IFRS 9 – Impact assessment at transition date 31 December 2017 – 1 January 2018

I. Introduction

The new international financial reporting standard IFRS 9 Financial Instruments, published by the International Accounting Standards Board (IASB) in July 2014, is applicable from 1 January 2018 for all credit institutions in Luxembourg in their prudential reporting FINREP/COREP and for the banks publishing their accounts under IFRS.

Due to the potential impact of IFRS 9 on credit institutions’ figures and internal systems, the CSSF proceeded with a follow-up study on its 2016 pre-implementation impact assessment with an IAS 39 / IFRS 9 transition exercise as at 31 December 2017 / 1 January 2018 including the following:

- Quantitative reconciliation tables between exposure amounts (financial assets and liabilities), impairment allowances and impact on own funds/capital ratios under IAS 39 as at 31 December 2017 and IFRS 9 as at 1 January 2018 (to be filled in by banks);

- Qualitative details on the impairment model implementation (to be filled in by banks).

The CSSF also asked for an auditors’ agreed-upon procedures report covering both the quantitative and the qualitative part of the study as well as the control environment in relation to the IFRS 9 implementation.

The study covered 126 banks (87 credit institutions incorporated under Luxembourg law, 29 branches of credit institutions located in the EEA and 10 branches of credit institutions located in a 3rd country). Banks in the process of stopping their activities or being integrated into another bank’s operations were exempted from the reconciliation exercise.

II. Main observations

Following the completion of the second exercise on IFRS 9, the main observations drawn from the analysis of the responses are presented below.

1. Quantitative impacts of IFRS 9

The global impacts induced by IFRS 9 as regards “Classification & Measurement” and “Impairment”, compared to IAS 39, are presented in tables 1 and 2 for both the pre-implementation impact assessment and the impact assessment at transition date; the average impacts for all banks on the CET1 ratio, broken down by business segments and the nature of the different impacts induced by IFRS 9, are indicated in table 3 as at 1 January 2018.

Table 1 – IFRS 9: Impact from Classification & Measurement

The balance sheet structure for the banks remains broadly the same, with 86,8% of financial assets being measured at amortised cost (first impact assessment: 86,5%), being in line with EBA’s observations.

It is however noteworthy that the use of the fair value through profit or loss (FVPL) category at transition date is slightly higher than the expected use in the previous survey. This might suggest that more debt instruments than anticipated have been affected by the new solely payments of principal and interest (SPPI) requirements.

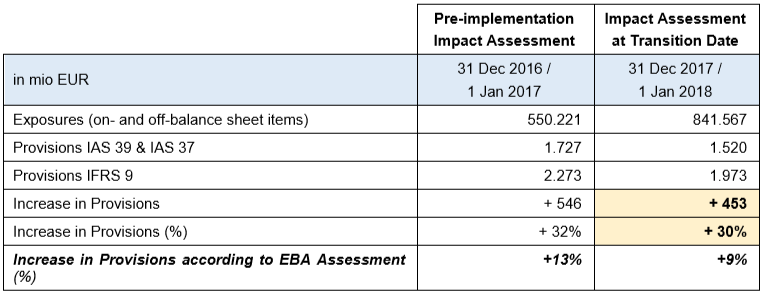

Table 2 – IFRS 9: Impact from Impairment

The impact from the new impairment requirements at transition date is lower than in the first impact assessment, in line with a general downward trend observed at international level.

The apparent higher sensitivity of Luxembourg banks (compared to EBA’s observations) results from the fact that, in Luxembourg, many banks are pure private banking players or custodian banks; those institutions held very small credit loss allowances under IAS 39 / IAS 37 and, consequently, the increase of provisions, expressed in percentage terms, necessarily led to higher figures.

In terms of coverage ratios (provisions divided by exposures), the implementation of the new impairment requirements resulted on transition to IFRS 9 in an increase from 18 bp to 23 bp.

It is also interesting to highlight that IRB banks reported lower increase in provisions than banks under the standardised approach at transition date. However it is to be acknowledged that the former had already built larger provisions under the previous framework.

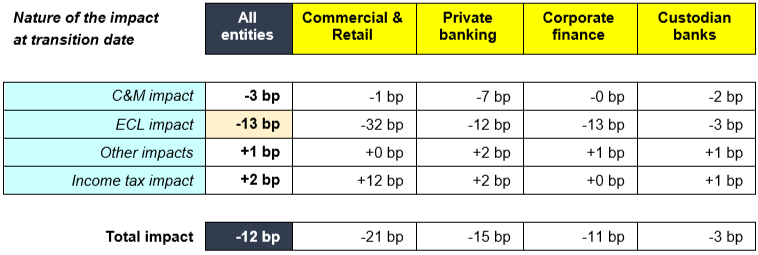

Table 3 – IFRS 9: Average impact on the CET1 ratio – broken down by business segments

The ‘fully-loaded’ implementation of IFRS 9 resulted in an average decrease in the CET1 ratios of Luxembourg banks by 12 bp at the transition date.

This impact is both:

- lower than the impact anticipated in the first impact assessment (-18 bp), which mainly reflects the general downward trend mentioned above and equally observed at international level, and

- lower than the one observed by EBA (-51 bp), which essentially results from the specificity of the Luxembourg banking sector: nearly half of Luxembourg credit institutions are pure private or custodian banks; these banks hold loans that are either short term or backed by cash and securities and are thus not very sensitive to credit risk.

Banks using the standardised approach for measuring credit risk, have a larger impact on own funds ratios due to the new IFRS 9 impairment requirements (-13 bp) than banks using the internal ratings-based (IRB) approach (-5 bp), where increase in ECL allowances could be mitigated through a lower deduction of the shortfall from CET1.

The impacts proved to be rather homogeneous for the whole Luxembourg banking sector with only a limited number of outliers. Finally it is to be highlighted that the date of initial application of IFRS 9 also corresponded to the end of the CRR transitional period (CSSF Regulation 14-01). Impacts reported by Luxembourg banks revealed that the positive impact inherited from the abolishment of the CRR prudential filters had outweighed the negative impact stemming from the new IFRS 9 requirements. In aggregate, the total prudential own funds reported by banks as of 1 January 2018 were thus higher than those as of 31 December 2017.

2. Qualitative aspects of IFRS 9

The review of the practical and operational implementation of IFRS 9, as evidenced by the factual findings from the 126 bank auditors’ agreed-upon procedures reports and banks’ replies to the qualitative questionnaire on impairment, shows the following:

Areas where banks performed well… :

- Banks have a governance framework in place and their internal procedures reflect segregation of duties principles, although sometimes only in draft versions or on a group level. Of the 102 banks that use group models for impairment purposes, 87% adequately adapted those to their local specificities;

- A large majority of banks covered all required aspects in their methodology used to calculate expected credit losses. Some banks missed one or more important elements, such as the calibration of input parameters, the discounting factor or the scenarios. The approaches on ECL measurement vary across banks and depend mainly on factors such as the type of exposure (business line, such as retail or wholesale), the materiality of the exposure, stage at which the exposure is classified, whether a collective or individual assessment is performed and classification in the SA or IRB portfolio. For exposures classified in stages 1 and 2, almost all banks use a PD × LGD × EAD approach for estimating ECL, irrespective of whether the assessment is done on an individual or a collective basis. For exposures classified in stage 3, most banks assess the credit losses on an individual basis and will use a discounted cash flow approach for estimating ECL;

- Similarly, a large majority of banks appropriately defined the significant increase in credit risk (SICR) and the transfer criteria between stages (including triggers and thresholds by types of exposures). Some banks’ procedures were not detailed enough in terms of including all reasonable and supportable information, did not include qualitative factors (e.g. watch list or forbearance status) or over-relied on the 30-days-past-due backstop. Half of the banks use the “low credit risk exemption” for investment grade debt securities;

- Almost all banks provided an adequate definition of default which is based on the 90 days-past-due criterion and the EBA definition of non-performing exposures. Banks use the same definition of default for prudential and for IFRS 9 purposes. In addition, most banks mentioned that exposures defaulted for prudential purposes will be classified in stage 3;

- A large majority of banks appropriately covered data sources and quality checks as well as model validation and back-testing.

… and matters that suggest a need for improvement :

- 17% of banks missed important details when analysing the relevant indicators for the business model assessment (mainly sales levels, remuneration targets, risk management);

- 19% of banks failed to assess the contractual cash-flow characteristics for all types of lending arrangements (either comprehensively or on a risk-based sampling basis) in order to conclude on the SPPI requirements;

- 23% of banks showed inaccuracies in their calculation of ECL, ranging from minor rounding differences to formula deficiencies (such as no discounting, no consideration of interest accruals, mathematical errors);

- 26% of banks did not incorporate forward-looking/macroeconomic information for the assessment of SICR and/or the calculation of ECL or skipped other important elements such as the selection and correlation of relevant factors and the risk-weights attributed to scenarios.

III. Conclusions

The survey has been beneficial to get a better understanding of how banks implemented IFRS 9 and what were the impacts of its first-time application.

In particular, the survey confirmed the highly judgemental nature of some areas (e.g. the assessment of a significant increase in credit risk) and the existence of significant application challenges (e.g. the use of forward-looking information and the availability of data).

IFRS 9 is a complex standard and the post-implementation review will be equally important because the full effect of IFRS 9 can be assessed comprehensively only when the standard has been applied by banks for several years. Therefore, the CSSF intends to monitor the ongoing quantitative impact of the application of IFRS 9 through selected indicators, using mainly COREP/FINREP templates.

In this area, EBA Guidelines 2017/06 on credit institutions’ credit risk management practices and accounting for expected credit losses (para 147-148) foresee that where competent authorities are aware that credit risk assessment or ECL measurement deficiencies are significant or are not remedied on a timely basis, competent authorities should consider imposing additional own funds requirements.

Should you have any question, please send it to the following three email recipients: Ms. Marguy Mehling (marguy.mehling@cssf.lu), Ms. Annick Bové (annick.bove@cssf.lu) and Mr. Clément Renac (clement.renac@cssf.lu).