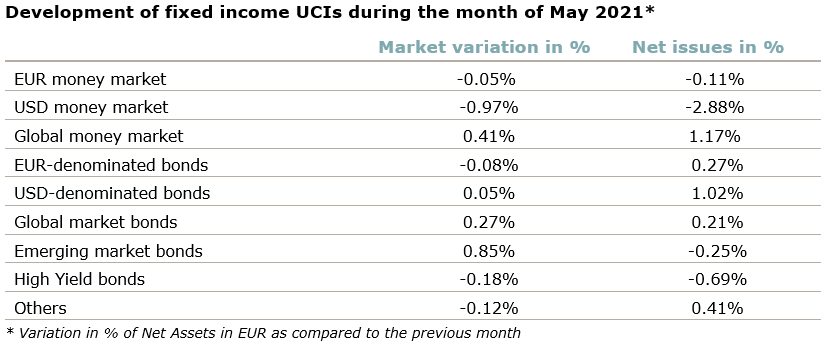

As for the EUR-denominated bond UCI category, government and investment grade corporate bonds moved sideways, in a context characterised by an ongoing accommodative monetary policy. Against this background, the EUR-denominated bond UCI category realized a slightly negative performance in May.

On the other side of the Atlantic, US treasuries were little changed in May following indications from the Federal Reserve (FED) that it maintains its accommodative monetary policy stance at the current juncture, despite rising inflation expectations. US corporate bonds on the other hand yielded positive returns. As a result, the USD-denominated bond UCI category slightly gained over the month under review, despite the depreciation of the USD against the EUR.

The Emerging market bonds UCI category rose in May in a context marked by the stabilization of US government bond yields, a weaker USD, rising commodity prices and a divergent evolution of emerging market currencies

In May, fixed income UCI categories registered an overall negative net capital investment, mainly driven by net outflows in the USD money market UCI category.

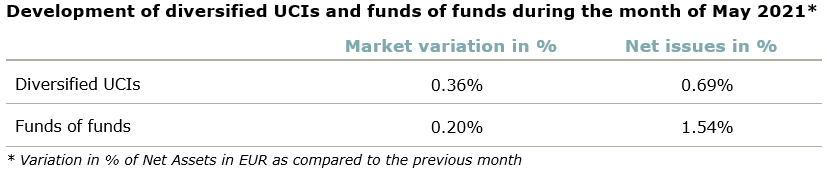

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

II. Breakdown of the number and net assets of UCIs

During the month under review, the following ten undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- AMSELECT, 10 rue Edward Steichen, L-2540 Luxembourg

- BCC INVESTMENT PARTNERS SICAV, 33A, avenue J-F Kennedy, L-1855 Luxembourg

- BEKA LUX SICAV, 6A, rue Gabriel Lippmann, L-5365 Munsbach

- BLUEBOX FUNDS, 106, route d’Arlon, L-8210 Mamer

- ELM KONZEPT, Kapstadtring 8, D-22297 Hamburg1

- MULTI SOLUTIONS, 15, avenue J-F Kennedy, L-1855 Luxembourg

UCIs Part II 2010 Law:

- MUZINICH TARGET LOANS 2025 ELTIF SICAV, S.A., 12E, rue Guillaume Kroll, L-1882 Luxembourg

SIFs:

- IBERIAN LAND FUND SICAV-SIF SA, 6a, rue Gabriel Lippmann, L-5365 Munsbach

- IE FAMILY VALUE, 5, allée Scheffer, L-2520 LUXEMBOURG

SICARs:

- SOUTHBRIDGE EUROPE MEZZANINE II S.C.A. SICAR, 17, boulevard Friedrich Wilhelm Raiffeisen, L-2411 Luxembourg

The following eleven undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- AEGON GLOBAL FUNDS, 31, Z.A. Bourmicht, L-8070 Bertrange

- AMETOS SICAV, 2, rue Edward Steichen, L-2540 Luxembourg

- BILKU 1, 6B, rue Gabriel Lippmann, L-5365 Munsbach

- GAM MULTICASH, 25, Grand-Rue, L-1661 Luxembourg

- GENESIS LIQUID ALTERNATIVE STRATEGIES FUND, 4, rue Thomas Edison, L-1445 Strassen

- UNIINSTITUTIONAL COCO BONDS, 3, Heienhaff, L-1736 Senningerberg

UCIs Part II 2010 Law:

- EUROPANEL SICAV, 4, rue Robert Stumper, L-2557 Luxembourg

SIFs:

- AXA IM ENHANCED JAPANESE EQUITY FUND, 49, avenue J-F Kennedy, L-1855 Luxembourg

- OLEASTRA S.A. SICAV-FIS, 15, rue de Flaxweiler, L-6776 Grevenmacher

- SCHRODER ITALIAN PROPERTY, 5, rue Höhenhof, L-1736 Senningerberg

SICARs:

- AXA PRIVATE DEBT II S.A., SICAR, 24, avenue Emile Reuter, L-2420 Luxembourg

1 Undertaking for collective investment for which the designated management company was authorised by the competent authorities of another Member State in accordance with Directive 2009/65/EC.