Global situation of undertakings for collective investment at the end of July 2021

Press release 21/22

I. Overall situation

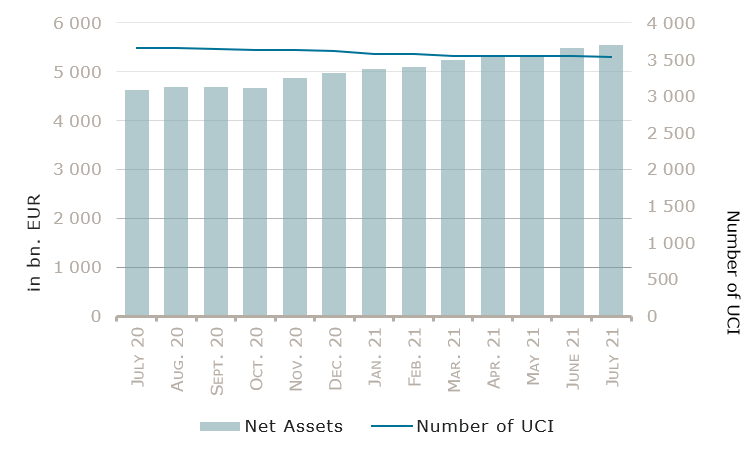

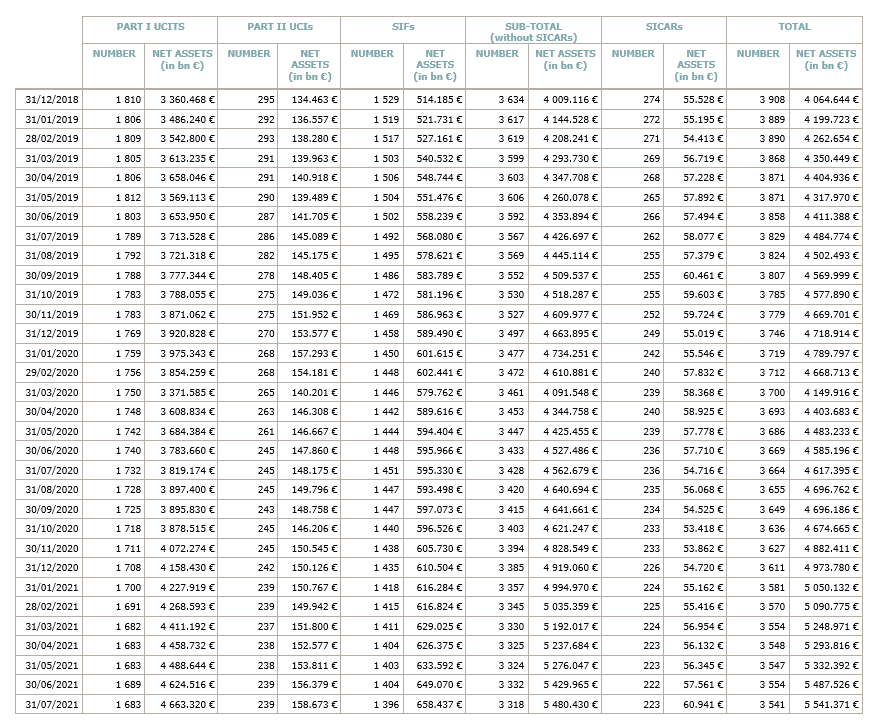

As at 31 July 2021, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialized investment funds and SICARs, amounted to EUR 5,541.371 billion compared to EUR 5,487.526 billion as at 30 June 2021, i.e. an increase of 0.98% over one month. Over the last twelve months, the volume of net assets rose by 20.01%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 53.845 billion in July. This increase represents the sum of positive net capital investments of EUR 39.083 billion (+0.71%) and of the positive development of financial markets amounting to EUR 14.762 billion (+0.27%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,541, against 3,554 the previous month. A total of 2,331 entities adopted an umbrella structure representing 13,249 sub-funds. Adding the 1,210 entities with a traditional UCI structure to that figure, a total of 14,459 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of July.

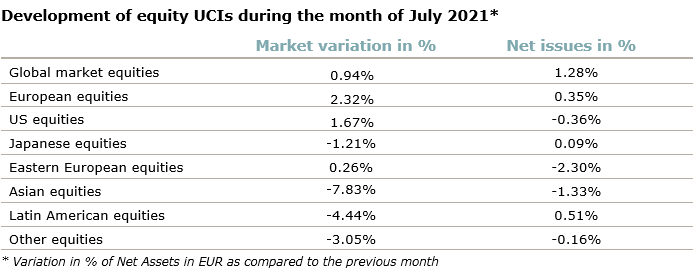

Concerning developed markets, the European equity UCI category rose in a context marked by better than expected corporate results, the launch of the European Recovery Fund and improving economic data, despite the spread of the more contagious Delta variant of Covid-19 and uncertainties relating to the continuing supply bottlenecks that weighted on European equity markets. The US equity UCI category rose as well in July, supported by a strong corporate earnings seasons and the continuing monetary policy support of the US Federal Reserve (“Fed”) in spite of the sharp pick-up in inflation. Amid the surge of new COVID-19 cases in Japan and concerns over new variants prompting a new state of emergency in Tokyo, the Japanese equity UCI category finished the month in negative territory.

As for emerging countries, the Asian equity UCI category registered overall a negative performance driven by tighter regulations for several sectors in China, higher infection rates in various Asian countries and inflationary fears. The Eastern European equity UCI category tracked globally sideways on the back of divergent developments: while the Russian equity market fell against the backdrop of volatile oil prices and the decision of the Russian Central Bank to raise its key interest rate, the equity markets of other Eastern European countries such as Poland and Czechoslovakia followed the upward trend of European equity markets. The Latin American equity UCI category saw a decline in overall, mainly due to concerns about the spread of the Delta variant and its impact on global recovery.

In July, the equity UCI categories registered an overall positive net capital investment, mainly driven by inflows in the Global market equity UCI category.

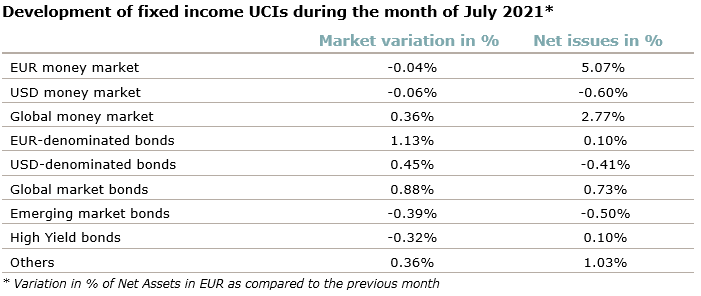

On both sides of the Atlantic, long-term government bond yields decreased in July (i.e. bond prices increased) amid concerns related to the spread of the Delta variant and some signs of a more moderate global growth, which caused investors to shift toward safer investments. Despite higher inflation rates, the European Central Bank and US Fed pursued their expansive monetary policies which further contributed to this downward trend. Against this backdrop and notwithstanding a slight increase of the risk premia on US corporate bonds, the yields of both European and US corporate bonds decreased as well, pushing the EUR and USD denominated bond UCI categories into positive territory.

The Emerging market bond UCI category realized a negative performance in consequence of the interest rate hikes by several emerging market central banks, rising risk premia on emerging market bonds and the depreciation of some emerging market currencies, despite declining US yields as well as globally resilient fundamentals in emerging markets.

In July, fixed income UCI categories registered an overall positive net capital investment. In relative terms, the EUR money market UCI category recorded the highest inflows.

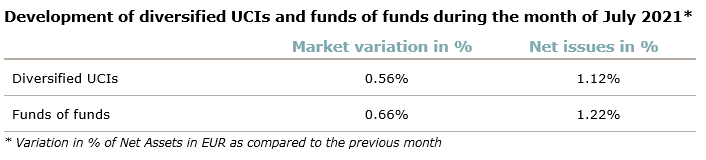

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

II. Breakdown of the number and net assets of UCIs

During the month under review, the following six undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- ABN AMRO SOLUTIONS, 49, avenue J-F Kennedy, L-1855 Luxembourg

- LUMYNA-MARSHALL WACE UCITS SICAV, 20, rue de la Poste, L-2346 Luxembourg

- PFP ADVISORY AKTIEN MITTELSTAND PREMIUM, 15, rue de Flaxweiler, L-6776 Grevenmacher

SIFs:

- BROOKFIELD REAL ESTATE EUROPE LUX S.A R.L. SICAV-SIF, Vertigo Naos Building – 6, rue Eugène Ruppert, L-2453 Luxembourg

- UNIINSTITUTIONAL PRIVATE DEBT SCS SICAV-SIF, 3, Heienhaff, L-1736 Senningerberg

SICARs:

- ARCANO SECONDARY FUND XIV, S.C.A., SICAR, Vertigo Naos Building – 6, rue Eugène Ruppert, L-2453 Luxembourg

The following nineteen undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- DPAM MONEY MARKET L, 12, rue Eugène Ruppert, L-2453 Luxembourg

- HB STRATEGIE, 15, rue de Flaxweiler, L-6776 Grevenmacher

- HELLERICH GLOBAL, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- ICE GLOBAL CREDIT FUNDS, 47-49, avenue J-F Kennedy, L-1855 Luxembourg

- IVA GLOBAL SICAV, 106, route d’Arlon, L-8210 Mamer

- MONTE SICAV, 60, avenue J-F Kennedy, L-1855 Luxembourg

- UNIGARANT: CHANCENVIELFALT (2021), 3, Heienhaff, L-1736 Senningerberg

- UNIGARANT80: DYNAMIK, 3, Heienhaff, L-1736 Senningerberg

- UNIPROFIANLAGE (2021), 3, Heienhaff, L-1736 Senningerberg

SIFs:

- ARENAFUNDS SICAV-SIF, 1B, rue Jean Piret, L-2350 Luxembourg

- CTBR LUXEMBOURG, 4, rue Robert Stumper, L-2557 Luxembourg

- FONDS EUROPEEN DE FINANCEMENT SOLIDAIRE (FEFISOL) S.A., SICAV-FIS, 5, allée Scheffer, L-2520 Luxembourg

- KBC FLEXIBLE, 80, route d’Esch, L-1470 Luxembourg

- LEASINVEST IMMO LUX, 6D, route de Trèves, L-2633 Senningerberg

- OASIS FUND, S.C.A., SICAV-FIS, 4, rue Robert Stumper, L-2557 Luxembourg

- PACTUM, 28-32, place de la Gare, L-1616 Luxembourg

- PRAEFINIUM, 4, rue Robert Stumper, L-2557 Luxembourg

- PRIME CAPITAL DEBT SCS, SICAV-FIS, 20, rue de la Poste, L-2346 Luxembourg

- SELECTIVE OPPORTUNITIES, 5, allée Scheffer, L-2520 Luxembourg