Global situation of undertakings for collective investment at the end of April 2016

Press release 16/26

I. Overall situation

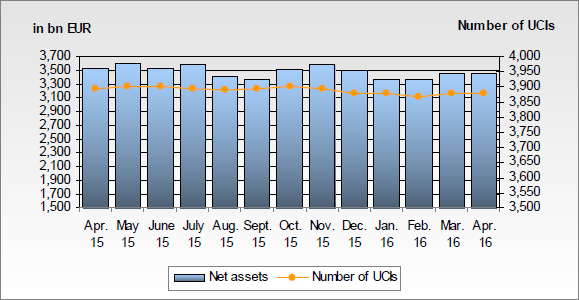

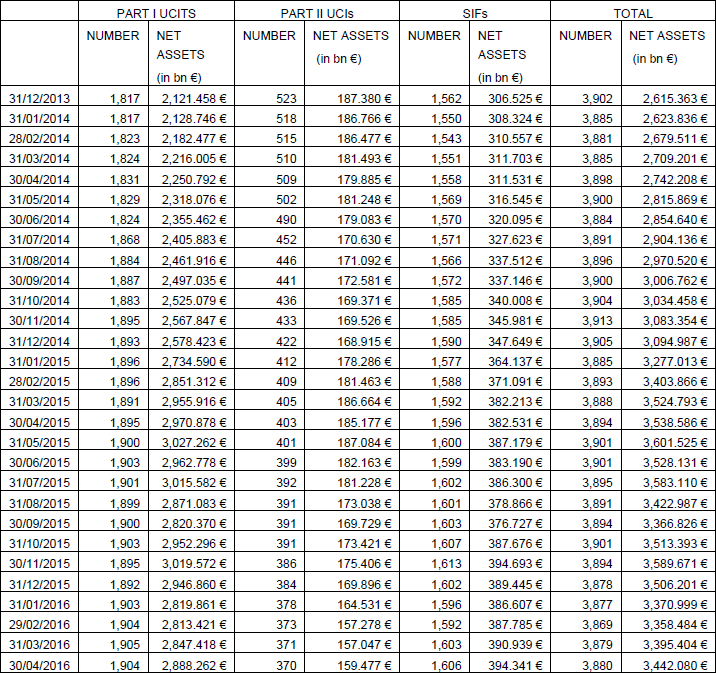

As at 30 April 2016, total net assets of undertakings for collective investment and specialised investment funds reached EUR 3,442.080 billion compared to EUR 3,395.404 billion as at 31 March 2016, i.e. a 1.37% growth over one month. Over the last twelve months, the volume of net assets decreased by 2.73%.

Consequently, the Luxembourg UCI industry registered a positive variation of EUR 46.676 billion in April. This increase represents the balance of positive net issues of EUR 24.499 billion (0.72%) and a positive development in financial markets amounting to EUR 22.177 billion (0.65%).

The number of undertakings for collective investment (UCIs) and specialised investment funds (SIFs) taken into consideration totalled 3,880 as against 3,879 in the previous month. A total of 2,568 entities have adopted an umbrella structure, which represents 12,853 sub-funds. When adding the 1,312 entities with a traditional structure to that figure, a total of 14,165 fund units are active in the financial centre.

As regards, on the one hand, the impact of financial markets on Luxembourg UCIs and SIFs (hereafter the “UCIs”) and, on the other hand, the net capital investment in these UCIs, the following can be said about April 2016.

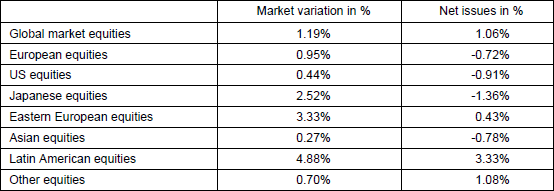

All the categories of equity UCIs registered a positive development during the month under review notably relating to the publication of overall reassuring economic figures and the ongoing rebound of oil prices.

As far as developed countries are concerned, European and US equity UCI categories realised a positive performance due, in particular, to the positive growth figures on both sides of the Atlantic. Even if stock prices as regards equity UCIs from Japan developed negatively in a context of economic indicators below investors’ expectations and in the absence of new monetary easing measures from the Bank of Japan, this decrease, however, has been more than offset by a sharp appreciation of the YEN against the EUR of more than 4.5%.

As regards emerging countries, the Asian equity UCI category, despite divergent equity market developments in the different countries of the region, closed the month with an overall positive performance. As a result of the oil prices as well as the improved economic indicators, the Eastern European and Latin American equity UCIs appreciated despite the political and economic problems in these regions.

In April, equity UCI categories registered an overall positive net capital investment.

Development of equity UCIs during the month of April 2016*

* Variation in % of Net Assets in EUR as compared to the previous month

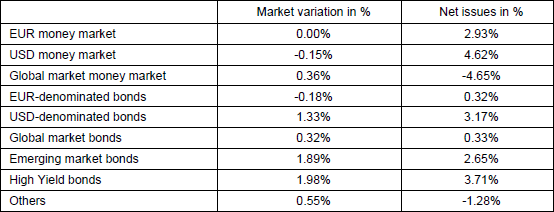

As far as EUR-denominated bond UCIs are concerned, government bonds experienced an increase in yields, due to less fears as regards global recession and the wait-and-see attitude of the European Central Bank. Similarly, yield spreads between high rated and lower rated countries increased slightly. As a result of the private bond buyback programme of the European Central Bank, the European private bonds recorded overall price increases. All in all, EUR-denominated bond UCIs registered a loss in value.

The yields of US government bonds only increased slightly following the cautious speech of the Fed, stressing that there will be no immediate rise in the interest rates. On the US private bond market, performance was positive. Overall, USD-denominated bond UCIs are up.

The category of emerging countries bond UCIs closed the month in positive territory due to the decrease in risk premiums on emerging bonds that resulted in an increase in bond rates founded on an increase in commodity prices, more stable economic data in China and the Fed’s cautiousness with interest rate policy.

In April, fixed-income UCI categories registered an overall positive net capital investment.

Development of fixed-income UCIs during the month of April 2016*

* Variation in % of Net Assets in EUR as compared to the previous month

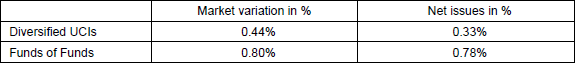

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below.

Diversified UCIs and Funds of Funds during the month of April 2016*

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and the net assets of UCIs according to Parts I and II, respectively, of the 2010 Law and of SIFs according to the 2007 Law

In April, the following 22 undertakings for collective investment and specialised investment funds were registered on the official list:

1) UCITS Part I 2010 Law:

- ALTERNATIVE RISK PREMIA INVESTMENT FUND, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- ARMONY INVESTMENT FUND, 11, rue Aldringen, L-1118 Luxembourg

- CAPITAL STRATEGY FUNDS SICAV, 1, rue du Potager, L-2347 Luxembourg

- H & A MULTI ASSET DYNAMIC, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- INFUSIVE UCITS FUND, 2, boulevard de la Foire, L-1528 Luxembourg

- LUX MULTIMANAGER SICAV, 11-13, boulevard de la Foire, L-1528 Luxembourg

- MIDAS, 5, rue Jean Monnet, L-2180 Luxembourg

- THE GUARDIAN SICAV, 49, avenue J-F Kennedy, L-1855 Luxembourg

- UNIAUSSCHÜTTUNG, 308, route d’Esch, L-1471 Luxembourg

2) SIFs:

- ACCESS CAPITAL FUND II SICAV-SIF, 5, allée Scheffer, L-2520 Luxembourg

- CMP GERMAN OPPORTUNITY FUND III, 1, rue Hildegard von Bingen, L-1282 Luxembourg

- GOLDEN PARTNER FUND, 25A, boulevard Royal, L-2449 Luxembourg

- ITALINVEST REAL ESTATE S.A. SICAV-SIF, 12, rue Eugène Ruppert, L-2453 Luxembourg

- MASSENA WEALTH MANAGEMENT 1 S.C.A./FIS, 28-32, place de la Gare, L-1616 Luxembourg

- MASSENA WEALTH MANAGEMENT 2 S.C.A./FIS, 28-32, place de la Gare, L-1616 Luxembourg

- MONDE EURO CORPORATE BONDS FUND, 287-289, route d’Arlon, L-1150 Luxembourg

- PARTNERS GROUP HAEK PRIVATE DEBT S.A., SICAV-SIF, 2, rue Jean Monnet, L-2180 Luxembourg

- PURE VALUE CAPITAL FUND S.C.A., SICAV-SIF, 33A, avenue J-F Kennedy, L-1855 Luxembourg

- RIVA ABSOLUTE RETURNS S.C.A. SICAV-SIF, 9, allée Scheffer, L-2520 Luxembourg

- ROBECO INSTITUTIONAL SOLUTIONS FUND, 11-13, boulevard de la Foire, L-1528 Luxembourg

- TJ CAPITAL FUND SICAV-SIF, 11, rue Aldringen, L-1118 Luxembourg

- WEST FUND SICAV-SIF, 18, rue de l’Eau, L-1449 Luxembourg

The following 21 undertakings for collective investment and specialised investment funds were deregistered from the official list during April:

1) UCITS Part I 2010 Law:

- AL MASAH CAPITAL FUND, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- ALLIANZ GLOBAL INVESTORS FUND IV, Bockenheimer Landstraße 42-44, D-60232 Frankfurt am Main

- ASSENAGON JAPAN TREASURY, 1B, Heienhaff, L-1736 Senningerberg

- CARAVAGGIO SICAV, 19-21, boulevard du Prince Henri, L-1724 Luxembourg

- DEKA-KICKGARANT 1, 5, rue des Labours, L-1912 Luxembourg

- GIS HIGH CONVICTION EQUITY (USD), 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- ÖHMAN SICAV 1, 11-13, boulevard de la Foire, L-1528 Luxembourg

- UNIGARANT: DEUTSCHLAND (2016), 308, route d’Esch, L-1471 Luxembourg

- UNIGARANT: DIVIDENDENSTARS (2016), 308, route d’Esch, L-1471 Luxembourg

- UNIGARANT: EUROPA (2016), 308, route d’Esch, L-1471 Luxembourg

2) UCITS Part II 2010 Law:

- DB FUNDS, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- OPERA FUND, 28-32, place de la Gare, L-1616 Luxembourg

3) SIFs:

- ADVANTAGE PREMIERE FUND S.C.A., SICAV-FIS, 2, avenue Charles de Gaulle, L-1653 Luxembourg

- ALTERNA INVEST S.A. SICAF SIF, 5, place de la Gare, L-1616 Luxembourg

- BARCLAYS ALTERNATIVES, 6, rue Lou Hemmer, L-1748 Senningerberg

- DEKA-IMMOBILIEN PRIVATE EQUITY, 3, rue des Labours, L-1912 Luxembourg

- EMC INVESTMENT (FIS), 15, rue de Flaxweiler, L-6776 Grevenmacher

- GERMAN RETAIL INVESTMENT PROPERTY FUND, 2, rue du Fort Bourbon, L-1249 Luxembourg

- GIM SPECIALIST FUNDS, 6, route de Trèves, L-2633 Senningerberg

- TECHNOPRO LUX S.A., SICAV-FIS, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- TOKYO RECOVERY FUND, 2, rue du Fort Bourbon, L-1249 Luxembourg