Profit and loss account of credit institutions as at 31 December 2017

Press release 18/17

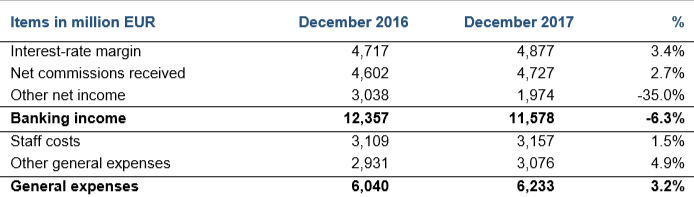

The CSSF estimates profit before provisions of the Luxembourg banking sector at EUR 5,345 million for the year 2017. Compared to 2016, profit before provisions thus decreased by 15.4%. The extent of this decrease compared to last year is primarily related to an outstanding effect, resulting from the proceeds from the disposal of a major holding by a bank of the financial centre at the end of 2016. These developments resulted in a 20.1% decrease of the net profit for the financial year in question.

In 2017, the Luxembourg banking sector recorded solid recurring banking income. Indeed, the interest-rate margin increased by 3.4% over one year. This positive development, experienced by 59% of Luxembourg banks, resulted in aggregate from an increase in business volume and in return on assets or the passing-on of negative interest rates by certain banks to their institutional customers. Moreover, following a negative development in 2016 (-2.5%), the net commissions received (+2.7%) again stabilised in 2017. Thus, 58% of the banks of the financial centre benefited from a very favourable stock market context in relation to their asset management activities on behalf of private and institutional customers.

The decrease in banking income (-6.3%) originates from the other net income. In 2016, this income increased substantially due to a significant gain realised on an exceptional transaction by a bank of the financial centre. Excluding this exceptional effect, the other net income would have decreased by 14.1% (instead of 35%) due in particular to a drop in the dividends received by certain credit institutions.

The general expenses also contributed to the negative development of the profit before provisions in 2017. The ongoing increase of the general expenses is a phenomenon that has been observed over the last three years and which concerns most Luxembourg credit institutions (64%). While part of the general expenses is due to investments in new infrastructures, an important part of these fees is directly related to the banks becoming compliant with a sustained flow of new accounting and regulatory standards. The other general expenses amount to EUR 3,076 million. For 2017, the taxes and fees paid by the Luxembourg banks in order to cover the fees and expenses of the banking supervision amount to EUR 16 million for the CSSF and 4 million1 for the European Central Bank (Single Supervisory Mechanism). The banking contributions received in 2017 by the CSSF to the European Single Resolution Fund and the Fonds de garantie des dépôts Luxembourg (Luxembourg Deposit Guarantee Fund) represent EUR 100 million and EUR 76 million, respectively.

The net profit for 2017 amounts to EUR 3,788 (-20.1%).

Profit and loss account as at 31 December 2017

1 For banking groups, the European Central Bank does only issue a single aggregate invoice for the whole group. The CSSF does not have information on the intragroup rebilling. Consequently, the amount of 4 million does not take account of the proportion borne, where appropriate, by the Luxembourg banks whose group head is established in other member countries of the euro area. This proportion may be estimated at approximately EUR 9 million, bringing the overall direct costs of the Luxembourg banks’ supervision by the European Central Bank to EUR 13 million.