Global situation of undertakings for collective investment at the end of January 2022

Press release 22/04

I. Overall situation

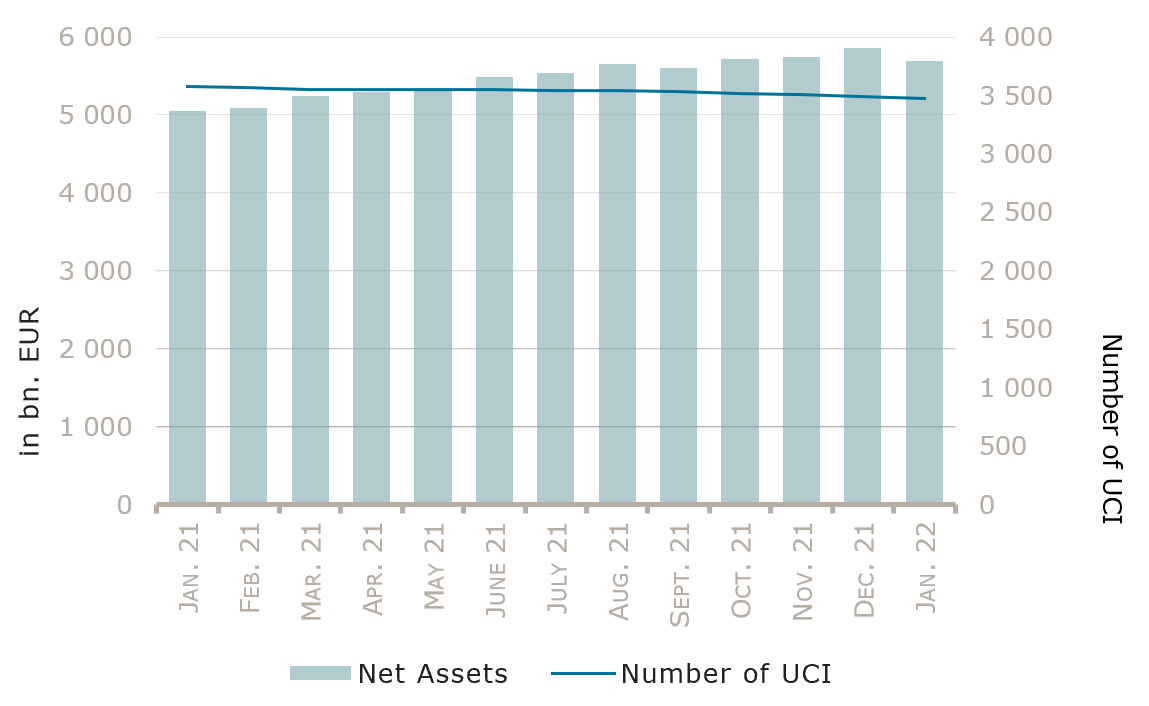

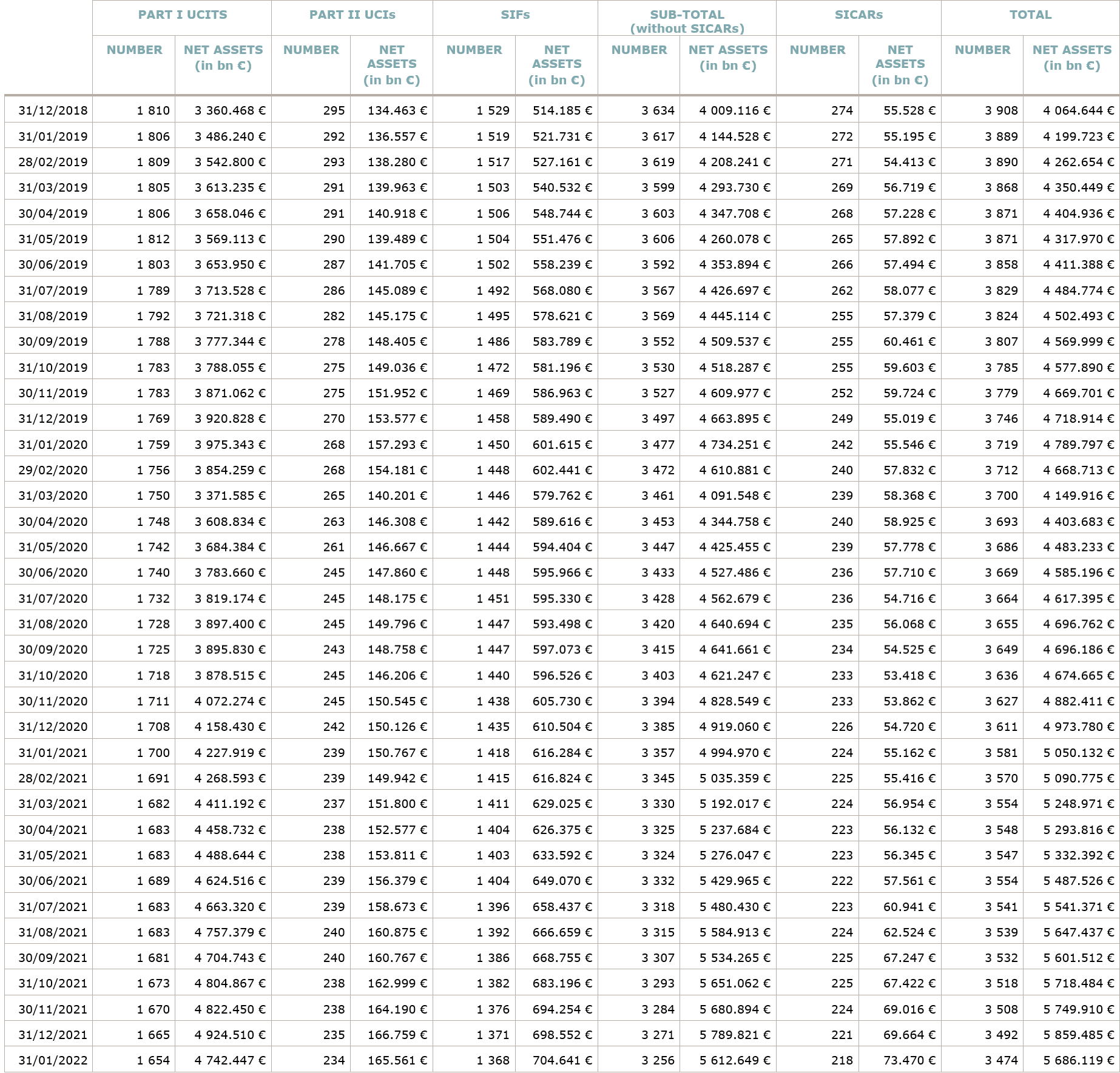

As at 31 January 2022, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialized investment funds and SICARs, amounted to EUR 5,686.119 billion compared to EUR 5,859.485 billion as at 31 December 2021, i.e. a decrease of 2.96% over one month. Over the last twelve months, the volume of net assets rose by 12.59%.

The Luxembourg UCI industry thus registered a negative variation amounting to EUR 173.366 billion in January. This decrease represents the sum of negative net capital investments of EUR 12.346 billion (-0.21%) and of the negative development of financial markets amounting to EUR 161.020 billion (-2.75%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,474, against 3,492 the previous month. A total of 2,283 entities adopted an umbrella structure representing 13,265 sub-funds. Adding the 1,191 entities with a traditional UCI structure to that figure, a total of 14,456 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of January.

In January, the Russia-Ukraine tensions and the continuing inflation concerns increased the market volatility and the equity UCI categories overall registered a negative performance whereas bond yields were rising.

Concerning developed markets, the European equity UCI category recorded losses in consequence of a deceleration of economic growth, a worsening of economic indicators, the backdrop of rising Covid-19 infections related to the Omicron variant and a higher inflation in the euro area. The US equity UCI category also realized a negative performance in January, driven by mixed economic data, global supply chain problems, the sharp and continuing pick-up of inflation and the possible tightening of monetary policy by the American Central Bank (“Fed”). The Japanese equity UCI category also finished the month in negative territory in consequence of the expectation of rising US interest rates, the impact of higher energy prices and the sharp pick-up in Covid-19 infections.

As for emerging countries, the Asian equity UCI category, despite heterogeneous developments across the region, saw a decline in overall amid concerns over the Fed’s rate hike plan, rising oil prices, global supply chain problems, geopolitical tensions between Russia and Ukraine and a slowing property market in China weighting on investor sentiment. The Eastern European equity UCI category registered losses mainly driven by the sharp decline of the Russian equity market related to the Russia-Ukraine tensions and a weakening of the Russian rouble (RUB). The Latin American equity UCI category, despite some diversity in the regional performance, achieved gains in consequence of higher commodity prices and strengthening domestic currencies.

In January, the equity UCI categories registered an overall positive net capital investment, mainly driven by inflows in the Global market equity UCI category.

Development of equity UCIs during the month of January 2022*

|

|

Market variation in % |

Net issues in % |

| Global market equities |

-6.35% |

0.63% |

| European equities |

-5.72% |

0.04% |

| US equities |

-6.94% |

-0.83% |

| Japanese equities |

-5.88% |

-0.76% |

| Eastern European equities |

-4,91% |

-1.35% |

| Asian equities |

-3.57% |

0.03% |

| Latin American equities |

7.82% |

0.46% |

|

Other equities |

-2.74% |

0.08% |

* Variation in % of Net Assets in EUR as compared to the previous month

Against the background of a higher inflation on both sides of the Atlantic and potentially more restrictive monetary policies by major Central banks, long term government bond yields rose (i.e. bond prices declined).

In this context, the EUR denominated bond markets registered a rise in long term bond yields while corporate bond spreads widened, despite the ECB maintaining its relatively “dovish” stance concerning its “Asset Purchase Programs” and keeping a stable outlook for interest rates, consistent with its inflation projections below target in the long run. As a result, the EUR denominated bond UCI category finished the month in negative territory

Concerning the USD denominated bond UCI category, the Fed suggested a possible acceleration of its monetary policy tightening and likely interest rates hikes against the backdrop of high inflation figures. Overall, the USD denominated bond UCI category declined despite the appreciation of the USD against the EUR.

The Emerging Market bond UCI category recorded losses as Emerging Markets bonds, despite rising commodity prices, were under pressure in January primarily on the back of the Fed’s announcement of a progressively more restrictive monetary policy, widening spreads, as well as the increased geopolitical risk between Russia and Ukraine.

In January, fixed income UCI categories registered an overall negative net capital investment. The USD and EUR money market UCI categories experienced the most significant outflows.

Development of fixed income UCIs during the month of January 2022*

|

Market variation in % |

Net issues in % |

|

| EUR money market |

-0.08% |

-6.36% |

| USD money market |

1.52% |

-5.49% |

| Global money market |

0.50% |

-1.61% |

| EUR-denominated bonds |

-1.05% |

-0.67% |

| USD-denominated bonds |

-0.95% |

-3.83% |

| Global market bonds |

-1.23% |

-0.47% |

| Emerging market bonds |

-1.13% |

-0.98% |

| High Yield bonds |

-1.29% |

-1.60% |

| Others |

-1.39% |

-0.82% |

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of January 2022*

|

Market variation in % |

Net issues in % |

|

| Diversified UCIs |

-2.33% |

0.67% |

| Funds of funds |

-2.48% |

1.29% |

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following five undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- GAMA FUNDS, 15, avenue J-F Kennedy, L-1855 Luxembourg

- GAP PORTFOLIO ESG UI-LUX, 15, rue de Flaxweiler, L-6776 Grevenmacher

SIFs:

- CBRE FRENCH LOGISTICS VENTURE SCSP SICAV-SIF, 4, rue du Fort Wallis, L-2714 Luxembourg

- PGIM REAL ESTATE EUROPEAN CORE DIVERSIFIED PROPERTY FUND SCSP SICAV-SIF, 20, rue de la Poste, L-2346 Luxembourg

- SWISS LIFE REAL ESTATE FUNDS (LUX) II S.C.A., SICAV-SIF, 4A, rue Albert Borschette, L-1246 Luxembourg

The following twenty-three undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- ASHMORE SICAV 2, 10, rue du Château d’Eau, L-3364 Leudelange

- ASSENAGON DEFENSIVE CONCEPT, 1B, Heienhaff, L-1736 Senningerberg

- BANKHAUS NEELMEYER VERMÖGENSSTRATEGIE, Kapstadtring 8, 22297 Hamburg1

- BINCKBANK FUND FCP, 42, rue de la Vallée, L-2661 Luxembourg

- DO GLOBAL ALPHA, 2, rue Edward Steichen, L-2540 Luxembourg

- DWS WORLD PROTECT 90, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- ELLWANGER & GEIGER, 9A, rue Gabriel Lippmann, L-5365 Munsbach

- PBO, 15, rue de Flaxweiler, L-6776 Grevenmacher

- PREMIUMMANDAT DEFENSIV, Bockenheimer Landstraße 42-44, 60323 Frankfurt am Main1

- RAIFFEISEN SCHWEIZ (LUXEMBURG) FONDS, 11-13, boulevard de la Foire, L-1528 Luxembourg

- STARCAPITAL LONG/SHORT ALLOCATOR, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- TARGET SCORE, 2, place François-Joseph Dargent, L-1413 Luxembourg

- VON DER HEYDT UMBRELLA, 17, rue de Flaxweiler, L-6776 Grevenmacher

UCIs Part II 2010 Law:

- WALLBERG GLOBAL MICROFINANCE FUND, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

SIFs:

- ALLIANZ LJ RISK CONTROL FUND AUD FCP-FIS, 3, rue Jean Piret, L-2350 Luxembourg

- CARPITAL LEGEND CARS FUND S.C.A SICAV-SIF, 68-70, boulevard de la Pétrusse, L-2320 Luxembourg

- CGI FUND SICAV SIF S.A., 25A, boulevard Royal, L-2449 Luxembourg

- GWA SIF, 5, allée Scheffer, L-2520 Luxembourg

- LUXIF, 75, Parc d’activités, L-8308 Capellen

- SELECT INDEX SERIES, 106, route d’Arlon, L-8210 Mamer

SICARs:

- FIVE ARROWS CO-INVESTMENTS FEEDER IV S.C.A. SICAR, 33, rue Sainte Zithe, L-2763 Luxembourg

- FIVE ARROWS PRINCIPAL INVESTMENTS INTERNATIONAL FEEDER II S.C.A. SICAR, 33, rue Sainte Zithe, L-2763 Luxembourg

- SENECA POOL S.A., SICAR, 12E, rue Guillaume Kroll, L-1882 Luxembourg

1 Undertaking for collective investment for which the designated management company was authorised by the competent authorities of another Member State in accordance with Directive 2009/65/EC.