Global situation of undertakings for collective investment at the end of July 2017

Press release 17/32

I. Overall situation

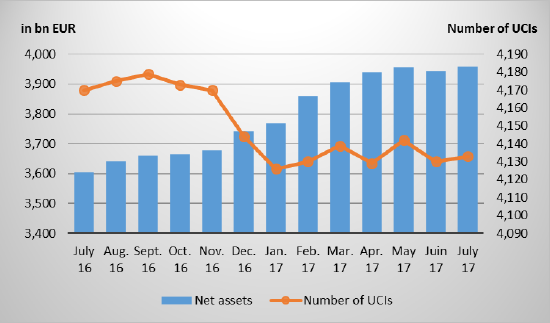

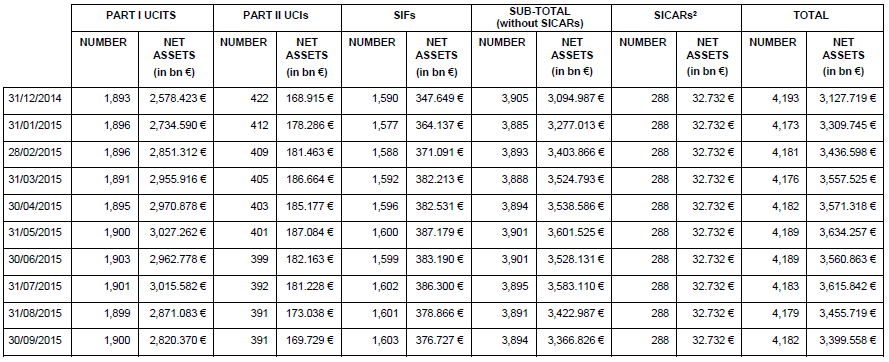

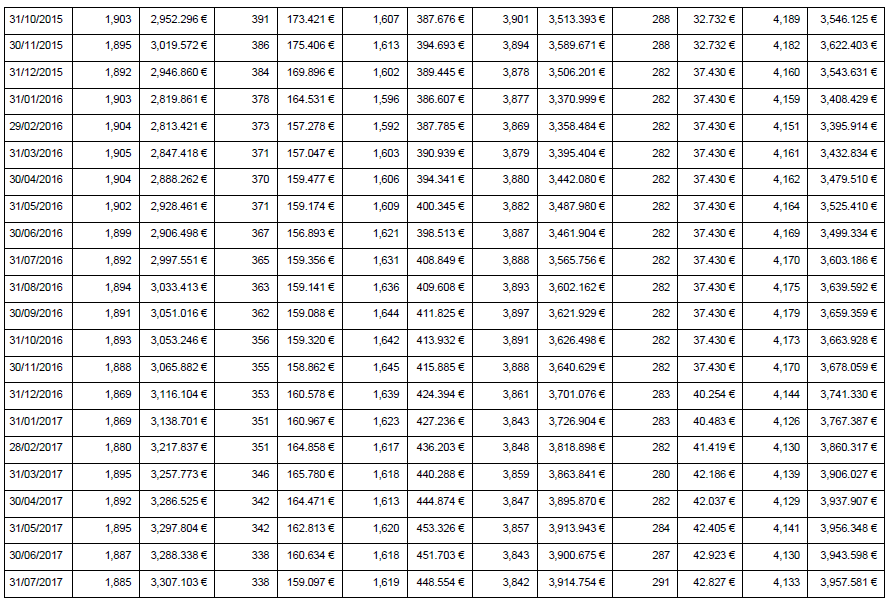

As at 31 July 2017, total net assets of undertakings for collective investment, including UCIs subject to the 2010 Law, specialised investment funds and SICARs, reached EUR 3,957.581 billion compared to EUR 3,943.598 billion as at 30 June 2017, i.e. a 0.35% growth over one month. Over the last twelve months, the volume of net assets rose by 9.84%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 13.983 billion in July. This increase represents the balance of positive net issues of EUR 29.150 billion (0.74%) and of the negative development of financial markets amounting to EUR 15.167 billion (-0.39%).

The development of undertakings for collective investment is as follows1:

The number of undertakings for collective investment (UCIs) taken into consideration totals 4,133 as against 4,130 in the previous month. A total of 2,644 entities have adopted an umbrella structure, which represents 13,174 sub-funds. When adding the 1,489 entities with a traditional structure to that figure, a total of 14,663 fund units are active in the financial centre.

As regards, on the one hand, the impact of financial markets on the main categories of undertakings for collective investment and, on the other hand, the net capital investment in these UCIs, the following can be said about July 2017:

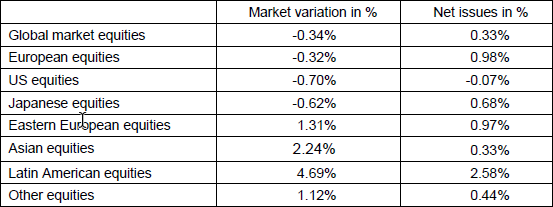

The various categories of equity UCIs developed differently during the month under review.

As far as developed countries are concerned, the European equity UCI category recorded, despite encouraging economic figures, slight price losses in the context of a strong appreciation of the EUR against the other main currencies. The depreciation of the USD against the EUR contributed to the fall of the US equity UCI category, whereas US equity markets have been growing in relation to performing corporate results and positive economic indicators. The category of Japanese equity UCIs slightly fell, mainly as a consequence of the JPY depreciating against the EUR.

As far as emerging countries are concerned, Asian equity UCIs are growing based on stable economic data in China and a positive global economic environment. Good economic figures in several countries of the region and the price increase of oil and of the main raw materials backed the positive performances of Eastern European and Latin American equity UCI categories.

In July, the equity UCI categories registered an overall positive net capital investment.

Development of equity UCIs during the month of July 2017*

*Variation in % of Net Assets in EUR as compared to the previous month

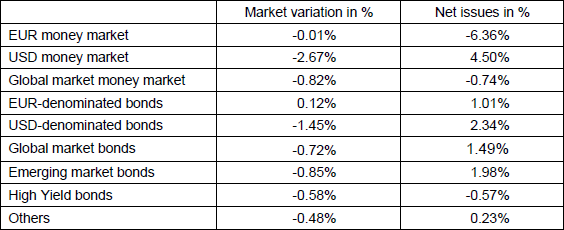

In Europe, government bond yields remained relatively consistent in the expectation of a detailed communication by the European Central Bank as regards its future asset buy-back programme. This month, yield spreads between euro area countries narrowed. Corporate bonds recorded price increases in a context of risk premium reductions, which implied a slight appreciation for the EUR-denominated bond UCI category.

The yields of US government bonds experienced moderate changes as well, due, on the one hand, to the US Federal Reserve initiating a tightening monetary policy and, on the other hand, political uncertainties in the US. Corporate bonds have experienced a positive development, but the depreciation of the USD against the EUR implied that the USD-denominated bond UCI category ended up in negative territory.

Influenced by positive economic figures and the rising prices of the main raw materials, emerging countries bonds experienced an upward trend, which was however largely compensated by the depreciation of the USD and of several emerging currencies against the EUR, resulting in the emerging countries bond UCI category closing lower.

In July, the category of fixed-income UCIs registered an overall positive net capital investment.

Development of fixed-income UCIs during the month of July 2017*

*Variation in % of Net Assets in EUR as compared to the previous month

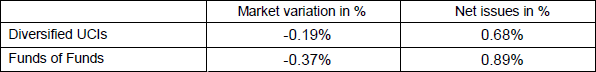

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of July 2017*

*Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following 23 undertakings for collective investment have been registered on the official list:

1) UCITS Part I 2010 Law:

- AILIS, 9-11, rue Goethe, L-1637 Luxembourg

- BAYERNINVEST EURO, 6, rue Gabriel Lippmann, L-5365 Munsbach

- BETAMINER FUND, 33, rue de Gasperich, L-5826 Hesperange

- BNP PARIBAS FORTIGO, 10, rue Edward Steichen, L-2540 Luxembourg

- HAIG, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- HTL FUNDS, 5, allée Scheffer, L-2520 Luxembourg

- SAVILLS IM REAL ESTATE SECURITIES INCOME FUND, 5, allée Scheffer, L-2520 Luxembourg

2) SIFs:

- AXA IM MEZZOALTO, 49, avenue J-F Kennedy, L-1855 Luxembourg

- BLADO INVESTMENTS S.C.A., SICAV-SIF, 6, rue Eugène Ruppert, L-2453 Luxembourg

- EURIZON ALTERNATIVE SICAV-SIF, 49, avenue J-F Kennedy, L-1855 Luxembourg

- FONDACO ORIZZONTE SIF, 2, place de Paris, L-2314 Luxembourg

- GREF II FCP-SIF, 19, Rangwee, L-2412 Howald

- KW INVESTMENT LUX S.À R.L. SICAV-SIF, 1, rue Jean-Pierre Brasseur, L-1258 Luxembourg

- MIMOSA CAPITAL SIF SICAV S.A., 15, avenue J-F Kennedy, L-1855 Luxembourg

- NEXTECH V ONCOLOGY S.C.S., SICAV-SIF, 7, rue Lou Hemmer, L-1748 Findel

- PATRIZIA RETAIL OPPORTUNITY SCS SICAV-SIF, 2-4, rue Beck, L-1222 Luxembourg

- PROQUITY S.A. SICAV-SIF, 17, rue Beaumont, L-1219 Luxembourg

- WINVEST SICAV-FIS, 4, rue Thomas Edison, L-1445 Strassen

3) SICARs:

- BTOV INDUSTRIAL TECHNOLOGIES SCS, SICAR, 1c, rue Gabriel Lippmann, L-5365 Munsbach

- CGIOF PARTICIPATIONS S.À R.L., SICAR, 2, avenue Charles de Gaulle, L-1653 Luxembourg

- HELSINN INVESTMENT FUND S.A. SICAR, 412F, route d’Esch, L-2086 Luxembourg

- MAIDEV S.À R.L., SICAR, 9, allée Scheffer, L-2520 Luxembourg

- RESILIENCE PARTNERS FUND I S.C.A., SICAR, 5, rue Guillaume Kroll, L-1882 Luxembourg

The following 20 undertakings for collective investment have been deregistered from the official list during the month of reference:

1) UCITS Part I 2010 Law:

- AKTIVA FONDER SICAV, 11, rue Aldringen, L-1118 Luxembourg

- BB-MANDAT AKTIENFONDS, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- QUANTEX FUNDS, 26, avenue de la Liberté, L-1930 Luxembourg

- RASINI SICAV, 106, route d’Arlon, L-8210 Mamer

- RF CAPITAL, 106, route d’Arlon, L-8210 Mamer

- STAFFORD SICAV, 5, Heienhaff, L-1736 Senningerberg

- UBS LUXEMBOURG SICAV, 33A, avenue J-F Kennedy, L-1855 Luxembourg

- UNIGARANT: DEUTSCHLAND (2017), 308, route d’Esch, L-1471 Luxembourg

- W & W INTERNATIONAL FUNDS, 9A, rue Gabriel Lippmann, L-5365 Munsbach

2) UCIs Part II 2010 Law:

- SEB OPTIMUS, 4, rue Peternelchen, L-2370 Howald

3) SIFs:

- AB EUROPEAN INFRASTRUCTURE DEBT FUND, SICAV-SIF S.C.SP., 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- AB EUROPEAN INFRASTRUCTURE SUBORDINATED DEBT FUND, SICAV-SIF S.C.SP., 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- ETIMOS FUND, 12, rue Eugène Ruppert, L-2453 Luxembourg

- EURIZON SPECIALISED INVESTMENT FUND, 8, avenue de la Liberté, L-1930 Luxembourg

- IPC-CAPITAL STRATEGY XIII, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- NOVA SICAV-FIS, 4, rue Jean Monnet, L-2180 Luxembourg

- SOPRILUX SICAV-SIF, 14, boulevard Royal, L-2449 Luxembourg

- STELARIS CAPITAL SICAV SIF, 12, rue Eugène Ruppert, L-2453 Luxembourg

- TAGES CAPITAL S.A. SICAV-SIF, 60, avenue J-F Kennedy, L-1855 Luxembourg

4) SICARs:

- SAFE SHIP INVESTMENT COMPANY S.C.A., SICAR, 20, boulevard Emmanuel Servais, L-2535 Luxembourg

1 Since the statistical data of SICARs were published only on an annual basis before December 2016, the chart includes the number and net assets of SICARs as at 31 December 2015 for the previous months, resulting in constant figures until November 2016 for these vehicles.

2 Before 31 December 2016, the statistical data of SICARs were published on an annual basis only.