Global situation of undertakings for collective investment at the end of May 2023

Press release 23/12

I. Overall situation

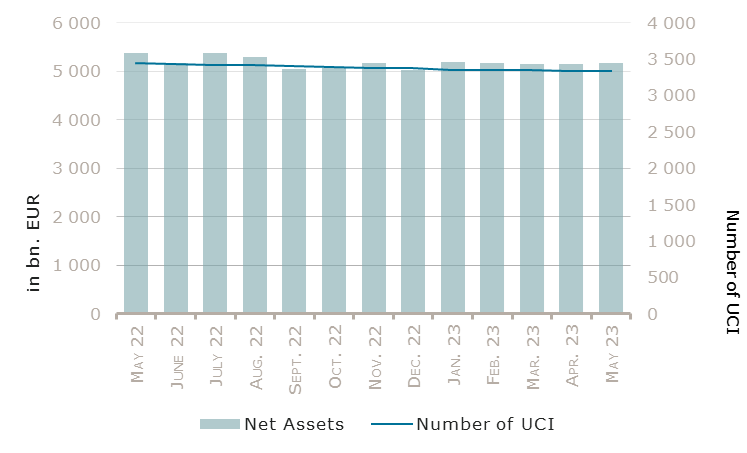

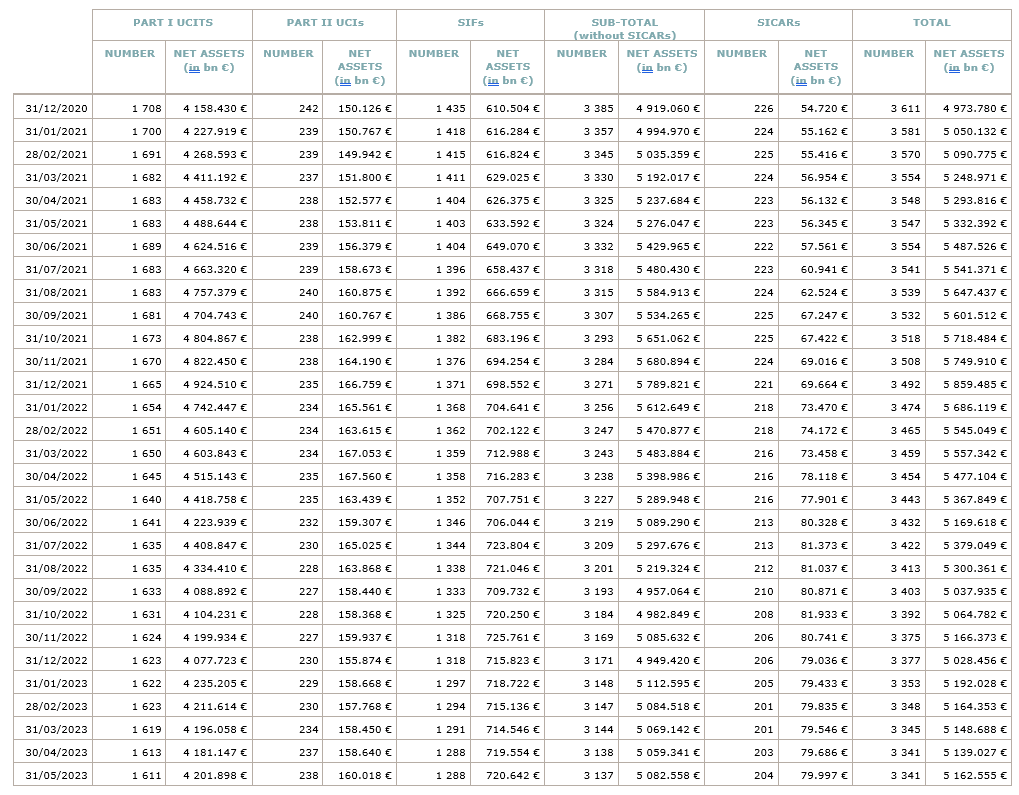

As at 31 May 2023, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 5,162.555 billion compared to EUR 5,139.027 billion as at 30 April 2023, i.e. an increase of 0.46% over one month. Over the last twelve months, the volume of net assets decreased by 3.82%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 23.528 billion in May. This increase represents the sum of negative net capital investments of EUR 11.109 billion (-0.22%) and of the positive development of financial markets amounting to EUR 34.637 billion (+0.68%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,341, against 3,341 the previous month. A total of 2,186 entities adopted an umbrella structure representing 13,071 sub-funds. Adding the 1,155 entities with a traditional UCI structure to that figure, a total of 14,226 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of May.

In line with the precedent months, May was characterised by the persistence of inflation, new policy rate hikes, the conflict in Ukraine, and globally resilient economic data (mainly for the labor market and the sector of services), but also by the debate on the US debt ceiling as additional source of uncertainty.

Concerning developed markets, the European equity UCI category, registered a negative performance as advanced indicators like the PMI slightly decreased. The US equity UCI category realised a positive performance driven by the strong appreciation of the USD against the EUR but also by better than expected economic indicators in housing and automobile sectors. The Japanese equity UCI category continued its positive momentum in May in the context of improving economic growth, solid results for the earnings season and a weakening Yen.

As for emerging countries, the Asian equity category registered a negative performance, driven by Chinese market, to due weaker than expected internal and external demand, but also by Thailand and Indonesian markets, while share prices in South Korea and Taiwan gained thanks to the rebound of the semiconductor market. The Eastern European equity UCI category realised a positive performance in a context of lower tensions on energy sector and of a large interest rate decrease in Hungary. The Latin America UCI category also registered a strong positive performance due to the recovery in Brazil and the rising consumer confidence in Mexico.

In May, the equity UCI categories registered a negative capital investment.

Development of equity UCIs during the month of May 2023*

| Market variation in % | Net issues in % | |

| Global market equities | 1.43% | -0.57% |

| European equities | -1.29% | -0.63% |

| US equities | 3.84% | -0.88% |

| Japanese equities | 3.76% | 2.40% |

| Eastern European equities | 0.50% | -1.01% |

| Asian equities | -2.52% | -1.02% |

| Latin American equities | 4.33% | -0.04% |

| Other equities | -0.58% | 0.51% |

* Variation in % of Net Assets in EUR as compared to the previous month

Yields variations were in May not aligned in the US and in Europe; they slightly declined in Europe and rose in the US.

Concerning the EUR-denominated bond category the European Central Bank raised interest rates by 25 basis points (bp) and announced it expects to end the reinvestments under the Asset Purchase Program (APP) as from July. Given the slight decline of the yields, and the relatively good performance of EUR-denominated investment grade corporate bond UCIs, the EUR-denominated bond category realised a positive performance in May.

Concerning the USD-denominated bond UCI category, the Federal Reserve delivered the expected 25bp hike, taking rates to 5.25%. Given the (relative) risk of default induced by the debt ceiling debate, and the relative persistence of the core inflation, yields continued to rise in May, the USD-denominated bond UCI category realised a negative performance in local currency, but positive in EUR thanks to the strong appreciation of the USD against the EUR.

Concerning the Emerging Market bond UCI category, Emerging markets bonds posted positive returns in May, mainly in consequence of the appreciation of the USD against the EUR.

In May, fixed income UCI categories registered an overall negative net capital investment. The EUR Money market UCI category recorded the highest outflows.

Development of fixed income UCIs during the month of May 2023*

| Market variation in % | Net issues in % | |

| EUR money market | 0.24% | -2.94% |

| USD money market | 2.86% | 2.33% |

| Global money market | 1.23% | -0.43% |

| EUR-denominated bonds | 0.33% | 1.03% |

| USD-denominated bonds | 0.55% | 1.72% |

| Global market bonds | 0.22% | -0.23% |

| Emerging market bonds | 0.56% | -0.07% |

| High Yield bonds | 0.56% | -1.12% |

| Others | 0.49% | -0.34% |

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of May 2023*

| Market variation in % | Net issues in % | |

| Diversified UCIs | 0.35% | -0.36% |

| Funds of funds | 0.90% | -0.19% |

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following thirteen undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- EFFECTUAL CAPITAL FUND SICAV, 4, rue Peternelchen, L-2370 Howald

- NORDLUX PRO, 15, rue de Flaxweiler, L-6776 Grevenmacher

- UNIDUOINVEST 4, 3, Heienhaff, L-1736 Senningerberg

- UNIEURORENTA UNTERNEHMENSANLEIHEN 2029, 3, Heienhaff, L-1736 Senningerberg

UCIs Part II 2010 Law:

- AZIMUT PRIVATE DEBT CAPITAL SOLUTIONS II – ELTIF, 2A, rue Eugène Ruppert, L-2453 Luxembourg

- EQT NEXUS FUND (MASTER) FCP, 51A, boulevard Royal, L-2449 Luxembourg

- PGIM PRIVATE REAL ESTATE, 49, Avenue J.F. Kennedy, L-1855 Luxembourg

SIFs:

- BA INSTITUTIONAL SOLUTIONS FCP – SIF, 6A, rue Gabriel Lippmann, L-5365 Munsbach

- BROOKFIELD STRATEGIC REAL ESTATE PARTNERS EUROPE LUX S.À R.L. SICAV-SIF, 49, Avenue J.F. Kennedy, L-1855 Luxembourg

- GREENOAK EUROPE CORE PLUS LOGISTICS SCSP, SICAV-SIF, 15, boulevard F.W. Raiffeisen, L-2411 Luxembourg

- ULLIS INVESTMENTS SA SICAV-SIF, 5, allée Scheffer, L-2520 Luxembourg

- VALOR INDUSTRIAL QR VALUE-ADD EU FUND SCA SICAV-SIF, 16, rue Eugène Ruppert, L-2453 Luxembourg

SICAR:

- DIGITAL TECH FUND SCA SICAR, 15, boulevard F.W. Raiffeisen, L-2411 Luxembourg

The following thirteen undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- AXA FRAMLINGTON US SELECT GROWTH FUND, 49, avenue J-F Kennedy, L-1855 Luxembourg

- DFO, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- EUROPE SECTORTREND, 5, Allée Scheffer, L-2520 Luxembourg

- MAINTOWER SICAV, 36, rue des Aubépines, L-8052 Bertrange

- MERCLIN II SICAV, 12, rue Eugène Ruppert, L-2453 Luxembourg

- MERCLIN SICAV, 12, rue Eugène Ruppert, L-2453 Luxembourg

- S.E.A. FUNDS, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

UCIs Part II 2010 Law:

- ES-INVESTSELECT: RENTEN UND IMMOBILIEN, 6, rue Lou Hemmer, L-1748 Findel

SIFs:

- AB NEXT 50 EMERGING MARKETS (LUXEMBOURG) FUND SICAV-SIF S.C.SP., 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- ALLIANCEBERNSTEIN NEXT 50 EMERGING MARKETS (MASTER) FUND SICAV-SIF S.C.SP., 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- ARMOR US CORPORATE BOND FUND, 287-289, route d’Arlon, L-1150 Luxembourg

- BPT HANSA LUX SICAV-SIF, 2, rue d’Alsace, L-1122 Luxembourg

- LUX FLEX, 5, rue Jean Monnet, L-2180 Luxembourg