Global situation of undertakings for collective investment at the end of November 2023

Press release 24/01

I. Overall situation

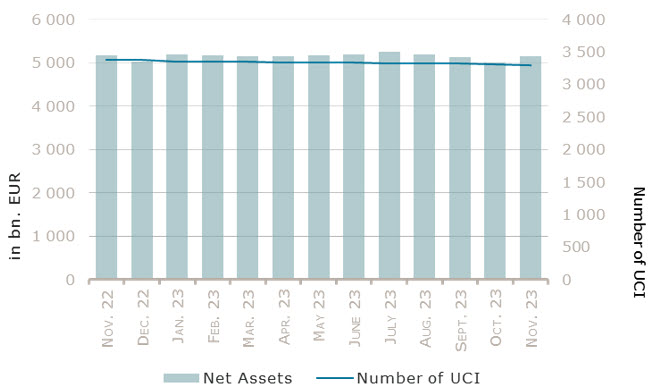

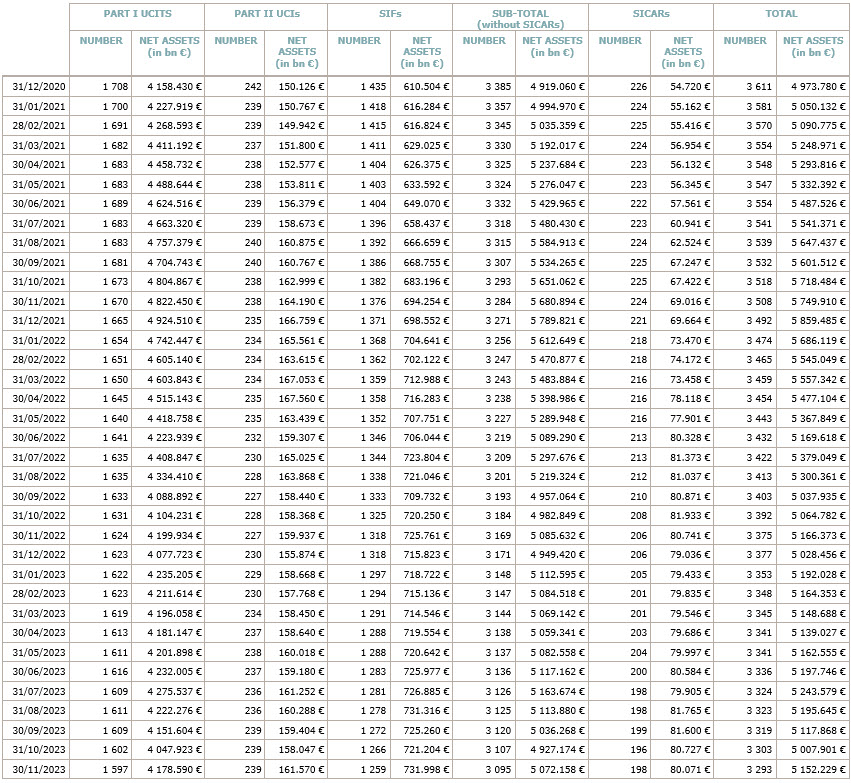

As at 30 November 2023, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 5,152.229 billion compared to EUR 5,007.901 billion as at 31 October 2023, i.e. an increase of 2.88% over one month. Over the last twelve months, the volume of net assets decreased by 0.27%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 144.328 billion in November. This increase represents the sum of negative net capital investments of EUR 9.240 billion (-0.19%) and of the positive development of financial markets amounting to EUR 153.568 billion (+3.07%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,293, against 3,303 the previous month. A total of 2,155 entities adopted an umbrella structure representing 12,864 sub-funds. Adding the 1,138 entities with a traditional UCI structure to that figure, a total of 14,002 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of November.

All the major equity markets posted significant positive performances in November, mainly driven by favourable data in the US showing a faster-than-expected decrease in inflation and a slowdown in economic activity supporting a soft landing scenario. Economic data in Europe and the UK also highlighted a decrease in inflation amid weak but slightly improving economic indicators. These releases raised hopes that the monetary policy tightening cycle might be over and triggered speculation that rate cuts may occur earlier than anticipated in 2024, resulting in a decrease in bond yields which benefited to equities worldwide. The Asian equities category registered the lowest performance (still fairly positive) due to the Chinese equity market, which is still affected by issues in the real estate market and lower investor and consumer confidence.

In November, the equity UCI categories registered an overall negative capital investment.

Development of equity UCIs during the month of November 2023*

|

Market variation in % |

Net issues in % |

|

| Global market equities |

5,97% |

-0,39% |

| European equities |

6,80% |

-1,12% |

| US equities |

6,63% |

-4,06% |

| Japanese equities |

4,55% |

-0,71% |

| Eastern European equities |

3,95% |

-2,30% |

| Asian equities |

1,39% |

-1,96% |

| Latin American equities |

10,02% |

2,15% |

| Other equities |

4,61% |

-0,61% |

* Variation in % of Net Assets in EUR as compared to the previous month

The above-mentioned economic indicators drove yields and spreads lower, resulting in gains for all bond UCI categories. Emerging markets bonds also benefitted from an easing of financial conditions that result from to the significant depreciation of the US dollar during the month.

In November, fixed income UCIs registered an overall positive net capital investment due to significant inflows in all the money market UCI categories whereas the other UCI bond categories registered limited flows.

Development of fixed income UCIs during the month of November 2023*

|

Market variation in % |

Net issues in % |

|

| EUR money market |

0,32% |

1,81% |

| USD money market |

-2,75% |

3,81% |

| Global money market |

0,56% |

1,93% |

| EUR-denominated bonds |

2,50% |

0,43% |

| USD-denominated bonds |

1,82% |

-0,47% |

| Global market bonds |

3,09% |

0,02% |

| Emerging market bonds |

3,00% |

-0,41% |

| High Yield bonds |

2,42% |

0,03% |

| Others |

2,09% |

-0,72% |

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of November 2023*

|

Market variation in % |

Net issues in % |

|

| Diversified UCIs |

2,90% |

-0,89% |

| Funds of funds |

1,99% |

1,25% |

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following five undertakings for collective investment have been registered on the official list:

UCIs Part II 2010 Law:

- AC ONE PLANET ELTIF, 15, boulevard Friedrich Wilhelm Raiffeisen, L-2411 Luxembourg

- PANTHEON PRIVATE MARKETS SICAV SA, Vertigo Building – Polaris, 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- ZURICH GLOBAL PRIVATE ASSET SOLUTIONS SICAV S.A., 19, rue de Bitbourg, L-1273 Luxembourg

SICARs:

- CETP V PARTICIPATIONS S.À R.L., SICAR, 2, avenue Charles de Gaulle, 4th floor, L-1653 Luxembourg

- ISSARTS PRIVATE EQUITY INVESTMENTS S.C.A. SICAR, 11, avenue Emile Reuter, L-2420 Luxembourg

The following fifteen undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- ALLIANZ PFANDBRIEFFONDS, Bockenheimer Landstraße 42-44, 60323 Frankfurt am Main1

- DEKA-MULTI ASSET ERTRAG, 6, rue Lou Hemmer, L-1748 Findel

- DJE PREMIUM, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- NN (L) PROTECTED, 80, route d’Esch, L-1470 Luxembourg

- PROFUND GLOBAL MULTI ASSET, 1C, rue Gabriel Lippmann, L-5365 Munsbach

UCIs Part II 2010 Law:

- EUROPEAN DIRECT PROPERTY FUND, 60, avenue J-F Kennedy, L-1855 Luxembourg

- NN (L) CMF, 80, route d’Esch, L-1470 Luxembourg

- NN (L) II, 80, route d’Esch, L-1470 Luxembourg

SIFs:

- AWL IMMO S.C.S. SICAV-SIF, 17, boulevard F.W. Raiffeisen, L-2411 Luxembourg

- B’S GLOBAL INVEST, 9A, rue Gabriel Lippmann, L-5365 Munsbach

- KCSST, 4, rue Thomas Edison, L-1445 Strassen

- KGJ INVESTMENTS S.A., SICAV-SIF, 33, rue de Gasperich, L-5826 Hesperange

- LGT (LUX) URANIA ILS FUND, 5, rue Jean Monnet, L-2180 Luxembourg

- OHA S.C.A., SICAV-SIF, 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- THREE HILLS DECALIA, 15, boulevard Friedrich Wilhelm Raiffeisen, L-2411 Luxembourg

1 Undertaking for collective investment for which the designated management company was authorised by the competent authorities of another Member State in accordance with Directive 2009/65/EC.