Global situation of undertakings for collective investment at the end of December 2022

Press release 23/01

I. Overall situation

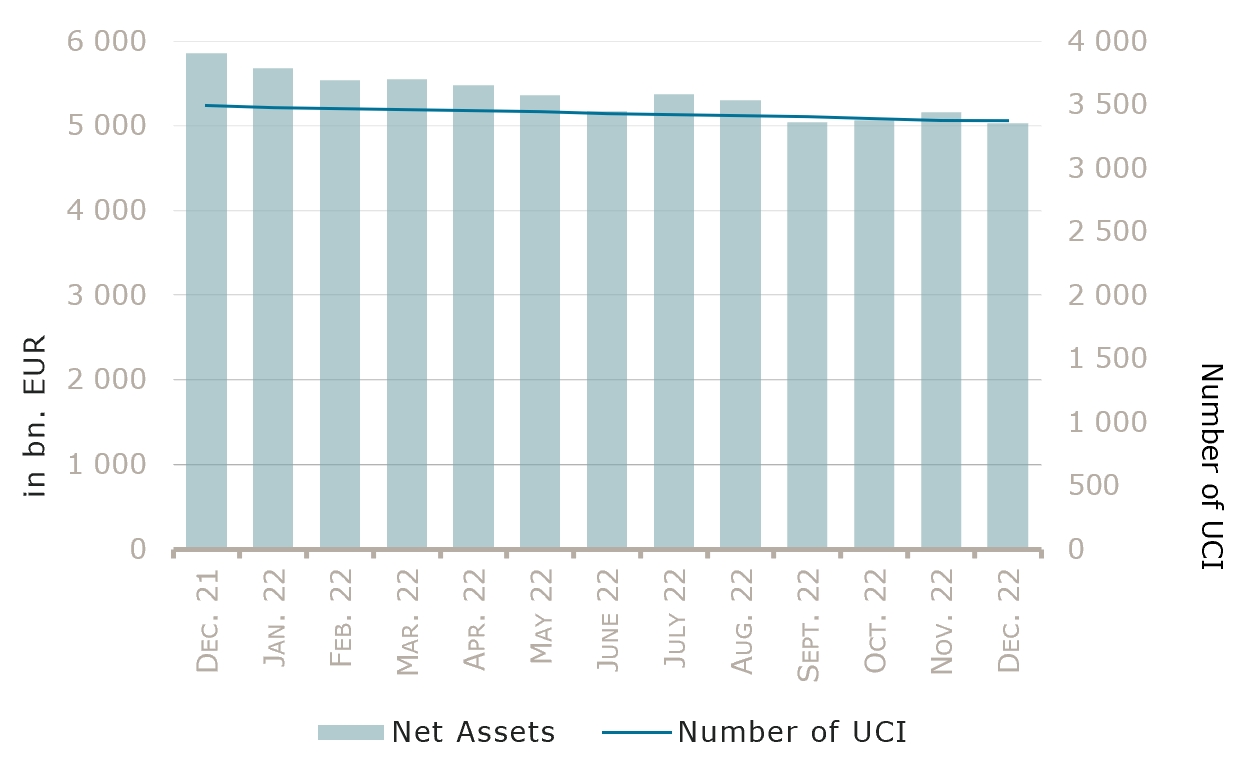

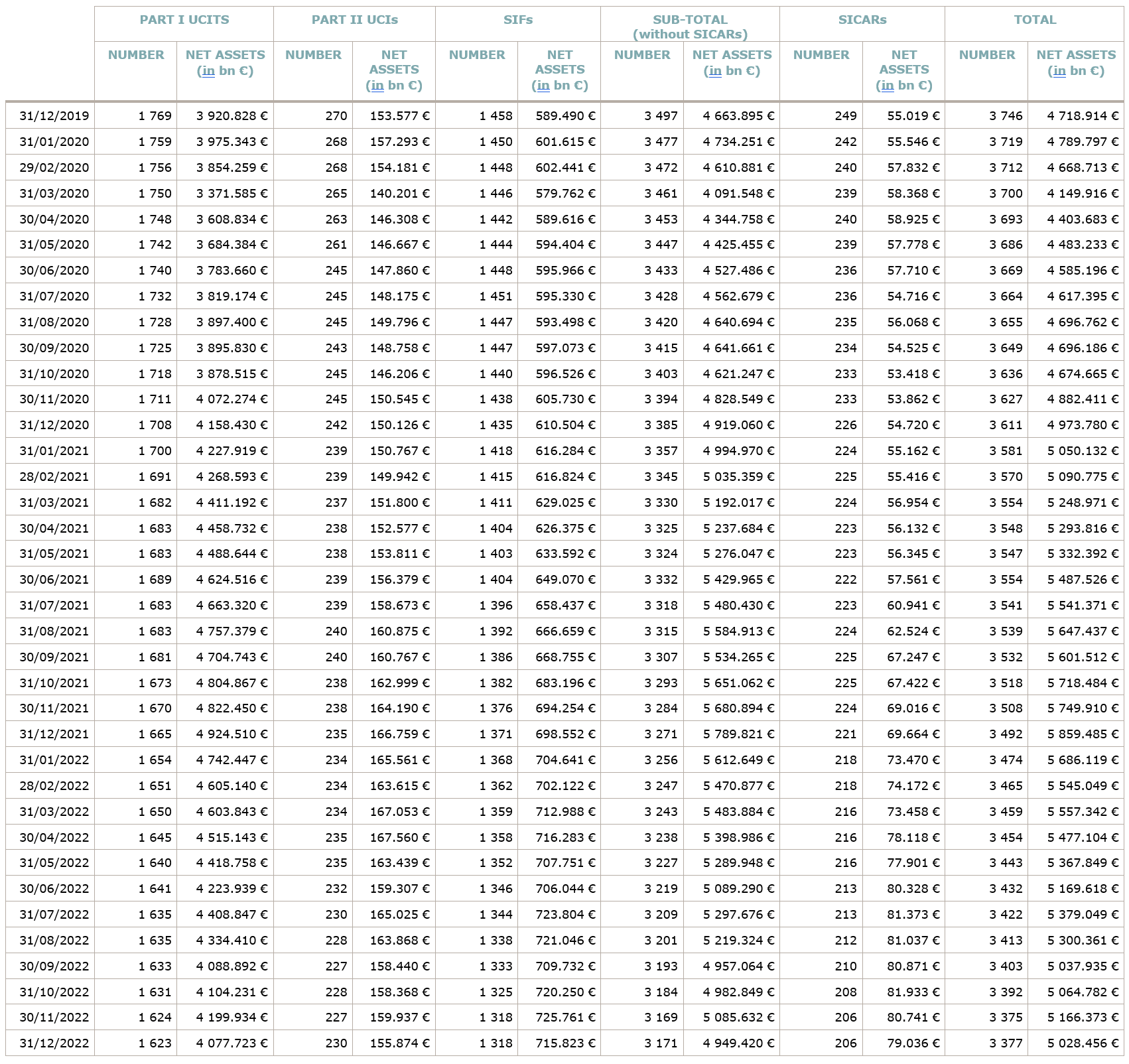

As at 31 December 2022, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 5,028.456 billion compared to EUR 5,166.373 billion as at 30 November 2022, i.e. a decrease of 2.67% over one month. Over the last twelve months, the volume of net assets decreased by 14.18%.

The Luxembourg UCI industry thus registered a negative variation amounting to EUR 137.917 billion in December. This decrease represents the sum of positive net capital investments of EUR 7.654 billion (+0.15%) and of the negative development of financial markets amounting to EUR 145.571 billion (-2.82%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,377, against 3,375 the previous month. A total of 2,199 entities adopted an umbrella structure representing 13,144 sub-funds. Adding the 1,178 entities with a traditional UCI structure to that figure, a total of 14,322 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of December.

In a context market by the Ukraine crisis, persistently high inflation, recession fears, rising interest rates and relatively hawkish communications of the Federal Reserve Board (Fed) and the European Central Bank (ECB), most of the UCI categories lost value during December, in contrast with the good performance of November.

Concerning developed markets, the European equity UCI category registered a negative performance as most of the advanced indicators confirmed the gradual weakening of the activity in Europe. The US equity UCI category also realised a negative performance in December, further amplified by the depreciation of the US dollar. The Japanese equity UCI category also lost value, the main event for investors in December being the decision by the Bank of Japan to widen the band within which it has been maintaining 10-year bond yields, while holding its benchmark interest rates steady.

The equity UCI category of emerging countries also recorded a negative performance in most regions. Despite the Chinese government’s decision to abandon the zero-COVID objective and its commitment to support the real estate sector and, more generally the economy, overall, the Asian equity category registered a negative performance. The Eastern European equity UCI category also decreased, in consequence of the higher interest rates and of the impact of the conflict in Ukraine. Finally, the Latin American equity UCI category followed the general downward trend, driven by slightly declining commodity prices and by the depreciation of the US dollar.

In December, the equity UCI categories registered an overall negative net capital investment.

Development of equity UCIs during the month of December 2022*

|

Market variation in % |

Net issues in % |

|

| Global market equities |

-4.94% |

0.01% |

| European equities |

-2.92% |

-0.74% |

| US equities |

-7.42% |

-0.64% |

| Japanese equities |

-3.38% |

-0.91% |

| Eastern European equities |

-0.49% |

-0.08% |

| Asian equities |

-1.21% |

0.65% |

| Latin American equities |

-5.73% |

-0.46% |

| Other equities |

-3.67% |

0.41% |

* Variation in % of Net Assets in EUR as compared to the previous month

In fixed income markets, government bond yields significantly increased on both sides of the Atlantic, which negatively affected bond prices (given the negative relationship between prices and yields).

Concerning the EUR-denominated bond UCI category, the ECB decided in December to raise its interest rates by 50 basis points. It also made a substantial upward revision to its inflation outlook, suggesting that further rate hikes were to be expected. As a consequence, the yields significantly increased across the curve, i.e. the bond prices declined, more than compensating the positive contribution of narrowing credit spreads in December. Overall, the EUR-denominated bond UCI category realised a negative performance.

Concerning the USD-denominated bond UCI category, US fixed income registered negative returns in December after a 50 basis points rate hike by the Fed mid-month and the consecutive statement by the Fed Chairman Jerome Powell that the fight against inflation was not yet won. The USD-denominated bond UCI category finished the month with a negative performance, amplified by the strong depreciation of the US dollar against the euro.

Despite the reversal of China’s zero-COVID policy and its refocus on economic growth, which had a positive impact on Emerging Market debt, the rise of US sovereign yields and the strong depreciation of the US dollar against the euro made the UCI Emerging markets bond category finish in negative territory.

In December, the UCI fixed income categories registered overall positive net capital inflows, the USD Money Market UCI category being the one with the highest inflows.

Development of fixed income UCIs during the month of December 2022*

|

Market variation in % |

Net issues in % |

|

| EUR money market |

0.09% |

1.36% |

| USD money market |

-2.65% |

3.75% |

| Global money market |

-1.44% |

-0.98% |

| EUR-denominated bonds |

-2.55% |

0.53% |

| USD-denominated bonds |

-1.83% |

0.48% |

| Global market bonds |

-1.88% |

0.25% |

| Emerging market bonds |

-0.89% |

1.15% |

| High Yield bonds |

-1.59% |

-0.36% |

| Others |

-1.67% |

-0.08% |

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of December 2022*

|

Market variation in % |

Net issues in % |

|

| Diversified UCIs |

-2.44% |

-0.31 % |

| Funds of funds |

-2.31% |

-0.07% |

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following seventeen undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- ALGOVEST – MULTI STRATEGY, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- BERENBERG EMERGING ASIA FOCUS FUND, 15, rue de Flaxweiler, L-6776 Grevenmacher

- VALORI SICAV, 33A, Avenue J.F. Kennedy, L-1855 Luxembourg

- VERMÖGENSMANAGEMENT DIVIDENDENSTARS, Bockenheimer Landstraße 42-44, 60323 Frankfurt am Main1

UCIs Part II 2010 Law:

- GOLDMAN SACHS ALTERNATIVES SICAV, 4, rue Peternelchen, L-2370 Howald

- HARBOURVEST GLOBAL PRIVATE SOLUTION SICAV S.A., 9, rue de Bitbourg, L-1273 Luxembourg

- MAXVAL INVESTMENT PARTNERS, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- SCHRODERS CAPITAL, 5, Hoehenhof, L-1736 Senningerberg

SIFs:

- ARDIAN REAL ESTATE EUROPEAN FUND III S.C.A., SICAV-SIF, 15, boulevard F.W. Raiffeisen, L-2411 Luxembourg

- BLACKROCK EUROPE PROPERTY FUND VI SCSP SIF, 20, rue de la Poste, L-2346 Luxembourg

- CORE INFRASTRUCTURE FUND III SCS SICAV-SIF, 5, allée Scheffer, L-2520 Luxembourg

- FIDELITY EUROPEAN REAL ESTATE CLIMATE IMPACT FUND SCA SICAV-SIF, 2A, rue Albert Borschette, L-1246 Luxembourg

- FRANCE CHINA COOPERATION FUND A SCSP SICAV-SIF, 25C, boulevard Royal, L-2449 Luxembourg

- FRANCE CHINA COOPERATION FUND B SCSP SICAV-SIF, 25C, boulevard Royal, L-2449 Luxembourg

- MERCER GLOBAL CORE REAL ESTATE FUND, SCSP SICAV-SIF, 8, rue Lou Hemmer, L-1748 Luxembourg-Findel

- SEPHIRA ASSET MANAGEMENT FUND SICAV-SIF, 94, rue du Grünewald, L-1912 Luxembourg

- SOFINA GLOBAL S.A. SIF, 12, rue Léon Laval, L-3372 Leudelange

The following fifteen undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- GEFIP INVEST, 60, avenue J-F Kennedy, L-1855 Luxembourg

- SEF, 49, avenue J-F Kennedy, L-1855 Luxembourg

- SI ANLAGEFONDS 2, 8-10, rue Jean Monnet, L-2180 Luxembourg

- SI UCITS ETF, 8-10, rue Jean Monnet, L-2180 Luxembourg

- VOBA FUND, 4, rue Jean Monnet, L-2180 Luxembourg

UCIs Part II 2010 Law:

- NATIXIS LOOMIS SAYLES SENIOR LOAN FUND, 2, rue Jean Monnet, L-2180 Luxembourg

SIFs:

- AUGUR FINANCIAL OPPORTUNITY SICAV, 9A, rue Gabriel Lippmann, L-5365 Munsbach

- BL PRIVATE EQUITY FUND SCA SICAV-SIF, 14, boulevard Royal, L-2449 Luxembourg

- COLLER INTERNATIONAL PARTNERS VI LUXEMBOURG FEEDER FUND SCA SICAV-SIF, 10, rue du Château d’eau, L-3364 Leudelange

- EUROPEAN DIVERSIFIED BOND FUND, 11-13, boulevard de la Foire, L-1528 Luxembourg

- GINKGO SICAV SIF, 1B, rue Jean Piret, L-2350 Luxembourg

- MUAM UMBRELLA FUND, 287-289, route d’Arlon, L-1150 Luxembourg

- PERMIAN GLOBAL FCP-SIF, 412F, route d’Esch, L-2086 Luxembourg

- PERMIAN GLOBAL S.C.A., SICAV-SIF, 412F, route d’Esch, L-2086 Luxembourg

- RURAL IMPULSE FUND II S.A., SICAV-SIF, 88, Grand-Rue, L-1660 Luxembourg

1 Undertaking for collective investment for which the designated management company was authorised by the competent authorities of another Member State in accordance with Directive 2009/65/EC.