Global situation of undertakings for collective investment at the end of October 2019

Press release 19/58

I. Overall situation

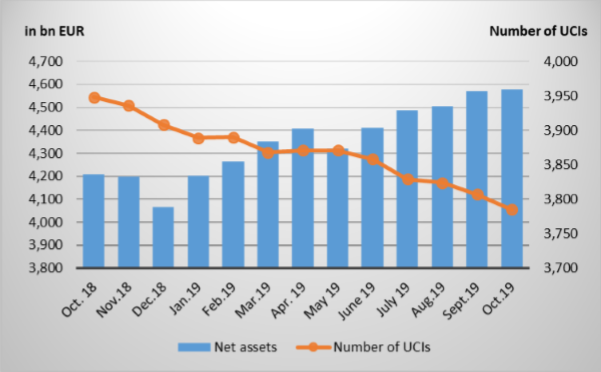

As at 31 October 2019, total net assets of undertakings for collective investment, including UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 4,577.890 billion compared to EUR 4,569.999 billion as at 30 September 2019, i.e. a 0.17% increase over one month. Over the last twelve months, the volume of net assets rose by 8.81%.

Consequently, the Luxembourg UCI industry registered a positive variation amounting to EUR 7.891 billion in October. This increase represents the balance of positive net issues amounting to EUR 15.549 billion (+0.34%) and of the negative development of financial markets amounting to EUR 7.658 billion (-0.17%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,785 as against 3,807 in the previous month. A total of 2,482 entities adopted an umbrella structure, which represented 13,545 sub-funds. When adding the 1,303 entities with a traditional structure to that figure, a total of 14,848 fund units were active in the financial centre.

As regards, on the one hand, the impact of financial markets on the main categories of undertakings for collective investment and, on the other hand, the net capital investment in these UCIs, the following can be said about October.

The more accommodating monetary policies announced by the main central banks and the progress made in the Sino-American trade negotiations dominated the financial markets, driving all stock markets upwards.

As far as developed countries are concerned, the European equity UCI category recorded a positive performance following the first signs of stabilisation of macroeconomic figures in Europe and the progress made in the negotiations between China and the United States and those linked to Brexit. Despite US equity markets performing positively, mostly as a consequence of better-than-expected corporate results, of a lessening of the trade tensions between the USA and China and of the decrease of the key interest rates by the US Federal Reserve (FED), the USD vs. EUR depreciation made US equity UCIs finish the month negatively. The Japanese equity UCIs developed positively as a result of the improving Sino-American trade relations, notwithstanding mitigated economic indicators in Japan.

As far as emerging countries are concerned, the Asian equity UCI category recorded an overall price increase linked to the appeasing trade tensions between China and the United States despite a growth slowdown in China and the current geopolitical problems in the region. Notwithstanding heterogeneous developments in the different Eastern European and Latin American countries, the equity UCI categories of Eastern Europe and of Latin America globally followed the rising trend.

In October, equity UCI categories registered an overall positive net capital investment.

Development of equity UCIs during the month of October 2019*

* Variation in % of Net Assets in EUR as compared to the previous month

In October, the renewed interest of investors in riskier assets implied an increase in the yields of government bonds in the euro area, whereas the yields of corporate bonds only slightly changed. This increase in yields, entailing a decrease in sovereign bond prices, explains the negative performance of the EUR-denominated bond UCIs for the month under review.

In the United States, the prices of the USD-denominated bonds remained rather unchanged under the effect of, on the one hand, the appeasing trade tensions with China and, on the other hand, the decrease in the FED’s key interest rates. Within the context of the USD vs. EUR depreciation, the USD-denominated bond UCI category registered an overall downward trend.

Although the prices of emerging markets bonds remained relatively stable as a whole – despite the idiosyncratic risks which affected certain specific countries – the depreciation of some emerging currencies and of the USD vs the EUR made emerging country bond UCIs finish the month negatively.

In October, the category of fixed-income UCIs registered an overall positive net capital investment.

Development of fixed-income UCIs during the month of October 2019*

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of October 2019*

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following eight undertakings for collective investment have been registered on the official list:

1) UCITS Part I 2010 Law:

- APO EMERGING HEALTH, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- MELUSINA INVESTMENTS, 49, avenue J-F Kennedy, L-1855 Luxembourg

- ROTHSCHILD & CO WM FUND, 5, allée Scheffer, L-2520 Luxembourg

2) UCIs Part II 2010 Law:

- –

3) SIFs:

- GC HAEK FUND S.A., SICAV-FIS, 6, avenue Marie-Thérèse, L-2132 Luxembourg

- HOVE SICAV – SIF, 30, boulevard Royal, L-2449 Luxembourg

- SIEGFRIED SUPPLY CHAIN FINANCE FUND S.C.A., SICAV-SIF, 33A, avenue J-F Kennedy, L-1855 Luxembourg

- TISHMAN SPEYER EUROPEAN REAL ESTATE VENTURE VIII MASTER FUND S.C.A. SICAV-SIF, 34-38, avenue de la Liberté, L-1930 Luxembourg

4) SICARs:

- HURUMA FUND S.C.A., SICAR-EuSEF, 30, Boulevard Royal, L-2449 Luxembourg

The following 30 undertakings for collective investment have been deregistered from the official list during the month under review:

1) UCITS Part I 2010 Law:

- ALTKÖNIG FUNDS, 15, rue de Flaxweiler, L-6776 Grevenmacher

- BARING RUSSIA FUND, 6, rue Lou Hemmer, L-1748 Senningerberg

- CHILTON UCITS, 6, rue Lou Hemmer, L-1748 Senningerberg

- DJE CONCEPT, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- HAAS UCITS, 5, allée Scheffer, L-2520 Luxembourg

- JSS MULTI LABEL SICAV, 11-13, boulevard de la Foire, L-1528 Luxembourg

- MAINSKY MACRO NAVIGATION FUND, 4, rue Thomas Edison, L-1445 Strassen

- VAB PRÄMIEN PLUS, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- WORLD STRATEGY PORTFOLIOS, 44, rue de la Vallée, L-2661 Luxembourg

2) UCIs Part II 2010 Law:

- MIRALT SICAV, 15, avenue J-F Kennedy, L-1855 Luxembourg

- TAUNUS TRUST II, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- WALLBERG REAL ASSET, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

3) SIFs

- AIS STRATEGIC INVESTMENT FUND, 42, rue de la Vallée, L-2661 Luxembourg

- AURYN, 4, rue Jean Monnet, L-2180 Luxembourg

- BTMU – PIMCO US INTERMEDIATE CORPORATE FUND, 287-289, route d’Arlon, L-1150 Luxembourg

- CAJAS ESPAÑOLAS DE AHORROS II SICAV, 60, avenue J-F Kennedy, L-1855 Luxembourg

- CAPLANTIC AIF, SICAV-SIF S.C.SP., 80, route d’Esch, L-1470 Luxembourg

- ESKATOS, 20, boulevard Emmanuel Servais, L-2535 Luxembourg

- FANISI VENTURE CAPITAL FUND S.C.A., SICAV-SIF, 42, rue de la Vallée, L-2661 Luxembourg

- FLEURON FUND, 291, route d’Arlon, L-1150 Luxembourg

- FOREVER FUNDS SICAV-SIF, 12, rue Eugène Ruppert, L-2453 Luxembourg

- HISTORIC & TROPHY BUILDINGS FUND, 5, allée Scheffer, L-2520 Luxembourg

- MUGC/UGA US INTERMEDIATE CORPORATE BOND FUND, 287-289, route d’Arlon, L-1150 Luxembourg

- MUGC/WA ASIAN USD BOND FUND, 287-289, route d’Arlon, L-1150 Luxembourg

- SQUARE CAPITAL ASSET SICAV-SIF, S.C.A., 5, rue Jean Monnet, L-2180 Luxembourg

- THE NEW CENTURY FUND, 15, avenue J-F Kennedy, L-1855 Luxembourg

- TIMBERCREEK REAL ESTATE FUND, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- VIOLALUX SICAV-SIF, 2, place François-Joseph Dargent, L-1413 Luxembourg

- VOLKSBANK HEILBRONN ASSET ALLOCATION HQLA, 308, route d’Esch, L-1471 Luxembourg

4) SICARs:

- TERRA VENTURE PARTNERS S.C.A., SICAR, 30, boulevard Royal, L-2449 Luxembourg