Global situation of undertakings for collective investment at the end of December 2023

Press release 24/02

I. Overall situation

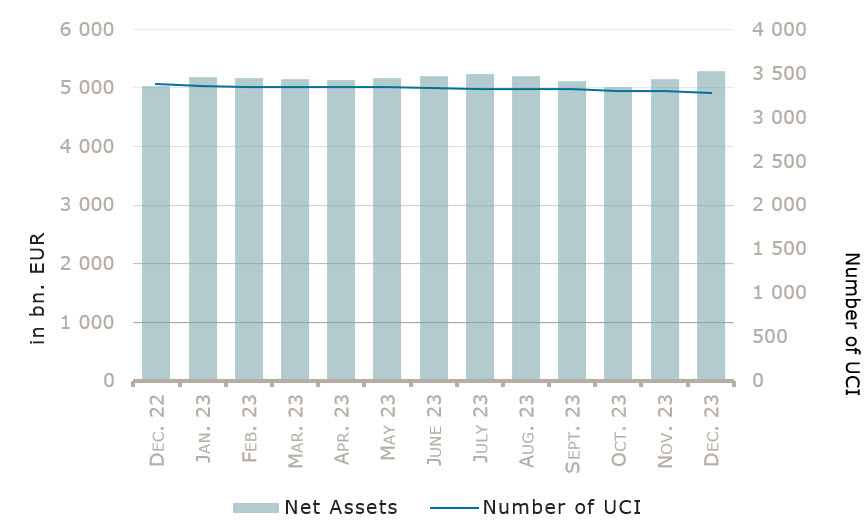

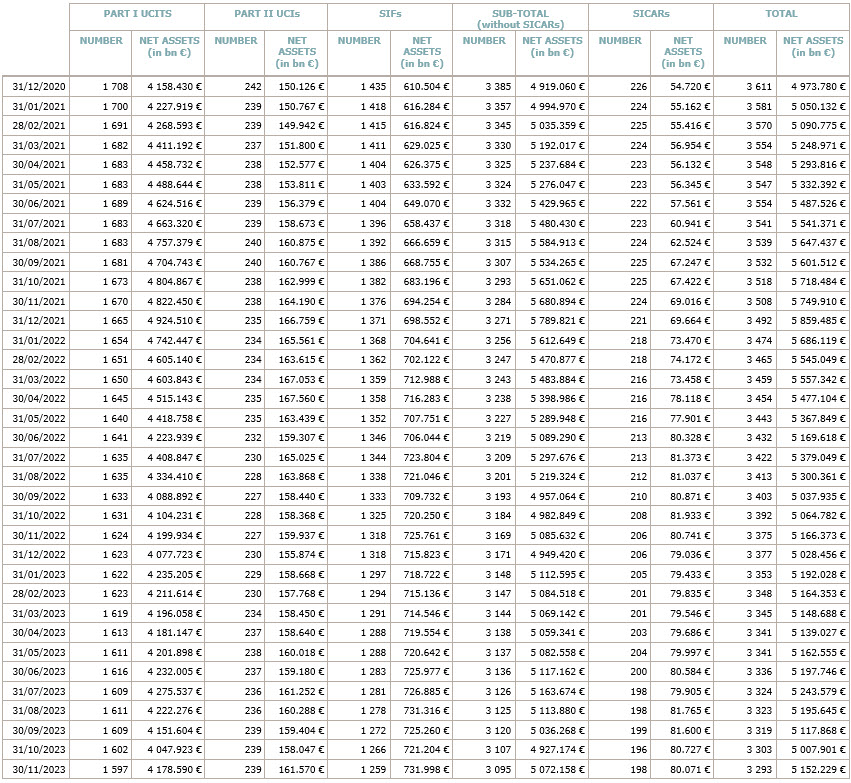

As at 31 December 2023, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 5,285.010 billion compared to EUR 5,152.229 billion as at 30 November 2023, i.e. an increase of 2.58% over one month. Over the last twelve months, the volume of net assets increased by 5.10%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 132.781 billion in December. This increase represents the sum of positive net capital investments of EUR 4.196 billion (+0.08%) and of the positive development of financial markets amounting to EUR 128.585 billion (+2.50%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,274, against 3,293 the previous month. A total of 2,147 entities adopted an umbrella structure representing 12,854 sub-funds. Adding the 1,127 entities with a traditional UCI structure to that figure, a total of 13,981 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of December.

Most equity markets continued their recovery in December against the background of optimism over rate cuts in 2024 amid declining inflation figures and despite the ongoing geopolitical conflicts. The European equity UCI category registered a positive performance despite weak economic indicators. The US equity UCI category realised a strong performance supported by better economic prospects, as well as a more dovish tone of the Fed compared to the ECB. As for emerging countries, Asian equity markets rose with all countries registering gains except China. The top performing markets in the region were Australia, India and Singapore. Finally, the Latin America UCI category registered a strong positive performance with all countries finishing the month positively.

In December, the equity UCI categories registered an overall negative capital investment.

Development of equity UCIs during the month of December 2023*

|

Market variation in % |

Net issues in % |

|

| Global market equities |

4.09% |

-0.68% |

| European equities |

3.81% |

-0.67% |

| US equities |

4.40% |

-1.45% |

| Japanese equities |

2.31% |

-0.07% |

| Eastern European equities |

2.56% |

0.13% |

| Asian equities |

0.32% |

-1.94% |

| Latin American equities |

7.21% |

2.09% |

| Other equities |

2.97% |

0.13% |

* Variation in % of Net Assets in EUR as compared to the previous month

Considering on both sides of the Atlantic the context of a falling inflation rate supporting the end of the rate hiking cycle and conducting to falling yields and credit spreads, the EUR denominated bond UCI category and the USD denominated bond UCI category realised gains in December. The Emerging market Bonds UCI category also posted positive returns on the back of anticipations of a soft landing of the US economy.

In December, fixed income UCIs registered an overall positive net capital investment due to significant inflows in all the money market UCI categories whereas the bond UCI categories mostly registered limited inflows.

Development of fixed income UCIs during the month of December 2023*

|

Market variation in % |

Net issues in % |

|

| EUR money market |

0.34% |

10.47% |

| USD money market |

-1.00% |

-0.74% |

| Global money market |

0.08% |

2.80% |

| EUR-denominated bonds |

2.90% |

1.17% |

| USD-denominated bonds |

2.40% |

-1.65% |

| Global market bonds |

2.82% |

0.42% |

| Emerging market bonds |

3.19% |

0.86% |

| High Yield bonds |

2.42% |

0.96% |

| Others |

2.42% |

-0.35% |

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of December 2023*

|

Market variation in % |

Net issues in % |

|

| Diversified UCIs |

2.53% |

-0.46% |

| Funds of funds |

1.94% |

1.18% |

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following eight undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- BERENBERG BETTER HEALTH FUND, 15, rue de Flaxweiler, L-6776 Grevenmacher

- CALAMOS ANTETOKOUNMPO GLOBAL FUNDS SICAV, 49, Avenue J.F. Kennedy, L-1855 Luxembourg

- COELI GLOBAL UCITS SICAV, 11-13, boulevard de la Foire, L-1528 Luxembourg

- PIM, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- UMWELTSPEKTRUM UCITS-ETF, 15, rue de Flaxweiler, L-6776 Grevenmacher

UCIs Part II 2010 Law:

- NUVEEN LUXEMBOURG UCI II SICAV S.A., 49, Avenue J.F. Kennedy, L-1855 Luxembourg

- PARTNERS GROUP EVERGREEN SICAV, 35D, avenue J-F Kennedy, L-1855 Luxembourg

SIFs:

- GREENOAK EUROPE CORE PLUS LOGISTICS PARALLEL SCSP, SICAV-SIF, 15, boulevard F.W. Raiffeisen, L-2411 Luxembourg

The following twenty-seven undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- ALLIANZ SUISSE – STRATEGY FUND, Bockenheimer Landstraße 42-44, 60323 Frankfurt am Main1

- AXA IM CASH, 49, avenue J-F Kennedy, L-1855 Luxembourg

- EURIZON OPPORTUNITÀ, 28, boulevard Kockelscheuer, L-1821 Luxembourg

- KSK DÜSSELDORF INVEST:, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- QUANT STRATEGIE, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- RAVEL ASSOCIATES SICAV, 12, rue Eugène Ruppert, L-2453 Luxembourg

UCIs Part II 2010 Law:

- PARTNERS GROUP GLOBAL VALUE REAL ESTATE SICAV, 68-70, boulevard de la Pétrusse, L-2320 Luxembourg

- THALIA ALTERNATIVE SICAV, 5, rue Jean Monnet, L-2180 Luxembourg

SIFs:

- ACE INVESTMENT FUND, 17-21, boulevard Joseph II, L-1840 Luxembourg

- AM INVESTMENT S.C.A. SICAV-FIS, 4, rue Robert Stumper, L-2557 Luxembourg

- CANEPA TMT GLOBAL FUND CLP-SIF, 15, avenue J-F Kennedy, L-1855 Luxembourg

- CORNUM CAPITAL S.A., SICAV-FIS, 5, rue Jean Monnet, L-2180 Luxembourg

- DEKA ALTERNATIVE INVESTMENTS REX, 6, rue Lou Hemmer, L-1748 Findel

- HTTS – HIGH TECH TRADING SYSTEM FUND, 49, boulevard du Prince Henri, L-1724 Luxembourg

- IBERIAN DISTRESSED ASSETS FUND (S.C.A.) SICAV-SIF, 6A, rue Gabriel Lippmann, L-5365 Munsbach

- IPF FUND I SCA, SICAV-FIS, 5, allée Scheffer, L-2520 Luxembourg

- MARATHON LES GRANDES JORASSES FUND SCA SICAV-SIF, 12E, rue Guillaume Kroll, L-1882 Luxembourg

- MARATHON LES GRANDES JORASSES MASTER FUND SCA SICAV-SIF, 12E, rue Guillaume Kroll, L-1882 Luxembourg

- NEXT GATE FUND, 33A, avenue J-F Kennedy, L-1855 Luxembourg

- QS REP SCA SIF, 22, rue des Bruyères, L-1274 Howald

- THE SWATCH GROUP SICAF-SIF, 10, rue Hondsbreck, L-5835 Alzingen

- THEIA SICAV SIF, 5, rue Jean Monnet, L-2180 Luxembourg

SICARs:

- PO CO-INVEST IHS SICAR, 33, rue Sainte Zithe, L-2763 Luxembourg

- SGAM PRIVATE VALUE S.C.A., SICAR A, 17, boulevard F.W. Raiffeisen, L-2411 Luxembourg

- SWISS ASIA – CHINA DISTRICT ENERGY SICAR, 6, rue Eugène Ruppert, L-2453 Luxembourg

- ESALIUS BIOCAPITAL II INVESTMENTS S.A. SICAR, 8, rue Lou Hemmer, L-1748 Luxembourg-Findel

- VESALIUS BIOCAPITAL II S.A. SICAR, 8, rue Lou Hemmer, L-1748 Luxembourg-Findel

1 Undertaking for collective investment for which the designated management company was authorised by the competent authorities of another Member State in accordance with Directive 2009/65/EC.