Global situation of undertakings for collective investment at the end of March 2023

Press release 23/08

I. Overall situation

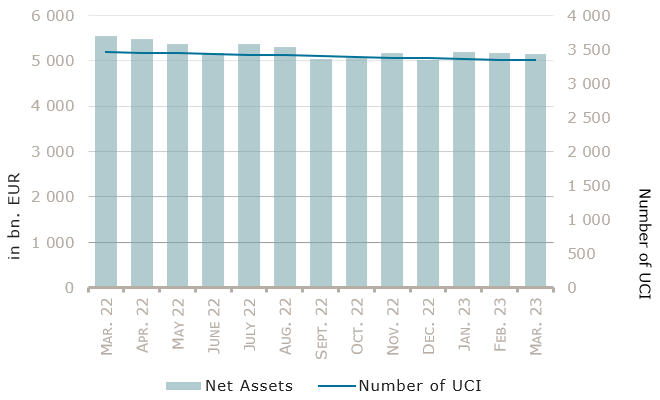

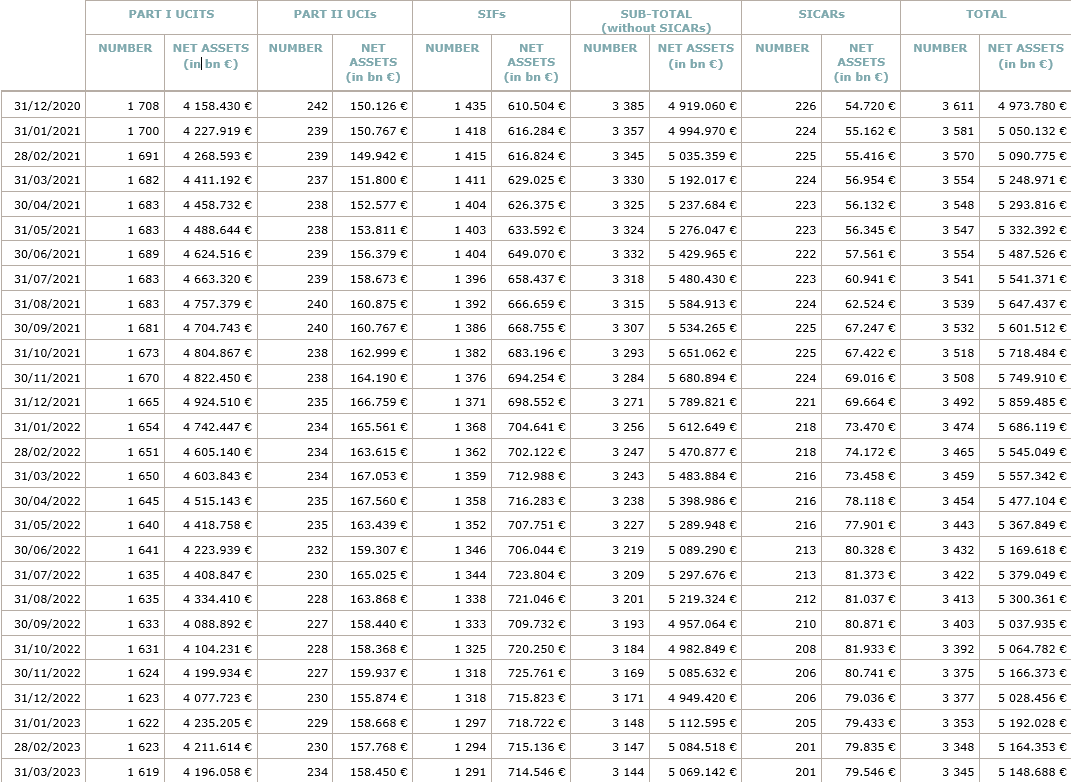

As at 31 March 2023, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 5,148.688 billion compared to EUR 5,164.353 billion as at 28 February 2023, i.e. a decrease of 0.30% over one month. Over the last twelve months, the volume of net assets decreased by 7.35%.

The Luxembourg UCI industry thus registered a negative variation amounting to EUR 15.665 billion in March. This decrease represents the sum of negative net capital investments of EUR 9.250 billion (-0.18%) and of the negative development of financial markets amounting to EUR 6.415 billion (-0.12%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,345, against 3,348 the previous month. A total of 2,188 entities adopted an umbrella structure representing 13,102 sub-funds. Adding the 1,157 entities with a traditional UCI structure to that figure, a total of 14,259 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of March.

In March, banking contagion fears emerged following the collapse of US regional banks and the subsequent takeover of Credit Suisse by UBS. Global government bonds rallied and, despite the stress, global equities slightly rose over the month.

Concerning developed markets, the European equity UCI category registered, in consequence of the banking stress and of higher volatility, a negative performance despite the positive orientation of advanced indicators of economic activity in the service sector. The US equity UCI category, despite the depreciation of the USD against the EUR, ended March in positive territory, supported by globally strong economic data and declining headline and core inflation rates. The Japanese equity UCI category registered a positive performance in the context of Japanese firms agreeing on a 3.8% overall wage hike at the annual ‘Shunto’ negotiations and of unaltered expansionary monetary policy for the last month of Governor Kuroda’s ten-year mandate.

As for emerging countries, the Asian equity category registered a negative performance for most equity markets in the region. China economic indicators continued to rebound from their covid slump but the initial euphoria over China’s reopening was limited by softer manufacturing data. The Eastern European equity UCI category also ended in negative territory as economic sentiment remained weak in the region. The Latin America UCI category realised a negative performance due to the decline of confidence indicators and concerns around the persistence of inflation.

In March, the equity UCI categories registered an overall negative net capital investment.

Development of equity UCIs during the month of March 2023*

|

Market variation in % |

Net issues in % |

|

| Global market equities |

0.25% |

-0.20% |

| European equities |

-0.45% |

-0.67% |

| US equities |

0.13% |

-0.13% |

| Japanese equities |

1.41% |

-0.62% |

| Eastern European equities |

-2.69% |

-5.92% |

| Asian equities |

-0.59% |

0.49% |

| Latin American equities |

-2.16% |

-1.42% |

| Other equities |

-0.15% |

-0.39% |

* Variation in % of Net Assets in EUR as compared to the previous month

On both sides of the Atlantic, government bond prices rallied despite major Central Banks proceeded to new rate hikes.

Concerning the EUR denominated bond UCI category, the European Central Bank (ECB) increased its rates by 50bps in March, similarly to its rate hike of February. In the context of the banking stress, markets have been volatile with temporarily widening credit spreads and declining yields. As a result, and given the negative relationship between yields and prices, the EUR denominated bond UCI category realised a positive performance.

Concerning the USD denominated bond UCI category, the Federal Reserve (Fed) hiked mid-March its rates by 25bps, in line with the precedent rate hike of February. For the same reasons applicable to the EUR category, the USD denominated bond UCI category realised a positive performance in March.

Concerning the Emerging Market bond UCI category, improving economic outlook and declining inflation rates contributed positively to the performance of emerging market bonds but the depreciation of the USD against the EUR, made the category finish in negative territory.

In March, fixed income UCI categories registered an overall positive net capital investment. The EUR Money market UCI category recorded the highest inflows.

Development of fixed income UCIs during the month of March 2023*

|

Market variation in % |

Net issues in % |

|

| EUR money market |

0.15% |

5.74% |

| USD money market |

-2.29% |

1.56% |

| Global money market |

-0.33% |

0.51% |

| EUR-denominated bonds |

1.10% |

0.27% |

| USD-denominated bonds |

0.31% |

1.21% |

| Global market bonds |

0.18% |

-0.09% |

| Emerging market bonds |

-0.30% |

-0.69% |

| High Yield bonds |

-1.34% |

-1.96% |

| Others |

-0.26% |

-1.27% |

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of March 2023*

|

Market variation in % |

Net issues in % |

|

| Diversified UCIs |

0.01% |

-0.62% |

| Funds of funds |

-0.26% |

-0.50% |

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following ten undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- BLK FONDS, 2, rue Gabriel Lippmann, L-5365 Munsbach

- TRADITIONSFONDS 1872, 3, Heienhaff, L-1736 Senningerberg

UCIs Part II 2010 Law:

- BLACKROCK ALTERNATIVE FUNDS II ELTIF SICAV, 6, rue Eugène Ruppert, L-2453 Luxembourg

- KKR INFRASTRUCTURE FUND (MASTER) FCP, 2, rue Edward Steichen, L-2540 Luxembourg

- KKR INFRASTRUCTURE FUND SICAV SA, 2, rue Edward Steichen, L-2540 Luxembourg

- KKR PRIVATE MARKETS EQUITY FUND (MASTER) FCP, 2, rue Edward Steichen, L-2540 Luxembourg

- KKR PRIVATE MARKETS EQUITY FUND SICAV SA, 2, rue Edward Steichen, L-2540 Luxembourg

SIFs:

- AGRICULTURE INVESTMENTS URUGUAY II SICAV-SIF, 2, rue Edward Steichen, L-2540 Luxembourg

- EURAZEO GROWTH SECONDARY FUND SCSP SICAV-SIF, 25C, boulevard Royal, L-2449 Luxembourg

- MAUNAKEA S.A. SICAV-SIF, 106, route d’Arlon, L-8210 Mamer

The following thirteen undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- ALESSIA, 2, rue d’Arlon, L-8399 Windhof

- ALLIANZ FINANZPLAN 2055, Bockenheimer Landstraße 42-44, 60323 Frankfurt am Main1

- GENOKONZEPT, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- ICBC (EUROPE) UCITS SICAV, 80, route d’Esch, L-1470 Luxembourg

- RP RENDITE PLUS, 6A, route de Trèves, L-2633 Senningerberg

- UNIPROFIANLAGE (2023), 3, Heienhaff, L-1736 Senningerberg

UCIs Part II 2010 Law:

- ROWE PRICE FUNDS SERIES II SICAV, 6, route de Trèves, L-2633 Senningerberg

SIFs:

- CAMBODIA-LAOS DEVELOPMENT FUND S.C.A., SICAV-SIF, 2, boulevard de la Foire, L-1528 Luxembourg

- CUBE INFRASTRUCTURE FUND, 5, allée Scheffer, L-2520 Luxembourg

- GREENOAK US (EU PARALLEL) II S.C.S., SICAV-SIF, 5, rue Heienhaff, L-1736 Senningerberg

- LENDINVEST S.C.A. SICAV SIF, 2, rue Jean Monnet, L-2180 Luxembourg

- MONDE EURO CORPORATE BONDS FUND, 287-289, route d’Arlon, L-1150 Luxembourg

- PPINVEST SICAV-SIF, 106, route d’Arlon, L-8210 Mamer

1 Undertaking for collective investment for which the designated management company was authorised by the competent authorities of another Member State in accordance with Directive 2009/65/EC.