Global situation of undertakings for collective investment at the end of December 2015

Press release 16/05

I. Overall situation

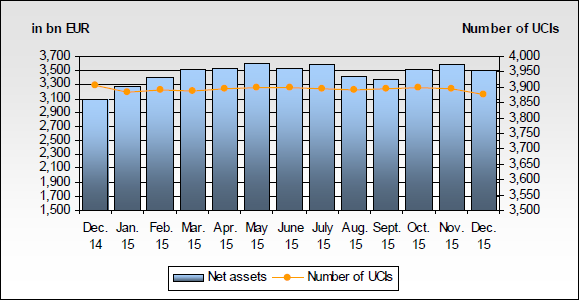

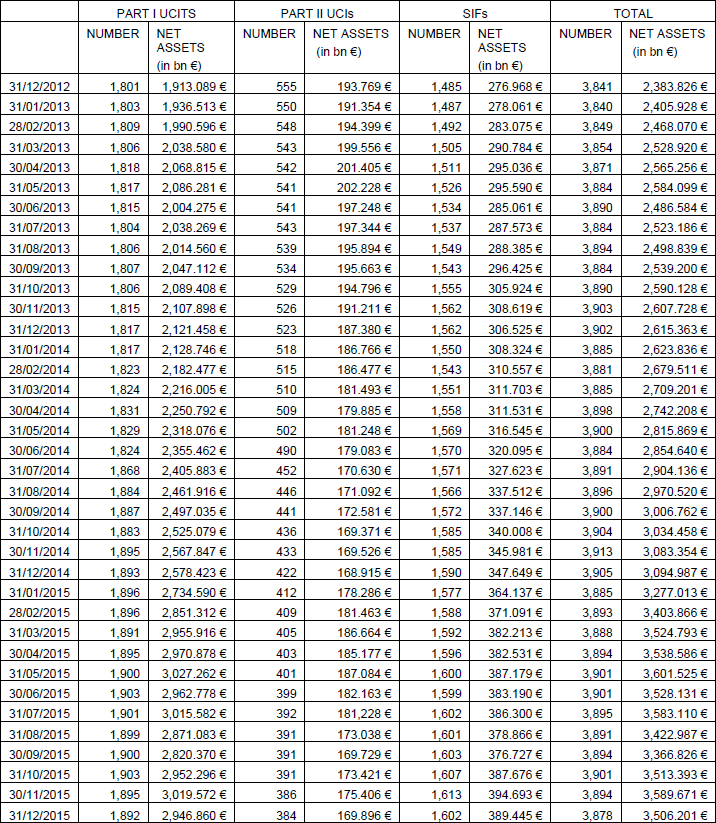

As at 31 December 2015, total net assets of undertakings for collective investment and specialised investment funds amounted to EUR 3,506.201 billion compared to EUR 3,589.671 billion as at 30 November 2015, i.e. a 2.33% decrease over one month. Over the last twelve months, the volume of net assets increased by 13.29%.

The Luxembourg UCI industry thus registered a negative variation amounting to EUR 83.470 billion in December. This decrease results from the positive net issues amounting to EUR 16.032 billion (+0.44%) combined with a negative development in financial markets of EUR 99.502 billion (-2.77%).

The number of undertakings for collective investment (UCIs) and specialised investment funds (SIFs) taken into consideration totalled 3,878 as against 3,894 in the previous month. A total of 2,552 entities have adopted an umbrella structure, which represents 12,782 sub-funds. When adding the 1,326 entities with a traditional structure to that figure, a total of 14,108 fund units are active in the financial centre.

As regards, on the one hand, the impact of financial markets on Luxembourg UCIs and SIFs (hereafter “UCIs”) and, on the other hand, the net capital investment in these UCIs, the following can be said about December:

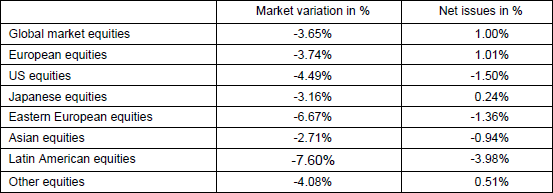

All equity UCI categories registered a negative development.

As far as developed countries are concerned, despite encouraging economic figures, the European equity UCI category recorded a negative performance, mainly in relation to the monetary easing measures announced by the European Central Bank which were below market expectations. Even though the increase in key interest rates decided by the Fed initially sustained the US equity markets, the US equity UCIs closed the month with a modest decrease, notably due to the declining trend in commodity prices and the ensuing issues for the US energy sector. Despite the announcement of new expansive monetary policy measures by the Central Bank of Japan, the Japanese equity UCIs were confronted with decreasing prices, mainly linked to a less positive economic climate.

As far as emerging countries are concerned, Asian equity UCIs closed the month with overall price losses, notably following the publication of very contrasting economic indicators in China. Eastern European and Latin American equity UCIs also registered a negative performance this month in the wake of falling commodity prices and, in particular oil prices, and of geopolitical or political issues in these territories.

In December, the equity UCI categories registered an overall positive net capital investment.

Development of equity UCIs during the month of December 2015*

* Variation in % of Net Assets in EUR as compared to the previous month

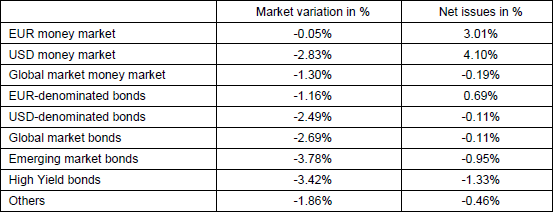

As regards bond markets, December was characterised mainly by diverging monetary policies on both sides of the Atlantic.

Concerning EUR-denominated bond UCIs, the yields of EUR-denominated government bonds slightly rose following the announcement by the European Central Bank of lower than expected monetary easing measures. Private bonds denominated in EUR also registered price falls, implying an overall loss in value of the EURdenominated

bond UCI category. USD-denominated bond UCIs slightly appreciated in value in relation to the widely-anticipated US Federal Reserve’s decision to increase US key interest rates; however, the 2.8% depreciation of the USD against the EUR implied a decreasing trend for the month under review.

The increase in risk premiums on emerging bonds, notably due to the downgrading of certain countries and the accentuated downward trend of certain commodities, implied an overall negative performance for the emerging countries bond UCI category.

In December, fixed-income UCIs showed an overall positive net capital investment, mainly due to net subscriptions in monetary UCIs.

Development of fixed-income UCIs during the month of December 2015*

* Variation in % of Net Assets in EUR as compared to the previous month

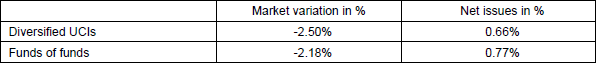

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Diversified income UCIs and funds of funds during the month of December 2015*

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and the net assets of UCIs according to Parts I and II, respectively, of the 2010 Law and of SIFs according to the 2007 Law

During the month under review, the following 24 undertakings for collective investment and specialised investment funds have been registered on the official list:

1) UCITS Part I 2010 Law:

- DECALIA SICAV, 15, avenue J-F Kennedy, L-1855 Luxembourg

- DWS STRATEGY EUROPE 80, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- DWS STRATEGY US 80, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- FOCUS FUNDS, 5, allée Scheffer, L-2520 Luxembourg

- HAAS UCITS, 5, allée Scheffer, L-2520 Luxembourg

- MAGALLANES VALUE INVESTORS UCITS, 15, avenue J-F Kennedy, L-1855 Luxembourg

- MYRA, 15, rue de Flaxweiler, L-6776 Grevenmacher

- ROCHE-BRUNE FUNDS, 33, rue de Gasperich, L-5826 Howald-Hesperange

- SALUS ALPHA SICAV, 2, rue de Canach, L-5368 Schuttrange

- SIDERA FUNDS SICAV, 33A, avenue J-F Kennedy, L-1855 Luxembourg

- SMEAD FUNDS, 49, avenue J-F Kennedy, L-1855 Luxembourg

- SOP CORPORATEBONDSTOTALRETURN, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- TAMAC QILIN, 15, rue de Flaxweiler, L-6776 Grevenmacher

2) UCIs Part II 2010 Law:

- GLS ALTERNATIVE INVESTMENTS, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

3) SIFs:

- CLEARSIGHT TURNAROUND FUND IV (SCA) SICAV-SIF, 6, rue Gabriel Lippmann, L-5365 Munsbach

- DCM SYSTEMATIC FUND SICAV-SIF, 15, avenue J-F Kennedy, L-1855 Luxembourg

- EUROPE II SICAV-SIF, 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- FONDACO MOSAICO, 5, allée Scheffer, L-2520 Luxembourg

- ING PRIVATE INVESTMENT SICAV-SIF, 5, allée Scheffer, L-2520 Luxembourg

- KGAL REAL ESTATE DEBT FUND SICAV-SIF S.C.S., 1C, rue Gabriel Lippmann, L-5365 Munsbach

- M-ALTERNATIVE INVESTMENT FUND, SICAV-SIF, 5, rue Heienhaff, L-1736 Senningerberg

- MUZINICH UK PRIVATE DEBT FUND, 49, avenue J-F Kennedy, L-1855 Luxembourg

- OBERON CREDIT INVESTMENT FUND III S.C.A. SICAV-SIF, 5, rue Guillaume Kroll, L-1882 Luxembourg

- PURE SICAV-SIF S.A., 2, rue d’Arlon, L-8399 Windhof

The following 40 undertakings for collective investment and specialised investment funds have been deregistered from the official list during the month under review:

1) UCITS Part I 2010 Law:

- ALANDSBANKEN SICAV, 14, boulevard Royal, L-2449 Luxembourg

- BASKET FONDS (LUX), 28-32, place de la Gare, L-1616 Luxembourg

- BIOPHARMA OPPORTUNITIES, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- CAPITAL ITALIA, 8-10, rue Jean Monnet, L-2180 Luxembourg

- DWS BESTSELECT BRANCHEN, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- ELIGO FUND, 4, rue Peternelchen, L-2370 Howald

- GLOBAL MULTI ASSET STRATEGY UI, 15, rue de Flaxweiler, L-6776 Grevenmacher

- GLOBAL TREND EQUITY OP, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- GRAND CRU SWISS, 534, rue de Neudorf, L-2220 Luxembourg

- IGNIS FUNDS SICAV, 16, boulevard d’Avranches, L-1160 Luxembourg

- PIONEER CIM, Piazza Gae Aulenti, 1 – Tower B, I-20154 Milano

- RENAISSANCE ASSET MANAGERS GLOBAL FUNDS, 6, route de Trèves, L-2633 Senningerberg

- STERLING RIDGE UCITS FUND, 6, rue Lou Hemmer, L-1748 Senningerberg

- TIEPOLO SICAV, 19-21, boulevard du Prince Henri, L-1724 Luxembourg

- UNIEURORENTA CORPORATES 50 (2015), 308, route d’Esch, L-1471 Luxembourg

- UNIOPTIRENTA 2015, 308, route d’Esch, L-1471 Luxembourg

- VERMÖGENSAUFBAU-FONDS HAIG, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- ZEBRA CAPITAL INTERNATIONAL, 7A, rue Robert Stümper, L-2557 Luxembourg

2) UCIs Part II 2010 Law:

- ARGOS INVESTMENT FUND, 20, boulevard Emmanuel Servais, L-2535 Luxembourg

- INVISTA EUROPEAN REAL ESTATE TRUST SICAF, 25C, boulevard Royal, L-2449 Luxembourg

- MMA ALTERNATIVE FUND, 20, boulevard Emmanuel Servais, L-2535 Luxembourg

3) SIFs:

- 1798 US SPECIAL SITUATIONS FUND, 5, allée Scheffer, L-2520 Luxembourg

- AC DIVERSIFIED RETURN, 5, Heienhaff, L-1736 Senningerberg

- BAYVK C1-FONDS, 15, rue de Flaxweiler, L-6776 Grevenmacher

- BOSTON & ALEXANDER, 2, rue Jean Monnet, L-2180 Luxembourg

- CORPORATE XI, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- CORPORATE XIII, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- EHOF SCA SICAV SIF, 55, avenue Pasteur, L-2311 Luxembourg

- ELEMENT ONE FUND SIF SICAV-SCA, 20, boulevard Emmanuel Servais, L-2535 Luxembourg

- GAVEKAL MULTI-STRATEGY FUND SIF SICAV S.A., 11A, boulevard Prince Henri, L-1724 Luxembourg

- GINKGO NO. 1, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- KATARIS, 15, avenue J-F Kennedy, L-1855 Luxembourg

- LYXOR SME CREDIT FUND, 28-32, place de la Gare, L-1616 Luxembourg

- MUGC/MS GNMA 30 YEAR FUND, 287-289, route d’Arlon, L-1150 Luxembourg

- NAOS FUND SIF, 7A, rue Robert Stümper, L-2557 Luxembourg

- NOKIA GROWTH PARTNERS III (S.C.A.) SICAV-SIF, 11-13, boulevard de la Foire, L-1528 Luxembourg

- NOMURA INTERNATIONAL EQUITY UMBRELLA FUND, 33, rue de Gasperich, L-5826 Howald-Hesperange

- SEB EUROPARENT SPEZIAL, 4, rue Peternelchen, L-2370 Howald

- STEINFORT CAPITAL GROWTH SICAV-SIF, 31, Z.A. Bourmicht, L-8070 Bertrange

- UIP FUND, 20, boulevard Emmanuel Servais, L-2535 Luxembourg