Global situation of undertakings for collective investment at the end of December 2018

Press release 19/09

I. Overall situation

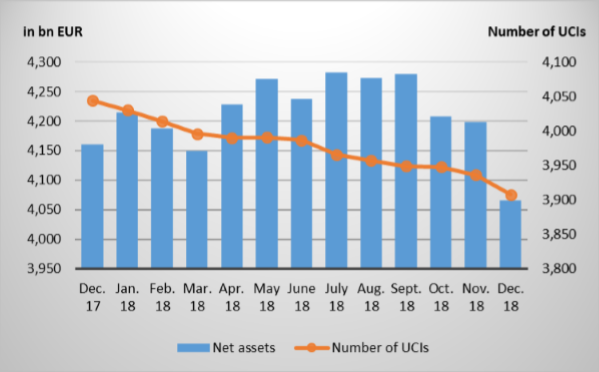

As at 31 December 2018, total net assets of undertakings for collective investment, including UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 4,064.644 billion compared to EUR 4,192.332 billion as at 30 November 2018, i.e. a 3.05% decrease over one month. Over the last twelve months, the volume of net assets decreased by 2.28%.

The Luxembourg UCI industry thus registered a negative variation amounting to EUR 127.688 billion in December. This decrease represents the balance of the negative net issues of EUR 12.860 billion (- 0.31%) and the positive development in financial markets amounting to EUR 114.828 billion (-2.74%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,908 as against 3,936 in the previous month. A total of 2,536 entities adopted an umbrella structure, which represented 13,526 sub-funds. When adding the 1,372 entities with a traditional structure to that figure, a total of 14,898 fund units were active in the financial centre.

As regards, on the one hand, the impact of financial markets on the main categories of undertakings for collective investment and, on the other hand, the net capital investment in these UCIs, the following can be said about December.

All the categories of equity UCIs recorded negative developments during the month under review due, among others, to the fear of a global economic slowdown.

As regards developed countries, the European equity UCIs registered in this context a very strong negative performance against the backdrop of disappointing growth figures in Europe and persistent political uncertainties. The signs of deceleration of the US economy and the fourth raise of key interest rates by the Fed this year account for the decrease of US equity UCIs. Based on weaker economic indicators in Japan and on the unfavourable global economic environment, the category of Japanese equity UCIs also ended the month in negative territory.

As regards emerging countries, the Eastern European, Latin American and Asian equity UCI categories followed the overall downward trend in a context of a less favourable global economic environment despite the temporary trade agreement between China and the United States and the growth stabilisation measures taken by the Chinese authorities.

In December, the equity UCI categories registered an overall negative net capital investment.

Development of equity UCIs during the month of December 2018*

* Variation in % of Net Assets in EUR as compared to the previous month

In Europe, volatilities in equity markets, worries about the global economic environment and political uncertainties led to the rise in prices of high-rated government bonds which were sought by investors as ‘safe haven’, whereas risk premiums increased overall for private sector bonds. All in all, EUR-denominated bond UCIs recorded slight price increases.

In the United States, USD-denominated bond UCIs were sought after by investors as a result of a significant correction of US equity markets in the context of less favourable economic indicators and the raise of key interest rates by the Fed, so that the category of USD-denominated bond UCIs ended the month in positive territory.

The category of emerging country bond UCIs changed little due to, on the one hand, solid fundamentals and reduced US bond yields and, on the other hand, the negative development of some emerging currencies and the weak commodity markets.

In December, the category of fixed-income UCIs registered an overall positive net capital investment.

Development of fixed-income UCIs during the month of December 2018*

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of December 2018*

* Variation in % of Net Assets in EUR as compared to the previous month

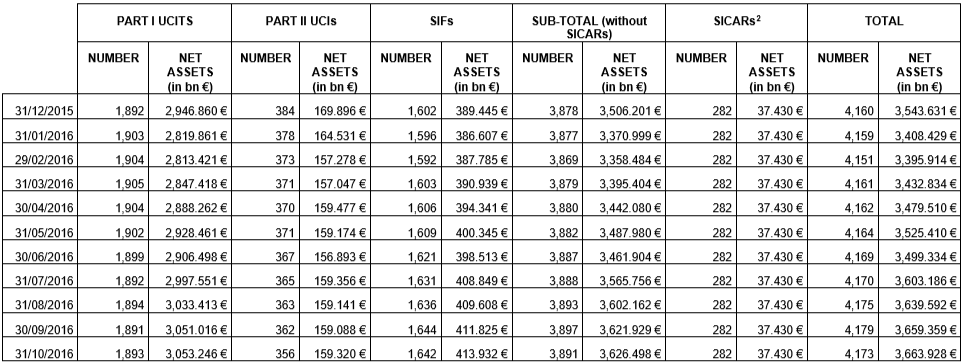

II. Breakdown of the number and net assets of UCIs

During the month under review, the following 10 undertakings for collective investment have been registered on the official list:

1) UCITS Part I 2010 Law:

- APERTURE INVESTORS SICAV, 60, avenue J-F Kennedy, L-1855 Luxembourg

- BCI AM SICAV, 106, route d’Arlon, L-8210 Mamer

- BERENBERG GLOBAL FOCUS FUND, 15, rue de Flaxweiler, L-6776 Grevenmacher

- BERENBERG SUSTAINABLE WORLD EQUITIES, 15, rue de Flaxweiler, L-6776 Grevenmacher

- BERENBERG VARIATO, 15, rue de Flaxweiler, L-6776 Grevenmacher

- O.I. VALOR, 12, rue Eugène Ruppert, L-2453 Luxembourg

- PRIVATFONDS: NACHHALTIG, 308, route d’Esch, L-1471 Luxembourg

- THEMATICA, 4, rue Thomas Edison, L-1445 Strassen

- UNIGARANT80: DYNAMIK, 308, route d’Esch, L-1471 Luxembourg

2) SIFs:

- KARL STORZ – FIS, 4, rue Thomas Edison, L-1445 Strassen

The following 38 undertakings for collective investment and specialised investment funds were deregistered from the official list during the month under review:

1) UCITS Part I 2010 Law:

- ABARIS CONSERVATIVE EQUITY, 5, rue Jean Monnet, L-2180 Luxembourg

- B&B FUND SOLUTIONS (LUX), 5, rue Jean Monnet, L-2180 Luxembourg

- CAPITAL INTERNATIONAL FUND JAPAN, 37A, avenue J-F Kennedy, L-1855 Luxembourg

- DB FIXED COUPON FUND 2018 II, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- DEKA-LIQUIDITÄTSPLAN 2, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- FT ALPHA GLOBAL MARKET NEUTRAL, 163, rue du Kiem, L-8030 Strassen

- FT EUROCORPORATES, 163, rue du Kiem, L-8030 Strassen

- H & A MULTI ASSET DYNAMIC, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- HANDELSBANKEN FUNDS, 15, rue Bender, L-1229 Luxembourg

- HELLERICH EMERGING MARKETS, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- LFP S&P CAPITAL IQ FUND, 60, avenue J-F Kennedy, L-1855 Luxembourg

- PENSPLAN SICAV LUX, 106, route d’Arlon, L-8210 Mamer

- PIONEER INVESTMENTS CHANCE, 5, Allée Scheffer, L-2520 Luxembourg

- PIONEER INVESTMENTS ERTRAG, 5, Allée Scheffer, L-2520 Luxembourg

- PIONEER INVESTMENTS WACHSTUM, 5, Allée Scheffer, L-2520 Luxembourg

- PNR GLOBAL (EX-JAPAN) AGGREGATE BOND, 5, allée Scheffer, L-2520 Luxembourg

- RBR FUNDS, 5, rue Jean Monnet, L-2180 Luxembourg

- REICHMUTH&CO FUNDS, 2, place François-Joseph Dargent, L-1413 Luxembourg

- SPECIAL OPPORTUNITIES, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- SWISS HEDGE, 6B, rue Gabriel Lippmann, L-5365 Munsbach

- UNIINSTITUTIONAL EM BONDS 2018, 308, route d’Esch, L-1471 Luxembourg

- XAIA NLP, 15, rue de Flaxweiler, L-6776 Grevenmacher

2) UCIs Part II 2010 Law:

- PARTNERS GROUP GLOBAL INFRASTRUCTURE SICAV, 2, place François-Joseph Dargent, L-1413 Luxembourg

3) SIFs:

- ALTERCAP I BIS, 412F, route d’Esch, L-1471 Luxembourg

- CHINA TECH SICAV-SIF SCSP, 412F, route d’Esch, L-1471 Luxembourg

- CS FUND OF FUNDS SICAV – SIF, 5, rue Jean Monnet, L-2180 Luxembourg

- D&L FINE ARTS S.A. SICAV-SIF, 76-78, rue de Merl, L-2146 Luxembourg

- FRANKLIN TEMPLETON ALTERNATIVE INVESTMENT FUNDS FCP-SIF, 8A, rue Albert Borschette, L1246 Luxembourg

- HEDGEPEAK SICAV-SIF, SCA, 2, boulevard de la Foire, L-1528 Luxembourg

- LBBW KF FCP-FIS, 15, rue de Flaxweiler, L-6776 Grevenmacher

- MERIDIAN, 20, rue de la Poste, L-2346 Luxembourg

- NEPHILA SICAV-SIF, 5, Heienhaff, L-1736 Senningerberg

- PAVONE SICAV-FIS, 33A, avenue J-F Kennedy, L-1855 Luxembourg

- THE MALASPINIAN FUND SCA SICAV-FIS, 14, boulevard Royal, L-2449 Luxembourg

- TOTAL RETURN S, 9A, rue Gabriel Lippmann, L-5365 Munsbach

- WARBURG INFRASTRUKTUR FONDS S.C.S. SICAV-SIF, 2, place François-Joseph Dargent, L-1413 Luxembourg

4) SICARs:

- 360 CAPITAL ONE S.C.A. – SICAR, 10, rue Antoine Jans, L-1820 Luxembourg

- AKUO INVESTMENT S.C.A. SICAR, 25A, boulevard Royal, L-2449 Luxembourg

1 The positive net issues of the money market UCI categories are in part the result of cross-border mergers of foreign funds into Luxembourg funds.

2 Before 31 December 2016, the statistical data of SICARs were only published on an annual basis.