Global situation of undertakings for collective investment at the end of April 2023

Press release 23/10

I. Overall situation

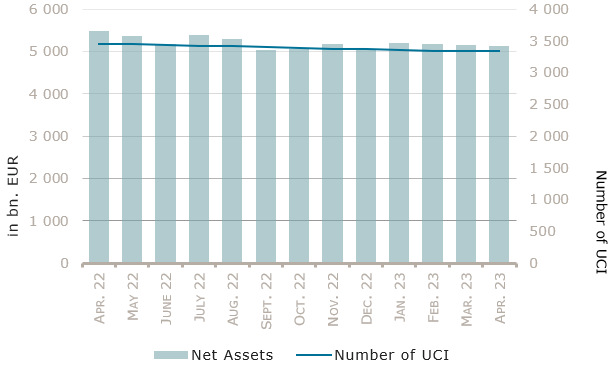

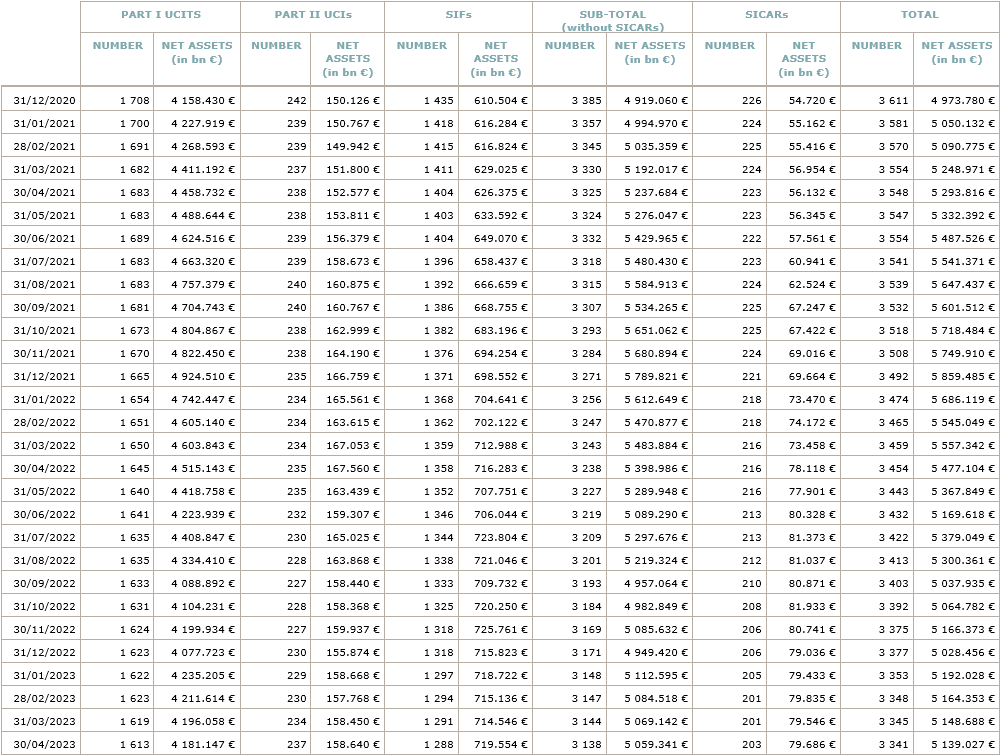

As at 30 April 2023, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 5,139.027 billion compared to EUR 5,148.688 billion as at 31 March 2023, i.e. a decrease of 0.19% over one month. Over the last twelve months, the volume of net assets decreased by 6.17%.

The Luxembourg UCI industry thus registered a negative variation amounting to EUR 9.661 billion in April. This decrease represents the sum of minor negative net capital investments of EUR 0.036 billion and of the negative development of financial markets amounting to EUR 9.625 billion (-0.19%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,341, against 3,345 the previous month. A total of 2,186 entities adopted an umbrella structure representing 13,071 sub-funds. Adding the 1,155 entities with a traditional UCI structure to that figure, a total of 14,226 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of April.

Despite the tightening of the monetary policy over last months and the uncertainty resulting from the banking sector stress in March and of the persistent conflict in Ukraine, economic data remained relatively solid in April and both equity and fixed income markets generated positive returns.

Concerning developed markets, the European equity UCI category registered a positive performance, supported by the positive orientation of advanced indicators of economic activity in the services sector, the decline of energy prices and the gradual slowdown of inflation. As to the US equity UCI category, better than expected corporate results, manufacturing and services PMIs moving higher and headline and core inflation rates trending lower have contributed to a positive performance. The Japanese equity UCI category benefitted from improving economic indicators, a weak Yen, positive corporate profit outlook and recorded a positive performance. The positive performance of the US and Japanese equity UCI categories were however fully neutralised by the monthly depreciation of the USD, respectively, the YEN, against the EUR.

As for emerging countries, the Asian equity category registered a negative performance driven by a sharp decline in Chinese equity market partly related to the persisting tensions over Taiwan and by weaker than expected semiconductor exports. The Eastern European equity UCI category realised a positive performance in a context of lower tensions on energy sector. The Latin America UCI category registered a negative performance despite the stronger earnings growth in Brazil and the rising consumer confidence in Mexico.

In April the equity UCI categories registered a negative capital investment.

Development of equity UCIs during the month of April 2023*

|

Market variation in % |

Net issues in % |

|

| Global market equities |

-0.33% |

-0.02% |

| European equities |

1.27% |

-0.96% |

| US equities |

-0.27% |

-1.25% |

| Japanese equities |

-0.16% |

-0.07% |

| Eastern European equities |

3.98% |

-0.63% |

| Asian equities |

-3.95% |

0.08% |

| Latin American equities |

-0.38% |

-0.72% |

| Other equities |

-0.26% |

0.34% |

* Variation in % of Net Assets in EUR as compared to the previous month

Compared to their drop in March, bond yields were relatively stable in April, in part due to the absence of monetary policy meetings of the European Central Bank and of the Federal Reserve this month. As the stress of the banking sector in March gradually declined, risk appetite recovered and credit spreads tightened in April, which contributed to positive returns for fixed income markets.

Concerning the EUR denominated bond UCI category, EU government bond yields were relatively stable, slightly rising. Reflecting the rising risk appetite, bond spreads were able to narrow back to pre-banking stress levels. Overall, the EUR denominated bond category in April realised a positive performance.

Concerning the USD denominated bond UCI category, US government bond yields were also relatively stable. Concerns on the US debt ceiling negotiations partly affected the US Treasuries market. The USD denominated bond UCI category, despite the depreciation of the USD against the EUR, realised in April a positive performance mainly driven the tightening of credit spreads.

Concerning the Emerging Market bond UCI category, Emerging markets bonds posted negative returns in April, mainly in consequence of the depreciation of the USD against the EUR.

In April, fixed income UCI categories registered an overall positive net capital investment. The EUR Money market UCI category recorded the highest inflows.

Development of fixed income UCIs during the month of April 2023*

|

Market variation in % |

Net issues in % |

|

| EUR money market |

0.21% |

3.84% |

| USD money market |

-0.90% |

-0.84% |

| Global money market |

-0.09% |

1.06% |

| EUR-denominated bonds |

0.30% |

0.92% |

| USD-denominated bonds |

0.03% |

1.70% |

| Global market bonds |

-0.10% |

-0.27% |

| Emerging market bonds |

-0.29% |

-0.52% |

| High Yield bonds |

-0.20% |

0.18% |

| Others |

-0.13% |

0.02% |

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of April 2023*

|

Market variation in % |

Net issues in % |

|

| Diversified UCIs |

0.13% |

-0.48% |

| Funds of funds |

-0.34% |

1.81% |

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following ten undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- GEKKO FUND SICAV, 4, rue Robert Stumper, L-2557 Luxembourg

- UNIINSTITUTIONAL COMMODITIES TRANSFORMATION, 3, Heienhaff, L-1736 Senningerberg

UCIs Part II 2010 Law:

- APOLLO PRIVATE MARKETS SICAV, 3, rue Jean Piret, L-2350 Luxembourg

- EQT NEXUS FUND SICAV, 51A, boulevard Royal, L-2449 Luxembourg

- FRANKLIN TEMPLETON PRIVATE MARKETS SICAV, 3, rue Jean Piret, L-2350 Luxembourg

SIFs:

- CC MULTI STRATEGIES SCA, SICAV-SIF, 30, Boulevard Royal, L-2449 Luxembourg

- KKR PROPERTY PARTNERS EUROPE SCA SICAV-SIF, 2, rue Edward Steichen, L-2540 Luxembourg

- PRINCIPAL EUROZONE DURABLE INCOME FUND SCSP SICAV-SIF, 5, allée Scheffer, L-2520 Luxembourg

SICAR:

- VESALIUS BIOCAPITAL IV INVESTMENTS S.A., SICAR, 8, rue Lou Hemmer, L-1748 Luxembourg-Findel

- VESALIUS BIOCAPITAL IV S.C.A., SICAR, 8, rue Lou Hemmer, L-1748 Luxembourg-Findel

The following fourteen undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- ADELIO UCITS FUND, 3, rue Jean Piret, L-2350 Luxembourg

- APOBANK VERMÖGENSVERWALTUNG, 8-10, rue Jean Monnet, L-2180 Luxembourg

- GAM STAR (LUX), 25, Grand-rue, L-1661 Luxembourg

- KAPITAL ALL OPPORTUNITIES, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- KAPITAL ERTRAG GLOBAL, 15, rue de Flaxweiler, L-6776 Grevenmacher

- OLB-FONDSCONCEPTPLUS WACHSTUM, Bockenheimer Landstraße 42-44, 60323 Frankfurt am Main1

- SMART-INVEST I, 15, rue de Flaxweiler, L-6776 Grevenmacher

- WR STRATEGIE, 4, rue Thomas Edison, L-1445 Strassen

SIFs:

- HINES RUSSIA & POLAND FUND, 35F, avenue J-F Kennedy, L-1855 Luxembourg

- NREP NORDIC STRATEGIES FUND FCP-FIS, 80, route d’Esch, L-1470 Luxembourg

- PARETO PARTNER, 9A, rue Gabriel Lippmann, L-5365 Munsbach

- RASMALA PALESTINE EQUITY FUND, 88, Grand-Rue, L-1660 Luxembourg

- SAN MAURIZIO SCA SICAV-SIF, 33A, avenue J-F Kennedy, L-1855 Luxembourg

- WELL BE FUND SCS SICAV-SIF, 15A, avenue J-F Kennedy, L-1855 Luxembourg

1 Undertaking for collective investment for which the designated management company was authorised by the competent authorities of another Member State in accordance with Directive 2009/65/EC.