Global situation of undertakings for collective investment at the end of September 2017

Press release 17/37

I. Overall situation

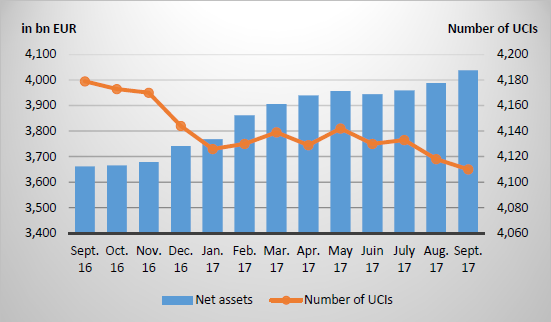

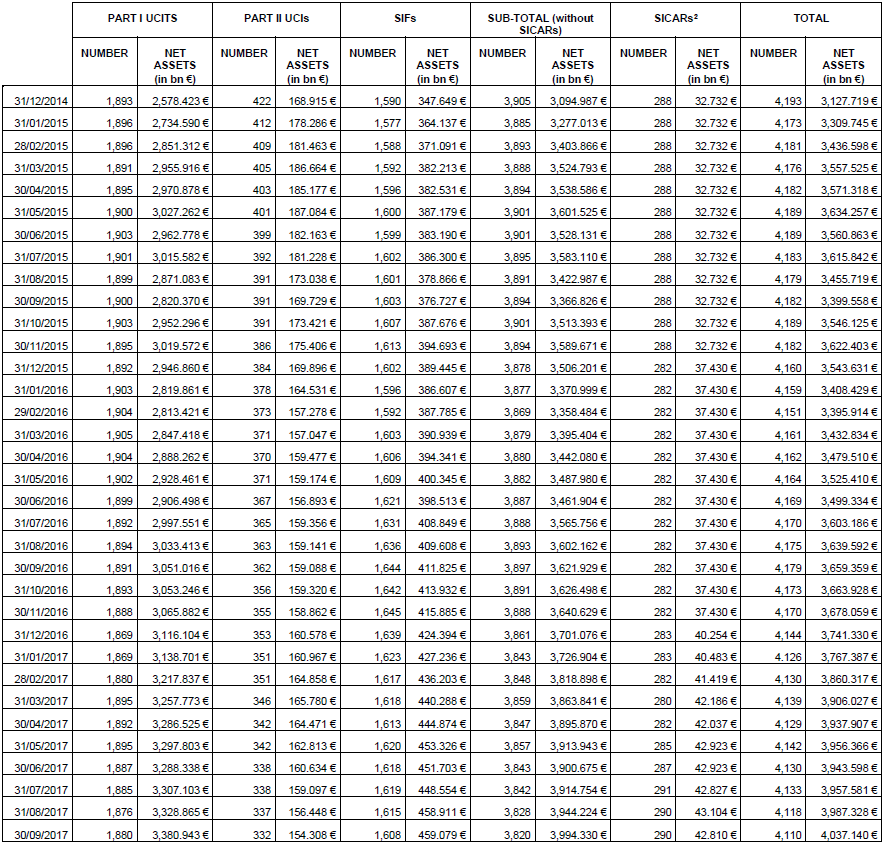

As at 30 September 2017, total net assets of undertakings for collective investment, including UCIs subject to the 2010 Law, specialised investment funds and SICARs amounted to EUR 4,037.140 billion compared to EUR 3,987.328 billion as at 31 August 2017, i.e. a 1.25% increase over one month. Over the last twelve months, the volume of net assets rose by 10.32%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 49.812 billion in September. This increase represents the balance of positive net issues amounting to EUR 13.887 billion (0.35%) and a positive development in financial markets amounting to EUR 35.925 billion (0.90%).

The development of undertakings for collective investment is as follows1:

The number of undertakings for collective investment (UCIs) taken into consideration totals 4,110 as against 4,118 in the previous month. A total of 2,628 entities have adopted an umbrella structure, which represents 13,230 sub-funds. When adding the 1,482 entities with a traditional structure to that figure, a total of 14,712 fund units are active in the financial centre.

As regards, on the one hand, the impact of financial markets on the main categories of undertakings for collective investment and, on the other hand, the net capital investment in these UCIs, the following can be said about September.

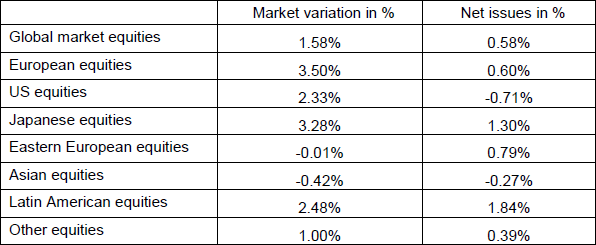

Most categories of equity UCIs developed positively during the month under review.

As regards developed countries, European equity UCIs realised a positive performance in a context of the sound economic data in the euro area and the result of the German elections. As a result mainly of the expectations linked to the tax reforms announced by the White House and the robust growth figures in the United States, US equity UCIs also ended the month in positive territory. Japanese equity UCIs developed positively owing to an overall favourable macroeconomic environment and the depreciation of the YEN against the USD and the EUR favouring Japan’s foreign trade.

As far as emerging countries are concerned, the Asian equity UCI category recorded slight price decreases notably due to a mild slowdown in growth in China. Against the background of divergent developments of the stock markets in the different Eastern European countries, Eastern European equity UCIs showed almost no change during the month under review. The sound economic figures in Brazil, the stable economic indicators in Mexico as well as the bullish trend in the main commodity prices explain the positive performance of US equity UCIs.

In September, equity UCI categories registered an overall positive net capital investment.

Development of equity UCIs during the month of September 2017*

* Variation in % of Net Assets in EUR as compared to the previous month.

* Variation in % of Net Assets in EUR as compared to the previous month.

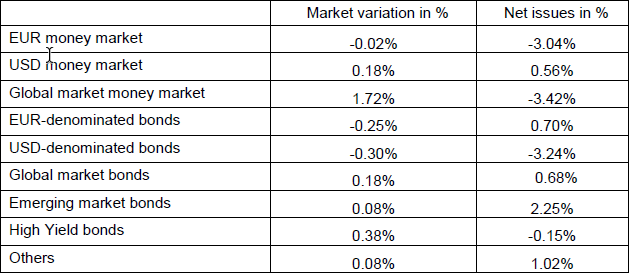

In Europe, the yields of government bonds increased in a context of sound macroeconomic figures and the yield spreads between high-rated and lower-rated countries of the euro area generally narrowed. In the wake of the increase in government bonds, the corporate bonds recorded small price decreases so that EUR-denominated bond UCIs slightly depreciated during the month under review.

In the United States, the announcement by the US Federal Reserve of balance sheet cutbacks and a possible increase of the key interest rates in December of this year led to higher US government bond yields. Corporate bond yields followed that trend, entailing price decreases of USD-denominated bond UCIs.

Bond UCIs of emerging countries stagnated during the month under review, due to the impact, on the one hand, of globally stable economic fundamentals and the positive development of the main commodity prices and, on the other hand, the rise in the US interest rates and the USD appreciation.

In September, the category of fixed-income UCIs registered an overall positive net capital investment.

Development of fixed-income UCIs during the month of September 2017*

* Variation in % of Net Assets in EUR as compared to the previous month.

* Variation in % of Net Assets in EUR as compared to the previous month.

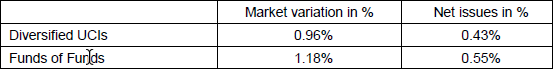

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below.

Development of diversified UCIs and Funds of Funds during the month of September 2017*

* Variation in % of Net Assets in EUR as compared to the previous month.

II. Breakdown of the number and net assets of UCIs

During the month under review, the following 18 undertakings for collective investment have been registered on the official list:

1) UCITS Part I 2010 Law:

- BERENBERG EUROPEAN FOCUS FUND, 15, rue de Flaxweiler, L-6776 Grevenmacher

- BERENBERG EUROPEAN MICRO CAP, 15, rue de Flaxweiler, L-6776 Grevenmacher

- BERENBERG EUROPEAN SMALL CAP, 15, rue de Flaxweiler, L-6776 Grevenmacher

- BERENBERG EUROZONE FOCUS FUND, 15, rue de Flaxweiler, L-6776 Grevenmacher

- FFPB MULTITREND FLEX, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- POSTBANK SICAV, 4, rue Jean Monnet, L-2180 Luxembourg

- THEME INVESTING, 534, rue de Neudorf, L-2220 Luxembourg

- UNIINSTITUTIONAL EUROPEAN BONDS: DIVERSIFIED, 308, route d’Esch, L-1471 Luxembourg

- UNIINSTITUTIONAL EUROPEAN BONDS: GOVERNMENTS PERIPHERIE, 308, route d’Esch, L-1471 Luxembourg

- VIVACITY FUNDS, 4, rue Jean Monnet, L-2180 Luxembourg

2) UCIs Part II 2010 Law:

- L/S ABSOLUTE RETURN FONDS, 26, avenue de la Liberté, L-1930 Luxembourg

- SELECT PORTFOLIO, 12, rue Eugène Ruppert, L-2453 Luxembourg

3) SIFs:

- COLOGNE ALTERNATIVE ASSETS SICAV-SIF SCA, 2, place François-Joseph Dargent, L-1413 Luxembourg

- DESCOPEDIA S.C.A., SICAV-SIF, 5, rue Heienhaff, L-1736 Senningerberg

- GII FUNDS SICAV SIF, 1B, rue Jean Piret, L-2350 Luxembourg

- PATRIZIA VALUE ADD HP SICAV-FIS, 2-4, rue Beck, L-1222 Luxembourg

- SWISS LIFE LOAN FUND (LUX) S.A., SICAV-SIF, 4A, rue Albert Borschette, L-1246 Luxembourg

4) SICARs:

- OXO CEE ANGEL SCSP SICAR, 44, boulevard Grande-Duchesse Charlotte, L-1330 Luxembourg

The following 26 undertakings for collective investment have been deregistered from the official list during the month under review:

1) UCITS Part I 2010 Law:

- 1. SICAV, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- CANDRIAM TOTAL RETURN, 136, route d’Arlon, L-1150 Luxembourg

- CME GOLD & SILVER EQUITY FUND, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- GPI FONDS, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- ISTANBUL EQUITY FUND, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- UNIINSTITUTIONAL EUROPEAN MIXED TREND, 308, route d’Esch, L-1471 Luxembourg

- VICTOIRE BRASIL INVESTMENT FUNDS, 42, rue de la Vallée, L-2661 Luxembourg

2) UCIs Part II 2010 Law:

- ALBATROS PERFORMANCE, 60, avenue J-F Kennedy, L-1855 Luxembourg

- CAPITAL GESTION, 9, boulevard Prince Henri, L-1724 Luxembourg

- CRONOS INVEST, 12, rue Eugène Ruppert, L-2453 Luxembourg

- DB PLATINUM II, 11-13, boulevard de la Foire – Centre Etoile, L-1528 Luxembourg

- EUROCASH-FUND, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- FOS OP GLOBAL STRATEGIC, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

3) SIFs:

- AKROS GLOBAL OPPORTUNITIES S.A., SICAV-FIS, 2, boulevard de la Foire, L-1528 Luxembourg

- ALTERA INVESTMENT FUND SICAV-SIF, 14, rue Edward Steichen, L-2540 Luxembourg

- DAO FUND SICAV-SIF, 2, boulevard de la Foire, L-1528 Luxembourg

- DEDICATED MAP QUANTMETRICS FUND, 28-32, place de la Gare, L-1616 Luxembourg

- DGA, 6, avenue Marie-Thérèse, L-2132 Luxembourg

- FUND HOUSE FCP-SIF, 6, route de Trèves, L-2633 Senningerberg

- GAIN CAPITAL S.A., SICAV-FIS, 5, avenue Gaston Diderich, L-1420 Luxembourg

- HSBC SPECIALIST FUNDS, 16, boulevard d’Avranches, L-1160 Luxembourg

- IMG FUND SCA, SICAV-SIF, 20, rue de la Poste, L-2346 Luxembourg

- IPC-PORTFOLIO INVEST IX, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- JMH ABSOLUTE RETURN SICAV SIF, 15, avenue J-F Kennedy, L-1855 Luxembourg

- SOFINA MULTI STRATEGY, 8A, boulevard Joseph II, L-1840 Luxembourg

4) SICARs:

- MEZZANOVE CAPITAL (SCA) SICAR, 23, avenue Monterey, L-2163 Luxembourg

1 Since the statistical data of SICARs were published only on an annual basis before December 2016, the chart includes the number and net assets of SICARs as at 31 December 2015 for the previous months, resulting in constant figures until November 2016 for these vehicles.

2 Before 31 December 2016, the statistical data of SICARs were only published on an annual basis.