Global situation of undertakings for collective investment at the end of October 2017

Press release 17/39

I. Overall situation

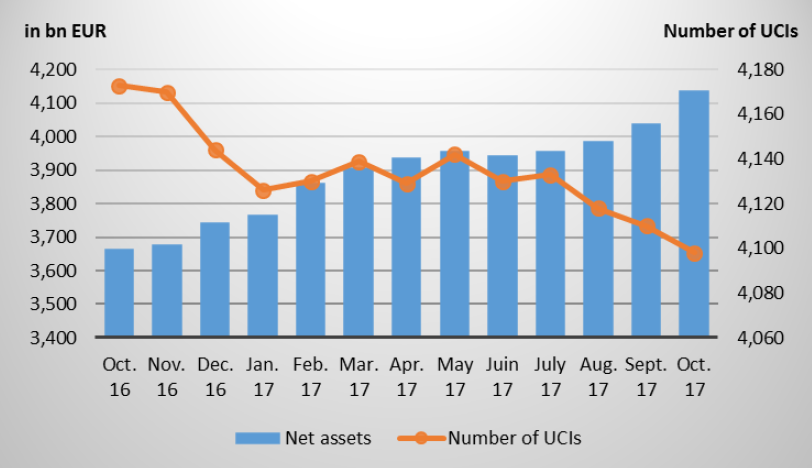

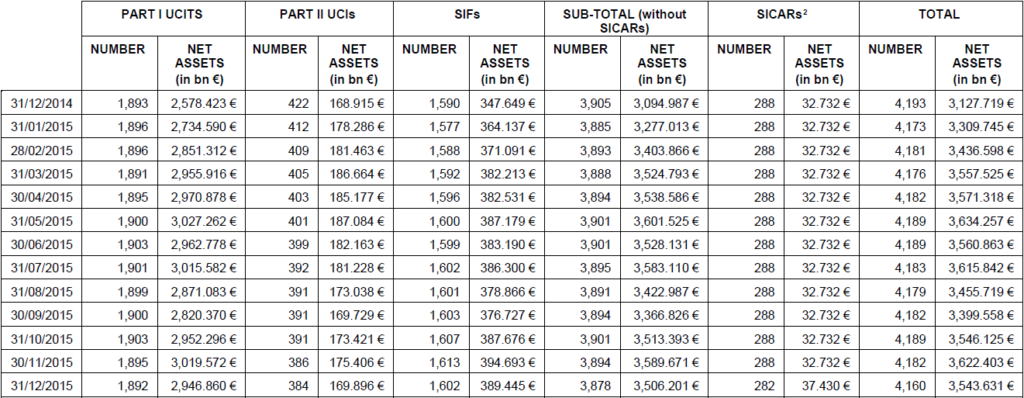

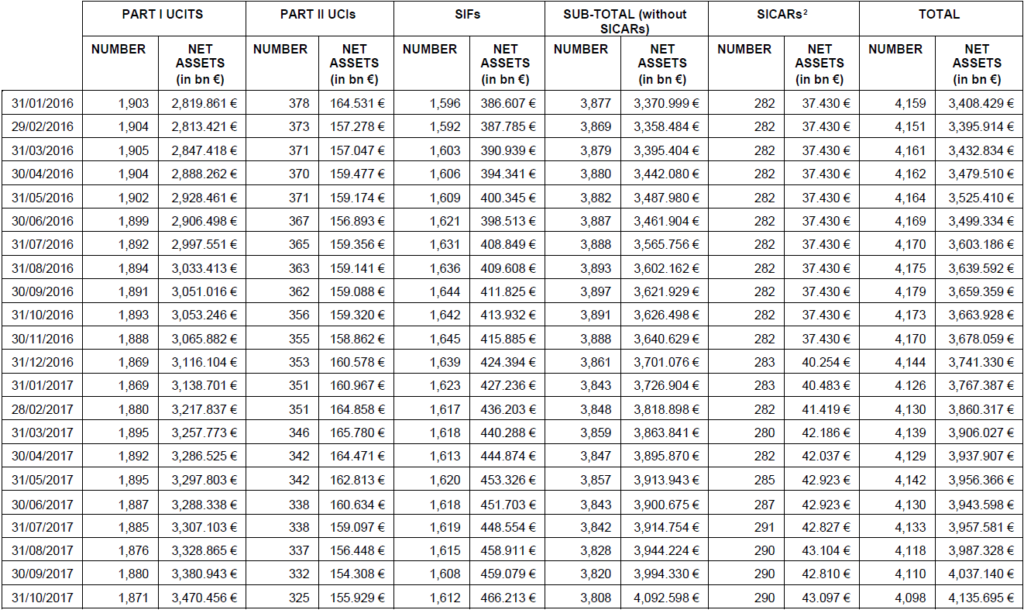

As at 31 October 2017, total net assets of undertakings for collective investment, including UCIs subject to the 2010 Law, specialised investment funds and SICARs amounted to EUR 4,135.695 billion compared to EUR 4,037.140 billion as at 30 September 2017, i.e. a 2.44% increase over one month. Over the last twelve months, the volume of net assets rose by 12.88%.

Consequently, the Luxembourg UCI industry registered a positive variation amounting to EUR 98.555 billion in October. This increase represents the balance of positive net issues amounting to EUR 35.619 billion (0.88%) and a positive development in financial markets amounting to EUR 62.936 billion (1.56%).

The development of undertakings for collective investment is as follows1:

The number of undertakings for collective investment (UCIs) taken into consideration totals 4,098 as against 4,110 in the previous month. A total of 2,626 entities have adopted an umbrella structure, which represents 13,239 sub-funds. When adding the 1,472 entities with a traditional structure to that figure, a total of 14,711 fund units are active in the financial centre.

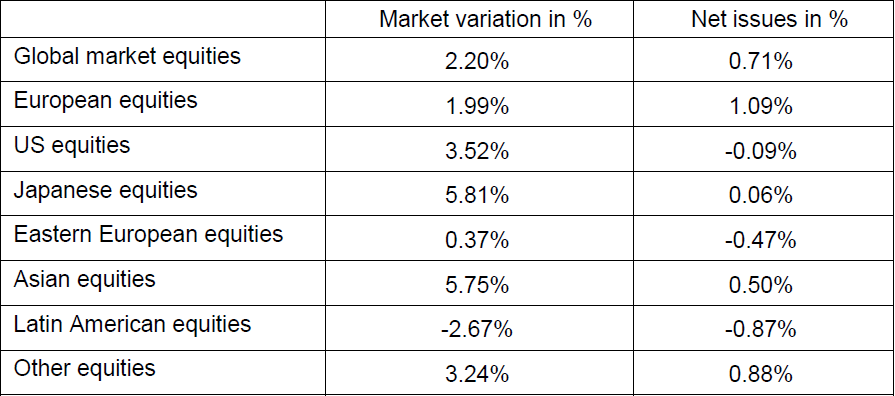

As regards, on the one hand, the impact of financial markets on the main categories of undertakings for collective investment and, on the other hand, the net capital investment within these UCIs, the following can be said about October.

The prices of all the equity UCI categories rose, except for the category of Latin American equity UCIs.

As regards developed countries, European equity UCIs performed positively in a context of dynamic economic growth in the euro area and the continuation of the ECB’s buy-back programme. Sound corporate results and the prospect of a tax reform in the United States bolstered the prices of American equity UCIs. The category of Japanese equity UCIs also ended the month in positive territory owing, notably, to a globally favourable economic environment and the possible continuation of the expansive monetary and tax policy following the re-election of the Japanese Prime Minister.

As far as emerging countries are concerned, the Asian equity UCI category progressed as a result mainly of stable economic figures in China and a favourable global economic environment. Sound economic figures in several Eastern European countries and the rise in oil prices explain the positive performance of the Eastern equity UCI category, while the Latin American UCI category suffered price losses owing to political and commercial uncertainties.

In October, equity UCI categories registered an overall positive net capital investment.

Development of equity UCIs during the month of October 2017*

* Variation in % of Net Assets in EUR as compared to the previous month

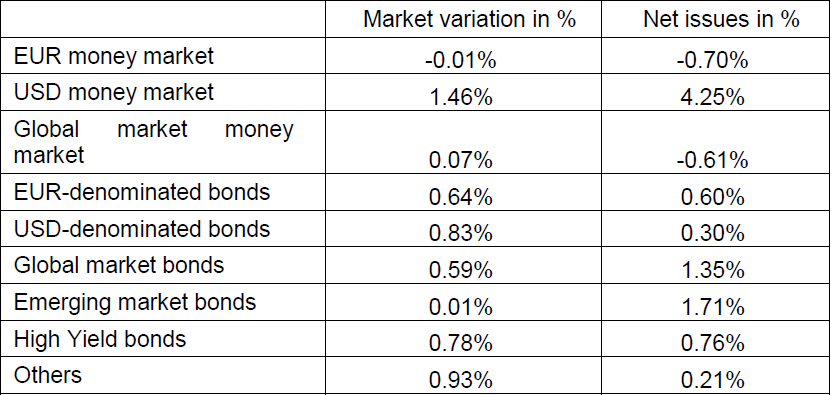

In Europe, bond yields fell slightly due to the prolongation of the ECB’s asset buy-back programme. In addition, the rate spreads between high rated and lower rated countries narrowed. Yields of corporate bonds followed that trend, entailing price increases of EUR-denominated bond UCIs.

While USD-denominated bond yields rose owing notably to higher than expected economic indicators and the possible tax reform, the appreciation of the USD against the EUR made the US equity UCIs finish the month positively.

The strong influx of capital in emerging market bonds and the rise in commodity prices were offset by the prospects of a less expansive future monetary policy in Europe and in the United States, so that the category of emerging countries UCIs changed only slightly in the month under review.

In October, the categories of fixed-income UCIs registered an overall positive net capital investment.

Development of fixed-income UCIs during the month of October 2017*

* Variation in % of Net Assets in EUR as compared to the previous month

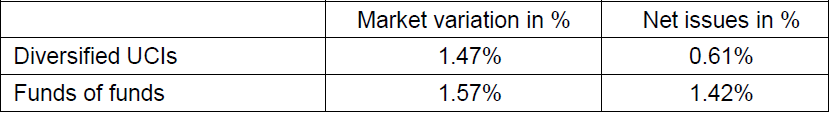

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of October 2017*

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following fifteen undertakings for collective investment have been registered on the official list:

1) UCITS Part I 2010 Law:

- (TLF), 2, rue Jean Monnet, L-2180 Luxembourg

- AQC 1 SICAV, 287-289, route d’Arlon, L-1150 Luxembourg

- FELS TOP 35+ AKTIEN EUROPA, 15, rue de Flaxweiler, L-6776 Grevenmacher

- INTERMONTE SICAV, 5, allée Scheffer, L-2520 Luxembourg

2) SIFs:

- AIS DIRECT INVESTMENT FUND, 42, rue de la Vallée, L-2661 Luxembourg

- AIS STRATEGIC INVESTMENT FUND, 42, rue de la Vallée, L-2661 Luxembourg

- AMUNDI PLANET, SICAV-SIF, 5, allée Scheffer, L-2520 Luxembourg

- AXA IM ANDANTE, 2-4 rue Eugène Ruppert, L-2453 Luxembourg

- CENTENNIAL ARBITRAGE S.A. SICAV-SIF, 11, rue Aldringen, L-1118 Luxembourg

- CENTRE LANE CREDIT PARTNERS, SLP – SIF, 40, avenue Monterey, L-2163 Luxembourg

- IVANHOÉ CAMBRIDGE SICAV-SIF, 60, avenue J-F Kennedy, L-1855 Luxembourg

- LO CO-INVESTMENT FUND, 291, route d’Arlon, L-1150 Luxembourg

- MERCER PRIVATE INVESTMENT PARTNERS V SICAV-SIF, 5, rue Guillaume Kroll, L-1413 Luxembourg

- ROUND HILL REAL ESTATE PARTNERS SCSP, 7, rue du Fort Rheinsheim, L-2419 Luxembourg

3) SICARs:

- PRONIA HEALTH SCA SICAR, 5, rue Jean Monnet, L-2180 Luxembourg

The following 27 undertakings for collective investment have been deregistered from the official list during the month under review:

1) UCITS Part I 2010 Law:

- ALLIANZ FINANZPLAN 2015, Bockenheimer Landstraße 42-44, D-60232 Frankfurt am Main3

- CANDRIAM LIFE BONDS, 136, route d’Arlon, L-1150 Luxembourg

- CASTELL, 534, rue de Neudorf, L-2220 Luxembourg

- FFPB WERT, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- FUNDQUEST INTERNATIONAL, 10, rue Edward Steichen, L-2540 Luxembourg

- GERLACHUS FUND, 15, rue de Flaxweiler, L-6776 Grevenmacher

- GOTTEX GLOBAL FUND, 15, avenue J-F Kennedy, L-1855 Luxembourg

- NV STRATEGIE, 2, place François-Joseph Dargent, L-1413 Luxembourg

- OCP INTERNATIONAL OP, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- RED ARC GLOBAL INVESTMENTS (LUXEMBOURG) SICAV, 31, Z.A. Bourmicht, L-8070 Bertrange

- TELL SICAV-UCITS, 33A, avenue J-F Kennedy, L-1855 Luxembourg

- UNIGARANT: BRIC (2017) II, 308, route d’Esch, L-1471 Luxembourg

- UNIGARANT: BRIC (2017), 308, route d’Esch, L-1471 Luxembourg

2) UCIs Part II 2010 Law:

- D&R INVEST, 14, rue Gabriel Lippmann, L-5365 Munsbach

- DER ERNEUERBARE, 21, avenue de la Liberté, L-1931 Luxembourg

- GUADARRAMA, SICAV, 15, avenue J-F Kennedy, L-1855 Luxembourg

- TIBERIUS ACTIVE COMMODITY OP, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- UNIGARANT: COMMODITIES (2017) III, 308, route d’Esch, L-1471 Luxembourg

- UNIGARANT: COMMODITIES (2017) IV, 308, route d’Esch, L-1471 Luxembourg

- UNIGARANT: COMMODITIES (2017) V, 308, route d’Esch, L-1471 Luxembourg

3) SIFs:

- BLME SHARIA’A UMBRELLA FUND SICAV-SIF, 2, place de Metz, L-1930 Luxembourg

- INSITOR IMPACT FUND S.C.A. SICAV-SIF, 18, rue de l’Eau, L-1449 Luxembourg

- KGAL REAL ESTATE DEBT FUND SICAV-SIF S.C.S., 1C, rue Gabriel Lippmann, L-5365 Munsbach

- MODERATO, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- NAI SECURITE PROTEGE, 5, allée Scheffer, L-2520 Luxembourg

- SHARD CAPITAL FUNDS, 20, boulevard Emmanuel Servais, L-2535 Luxembourg

4) SICARs:

- 2BCAPITAL LUXEMBOURG S.C.A. SICAR, 6A, rue Gabriel Lippmann, L-5365 Munsbach

1 Since the statistical data of SICARs were published on an annual basis before December 2016, the chart includes the number and net assets of SICARs as at 31 December 2015 for the previous months, resulting in constant figures until November 2016 for these vehicles.

2 Before 31 December 2016, the statistical data of SICARs were only published on an annual basis.

3 Undertaking for collective investment for which the designated management company was authorised by the competent authorities of another Member State in accordance with Directive 2009/65/EC.