Global situation of undertakings for collective investment at the end of February 2019

Press release 19/14

I. Overall situation

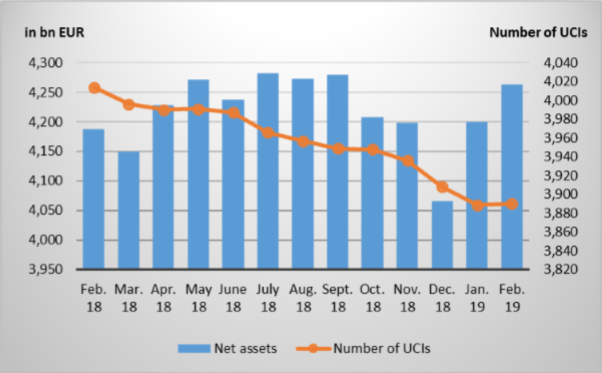

As at 28 February 2019, total net assets of undertakings for collective investment, including UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 4,262.654 billion compared to EUR 4,199.723 billion as at 31 January 2019, i.e. a 1.50% increase over one month. Over the last twelve months, the volume of net assets rose by 1.80%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 62.931 billion in February. This increase represents the balance of negative net issues of EUR 7.096 billion (-0.17%) and the positive development in the financial markets amounting to EUR 70.027 billion (+1.67%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,890 as against 3,889 in the previous month. A total of 2,523 entities adopted an umbrella structure, which represented 13,558 sub-funds. When adding the 1,367 entities with a traditional structure to that figure, a total of 14,925 fund units were active in the financial centre.

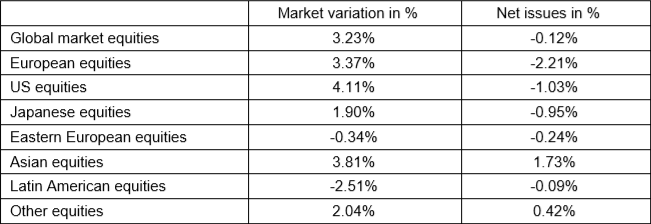

As regards, on the one hand, the impact of financial markets on the main categories of undertakings for collective investment and, on the other hand, the net capital investment in these UCIs, the following can be said about February.

The equity markets developed differently during the month under review.

As regards developed countries, the category of European equity UCIs recorded a positive performance due notably to the maintenance of the accommodating monetary policy by the European Central Bank and the progress made in the trade negotiations between the United States and China and that, despite mitigated macroeconomic data in the euro area and the slowdown in world trade. The category of US equity UCIs registered an increase as a result of the progress in trade negotiations between China and the US which led to a postponement in new customs surcharges on Chinese products and the political agreement ending the shutdown of the US government. Based on the progress in trade negotiations between China and the US and the weakness of the YEN compared to the USD, the category of Japanese equity UCIs ended the month in positive territory despite the decline of the Japanese foreign trade.

As regards emerging markets, the Asian equity UCIs recorded overall a positive performance, mainly based on progress in trade negotiations between China and the US, despite the divergent developments in the different Asian countries. In the context of a less favourable global macroeconomic environment, the Eastern European equity UCIs and the Latin American UCIs recorded price losses.

In February, the equity UCI categories registered an overall negative net capital investment.

Development of equity UCIs during the month of February 2019*

* Variation in % of Net Assets in EUR as compared to the previous month

In Europe, corporate bonds registered price gains in the context, notably, of the rise in risk appetite, whereas the EUR-denominated government bond yields slightly increased. The maintenance of the accommodating policy by the European Central Bank against the background of weaker macroeconomic data in the euro area and the prospect of a new cycle of longer-term refinancing operations for banks supported the prices of EUR-denominated bonds so that, overall, the EUR-denominated bond UCIs recorded a positive perfomance.

In the United States, although the USD-denominated government bond yields remained relatively flat during the month under review, owing notably to the careful choice of words of the American Federal Reserve as to the future orientation of its monetary policy, the appreciation of the USD against the EUR resulted in the USD-denominated bond UCIs ending the month in positive territory.

As regards emerging countries, the high demand for emerging countries bonds denominated in USD, the rise in prices of some commodities and the reduction of risk premiums mainly influenced the upward trend of the category of emerging countries bonds.

In February, fixed-income UCI categories registered an overall negative net capital investment.

Development of fixed-income UCIs during the month of February 2019*

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of February 2019*

* Variation in % of Net Assets in EUR as compared to the previous month

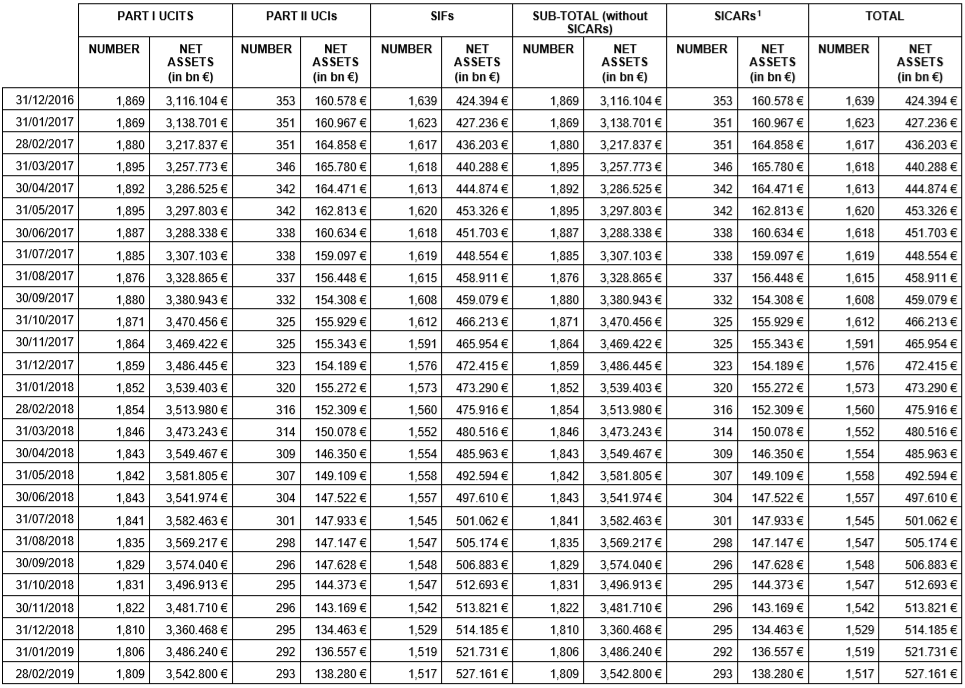

II. Breakdown of the number and net assets of UCIs

During the month under review, the following 11 undertakings for collective investment have been registered on the official list:

1) UCITS Part I 2010 Law:

- ACTIAM (L), 60, avenue J-F Kennedy, L-1855 Luxembourg

- CIRCLE FUND, 94, rue du Kiem, L-1857 Luxembourg

- DEKA-UNTERNEHMERSTRATEGIE EUROPA, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- FONDACO OBIETTIVO WELFARE UCITS SICAV, 146, Boulevard de la Pétrusse, L-2330 Luxembourg

- SOCIAL RESPONSIBILITY FUNDS, 16, rue Gabriel Lippmann, L-5365 Munsbach

- SPDB GLOBAL FUNDS, 49, avenue J-F Kennedy, L-1855 Luxembourg

- UC AXI GLOBAL COCO BONDS UCITS ETF, 8-10, rue Jean Monnet, L-2180 Luxembourg

2) UCIs Part II 2010 Law:

- MUZINICH FIRSTLIGHT MIDDLE MARKET ELTIF SICAV, S.A., 6D, route de Trèves, L-2633 Senningerberg

3) SIFs:

- SKOPOS IMPACT FUND II SICAV-SIF, SCA, 19-21, route d’Arlon, L-8009 Strassen

- TEMPUS EUROPE INVESTMENT FUND S.À R.L., SICAV-SIF, 15, boulevard Friedrich Wilhelm Raiffeisen, L-2411 Luxembourg

4) SICARs:

- ADARA VENTURES III S.C.A., SICAR, 15, Boulevard Friedrich Wilhelm Raiffeisen, L-2411 Luxembourg

The following 10 undertakings for collective investment have been deregistered from the official list during the month under review:

1) UCITS Part I 2010 Law:

- BNP PARIBAS QUAM FUND, 10, rue Edward Steichen, L-2540 Luxembourg

- FULLGOAL INTERNATIONAL UCITS ETF, 106, route d’Arlon, L-8210 Mamer

- SPOTRTM 1, 33, rue de Gasperich, L-5826 Hesperange

- WAVERTON INVESTMENT FUNDS SICAV, 44, rue de la Vallée, L-2661 Luxembourg

2) UCIs Part II 2010 Law:

- –

3) SIFs:

- AERIANCE FCP-SIF, 20, boulevard Emmanuel Servais, L-2535 Luxembourg

- ALPSTEIN FUND, 6, rue Lou Hemmer, L-1748 Senningerberg

- APN CF (NO. 1) SICAV-FIS, 6, rue Eugène Ruppert, L-2453 Luxembourg

- OPTI-GROWTH FUND, 20, boulevard Emmanuel Servais, L-2535 Luxembourg

4) SICARs:

- FIVE ARROWS CO-INVESTMENTS FEEDER V S.C.A. SICAR, 33, rue Sainte Zithe, L-2763 Luxembourg

- NOVENERGIA II-ENERGY & ENVIRONMENT (SCA), SICAR, 28, Boulevard Royal, L-2449 Luxembourg

1 Before 31 December 2016, the statistical data of SICARs were only published on an annual basis.