Profit and loss account of credit institutions as at 30 September 2019

Press release 19/61

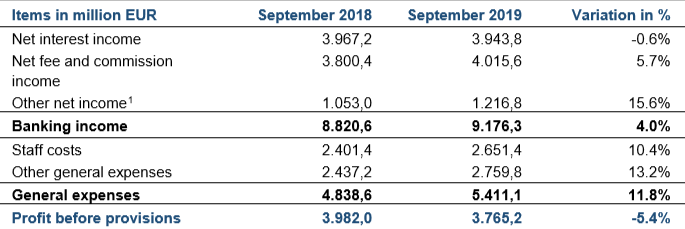

Profit before provisions of the Luxembourg banking sector amounts to EUR 3,765.2 million at the end of the third quarter of 2019, a decrease of 5.4% compared to the same period of the previous year.

As regards income, net interest income fell by 0.6% in aggregate terms. Yet, half of the credit institutions recorded a growing net interest income resulting from an increased business volume and an improved average return rate on assets. The application by the European Central Bank of negative interest rates on the deposit facility continues to pose a real challenge for credit institutions. In order to offset the negative interests paid on assets, some banks now apply negative interest rates on the deposits collected from professional customers and have started extending this practice to high net worth individuals.

Net fee and commission income rose by 5.7%, reflecting the positive development of asset management and financial asset keeping activities. However, only 45% of the banks recorded an increase in their net fee and commission income, In addition, the scale of the growth originates primarily from a few credit institutions whose increase in business volume is closely linked to the Brexit.

As in previous quarters, general expenses continued to rise sharply (+11.8%). This rise concerns other general expenses (+13.2%) as well as staff costs (+10.4%). Although most banks recorded an increase in general expenses, the magnitude of this growth mainly originates from the mobilisation of human and technical means necessary to manage the banking activities transferred to some credit institutions in view of the Brexit.

The above-mentioned developments result in a deterioration of the cost-to-income ratio which moved from 55% to 59% at the end of the third quarter of 2019. This negative trend shows the difficulty of banks to maintain their profitability.

Profit and loss account as at 30 September 2019

1 Including dividends received.