Global situation of undertakings for collective investment at the end of September 2019

Press release 19/53

I. Overall situation

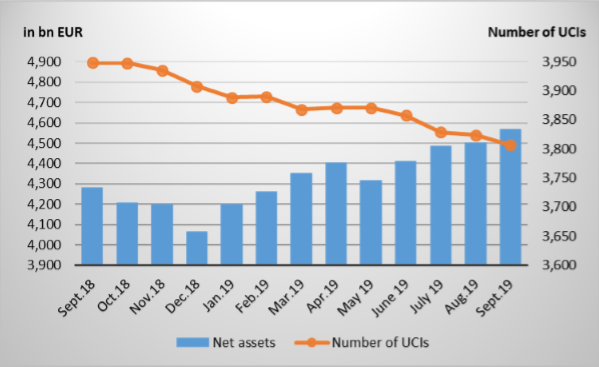

As at 30 September 2019, total net assets of undertakings for collective investment, including UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 4,569.999 billion compared to EUR 4,502.493 billion as at 31 August 2019, i.e. a 1.50% increase over one month. Over the last twelve months, the volume of net assets rose by 6.78%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 67.506 billion in September. This increase represents the sum of positive net issues amounting to EUR 7.522 billion (+0.17%) and of a positive development in financial markets amounting to EUR 59.984 billion (+1.33%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,807 as against 3,824 in the previous month. A total of 2,494 entities adopted an umbrella structure, which represented 13,510 sub-funds. When adding the 1,313 entities with a traditional structure to that figure, a total of 14,823 fund units were active in the financial centre.

As regards, on the one hand, the impact of financial markets on the main categories of undertakings for collective investment and, on the other hand, the net capital investment in these UCIs, the following can be said about September.

The more accommodating monetary policies announced by the main central banks and the hope for appeasing SinoAmerican trade negotiations dominated the financial markets, driving all equity UCI categories upwards.

As far as developed countries are concerned, the European equity UCI categories recorded a positive performance in the context of a more accommodating monetary policy by the European Central Bank (ECB) and the announcement of the resumption of trade negotiations between the United States and China. US equity UCIs also ended the month positively, mainly under the effect of the decrease of key interest rates by the Fed that resulted from the deterioration of the US growth and the ongoing geopolitical risks. The Japanese equity UCIs developed positively as a result of the temporary trade agreement concluded between the US and Japan, notwithstanding mitigated macroeconomic indicators in Japan.

As far as emerging countries are concerned, the Asian equity UCI category recorded an overall price increase following the improvement in trade tensions between China and the United States, despite heterogeneous developments in Asian stock markets, a growth slowdown in China and persistent geopolitical risks. Eastern European and Latin American equity UCIs broadly followed this upward trend.

In September, equity UCI categories registered an overall positive net capital investment.

Development of equity UCIs during the month of September 2019*

* Variation in % of Net Assets in EUR as compared to the previous month

The uncertainties of investors regarding the effectiveness of the new expansive monetary policy measures of the ECB globally raised the yields of government bonds within the euro area. The yields on private bonds followed this upward trend, implying a depreciation of the EUR-denominated bond UCI category.

In the US, the yields of USD-denominated bonds increased as a result of the investors’ uncertainties relating to the Fed’s future monetary policy and the less-than-expected decrease of key interest rates. This increase in yields which resulted in price losses of bonds was, however, more than offset by the appreciation of the USD against the EUR. Consequently, USD-denominated bond UCIs ended in positive territory.

The decrease in key interest rates by the Fed and by many emerging countries, the hope for improvement in trade tensions as well as the appreciation of the main emerging currencies and of the USD against the EUR explain the price gains in the category of emerging countries bonds.

In September, fixed-income UCI categories registered an overall negative net capital investment.

Development of fixed-income UCIs during the month of September 2019*

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of September 2019*

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following 13 undertakings for collective investment have been registered on the official list:

1) UCITS Part I 2010 Law:

- BAUMANN & CIE PARTNER FONDS (LUX), 9A, rue Gabriel Lippmann, L-5365 Munsbach

- BUY & HOLD LUXEMBOURG, Calle de la Cultura 1-1, E-46002 Valencia1

- CARTESIO FUNDS, 60, avenue J-F Kennedy, L-1855 Luxembourg

- DF DEUTSCHE FINANCE SECURITIES FUND, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- FLOSSBACH VON STORCH ONE, 6, avenue Marie-Thérèse, L-2132 Luxembourg

- SILEX RISK MANAGED, 5, allée Scheffer, L-2520 Luxembourg

2) UCIs Part II 2010 Law:

- ENTREPRENEUR SELECT MULTI STRATEGY, 4, rue Thomas Edison, L-1445 Strassen

3) SIFs:

- ALLIANZ DEBT INVESTMENTS SCSP SICAV-SIF, 10-12, boulevard F-D Roosevelt, L-2450 Luxembourg

- BEGO ALTERNATIVE ASSETS FUND III S.A., SICAV-FIS, 15, rue de Flaxweiler, L-6776 Grevenmacher

- FREGATE FUND, 15, avenue J-F Kennedy, L-1855 Luxembourg

- LO EUROPEAN VENTURE CAPITAL OPPORTUNITY FUND III, 291, route d’Arlon, L-1150 Luxembourg

- PATRIZIA LIVING CITIES RESIDENTIAL FUND, 2-4, rue Beck, L-1222 Luxembourg

4) SICARs:

- LA MAISON ITF S.C.A., SICAR, 9, allée Scheffer, L-2520 Luxembourg

The following 30 undertakings for collective investment have been deregistered from the official list during the month under review:

1) UCITS Part I 2010 Law:

- ALLIANZ RENDITE PLUS 2019, Bockenheimer Landstraße 42-44, D-60232 Frankfurt am Main2

- AMERICAN CENTURY SICAV, 49, avenue J-F Kennedy, L-1855 Luxembourg

- DFV SONDERVERMÖGEN, 16, rue Gabriel Lippmann, L-5365 Munsbach

- GF INTERNATIONAL, 49, avenue J-F Kennedy, L-1855 Luxembourg

- THE CENTURY FUND SICAV, 6H, route de Trèves, L-2633 Senningerberg

- UNIGARANT: DEUTSCHLAND (2019) II, 308, route d’Esch, L-1471 Luxembourg

- UNIGARANT: DEUTSCHLAND (2019), 308, route d’Esch, L-1471 Luxembourg

- UNIGARANT95: CHANCENVIELFALT (2019) II, 308, route d’Esch, L-1471 Luxembourg

- UNIINSTITUTIONAL GLOBAL HIGH DIVIDEND EQUITIES PROTECT, 308, route d’Esch, L-1471 Luxembourg

- UNIONPROTECT: EUROPA (CHF), 308, route d’Esch, L-1471 Luxembourg

- VBMH VERMÖGEN, 308, route d’Esch, L-1471 Luxembourg

2) UCIs Part II 2010 Law:

- INSINGERGILISSEN MANAGER SELECTION SICAV, 11, rue Aldringen, L-1118 Luxembourg

- UNIGARANT: CHANCENVIELFALT (2019) II, 308, route d’Esch, L-1471 Luxembourg

- UNIGARANT: COMMODITIES (2019), 308, route d’Esch, L-1471 Luxembourg

- WESTOPTIFLEX SICAV, 6, rue Lou Hemmer, L-1748 Findel

3) SIFs

- ALTERNATIVE LOAN FUND SICAV-FIS, 80, route d’Esch, L-1470 Luxembourg

- AMAZONAS-AI FUND SCS, SICAV-FIS, 2, place François-Joseph Dargent, L-1413 Luxembourg

- BOUWFONDS INTERNATIONAL REAL ESTATE FUND, 20, rue de la Poste, L-2346 Luxembourg

- BTMU – GS US INTERMEDIATE CORPORATE FUND, 287-289, route d’Arlon, L-1150 Luxembourg

- EUROPEAN SPECIAL OPPORTUNITIES FUND IV FCP SIF, 51, avenue J-F Kennedy, L-1855 Luxembourg

- MY CAPITAL S.C.S. SICAV-SIF, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- NIKKO AM WORLD FUNDS, 1B, rue Gabriel Lippmann, L-5365 Munsbach

- PRAGMA SICAV-FIS, 5, rue Jean Monnet, L-2180 Luxembourg

- PRUDENT INVESTMENT FUND, 2, boulevard de la Foire, L-1528 Luxembourg

- ROBUST LINCOLN FUND S.A.- SICAV – SIF, 19, rue Eugène Ruppert, L-2453 Luxembourg

- S & P 500 INDEX FUND, 287-289, route d’Arlon, L-1150 Luxembourg

- SAUREN GLOBAL VALUE, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- SOMERSET CAPITAL PARTNERS UMBRELLA FUND FCP-SIF, 14, rue Edward Steichen, L-2540 Luxembourg

- UGA (QII) INTERMEDIATE US CORPORATE BOND FUND, 287-289, route d’Arlon, L-1150 Luxembourg

4) SICARs:

- DANUBE SCA, SICAR, 68-70, Boulevard de la Pétrusse, L-2320 Luxembourg

1 Undertaking for collective investment for which the designated management company was authorised by the competent authorities of another Member State in accordance with Directive 2009/65/EC.

2 Undertaking for collective investment for which the designated management company was authorised by the competent authorities of another Member State in accordance with Directive 2009/65/EC.