Global situation of undertakings for collective investment at the end of April 2019

Press release 19/20

I. Overall situation

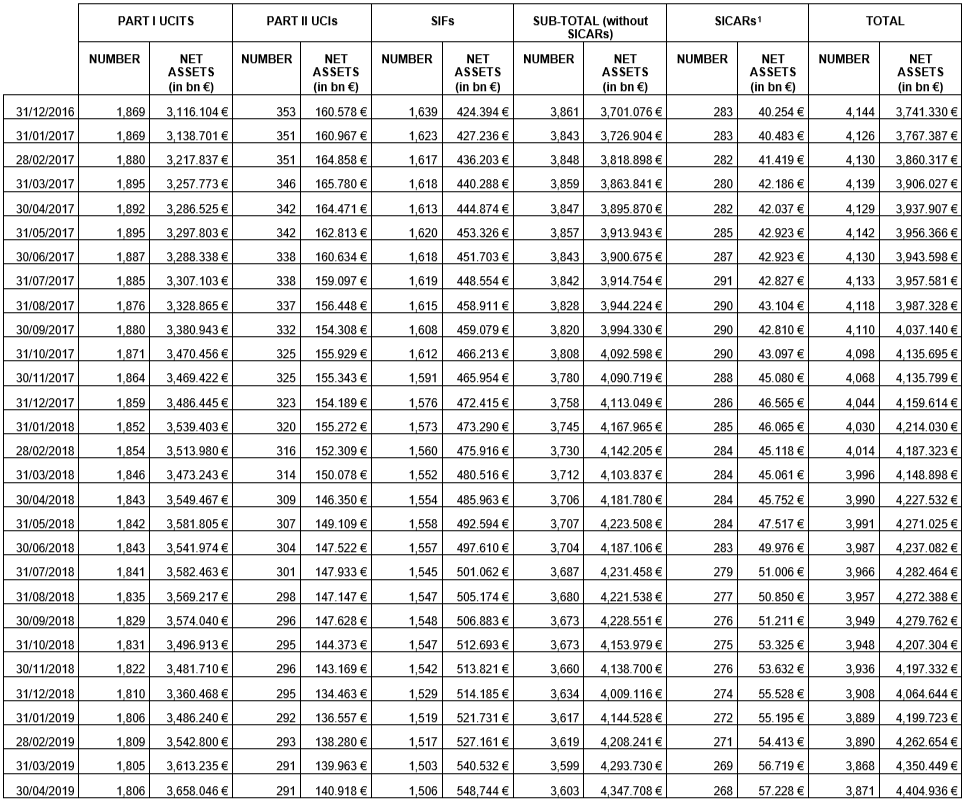

As at 30 April 2019, total net assets of undertakings for collective investment, including UCIs subject to the 2010 Law, specialised investment funds and SICARs amounted to EUR 4,404.936 billion compared to EUR 4,350.449 billion as at 31 March 2019, i.e. a 1.25% increase over one month. Over the last twelve months, the volume of net assets rose by 4.20%.

The Luxembourg UCI industry registered thus a positive variation of EUR 54.487 billion in April. This increase represents the balance of negative net issues of EUR 1.209 billion (-0.03%) and the positive development in the financial markets amounting to EUR 55.696 billion (+1.28%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,871 as against 3,868 in the previous month. A total of 2,513 entities adopted an umbrella structure, which represented 13,553 sub-funds. When adding the 1,358 entities with a traditional structure to that figure, a total of 14,911 fund units were active in the financial centre.

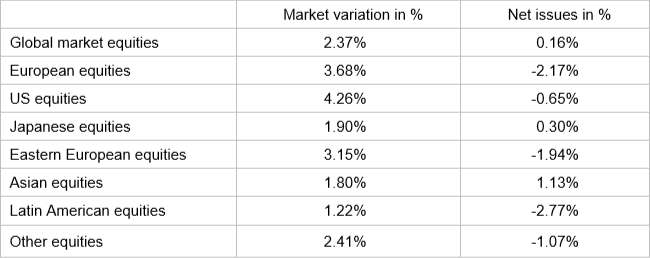

As regards, on the one hand, the impact of financial markets on the main categories of undertakings for collective investment and, on the other hand, the net capital investment in these UCIs, the following can be said about April.

All equity UCI categories registered a positive development during the month under review.

As regards developed countries, the category of European equity UCIs performed well in view of the positive macroeconomic figures and the stabilisation of the overall economic situation, despite trade tensions between Europe and the United States. Business results beyond expectation, progress in Sino-American trade negotiations and the maintenance of an accommodating monetary policy in the United States supported the category of US equity UCIs.

The category of Japanese equity UCIs ended the month in positive territory as a result of a stable domestic demand, the stabilisation of growth in China and the accommodating monetary policy of the Bank of Japan.

As regards emerging countries, in view of the heterogeneous developments in the different countries of the region, the category of Asian equity UCIs recorded, on the whole, a positive performance especially due to the growth stabilisation in China. Business results beyond expectations, the upswing of the overall economic situation and the rise in oil prices explain the price increase of the category of Eastern European equity UCIs. The share prices in Latin America followed overall this upward trend, so that the category of Latin American equity UCIs ended the month in positive territory.

In April, equity UCI categories registered an overall negative net capital investment.

Development of equity UCIs during the month of April 2019*

* Variation in % of Net Assets in EUR as compared to the previous month

In Europe, the prices of high-rated government bonds slightly decreased as a result of positive economic signs, whereas low-rated government bonds were more sought after by investors which led to a price increase. Corporate bonds slightly increased in a context of business results beyond expectations, so that the EUR-denominated bond UCIs showed overall a modest rise.

In the United States, the USD-denominated bond UCIs remained rather unchanged during the month under review due to, on the one hand, slightly greater government bond yields in a context of positive economic indicators and a higher inflation rate and, on the other hand, lower USD-denominated corporate bond yields.

Against the background of divergent developments of the stock markets and currencies in the emerging countries, the category of emerging market bond UCIs showed almost no change during the month under review.

In April, fixed-income UCI categories registered an overall positive net capital investment.

Development of fixed-income UCIs during the month of April 2019*

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of April 2019*

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following 10 undertakings for collective investment have been registered on the official list:

1) UCITS Part I 2010 Law:

- AZ FUND 3, 35, avenue Monterey, L-2163 Luxembourg

- HVB STIFTUNGSPORTFOLIO-FONDS 1, 8-10, rue Jean Monnet, L-2180 Luxembourg

- SEAHAWK EQUITY LONG SHORT FUND, 4, rue Thomas Edison, L-1445 Strassen

- TRZ UCITS FUND, 9A, rue Gabriel Lippmann, L-5365 Munsbach

- UNIINSTITUTIONAL EQUITIES MARKET NEUTRAL, 308, route d’Esch, L-1471 Luxembourg

2) SIFs:

- HERANIA SICAV-SIF, 15, rue de Flaxweiler, L-6776 Grevenmacher

- KAPITAL 1852 SCS SICAV-FIS, 4, rue Thomas Edison, L-1445 Strassen

- SWISS LIFE INVESTMENT COMPANY S.A., SICAF-SIF, 4A, rue Albert Borschette, L-1246 Luxembourg

- SWISS LIFE REF (LUX) PARIS PRIME OFFICE S.A., SICAV-SIF, 4A, rue Albert Borschette, L-1246 Luxembourg

3) SICARs:

- COFRA INVEST SICAR, SÀRL, 19-21, route d’Arlon, L-8009 Luxembourg

The following seven undertakings for collective investment have been deregistered from the official list during the month under review:

1) UCITS Part I 2010 Law:

- COMMERZBANK AKTIENTREND DEUTSCHLAND, 25, rue Edward Steichen, L-2540 Luxembourg

- DNB SICAV, 5, allée Scheffer, L-2520 Luxembourg

- RIVERTREE MONEY MARKET, 11, rue Aldringen, L-1118 Luxembourg

- TOP TEN CLASSIC, 1C, rue Gabriel Lippmann, L-5365 Munsbach

2) SIFs:

- FIA FUND SICAV SIF, 49, avenue J-F Kennedy, L-1855 Luxembourg

3) SICARs:

- MISTRALIA CAPITAL S.C.A., SICAR, 6A, rue Gabriel Lippmann, L-5365 Munsbach

- ADARA VENTURES SICAR, S.C.A., 20, boulevard Emmanuel Servais, L-2535 Luxembourg

1 Before 31 December 2016, the statistical data of SICARs were only published on an annual basis.