Global situation of undertakings for collective investment at the end of February 2016

Press release 16/17

I. Overall situation

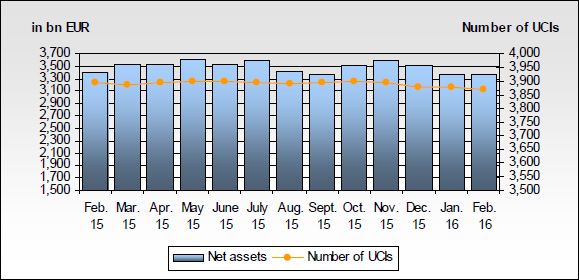

As at 29 February 2016, total net assets of undertakings for collective investment and specialised investment funds amounted to EUR 3,358.484 billion compared to EUR 3,370.999 billion as at 31 January 2016, i.e. a 0.37% decrease over one month. Over the last twelve months, the volume of net assets decreased by 1.33%.

The Luxembourg UCI industry registered a negative variation amounting to EUR 12.515 billion during the month of February. This decrease represents the balance of the negative net issues of EUR 1.383 billion (-0.04%) and the negative development in financial markets amounting to EUR 11.132 billion (-0.33%).

The number of undertakings for collective investment (UCIs) and specialised investment funds (SIFs) taken into consideration totalled 3,869 as against 3,877 in the previous month. A total of 2,550 entities have adopted an umbrella structure, which represents 12,818 sub-funds. When adding the 1,319 entities with a traditional structure to that figure, a total of 14,137 fund units are active in the financial centre.

As regards, on the one hand, the impact of financial markets on Luxembourg UCIs and SIFs (hereafter “UCIs”) and, on the other hand, the net capital investment in these UCIs, the following can be said about February.

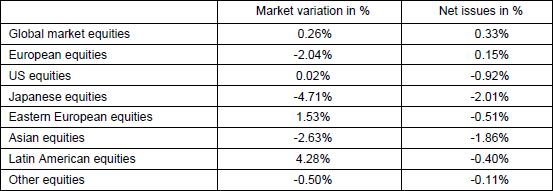

The various categories of equity UCIs developed differently during the month under review.

As far as developed countries are concerned, while the European equity UCIs recorded price losses due notably to uncertainties related to the global economic conditions and the possible Brexit, the category of US equity UCIs ended the month with more or less stable prices, amid results of corporates which exceeded expectations but also uncertainties as regards the Fed’s policy of increasing key interest rate. The drop in value of Japanese equity UCIs is due, in particular, to the sharp appreciation of the JPY against the EUR and the USD which penalized Japanese exports and to economic indicators in Japan that are lower than the investors’ expectations.

As far as emerging countries are concerned, in view of uncertainties in relation to economic growth and structural changes in China, Asian equity UCIs finished the month in negative territory, despite heterogeneous developments across the different equity markets in the region. Notwithstanding geopolitical and political tensions, Eastern European and Latin American equity UCIs appreciated as a result of the increase in oil prices and in certain commodities as well as of the improved economic indicators.

In February, the equity UCIs registered an overall negative net capital investment.

Development of equity UCIs during the month of February 2016*

* Variation in % of Net Assets in EUR as compared to the previous month

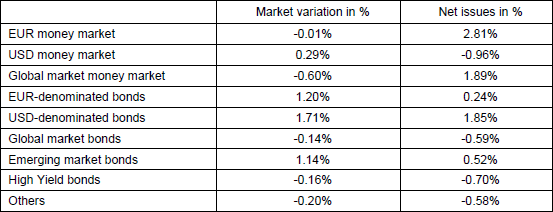

In the context of economic uncertainties and the growing risk aversion of investors, European and American government bonds continued to benefit from their “safe-haven” status, their yields further decreasing in February.

As far as EUR-denominated bond UCIs are concerned, government bonds as well as private bonds recorded price increases due, among others, to the potentially new monetary easing in Europe. The rate spreads in the euro area thus expanded between high-rated bonds and low-rated bonds in the public as well as private sector and risk premiums for private bonds rose. All in all, EUR-denominated bond UCIs are up.

Similarly, USD-denominated bond UCIs, in the context of positive performance of government bonds and private bonds, managed to record profits, in particular, as a result of uncertainties which burdened economic growth in the United States and a possible review of the increase of key interest rates by the Fed. The appreciation of the USD against the EUR sustained this movement.

Despite the downgrade of certain emerging countries, emerging countries bond UCIs benefited from the increase in oil price and record an overall positive performance.

In February, fixed-income UCIs registered an overall negative net capital investment.

Development of fixed-income UCIs during the month of February 2016*

* Variation in % of Net Assets in EUR as compared to the previous month

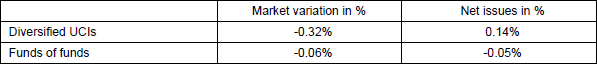

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Diversified income UCIs and funds of funds during the month of February 2016*

* Variation in % of Net Assets in EUR as compared to the previous month

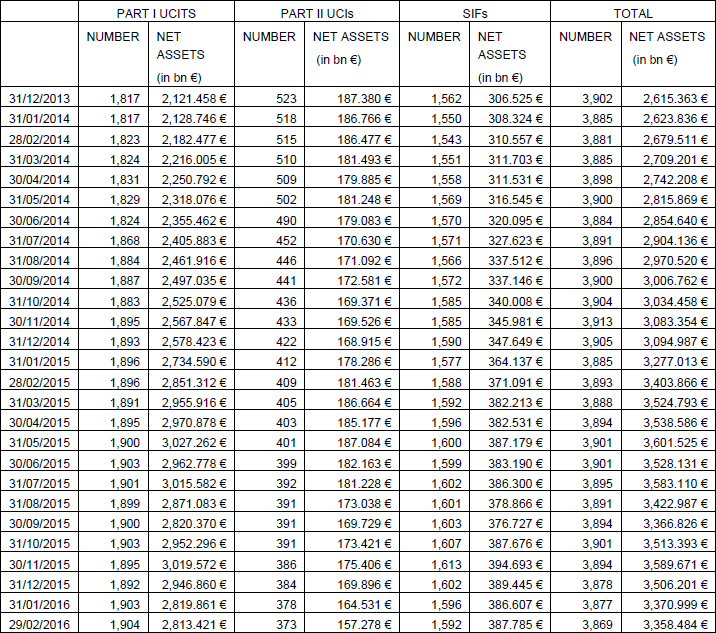

II. Breakdown of the number and the net assets of UCIs according to Parts I and II, respectively, of the 2010 Law and of SIFs according to the 2007 Law

During the month under review, the following 24 undertakings for collective investment and specialised investment funds have been registered on the official list:

1) UCITS Part I 2010 Law:

- FULLGOAL INTERNATIONAL UCITS ETF, 106, route d’Arlon, L-8210 Mamer

- GKB (LU), 19, rue de Bitbourg, L-1273 Luxembourg

- IQ GLOBAL, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- LINNEX CAPITAL SICAV, 5, rue Jean Monnet, L-2180 Luxembourg

- PNR GLOBAL (EX-JAPAN) AGGREGATE BOND, 8-10, rue Jean Monnet, L-2180 Luxembourg

- UNIINSTITUTIONAL BASIC EMERGING MARKETS, 308, route d’Esch, L-1471 Luxembourg

- UNIINSTITUTIONAL BASIC GLOBAL CORPORATES HY, 308, route d’Esch, L-1471 Luxembourg

- UNIINSTITUTIONAL BASIC GLOBAL CORPORATES IG, 308, route d’Esch, L-1471 Luxembourg

- UNIINSTITUTIONAL CORPORATE HYBRID BONDS, 308, route d’Esch, L-1471 Luxembourg

- VIA AM SICAV, 2, rue Jean Monnet, L-2180 Luxembourg

2) SIFs:

- ALLIANCE SICAV-SIF S.A., 2, rue d’Alsace, L-1122 Luxembourg

- AXA IM REPRESENTATIVE, 49, avenue J-F Kennedy, L-1855 Luxembourg

- BRIDGE S.C.A., SICAV-SIF, 20, boulevard Emmanuel Servais, L-2535 Luxembourg

- CIS CLO SELECT I SICAV-SIF, S.A., 40-42 Grand-Rue, L-6630 Wasserbillig

- EDR PRIVATE EQUITY SELECT ACCESS FUND S.A., SICAV-SIF, 20, boulevard Emmanuel Servais, L-2535 Luxembourg

- EQUINOX III, SLP-SIF, 9-11, Grand-Rue, L-1661 Luxembourg

- H.I.G. INVESTMENT FUND I S.ÀR.L., SICAV-SIF, 5, rue Guillaume Kroll, L-1882 Luxembourg

- INTERNATIONAL PATRIMONIUM FUND SICAV-SIF S.C.A., 11, rue Aldringen, L-1118 Luxembourg

- LICANCABUR INVESTMENT FUND S.A., SICAV-SIF, 58, rue Charles Martel, L-2134 Luxembourg

- MOTION SECURE FUND, 33A, avenue J-F Kennedy, L-1855 Luxembourg

- QUATTREX S.C.A., SICAV-SIF, 2, rue d’Alsace, L-1122 Luxembourg

- SPIRAL S.A., SICAV-SIF, 5, rue Jean Monnet, L-2180 Luxembourg

- VOLKSBANK HEILBRONN ASSET ALLOCATION HQLA, 308, route d’Esch, L-1471 Luxembourg

- WEALTHCAP ZWEITMARKTWERTE 5 SCS SICAV-SIF, 5, rue Heienhaff, L-1736 Senningerberg

The following 32 undertakings for collective investment and specialised investment funds have been deregistered from the official list during the month u:

1) UCITS Part I 2010 Law:

- ALLIANZ PIMCO LAUFZEITFONDS WÄHRUNGEN 2016, Bockenheimer Landstraße 42-44, D-60232 Frankfurt am Main

- DB PLATINUM III, 11-13, boulevard de la Foire – Centre Etoile, L-1528 Luxembourg

- DEGROOF MONETARY, 12, rue Eugène Ruppert, L-2453 Luxembourg

- FTSE EPRA EUROPE THEAM EASY UCITS ETF, 33, rue de Gasperich, L-5826 Howald-Hesperange

- KENNOX STRATEGIC VALUE FUND FEEDER (LUXEMBOURG), 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- NEW VILLAGE FUND, 12, rue Eugène Ruppert, L-2453 Luxembourg

- NMX®30 INFRASTRUCTURE GLOBAL THEAM EASY UCITS ETF, 33, rue de Gasperich, L-5826 Howald-Hesperange

- PGT CAPITAL, 26, avenue de la Liberté, L-1930 Luxembourg

- PULSAR (LUX), 11, rue Aldringen, L-1118 Luxembourg

- PWM MANDAT – DWS, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- YCAP SELECTION INVESTMENT, 9A, boulevard du Prince Henri, L-1724 Luxembourg

2) UCIs Part II Law 2010:

- CARAVELA FUND, 11, rue Aldringen, L-1118 Luxembourg

- SINCRO SICAV II, 42, rue de la Vallée, L-2661 Luxembourg

- SMBC NIKKO INVESTMENT FUND (LUX), 9A, rue Robert Stumper, L-2557 Luxembourg

- UBS LUXEMBOURG DIVERSIFIED SICAV, 33A, avenue J-F Kennedy, L-1855 Luxembourg

3) SIFs:

- AVIVA INVESTORS CENTRAL EUROPEAN PROPERTY FUND, 2, rue du Fort Bourbon, L-1249 Luxembourg

- BGV III FEEDER 2 SICAV-FIS, 6, rue Eugène Ruppert, L-2453 Luxembourg

- BGV III FEEDER 3 SICAV-FIS, 6, rue Eugène Ruppert, L-2453 Luxembourg

- BGV III FEEDER 4 SICAV-FIS, 6, rue Eugène Ruppert, L-2453 Luxembourg

- BMS SICAV-SIF, 33, rue de Gasperich, L-5826 Howald-Hesperange

- BRZ FUND, 15, avenue J-F Kennedy, L-1855 Luxembourg

- CENTRAL EUROPEAN INDUSTRIAL FUND, 2, rue du Fort Bourbon, L-1249 Luxembourg

- CONQUEST SICAV-SIF, 2, place Dargent, L-1413 Luxembourg

- CORDEA SAVILLS ITALIAN OPPORTUNITIES N0.2, S.C.A., SICAV-SIF, 10, rue C-M Spoo, L-2546 Luxembourg

- CYAN OAK GLOBAL OPPORTUNITIES FUND, 28-32, place de la Gare, L-1616 Luxembourg

- KING’S MEADOW FUND SA, SICAV-FIS, 6, rue Eugène Ruppert, L-2453 Luxembourg

- MUGC AB MEXICO INTERMEDIATE BOND FUND, 287-289, route d’Arlon, L-1150 Luxembourg

- MUGC AB MEXICO LONG DURATION BOND FUND, 287-289, route d’Arlon, L-1150 Luxembourg

- MUGC/HS ASIAN USD BOND FUND, 287-289, route d’Arlon, L-1150 Luxembourg

- MUGC/PRAMERICA LATIN AMERICA USD BOND FUND, 287-289, route d’Arlon, L-1150 Luxembourg

- R-CAP RESOURCES INVESTMENTS SICAV-SIF, SCA, 63-65, rue de Merl, L-2146 Luxembourg

- SFM, 33, rue de Gasperich, L-5826 Howald-Hesperange