Global situation of undertakings for collective investment at the end of January 2020

Press release 20/09

I. Overall situation

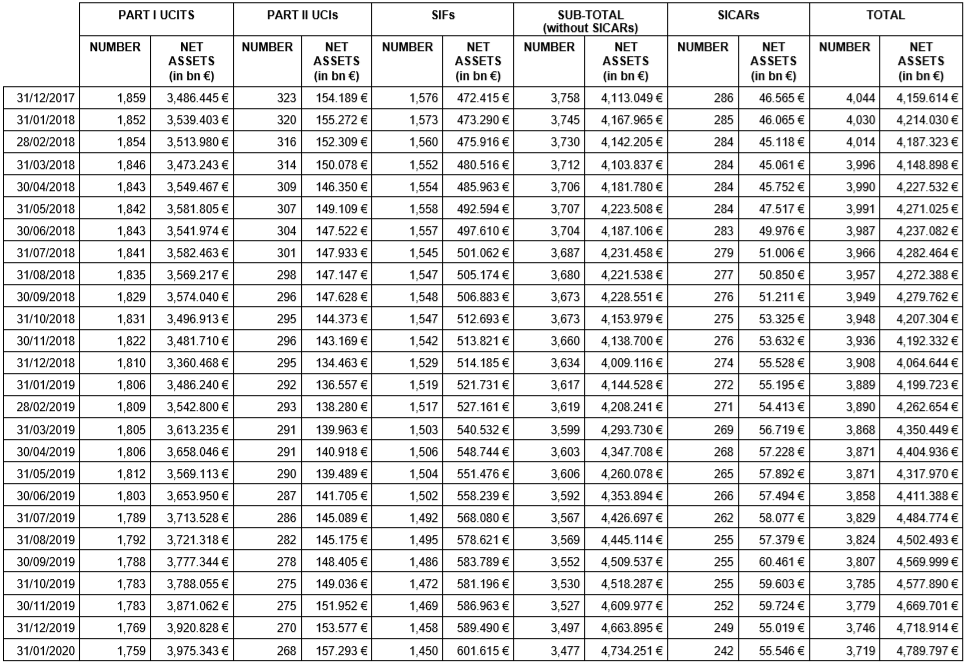

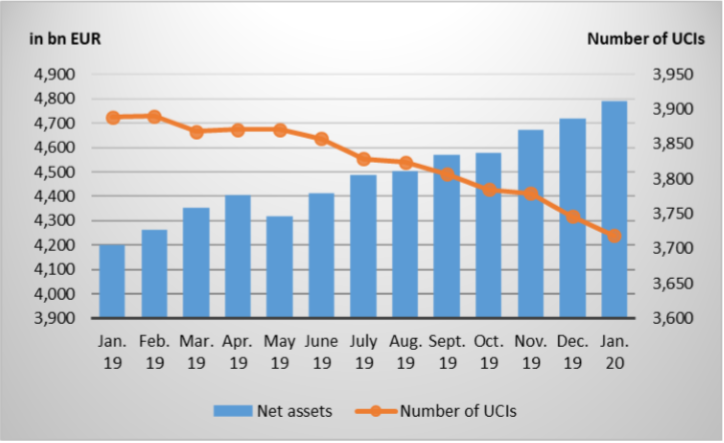

As at 31 January 2020, total net assets of undertakings for collective investment, including UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 4,789.797 billion compared to EUR 4,718.914 billion as at 31 December 2019, i.e. a 1.50% increase over one month. Over the last twelve months, the volume of net assets rose by 14.05%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 70.883 billion in January. This increase represents the sum of positive net issues amounting to EUR 38.100 billion (+0.81%) and of a positive development in financial markets amounting to EUR 32.783 billion (+0.69%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,719 as against 3,746 in the previous month. A total of 2,434 entities adopted an umbrella structure, which represented 13,529 sub-funds. When adding the 1,285 entities with a traditional structure to that figure, a total of 14,814 fund units were active in the financial centre.

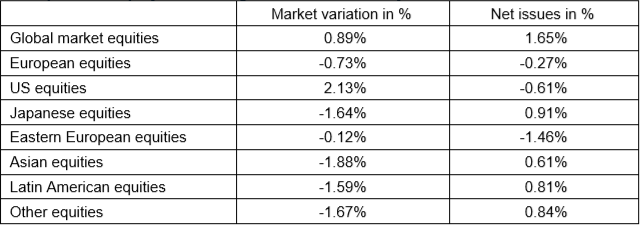

As regards, on the one hand, the impact of financial markets on the main categories of undertakings for collective investment and, on the other hand, the net capital investment in these UCIs, the following can be said about January.

In January, the spread of the coronavirus epidemic in China weighed on financial markets, resulting in a decrease in most equity UCI categories.

As far as developed countries are concerned, the European equity UCIs recorded price decreases linked to this epidemic, despite stable economic figures in Europe and the preliminary trade agreement signed between the US and China in January. The price increases in the US equity UCI category can be explained by the progress made in the Sino-American trade negotiations, higher-than-expected corporate results and the USD appreciation vs. EUR. Japanese equity UCIs recorded a negative performance during the month under review in a context marked by the coronavirus epidemic.

As for emerging countries, Asian equity UCIs registered an overall price decline, mainly as a consequence of the worsening of the coronavirus epidemic in China, despite the fact that the first phase of the US-China trade agreement has been signed and support measures have been launched by the Chinese central bank. Notwithstanding the positive performance of the Russian equity market, the Eastern European equity UCIs have recorded overall negative results linked to the political issues of certain Eastern European countries and the propagation of the epidemic, which adversely impacted the financial markets. Latin American equity UCIs followed this downward trend, accentuated by the decrease in raw material prices and the political issues in certain countries of the region.

In January, the equity UCI categories registered an overall positive net capital investment.

Development of equity UCIs during the month of January 2020*

* Variation in % of Net Assets in EUR as compared to the previous mont

* Variation in % of Net Assets in EUR as compared to the previous mont

On both sides of the Atlantic, government bonds have appreciated as a consequence of a rising risk aversion by investors looking for safe haven investments in a context marked by the spread of the coronavirus epidemic in China and the tensions between the US and Iran. The prices of European and US corporate bonds followed the upward trend, entailing positive results for EUR- and USD-denominated bond UCIs.

Moreover, the appreciation of the USD against the EUR intensified the increase of USD-denominated bond UCIs. Emerging countries bond UCIs recorded a positive performance linked to solid fundamentals in most emerging countries and the preliminary trade agreement between China and the US, despite a slight increase in risk premiums and idiosyncratic risks for certain countries.

In January, the category of fixed-income UCIs registered an overall positive net capital investment.

Development of fixed-income UCIs during the month of January 2020*

* Variation in % of Net Assets in EUR as compared to the previous month

* Variation in % of Net Assets in EUR as compared to the previous month

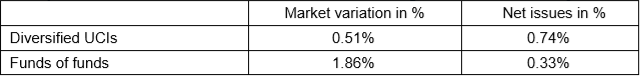

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of January 2020*

* Variation en % des Actifs Nets en EUR par rapport au mois précédent

* Variation en % des Actifs Nets en EUR par rapport au mois précédent

II. Breakdown of the number and net assets of UCIs

During the month under review, the following 10 undertakings for collective investment have been registered on the official list:

1) UCITS Part I 2010 Law:

- NIXDORF UMBRELLA, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- RAVEL ASSOCIATES SICAV, 12, rue Eugène Ruppert, L-2453 Luxembourg

- UI I, 15, rue de Flaxweiler, L-6776 Grevenmacher

- UNIAUSSCHÜTTUNG KONSERVATIV, 308, route d’Esch, L-1471 Luxembourg

2) UCIs Part II 2010 Law:

- SYMBIOTICS SICAV II, 106, route d’Arlon, L-8210 Mamer 3) SIFs:

- AB PRIVATE CREDIT INVESTORS MIDDLE MARKET DIRECT LENDING FEEDER FUND, SICAV-SIF S.C.SP., 2-4 rue Eugène Ruppert, L-2453 Luxembourg

- AB PRIVATE CREDIT INVESTORS MIDDLE MARKET DIRECT LENDING FUND, SICAV-SIF S.C.SP., 2-4 rue Eugène Ruppert, L-2453 Luxembourg

- FONDACO PRIVATE MARKETS FUND, 146, boulevard de la Pétrusse, L-2330 Luxembourg

- LATIN AMERICAN GREEN BOND FUND S.A., SICAV-SIF, 31, Z.A. Bourmicht, L-8070 Bertrange

3) SIFs:

- AB PRIVATE CREDIT INVESTORS MIDDLE MARKET DIRECT LENDING FEEDER FUND, SICAV-SIF S.C.SP., 2-4 rue Eugène Ruppert, L-2453 Luxembourg

- AB PRIVATE CREDIT INVESTORS MIDDLE MARKET DIRECT LENDING FUND, SICAV-SIF S.C.SP., 2-4 rue Eugène Ruppert, L-2453 Luxembourg

- FONDACO PRIVATE MARKETS FUND, 146, boulevard de la Pétrusse, L-2330 Luxembourg

- LATIN AMERICAN GREEN BOND FUND S.A., SICAV-SIF, 31, Z.A. Bourmicht, L-8070 Bertrange

4) SICARs:

- CREDIT SUISSE AMOON 2 SCA SICAR, 3, rue Jean Piret, L-2350 Luxembourg

The following 37 undertakings for collective investment have been deregistered from the official list during the month under review:

1) UCITS Part I 2010 Law:

- ALLIANZ GLOBAL INVESTORS FUND II, 6A, route de Trèves, L-2633 Senningerberg

- AMUNDI ISLAMIC, 5, allée Scheffer, L-2520 Luxembourg

- CHANCENGARANT, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- DEKA-INSTITUTIONELL GARANTIEKONZEPT, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- DEKA-PB WERTERHALT 2Y, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- JB STRUKTUR, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- METHOD INVESTMENTS SICAV, 2, rue d’Alsace, L-1122 Luxembourg

- MULTI LEADERS FUND DEFENSIVE RETURN, Charles-de-Gaulle-Platz 1, D-50679 Köln(1)

- MULTI LEADERS FUND DYNAMIC GROWTH, Charles-de-Gaulle-Platz 1, D-50679 Köln(1)

- PERGAM FUNDS, 5, allée Scheffer, L-2520 Luxembourg

- SILVER TIME LOQ EQUITY SICAV, 5, allée Scheffer, L-2520 Luxembourg

- STARCAPITAL EMERGING MARKETS, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- UNIINSTITUTIONAL RISK PREMIA, 308, route d’Esch, L-1471 Luxembourg

- WORLD INVESTMENT OPPORTUNITIES FUNDS, 44, rue de la Vallée, L-2661 Luxembourg

2) UCIs Part II 2010 Law:

- CORPORATE II, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- CORPORATE III, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- CREDIT SUISSE PRIME SELECT TRUST (LUX), 5, rue Jean Monnet, L-2180 Luxembourg

3) SIFs

- ALPHA WEALTH MANAGEMENT FUND-SIF, 2, boulevard de la Foire, L-1528 Luxembourg

- BGV BAYERISCHE GRUNDVERMÖGEN III SICAV-FIS, 12C, rue Guillaume Kroll, L-1882 Luxembourg

- IMMOBILIA FUND, 19, rue Eugène Ruppert, L-2453 Luxembourg

- PREMIUM SICAV SIF, 5, rue Jean Monnet, L-2180 Luxembourg

- S. U. P. AQUARIUS SICAV-FIS, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- S. U. P. LIBRA SICAV-FIS, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- S. U. P. PREMIUM II, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- S. U. P. PREMIUM III, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- S. U. P. PREMIUM IV, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- S. U. P. PREMIUM V, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- S.U.P. SCORPIO SICAV-FIS, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- TAUNUS TRUST FAMILIENFONDS SICAV-FIS, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

4) SICARs:

- BR ARTEMIS S.A R.L. SICAR, 15, boulevard F.W. Raiffeisen, L-2411 Luxembourg

- CAIVS S.C.A. SICAR, 5, allée Scheffer, L-2520 Luxembourg

- EXPANSION 17 S.C.A., SICAR, 5, rue Pierre d’Aspelt, L-1142 Luxembourg

- GLOBAL PERFORMANCE 17 S.C.A., SICAR, 5, rue Pierre d’Aspelt, L-1142 Luxembourg

- IBERIAN CAPITAL III SICAR, 6, rue Eugène Ruppert, L-2453 Luxembourg

- LUPERCALE S.A., SICAR, 1b, rue Jean Piret, L-2350 Luxembourg

- ORANJE-NASSAU DÉVELOPPEMENT S.C.A., SICAR, 5, rue Pierre d’Aspelt, L-1142 Luxembourg

- RUSNANO SISTEMA SICAR S.A., 42, rue de la Vallée, L-2661 Luxembourg

(1) Undertaking for collective investment for which the designated management company was authorised by the competent authorities of another Member State in accordance with Directive 2009/65/EC.