Examination of non-financial information published by certain issuers for 2018 financial year

1. Executive Summary

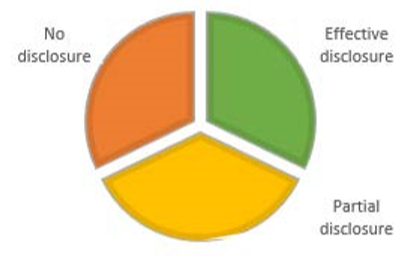

The financial year ending 31 December 2018 marked the second year of the application of the Law of 23 July 20161 (“Law”). Overall, the level of disclosure in relation to environmental, social, employee, respect for human rights, anticorruption and bribery matters in the non-financial statement of issuers covered by the Law improved compared to the previous year, showing not only an increased level of compliance with the Law, but also a genuine integration of these matters into the lifecycle of companies.

The report is structured around the guidance provided by the non-binding Guidelines issued by the European Commission which set out key principles for providing useful, relevant and comparable information. In order to provide such information, entities should first identify the matters that are significant (materiality assessment); such material information improves the relevance of their non-financial statements. However, materiality is a fundamental concept that is not yet applied equally by all reviewed issuers.

On the positive side, the non-financial statements are generally fair, understandable, comprehensive and oriented towards the entity’s stakeholders. They are, however, not always well balanced.

With respect to the content of the non-financial statements, the entities’ policies and, to some extent, the use of key performance indicators, are the aspects of the Law that are dealt with the most effectively. However, there is still room for improvement in certain areas where a higher level of disclosure is expected for the next non-financial statements, in particular:

- the description of the entity’s business model incorporating the sustainability criteria;

- the due diligence process in place to ensure that the entity achieves concrete objectives; and

- the key risks related to the matters foreseen in the Law and their management.

2. General Background

Regulatory and legal framework

As from 1 January 2017, the Law of 23 July 2016, implementing the European Directive 2014/95/UE2, requires certain large undertakings and groups to provide additional non-financial and diversity disclosures including, for public interest entities which fulfil the conditions listed in paragraph (1) of Article 68bis of the Law of 19 December 20023 on a non-consolidated basis, or in paragraph (1) of Article 1730-1 of the Law of 10 August 19154 on a consolidated basis, a nonfinancial statement containing information relating to, as a minimum, environmental, social and employee matters, respect for human rights, anti-corruption and bribery matters.

As part of its mission to supervise securities markets, the CSSF is, in particular, responsible for the control of the financial reports published by issuers of securities. This activity aims to ensure compliance of financial information with applicable accounting standards, but also covers topics related to other parts of the annual report, including nonfinancial information.

The CSSF fulfils its enforcement diligences in accordance with the Transparency Law5 conferring on the CSSF the power to control the relevant information published by issuers of securities governed by said law. Enforcement is, thus, an ex post control of such information published by issuers.

Purpose and scope of the examination

On 10 January 2019, the CSSF published the results of the first examination it had carried out on the relevant nonfinancial publications for 2017. The purpose of this examination was mainly to find out how and to which extent Issuers complied with the new disclosure obligations. The focus was put, in particular, on the information Issuers have chosen to disclose, by topic, as well as on the non-performance indicators presented.

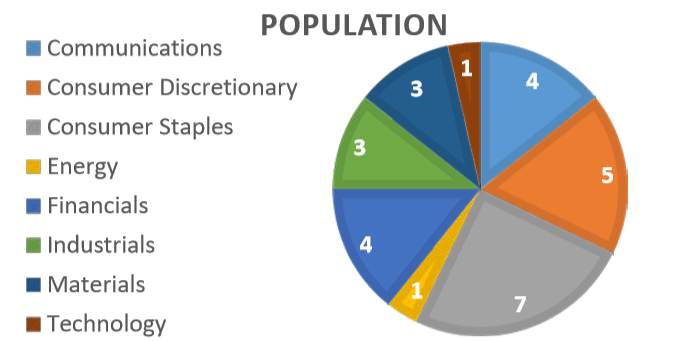

The focus of this second examination was to review, from a more qualitative perspective, how the key principles introduced by the Guidelines have been applied in order to understand how Issuers are effectively preparing high quality, relevant, useful, consistent and more comparable non-financial information. In total, the number of Issuers subjected to examination was 28. Based on the Bloomberg Industry Classification Standard6, this population is spread across 8 out of the 10 existing macro-sectors.

Methodology

The examination was performed on the basis of the guidance provided by the Guidelines. Although they are nonbinding by nature, they have been foreseen by the recitals of the NFI Directive as a key document with a view to facilitating the disclosure of non-financial information by undertakings.

Those Guidelines are proposed within the remit of the reporting requirements provided for under the NFI Directive. While the European Commission has prepared these Guidelines to develop a principle-based methodology relevant to companies across all economic sectors, taking into account best practices and the results of related initiatives, both within the EU and at international level, they also encourage companies to avail themselves of the flexibility under the NFI Directive when disclosing non-financial information.

The Guidelines mainly focus on the two aspects of the non-financial statement, i.e. the key principles governing its drawing-up and the minimum content to include. This report revolves primarily around the 6 principles that should be implemented to produce effective information. These key principles, listed in sections 3.1 to 3.6 of the Guidelines, recommend disclosing information that is (i) material, (ii) fair, balanced and understandable, (iii) comprehensive but concise, (iv) strategic and forward-looking, (v) stakeholders-oriented and (vi) consistent and coherent. Where appropriate, links are made between those principles and the minimum content of the non-financial statement, i.e. for all matters covered at a minimum by the NFI Directive: the entity’s business model, its policies and due diligence process, the outcome of these policies, the principal risks related to those matters and the key performance indicators relevant to the particular business.

In this document, the CSSF issues recommendations that are in line with the Guidelines in order to improve the qualitative and quantitative disclosures made by Issuers when preparing their non-financial statement, with the ultimate purpose of fostering comparability between information, while strengthening entity-specific aspects of information necessary to the user of non-financial information.

In some cases, reference is made to reporting frameworks, but this does not mean that the CSSF prefers to opt for one of these frameworks.

3. Review of the key principles enacted by the Guidelines

Principle 1 – Disclosure of material information

The starting point of the establishment of a non-financial statement is to define which matters to address in it. The new Articles 19a and 29a of the Accounting Directive 2013/34/EU, inserted by the NFI Directive, refer to “[…] information to the extent necessary for an understanding of the undertaking’s development, performance, position and impact of its activity […]” and set, as a minimum, environmental, social and employee matters, respect for human rights, anticorruption and bribery matters. The application of the materiality principle is fundamental as Issuers need to determine which of the policies in relation to the non-financial matters need to be disclosed. A key element of the guidance is that any disclosure would take into account the entity’s specific circumstances.

Such disclosure shall include not only a description of the matters which have been assessed as material to the entity, but also the internal procedures which have been set forth and how the process was conducted, as well as the people involved (i.e. third-parties and stockholders consulted for that purpose) in the selection of those matters. Good practices result in the presentation of the materiality’s assessment under a matrix form, showing matters relevant for the entity and its shareholders, or the impact of these matters on the entity’s business. This type of disclosure, while not mandatory, provides valuable information to the user of the non-financial statement about how sustainability factors are considered as well as their relative importance as compared to the entity’s activities.

“Issuers tend to disclose information on the non-financial matters required by the Law regardless of their materiality”

The examination shows that, in general, Issuers still tend to disclose information on the non-financial matters required by the Law regardless of their materiality. Thus, some Issuers apply a ‘tick-the-box’ approach or provide boilerplate information in order to appear to be in compliance with the Law. However, it does not seem appropriate to consider that all non-financial matters are of the same prominence for each entity or sector. The contextualisation of the information is a major component of the materiality analysis, which should help Issuers to select information for which they can provide a relevant content.

However, a satisfactory observation is that where the materiality analysis is provided, Issuers usually disclose (an) additional matter(s) which is (are) material to them, in addition to those required by the Law.

In this critical exercise, the Global Reporting Initiative (’GRI’) and the International Integrated Reporting Council (‘<IR>’), two non-profit organisations encouraging companies to further disclose their impacts on non-financial matters, have both issued publications7,8 and/or a standard9 to help define materiality and set the reporting boundary. These documents are useful to guide the Issuers in their identification process.

Accordingly, the CSSF urges Issuers to explain, in their non-financial statement, their process to determine materiality in the context of the non-financial information as well as its outcomes. Issuers are reminded to disclose in their non-financial statement only the matters which are material to them. Providing immaterial information does not meet the objective of the Law and may distract the attention from material information. Going forward, Issuers are also expected to provide, on a regular basis, an update of their materiality assessment to ensure that matters addressed in their declaration remain relevant in their context.

The CSSF also wishes to remind Issuers of the dual materiality principle set out in paragraph 3.1 of the Guidelines, which considers both the impact of the non-financial matters on Issuers, including any dependencies, and the impact of Issuers on non-financial matters. It would also like to remind that, as part of the enforcement priorities for 2019 financial statements, the materiality principle has been identified as one of the key general aspects that the CSSF will continue to scrutinize.

Policies and due diligence process

Having assessed which matters are material, Issuers are also required to provide a fair view of their policies. The Guidelines recommend entities to consider disclosures on their approach to key non-financial aspects, their main objectives, and how they are planning to deliver on those objectives and implementing those plans. In particular, an entity may explain its management and board’s responsibilities and decisions, and how resource allocations relate to these objectives.

Two thirds of the Issuers explain the governance aspects in relation to the information provided in this context in their non-financial statement, by describing key personnel responsibilities and decisions. However, only half of them provide detailed information in relation to the implementation of the policies.

Beyond the disclosure of policies, the Law requires entities to disclose due diligence processes relating to these policies, and by extension to the risk management and outcomes, which aim to ensure that entities deliver against concrete goals.

Due diligence processes do not only apply to policies related to non-financial matters: the Guidelines also require Issuers to provide material disclosures on due diligence implemented on their suppliers and subcontracting chains, where relevant and proportionate.

The disclosure of the due diligence processes is a mandatory requirement of the Law that is too often omitted by Issuers. They are required, when applicable, to provide a description of how to ensure the effectiveness of their policies in place. This element is also the necessary bridge between the disclosure of policies and their outcome.

Outcome of the policies

While many Issuers do not disclose the description and/or effectiveness of their due diligence processes, they satisfactorily provide a useful and fair view of the outcome of their policies. Obviously, the level of disclosure is not of the same quality amongst Issuers but at a minimum, qualitative and/or quantitative information provides users with the results of the policies previously described.

Similarly, Issuers do not generally make or explain the relationship between financial and non-financial outcomes. Indeed, implementing non-financial policies covering environment, employee and social matters is often costly to the entity on the one hand, but on the other hand, they will probably generate positive financial effects and savings over time (for instance benefits expected from reduction of greenhouse gases, improvement of health and safety at work, or support to the communities).

Consequently, Issuers are encouraged to assess and evaluate the financial outcomes and benefits of the application of their policies on the non-financial matters over time in order to highlight that such policies are not only building their corporate and social responsibility, but they can likewise turn out as competitive advantages as part of their long-term strategy.

Principle 2 – Fair, balanced and understandable information

The fairness and the balance of the information, which aims to give an equal consideration to favourable and unfavourable aspects, was maybe the most difficult to assess in the context of this examination.

While the CSSF has noted that Issuers overall present the information in an objective way, i.e. not in a promotional way, relying on facts rather than on interpretation, and that the tone remains neutral, it regrets that unfavourable aspects are omitted at least nine times out of ten. Issuers rely on facts when presenting, as an example, the outcomes of their policies but hardly mention when they met difficulties or failed to achieve their objectives. Instead, the emphasis is set on progress made or on short-term expectations. A similar kind of unbalanced information occurs when Issuers describe their strengths, but do not elaborate on their vulnerabilities.

“Unfavourable aspects are omitted nine times out of ten”

Regardless of the above, the understandability of the statement is never compromised and the terminology used by Issuers, when not standard, is accompanied by a glossary (one Issuer out of four provides a glossary). However, boilerplate terminology has unfortunately still a large place in the statements, in particular when describing some of the policies applied on non-financial matters like human rights and anti-corruption and bribery. Even if the objectives of these matters are more standardised, entities must remain as specific as possible.

The Guidelines present another interesting aspect in relation to the understandability of information, i.e. “a company should explain the scope and boundaries of the information disclosed, in particular when certain information relates only to one or several of its segments, or excludes specific segments”.

As regards this aspect, the CSSF has observed that Issuers often present the information globally, without distinguishing between their different segments, and without excluding segments from the scope. In a few cases however, Issuers present the information separately as their activities are very different from one another; aggregate information would therefore not be relevant to the user of the information.

Good practices include the presentation of information by geographical areas, but also a presentation by brand or by product.

The Guidelines also mention that a combination of narrative reporting, quantitative information and visual presentation makes communication more effective and transparent. It has been noted that for half of the Issuers, these three criteria are well balanced. Narrative information without figures is not helpful to the user of information to make a proper assessment as to whether an Issuer has met its targets, and neither would be the presentation of figures without appropriate explanations. While the visual information is more often omitted (25% of the Issuers do not provide visual information), it can help the reader to develop a condensed and structured view of the information.

Finally, the Guidelines require entities to disclose assumptions and limitations to their non-financial statement, sources of information provided and/or the methodology applied in disclosing the information, which is done by hardly 25% of Issuers.

Issuers are urged to present a more fair and balanced view of their activities taking into account the unfavourable aspects of their business when describing their activities, as well as the unfortunate events which occurred during the period covered by the information, meaning that difficulties and issues should also be disclosed. Such omissions can create prospectively a prejudicial bias in the opinion of the readers of the statement, should undisclosed or unexpected events materialise with negative consequence for the entity, or its environment.

Also, the momentum for environmental matters such as climate change may induce Issuers to disclose more or only favourable information to embrace this momentum.

Similarly, delays in the execution of a mid- or long-term strategy on non-financial matters, or divulgation of outcomes which do not meet expectations should be more emphasised, as a similar bias may be perceived by a user of the information comparing such information year after year.

Objectives cannot be modified without notice.

Principle 3 – Comprehensive but concise information

While the Law states that the entities concerned shall include information relating to, as a minimum, environmental, social and employee, respect for human rights, anti-corruption and bribery matters, it does not mean that an entity addressing all of these matters provides comprehensive information.

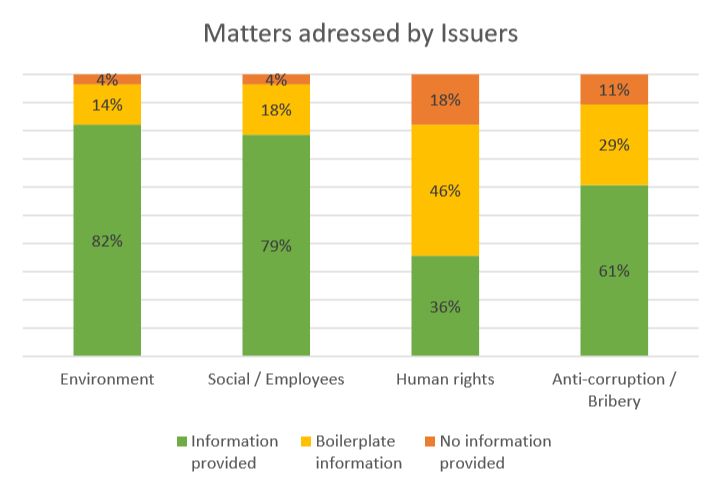

Accordingly, any material information aiming at providing a comprehensive view of the undertaking’s development, performance, position and impact of its activity must be disclosed. In their 2018 statements, Issuers address the required matters as follows:

A positive observation is that most of the time, non-financial statements, where presented, include, in a non-boilerplate form, information regarding environmental, social and employee matters. Information however remains significantly boilerplate when addressing anti-corruption and bribery matters, and too often meaningless when addressing human rights.

In some cases however, these matters are not addressed at all. Accordingly, in accordance with the Law, the Issuers concerned must provide a clear and reasoned explanation where they do not pursue policies in relation to one or more of those matters.

“Issuers must provide a clear and reasoned explanation where they do not pursue policies in relation to one or more of those matters”

As part of the examination, it has been noted that only one third of Issuers disclose more than the minimum matters required by the Law. Such additional matters often include supply chain, but a broad range of other topics across industries was observed: legal matters related to anti-terrorism and embargoes, innovation, product responsibility, procurement, customer (or tenants) satisfaction.

The CSSF still considers that, based on the current situation, the non-financial statement does not always provide a comprehensive information for approximately a third of the Issuers. The CSSF also encourages Issuers to go beyond the minimum requirements of the Law. Full compliance is only achieved if the objectives of the non-financial statement have been met.

While non-financial information must be included in the management report, the Law allows the preparation of a separate report. A closer look at the relevant paragraph specifies that “Where an undertaking prepared a separate report corresponding to the same financial year (…) and covering the information required for the non-financial statement (…), that undertaking is exempted from the obligation to prepare the non-financial statement”.

As of 31 December 2018, the publication of a separate report has become the main trend amongst Issuers, as more than half of them published on their website a report which is generally referred to as a “corporate sustainability report”. However, the CSSF reminds Issuers that, should they prepare a separate report, it must address at a minimum all the non-financial matters referred to in the Law. Information cannot be split between different reports.

Furthermore, there are still Issuers publishing a separate report which is not cross-referenced in their annual report as required by the Law, although the number of instances of such omissions has decreased as compared to last year.

Issuers are reminded, as suggested by the Guidelines, to summarise information, focus on material information, remove generic information, limit details, avoid elements that are no longer relevant, use cross-reference and signposting, etc. With regard to the separate report, the Law makes it mandatory to explicitly refer to this separate report in the management report, in order to be exempted from the preparation of a non-financial statement.

Principle 4 – Strategic and forward-looking information

Another key principle of the non-financial information outlined by the Guidelines is the link between disclosures and the entity’s strategy. As per Section 3.4 of the Guidelines, “the statement is expected to provide insights into a company’s business model, strategy and its implementation, and explain the short-term, medium-term and long-term implications of the information reported”.

The description of the entity’s business model is the starting point of the management report as it should include a description of its activities, its strategy, and a synthetic representation of the major aspects of its business: the entity’s products or services, its clients, its supply chain, its manufacturing processes, etc. It is a picture, ideally simple and understandable, of what the entity does, how, where and for whom.

The Guidelines provide orientation on the topics to be covered to gain a comprehensive view of the activity of an entity. 60% of the Issuers have appropriately integrated the non-financial matters in the representation of their business model and strategy.

It has also been noted that 40% of Issuers presenting their business model disclose non-financial Key Performance Indicators (“KPIs”, which are further discussed in this report) in order to illustrate their model in addition to the narrative explanation. Such information is recommended by the Guidelines in order to help readers of information get a better picture of the entity’s business model.

With regard to the horizon, 60% of the Issuers disclose their short-term objectives, but only 30% of them with a longterm view. Also, while Issuers present their strategy with different perspectives, only one Issuer out of four provides a view over time (i.e. short, medium and long term).

Forward-looking information should be accompanied by data, such as targets and/or benchmarks, in order to help investors and stakeholders to put the entity’s performance into context. Such objectives provide the reader of information with a quantitative representation of the strategy.

In practice, a majority of Issuers disclose some targets, whether in quantitative terms or qualitative terms, or both, in particular in relation to environmental matters for which, in general, objectives set by entities are the most numerous, and sometimes the most ambitious.

Benchmarks are usually not used by Issuers, i.e. entities do not measure their own performance against standards or other points of reference. This trend may be driven by a low availability of benchmarks relating to those matters, or across the sectors.

Separately, it was observed that some Issuers make strong commitments which are quantifiable or linked to regulation or worldwide objectives. A fair example of the latter provided by an Issuer is the respect of the Paris Agreement to mitigate global warming (from the main objective to keep the increase in global average temperature to well below 2°C, the European Union took steps to implement its target to reduce greenhouse gases emissions by at least 40% by 2030).

Finally, the presentation of objectives would be irrelevant for the reader of the statement if it is not accompanied by an update of where the entity stands. This is nearly unanimously understood as more than 70% of the Issuers presenting KPIs present progress towards targets. This result is expected to be even higher in the next year(s) as some Issuers were presenting their non-financial statement for the first time in 2018 following notifications sent by the CSSF last year.

The CSSF reminds Issuers that, in accordance with the Guidelines, they may consider specific disclosures explaining what makes their production methods competitive and sustainable. Issuers are also encouraged to use non-financial KPIs to explain their business model. The short-term is prevailing in the reviewed non-financial statements, being clearly unsatisfactory. Issuers must present their medium- and long-term objectives in order to allow the users of the information to understand the vision of the entity in addition to its short term objectives, and thus to follow its progress over years.

Principle 5 – Stakeholder oriented information

The Guidelines remind entities that they are expected to consider the information needs of all relevant stakeholders. They should also focus on information needs of stakeholders as a collective group, rather than on the needs or preferences of individual or atypical stakeholders, or those with unreasonable information demands. In that context, no significant bias in the information provided by Issuers was noted.

Based on this review, good practices include a presentation on the identification and selection of the key internal and external stakeholders with whom the entity should engage. This step can generally be included as an integral part of the determination of the material information.

Principle 6 – Consistent and coherent information

The non-financial statement is expected to be consistent with other elements of the management report. In other words, whether non-financial information is published in the management report or in a separate document, it must neither convey a different message to investors, nor should the management disclose facts that would not be consistent with the information presented elsewhere.

However, the Guidelines go further and specify that, in that context, “Making clear links between the information presented in the non-financial statement and other information disclosed in the management report makes the information more useful, relevant and cohesive”.

More than 80% of Issuers do not make or explain linkages between documents, which must be done as much as possible when contents are related to each other, making it easier to understand interdependencies and creating a coherent document.

Examples of linkages between financial and non-financial reports include, for instance, complementary information on risks related to financial matters (please also refer to ‘Principal risks and their management hereafter). It should also ideally include linkages between non-financial and financial information.

Consistency should also be observed over time to enable the users of information to compare past and present changes in the entity’s development, position, performance and impact. Such consistency should particularly be made in the choice and methodology of KPIs. However, no significant year-to-year changes in information provided by Issuers were noted.

Consistency of information, internally and externally, is essential and generally observed across Issuers. However, the CSSF encourages building linkages between sections of the management report or between the separate report and the annual report. By doing so, the reading and understanding of information, whether financial or non-financial, will be made easier for the user.

When applicable, Issuers are expected to explain any changes in reporting policy or methodology, the reasons for changing them and their effects.

4. Other considerations in relation to the minimum content

While the Guidelines provide guidance on the key principles to be applied when drawing up the non-financial statement, it also provides orientations on the minimum content to include. Observations in relation to an entity’s business model, its policies and due diligence process, and the outcomes have already been detailed in the previous section of this report. Other items to be disclosed in the non-financial statement include information on risks as well as key performance indicators, on which the CSSF also has significant observations.

Principal risks and their management

The Law states that the non-financial information must contain information on “the principal risks related to those matters linked to the undertaking’s operations including, where relevant and proportionate, its business relationships, products or services which are likely to cause adverse impacts in those areas, and how the undertaking manages those risks”.

Based on its review, the CSSF has noted a potential misunderstanding of this requirement. Actually, management reports of all Issuers present a section on risk management, including the risk factors and information on how to manage and mitigate these risks. However, while these risks are of both financial and non-financial nature, they do not always include the risks in relation to the non-financial matters covered by the Law. As a matter of fact, less than half of the Issuers disclose risks in relation to their selected non-financial matters and this list sometimes appears to be not comprehensive.

In addition, and in accordance with the guidance provided, a significant number of Issuers present information in relation to their supply chain and business relationships as part of their principal risk and their management.

Good practices would include, in accordance with the Guidelines, a perspective on short, medium and long-term risks in relation to non-financial matters. However, there are still some instances where the Issuers’ approach is still limited to the short term, similarly to what was discussed before.

Issuers are requested to consider risks in relation to non-financial matters beyond those already disclosed in their annual report and where appropriate, make links between the risk management section of the management report and the non-financial statement, or to the separate report.

Key performance indicators

Last but not least, the Law requires the non-financial statement to include indicator-based disclosures that the Guidelines complement with material narratives. The issue of KPIs was already addressed in this document but it can be stressed that KPIs have an essential role in the non-financial statement as they are a measure of the entity’s development, performance, position and impact of its activity on the one hand and they improve comparability between entities and/or sectors on the other hand.

The KPIs reported by Issuers could mainly be grouped into three categories:

- general KPIs, which are commonly recognised across a wide variety of entities, regardless of their sectors and activities. These indicators are broadly used across all the non-financial matters;

- sectoral KPIs, which are specific to the entity’s activities. These indicators are developed around thematic issues and allow useful and relevant peer comparisons; and

- entity-specific KPIs, which take into accounts Issuers’ specific circumstances.

Two satisfactory observations are that Issuers consistently use the same indicators over time and provide usually but not always (appropriate) narratives. However, the Guidelines suggest more useful information that entities can disclose, such as:

- frameworks;

- data collection and methodology ; and

- why KPIs increased or decreased in the reporting year, and how KPIs might evolve in the future.

On the first point, half of the Issuers provide information about frameworks they have relied upon to build their disclosures. In that context, the Guidelines provide in their introduction a significant (non-exhaustive) list of such frameworks. Issuers are encouraged to review this list and select the most relevant framework(s) in order to provide information which complies with the principles laid down by the non-binding Guidelines. Also, Issuers can provide more sources of information, when not relying on international reporting frameworks.

Based on the CSSF’s observations, information on data collection or methodology are barely explained. These data, when disclosed, usually stem from regulations and international standards.

Finally, as regards the evolution of the KPIs, there are approximately only 20% of Issuers which disclose information, whether qualitative or quantitative, on the expected evolution of the KPIs. This is directly correlated with the fact that Issuers, although providing targets, do not carry out a proper follow-up on where they stand, and which corrective measures, if any, are needed in order to meet the said objectives.

Overall, Issuers are broadly reporting KPIs which are general and sectoral. They are however encouraged to find more entity-specific indicators which are directly in line with the information reported in the non-financial statement, taking into account the business circumstances. Also, Issuers should provide more linked information in relation to targets, as seen on principle 4 above, to allow the users of non-financial information to understand the evolution of disclosed indicators, and to receive further qualitative explanations where appropriate.

Issuers are also reminded that the Law requires the disclosure of framework(s) relied on, when applicable, to prepare the information included in the non-financial statement.

5. Next steps

Assurance

The Law states that the réviseur d’entreprises agréé (the “approved statutory auditor”) checks whether the (consolidated) non-financial statement or the separate report has been provided. Practically speaking, it means that the approved statutory auditor is not required to assess the content and completeness of the statement, but should check its existence only.

Thus, amongst the Issuers scrutinised, only very few of them have voluntarily undertaken an audit of their non-financial statement. These audits take the form of a limited assurance engagement which covers, for instance, a report framework or a selection of information chosen by the Issuer.

External and independent assurance could foster the reader’s confidence in the reliability of data presented, which otherwise remains at the discretion of the Issuer.

Update of the Guidelines

On 18 June 2019, the European Commission has published guidelines on corporate climate-related information reporting, which in practice consist of a new supplement to the existing Guidelines, which remain applicable. This supplement to the Guidelines will provide companies with practical recommendations on how to better report the impact that their activities are having on the climate as well as the impact of climate change on their business.

While the Guidelines remain non-binding, the CSSF urges issuers to review the new guidance. In addition to the key principles and the minimum content to include in the non-financial statement, it also provides with a non-exhaustive list of examples and KPIs for each thematic aspects that entities are expected to consider when disclosing non-financial information.

Enforcement of financial information

On 19 December 2019, the CSSF has released its priorities in relation to the enforcement of financial information for 2019 financial statements, which include a specific section on the disclosure of non-financial information. In that context, the CSSF will particularly scrutinise certain areas of the non-financial statement, and will carry out an update of this examination in order to continue providing Issuers with recommendations and good practices.

1 The Law of 23 July 2016 on disclosure of non-financial and diversity information for certain large undertakings and groups.

2 Directive 2014/95/UE of the European Parliament and of the Council of 22 October 2014 amending Directive 2013/34/EU as regards disclosure of non-financial and diversity information by certain large undertakings and groups (“NFI Directive”).

3 The Law of 19 December 2002 on the register of commerce and companies and the accounting and annual accounts of undertakings (“Law of 19 December 2002”).

4 The Law of 10 August 1915 on commercial companies (“Law of 10 August 1915”).

5 The Law of 11 January 2008 on transparency requirements for issuers (“Transparency Law”)

6 The Bloomberg Industry Classification Standard supports the investment process by organising legal entities and securities into consistent peer groups according to specific activities and risk categories (source: www.bloomberg.com).

7 Defining What Matters, GRI, 2016

8 Materiality in <IR> – Guidance for the preparation of integrated reports, <IR>, November 2015

9 GRI 103 : Management Approach