Global situation of undertakings for collective investment at the end of June 2023

Press release 23/14

I. Overall situation

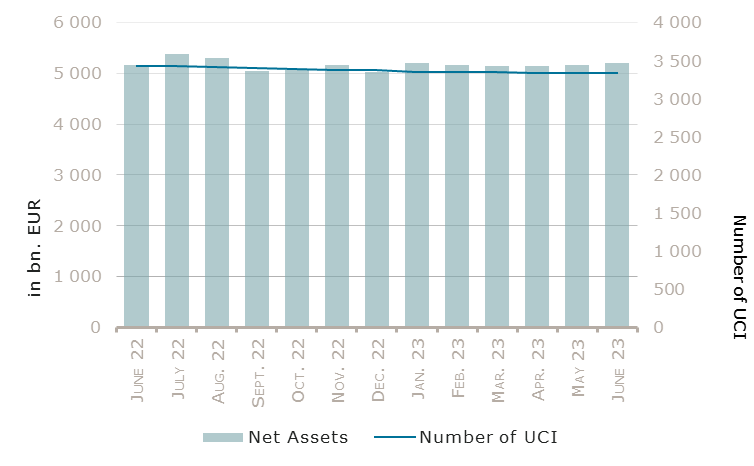

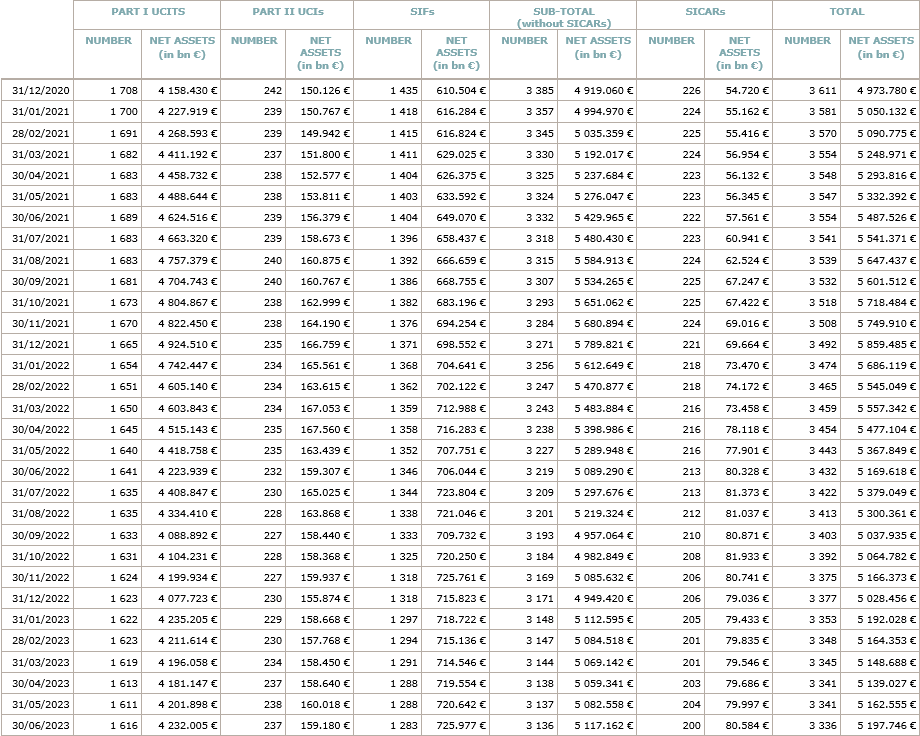

As at 30 June 2023, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 5,197.746 billion compared to EUR 5,162.555 billion as at 31 May 2023, i.e. an increase of 0.68% over one month. Over the last 12 months, the volume of net assets increased by 0.54%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 35.191 billion in June. This increase represents the sum of negative net capital investments of EUR 15.302 billion (-0.30%) and of the positive development of financial markets amounting to EUR 50.493 billion (+0.98%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,336, against 3,341 the previous month. A total of 2,182 entities adopted an umbrella structure representing 13,069 sub-funds. Adding the 1,154 entities with a traditional UCI structure to that figure, a total of 14,223 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of June.

The markets remained mainly driven by the level of inflation which has started to moderate, bringing the US Federal Reserve to pause its continuous interest rate hikes since March 2022 while the European Central Bank maintained a hawkish stance with an additional deposit rate raise to 3.5% in June despite growing concerns about the economic slowdown, reflected by weak economic indicators and the Eurozone mild technical recession after revised data showed a contraction of GDP in Q4/2022 and Q1/2023.

Equity in developed markets witnessed steady performances, supported by the resilience of the labor market and retail consumption, notably in the US. Against this backdrop, the US equity UCI category rallied while the European equity UCI category followed the positive trend, bouncing back from May losses though attenuated by a persistent core and service inflation. The Japanese equity UCI category continued to rally on the grounds of solid foreign demand.

The bull equity market also spread across emerging countries with the Asian equity category showing positive returns on the back of disinflation signs opening the potential for possible future rate cuts and of the hype surrounding AI that favors the tech sector in South-Korea and Taiwan, despite a slowdown of the Chinese economy. Regarding the Eastern European equity UCI category, earnings in Poland and Hungary bolstered the positive sentiment over the region, shifting this category into positive territory. The Latin America UCI category also registered a strong positive performance boosted by Brazil’s GDP growth well above analyst expectations.

In June, the equity UCI categories registered a negative capital investment.

Development of equity UCIs during the month of June 2023*

|

Market variation in % |

Net issues in % |

|

| Global market equities |

2.66% |

-0.42% |

| European equities |

1.77% |

-1.12% |

| US equities |

4.58% |

-1.01% |

| Japanese equities |

2.26% |

1.45% |

| Eastern European equities |

3.61% |

-1.61% |

| Asian equities |

1.61% |

-0.08% |

| Latin American equities |

7.70% |

2.96% |

| Other equities |

2.08% |

-0.63% |

* Variation in % of Net Assets in EUR as compared to the previous month

Yields increased in June both in the US and in Europe.

Concerning the EUR denominated bond category and after a new 0.25% interest rate hike in June, expectations that the European Central Bank will need to raise interest rates further to fight the sticky inflation pushed up yields especially on short maturities and therefore lowered bond prices, delaying in the meantime hopes to see the Frankfurt based institution easing its monetary policy. As a result, the EUR denominated bond category achieved a negative return.

Regarding the USD denominated bond UCI category, upward pressure on yields remained after Jerome Powell, Chairman of the US Federal Reserve, reiterated his determination to bring down the inflation towards the 2% objective requiring at least two more interest rate increases. The depreciation of the USD against EUR further weighted on the performance of this category which posted a negative performance in June.

Concerning the Emerging Market bond UCI category, Emerging markets bonds exhibited positive returns supported by robust consumer prices decrease and the perspective to see central banks cut key policy rates.

In June, fixed income UCI categories registered an overall negative net capital investment.

Development of fixed income UCIs during the month of June 2023*

|

Market variation in % |

Net issues in % |

|

| EUR money market |

0.22% |

2.53% |

| USD money market |

-1.61% |

-0.22% |

| Global money market |

0.21% |

0.66% |

| EUR-denominated bonds |

-0.35% |

0.25% |

| USD-denominated bonds |

-1.11% |

3.85% |

| Global market bonds |

-0.26% |

0.36% |

| Emerging market bonds |

1.27% |

-0.32% |

| High Yield bonds |

0.25% |

-0.82% |

| Others |

-0.22% |

-2.99% |

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of June 2023*

|

Market variation in % |

Net issues in % |

|

| Diversified UCIs |

0.68% |

-0.49% |

| Funds of funds |

0.43% |

0.31% |

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following eleven undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- AVANT-GARDE STOCK FUND, 9A, rue Gabriel Lippmann, L-5365 Munsbach

- AYDEAL UCITS, 287-289, route d’Arlon, L-1150 Luxembourg

- DE-DIVIDENDENFONDS, 4, rue Thomas Edison, L-1445 Strassen

- CASE INVEST, 4, rue Thomas Edison, L-1445 Strassen

- LUX GLOBAL PLATFORM, 106, route d’Arlon, L-8210 Mamer

- SISSENER SICAV, 33, rue de Gasperich, L-5826 Howald-Hesperange

- SK UNNAKAMEN IMPACT INVEST, 6, rue Lou Hemmer, L-1748 Findel

UCIs Part II 2010 Law:

- LUXEMBOURG SPECIALIST INVESTMENT FUNDS (2) FCP, 16, boulevard Royal, L-2449 Luxembourg

- PARTNERS GROUP PRIVATE MARKETS II SICAV, 35D, avenue J-F Kennedy, L-1855 Luxembourg

SIFs:

- CLARION EUROPE LOGISTICS V SCA, SICAV-SIF, 42-44, avenue de la Gare, L-1610 Luxembourg

- CORE INFRASTRUCTURE FUND PRIME SCSP SICAV-SIF, 5, allée Scheffer, L-2520 Luxembourg

The following sixteen undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- DEUTSCHER MITTELSTANDSANLEIHEN FONDS, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- ECOFIN SICAV, 106, route d’Arlon, L-8210 Mamer

- NORDLUX PRO FONDSMANAGEMENT, 9A, rue Gabriel Lippmann, L-5365 Munsbach

UCIs Part II 2010 Law:

- NORD/LB LUX UMBRELLA FONDS, 9A, rue Gabriel Lippmann, L-5365 Munsbach

- UNI-DEFF SICAV, 12, rue Eugène Ruppert, L-2453 Luxembourg

SIFs:

- 3TS CEE FUND SICAV-SIF, 8, rue Lou Hemmer, L-1748 Senningerberg

- ALTHELIA CLIMATE FUND, 60, avenue J-F Kennedy, L-1855 Luxembourg

- BLUEHOUSE ACCESSION PROPERTY III, 15, boulevard Friedrich Wilhelm Raiffeisen, L-2411 Luxembourg

- CROWN PREMIUM PRIVATE EQUITY IV FEEDER S.C.S., SICAV-FIS, 9, Allée Scheffer, L-2520 Luxembourg

- CROWN PREMIUM PRIVATE EQUITY IV SICAV-FIS, 9, Allée Scheffer, L-2520 Luxembourg

- LOGICAL SICAV SIF, 16, boulevard d’Avranches, L-1160 Luxembourg

- LYXOR DEBT FUND, 2-4, rue Eugène Ruppert, L-2453 Luxembourg

SICARs:

- CETP II PARTICIPATIONS S.A R.L. SICAR, 2, avenue Charles de Gaulle, L-1653 Luxembourg

- CLBRM EQUITY 2007 S.A., SICAR, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- CRSEF PARTICIPATIONS S.À R.L., SICAR, 2, avenue Charles de Gaulle, 4th floor, L-1653 Luxembourg

- GOODMAN PROPERTY OPPORTUNITIES (LUX) S.A R.L., SICAR, 5, rue de Strasbourg, L-2561 Luxembourg