Global situation of undertakings for collective investment at the end of February 2018

Press release 18/14

I. Overall situation

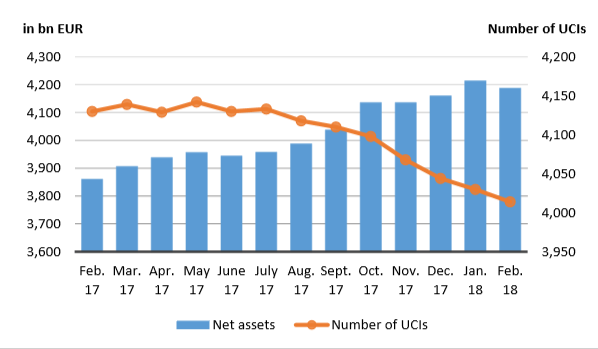

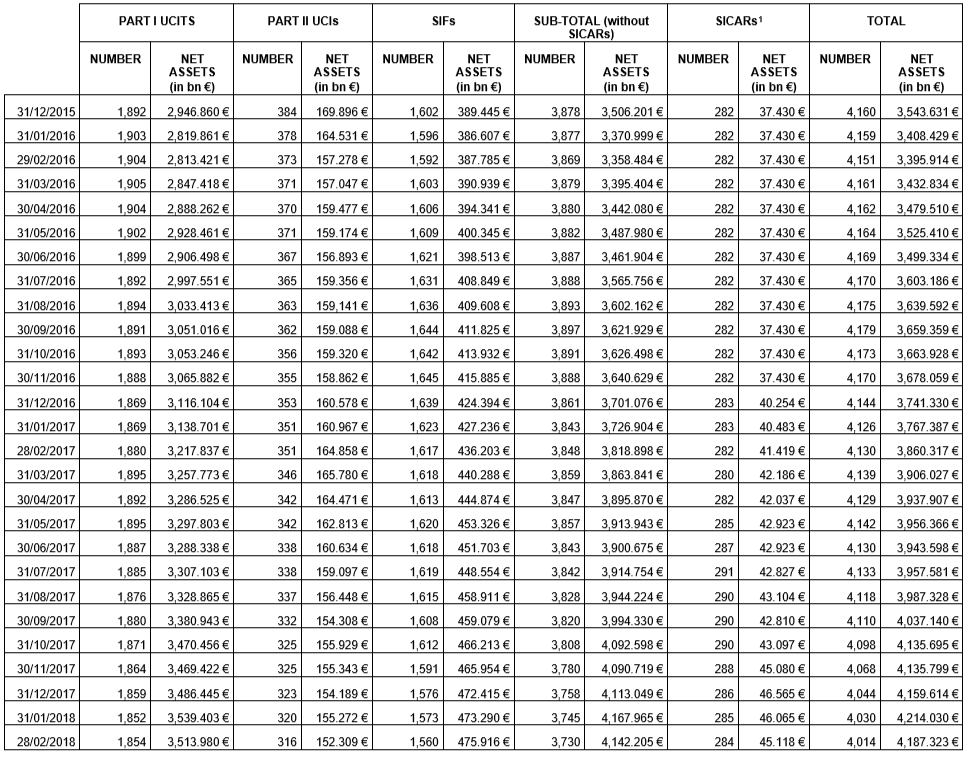

As at 28 February 2018, total net assets of undertakings for collective investment, including UCIs subject to the 2010 Law, specialised investment funds and SICARs amounted to EUR 4,187.323 billion compared to EUR 4,214.030 billion as at 31 January 2018, i.e. a 0.63% decrease over one month. Over the last twelve months, the volume of net assets rose by 8.47%.

The Luxembourg UCI industry registered a negative variation amounting to EUR 26.707 billion during the month of February. This decrease results from the balance of positive net issues amounting to EUR 16.974 billion (0.40%) combined with a negative development in financial markets amounting to EUR 43.681 billion (-1.03%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totals 4,014 as against 4,030 in the previous month. A total of 2,583 entities have adopted an umbrella structure, which represents 13,345 sub-funds. When adding the 1,431 entities with a traditional structure to that figure, a total of 14,776 fund units are active in the financial centre.

As regards, on the one hand, the impact of financial markets on the main categories of undertakings for collective investment and, on the other hand, the net capital investment in these UCIs, the following can be said about February.

The stronger than expected perspective of a monetary tightening of the US Federal Reserve following the publication of the statistics in the United States on the labour market and of inflation exceeding anticipations dominated the financial markets, entailing a fall in the equity and bond prices.

While as far as developed countries are concerned, the European, American and Japanese equity UCIs all recorded losses in this context, despite positive economic fundamentals, the decrease in the American and Japanese equity UCIs was offset party by the depreciation of the US dollar and the yen against the euro.

As regards emerging countries, the Asian equity UCIs followed the downward trend whereas certain economic indicators in China also report a slowdown in growth. Even if the negative performance was less marked for Eastern European and Latin American equity UCIs due in particular to a robust growth of certain countries, these categories followed this downward trend.

In February, equity UCI categories registered an overall positive net capital investment.

Development of equity UCIs during the month of February 2018*

* Variation in % of Net Assets in EUR as compared to the previous month.

As regards the EUR-denominated bonds, the increase in inflation anticipations resulted, on average, in a slightly upward trend of the yields. The yield spreads between high-rated and lower-rated countries rose somewhat, in particular due to the changing political situation in certain countries. The corporate bonds, however, changed less during the month under review, the EUR-denominated bond UCIs overall recorded slight price decreases.

Concerning the USD-denominated bonds following the publication of sound figures on the US labour market and growth inflation forecasts, investors reassessed their expectations on the monetary tightening of the US Federal Reserve, which resulted in a rise in the longer-term government bond yields. This increase in rates was more than offset by the USD appreciation against the EUR of almost 2% so that the category of USD-denominated bond UCIs ended the month in positive territory.

The general increase of yields, the rise in volatilities and resurgence of risk aversion had also a negative impact on the emerging market bonds which ended the month with negative results.

Overall, fixed-income UCIs registered negative net capital investment during February.

Development of fixed-income UCIs during the month of February 2018*

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of February 2018*

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following 10 undertakings for collective investment have been registered on the official list:

1) UCITS Part I 2010 Law:

- FUNDSOLUTION, 9A, rue Gabriel Lippmann, L-5365 Munsbach

- GAAM – PREMIUM SELECTION BALANCED FUND, 2, place François-Joseph Dargent, L-1413 Luxembourg

- LIMMAT CAPITAL SICAV, 5, rue Jean Monnet, L-2180 Luxembourg

- TRIGON, 4, rue Thomas Edison, L-1445 Strassen

- UNIINDUSTRIE 4.0, 308, route d’Esch, L-1471 Luxembourg

2) UCIs Part II 2010 Law:

- PARTNERS GROUP GLOBAL VALUE REAL ESTATE SICAV, 2, place François-Joseph Dargent, L-1413 Luxembourg

3) SIFs:

- FONDACO THEMATIC SIF, 2, place de Paris, L-2314 Luxembourg

- MK VENTURE BEST SELECTION S.C.A., SICAV-FIS, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- QUAESTIO PRIVATE MARKETS FUNDS S.C.SP., SICAV-SIF, 5, allée Scheffer, L-2520 Luxembourg

4) SICARs:

- QS PEP (L) SICAR, 3, boulevard Royal, L-2449 Luxembourg

The following 26 undertakings for collective investment have been deregistered from the official list during the month under review:

1) UCITS Part I 2010 Law:

- ASSETS GENERATION FUND UI, 15, rue de Flaxweiler, L-6776 Grevenmacher

- ING ORANGE FUND, 5, allée Scheffer, L-2520 Luxembourg

- TRI ANGA, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- TRIGLOBAL, 534, rue de Neudorf, L-2220 Luxembourg

- VICTORY FUND, 15, avenue J-F Kennedy, L-1855 Luxembourg

2) UCIs Part II 2010 Law:

- AVIVA INVESTORS EUROPEAN REAL ESTATE FUND OF FUNDS, 34, avenue de la Liberté, L1930 Luxembourg

- BIL PRIME ADVANCED, 14, Porte de France, L-4360 Esch-sur-Alzette

- LUX ALTERNATIVE, 2, place François-Joseph Dargent, L-1413 Luxembourg

- TRANSTREND EQUITY STRATEGIES, 5, allée Scheffer, L-2520 Luxembourg

3) SIFs:

- ADAGIO, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- ADEL-FIS, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- ALPHAONE SICAV-FIS, 6, rue Lou Hemmer, L-1748 Senningerberg

- BUYSSE & PARTNERS INVESTMENT FUND, 12, rue Eugène Ruppert, L-2453 Luxembourg

- DATACENTER DEVELOPMENT, 17, rue des Bains, L-1212 Luxembourg

- EMVEST PRO ALIA FUND, 20, boulevard Emmanuel Servais, L-2535 Luxembourg

- GARBE LOGISTIC EUROPEAN STRATEGIC FUND II, 9, avenue Guillaume, L-1651 Luxembourg

- IPC-CAPITAL STRATEGY VI, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- KESTEGO SICAV-SIF, 20, boulevard Emmanuel Servais, L-2535 Luxembourg

- MAASVEST, 44, avenue J-F Kennedy, L-1855 Luxembourg

- OBERON CREDIT INVESTMENT FUND I S.C.A. SICAV-SIF, 5, rue Guillaume Kroll, L-1882 Luxembourg

- PJH GLOBAL OPPORTUNITIES FUND – FIS, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- R SELECT, 5, allée Scheffer, L-2520 Luxembourg

- VIVALYS PATRIMONIA, 11, rue Aldringen, L-1118 Luxembourg

- VOLKSBANK HEILBRONN ASSET ALLOCATION, 308, route d’Esch, L-1471 Luxembourg

4) SICARs:

- ALPHA I VC SICAR S.A., 4, rue Thomas Edison, L-1445 Strassen

- GALAXY S. A R. L. SICAR, 2, place de Metz, L-1930 Luxembourg

1 Before 31 December 2016, the statistical data of SICARs were only published on an annual basis.