Global situation of undertakings for collective investment at the end of October 2018

Press release 18/39

I. Overall situation

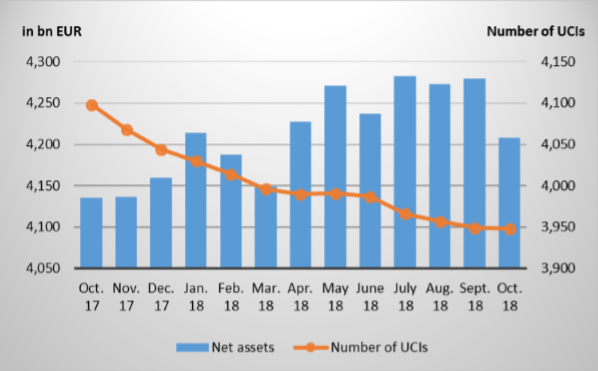

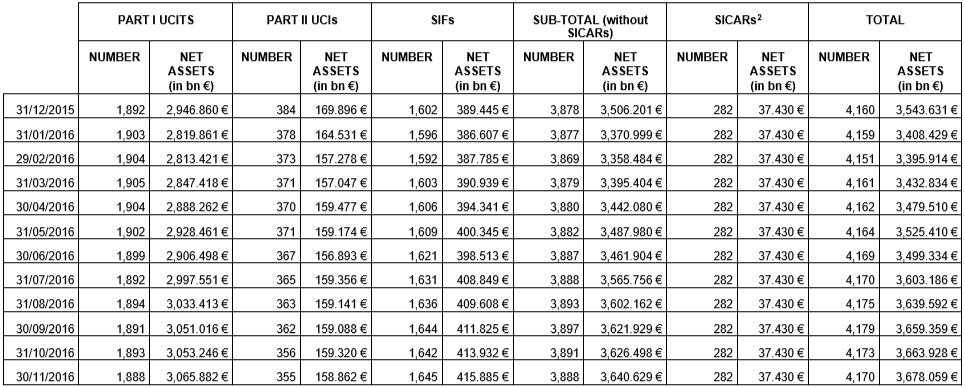

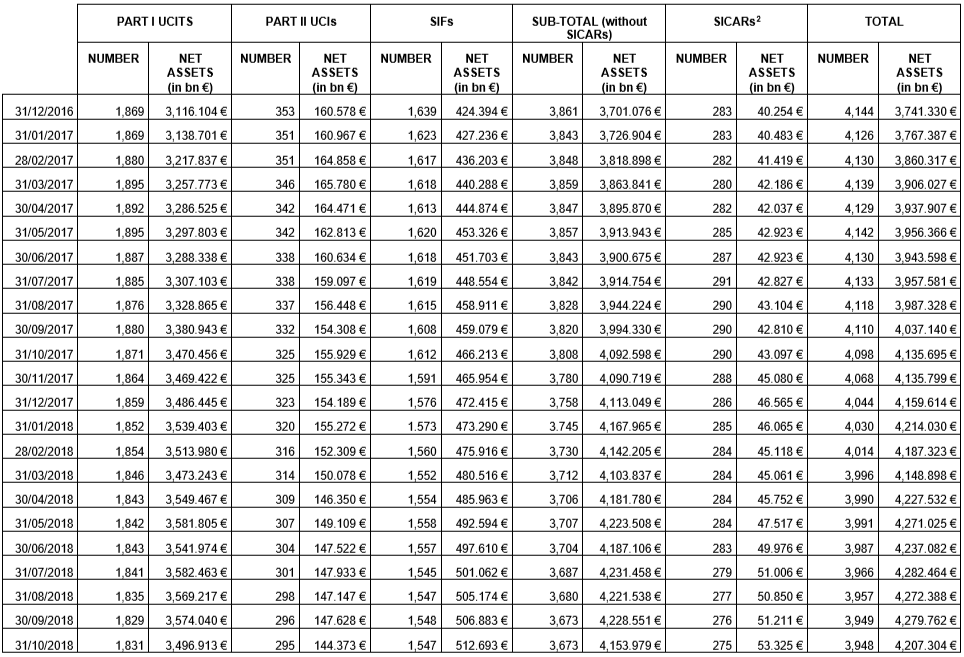

As at 31 October 2018, total net assets of undertakings for collective investment, including UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 4,207.304 billion compared to EUR 4,279.762 billion as at 30 September 2018, i.e. a 1.69% decrease over one month. Over the last twelve months, the volume of net assets rose by 1.73%.

The Luxembourg UCI industry thus registered a negative variation of EUR 72.458 billion during the month of October. This decrease results from the balance of positive net issues of EUR 24.779 billion (+0.58%) and a negative development in financial markets of EUR 97.237 billion (-2.27%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,948 as against 3,949 in the previous month. A total of 2,564 entities adopted an umbrella structure, which represented 13,509 sub-funds. When adding the 1,384 entities with a traditional structure to that figure, a total of 14,893 fund units were active in the financial centre.

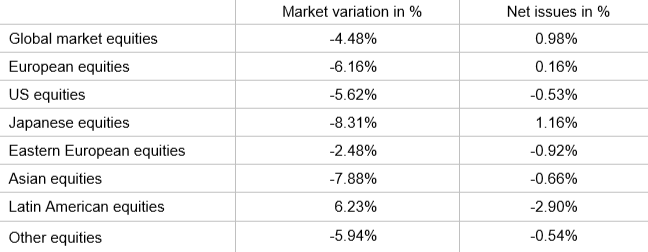

As regards, on the one hand, the impact of financial markets on the main categories of undertakings for collective investment and, on the other hand, the net capital investment in these UCIs, the following can be said about October.

Most equity UCI categories registered a sharp correction during the month under review.

As regards developed countries, the European equity UCI category recorded a negative performance in a context of fears of an economic slowdown in Europe, the decline in results of undertakings and the uncertainties related to the Italian budget. Despite sound economic fundamentals in the United States, the category of US equity UCIs developed negatively, mainly as a result of the increase of the long-term interest rates in the United States and the persistent trade tensions. The mixed economic indicators in Japan, fears of a global economic slowdown and the heightened trade tensions between China and the United States led to the heavy price losses in the Japanese equity UCI category.

As regards emerging countries, the persistent trade tensions between the United States and China, the slowdown in growth in China as well as the concerns regarding the global economic environment resulted in the depreciation of the prices of Asian equity UCIs. Despite the good results of Russian undertakings, the Eastern European equity UCIs could not avoid negative developments in the main equity markets, ending therefore down. This downward trend was due, in particular, to the fall in oil prices and geopolitical problems in the region. The category of Latin American equity UCIs ended in positive territory, against the background of the results of the Brazilian elections.

In October, equity UCI categories registered an overall positive net capital investment.

Development of equity UCIs during the month of October 2018*

* Variation in % of Net Assets in EUR as compared to the previous month

In Europe, the rise of the risk aversion of investors led to the increase of prices of high-rated government bonds which were sought after as “safe haven”, whereas the persistent uncertainties regarding the Italian budget resulted in a decrease of low-rated government bond prices, so that, overall, government bonds developed little during the month. The uncertainties in the financial markets also caused the rise in risk premiums of corporate bonds. Consequently, EUR-denominated bond UCIs recorded slight price decreases.

In the United States, even if the fears of a monetary policy tightening in a context of sound economic figures negatively influenced bond prices, the appreciation of the USD against the EUR led the USD-denominated bond UCIs to end the month in positive territory.

The category of emerging market UCIs registered overall a negative performance as a result of the increased volatility in equity markets, the gradual decline of the Chinese growth, the persistent trade tensions, the rise in the US interest rates and the downward trend of commodity prices.

During October, the money market UCIs showed a positive net capital investment whereas the other fixed-income UCI categories recorded an overall negative net capital investment.

Development of fixed-income UCIs during the month of October 2018*

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of October 2018*

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following 11 undertakings for collective investment have been registered on the official list:

1) UCITS Part I 2010 Law:

- ABARIS DEFENSIVE EQUITY, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- ANSA – GLOBAL Q MACRO L/S, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- BRIGHTSPHERE GLOBAL FUNDS, 15, avenue J-F Kennedy, L-1855 Luxembourg

- DMS UCITS PLATFORM, 2, rue d’Alsace, L-1122 Luxembourg

- LUXBRIDGE SICAV, 9A, boulevard du Prince Henri, L-1724 Luxembourg

2) UCI Part II 2010 Law:

- –

3) SIFs:

- FOOD SECURITIES FUND S.A., SICAV-FIS, 15, avenue J-F Kennedy, L-1855 Luxembourg

- LCM PARTNERS CO V FCP-SIF, 20, rue de la Poste, L-2346 Luxembourg

- OCEANS UMBRELLA SICAV-SIF, 287-289, route d’Arlon, L-1150 Luxembourg

- PG BAV RBI PRIVATE DEBT FUND FCP-SIF, 2, place François-Joseph Dargent, L-1413 Luxembourg

- PRIMUS INVESTMENTS S.C.S. SICAV-SIF, 5, rue Heienhaff, L-1736 Senningerberg

4) SICARs:

- SANDIA SICAR S.À R.L., 5, rue Guillaume Kroll, L-1882 Luxembourg

The following 12 undertakings for collective investment have been deregistered from the official list during the month under review:

1) UCITS Part I 2010 Law:

- FORMUEPLEJE LUX SICAV, 15, rue Bender, L-1229 Luxembourg

- LEAF, 12, rue Eugène Ruppert, L-2453 Luxembourg

- ML FUNDS, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

2) UCIs Part II 2010 Law:

- MPF STRATEGIE DEFENSIV, 2, place François-Joseph Dargent, L-1413 Luxembourg

3) SIFs:

- ATHENE REAL ESTATE FUND FCP-FIS, 80, route d’Esch, L-1470 Luxembourg

- CAPITAL STREAM INVESTMENTS SICAV SIF SCA, 29, rue Alphonse München, L-2172 Luxembourg

- CHARLEMAGNE OPPORTUNITIES S.C.A. SICAV-SIF, 12, rue Eugène Ruppert, L-2453 Luxembourg

- DLIBJ OPEN FUND, 1B, rue Gabriel Lippmann, L-5365 Munsbach

- EFH FUNDS SCA SICAV SIF, 2, boulevard de la Foire, L-1528 Luxembourg

- NATURAL RESOURCES VALUE FUND S.C.A. SICAV-SIF, 11, rue Aldringen, L-1118 Luxembourg

4) SICARs:

- ARROWS INVESTMENTS S.A R.L. SICAR, 412F, route d’Esch, L-2086 Luxembourg

- GAWA MICROFINANCE FUND S.C.A., SICAR, 20, rue de la Poste, L-2346 Luxembourg

1 The positive net issues of the money market UCI categories are in part the result of cross-border mergers of foreign funds into Luxembourg funds.

2 Before 31 December 2016, the statistical data of SICARs were only published on an annual basis