Global situation of undertakings for collective investment at the end of March 2020

Press release 20/12

I. Overall situation

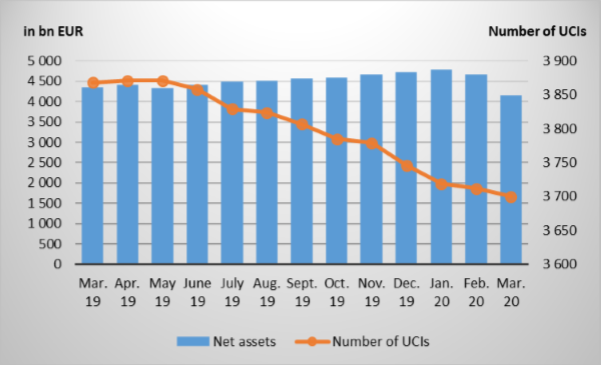

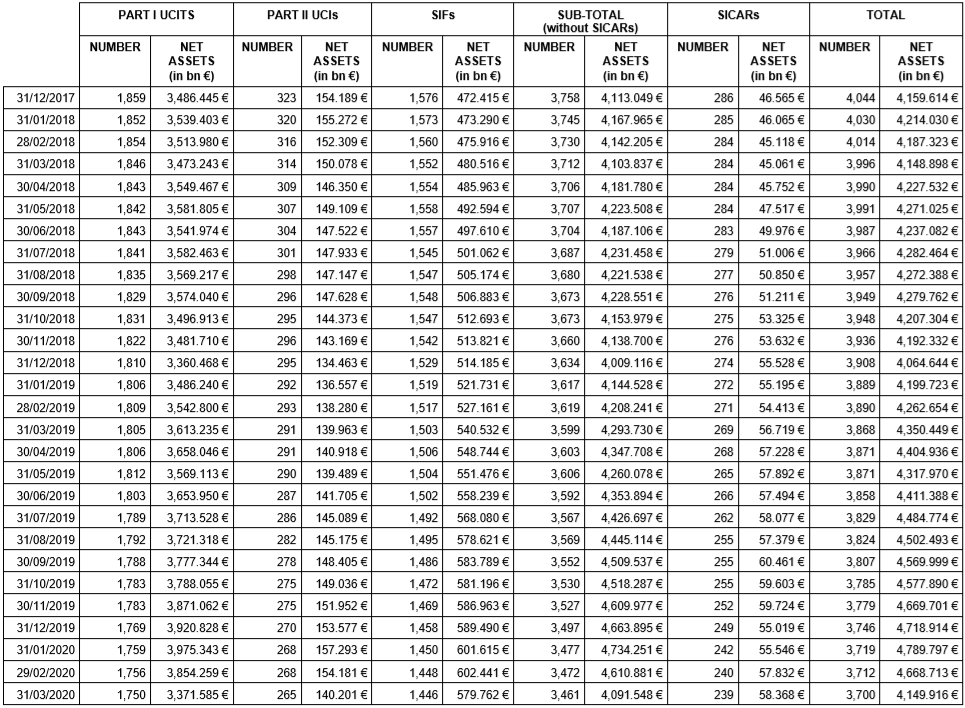

As at 31 March 2020, total net assets of undertakings for collective investment, including UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 4,149.916 billion compared to EUR 4,668.713 billion as at 29 February 2020, i.e. an 11.11% decrease over one month. Over the last twelve months, the volume of net assets decreased by 4.61%.

The Luxembourg UCI industry thus registered a negative variation amounting to EUR 518.797 billion during the month of March. This decrease represents the balance of the negative net issues of EUR 128.179 billion (-2.74%) and the negative development in financial markets amounting to EUR 390.618 billion (-8.37%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,700 as against 3,712 in the previous month. A total of 2,426 entities adopted an umbrella structure, which represented 13,496 sub-funds. When adding the 1,274 entities with a traditional structure to that figure, a total of 14,770 fund units were active in the financial centre.

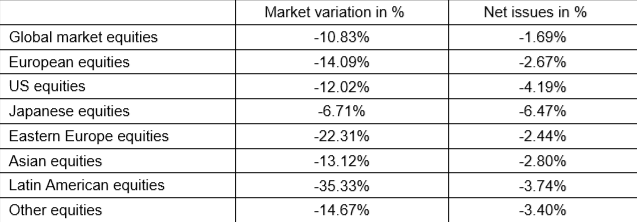

As regards, on the one hand, the impact of financial markets on the main categories of undertakings for collective investment and, on the other hand, the net capital investment in these UCIs, the following can be said about March.

The coronavirus pandemic and its negative impacts on the global economic activity largely dominated the financial markets which resulted in significant price losses on global equity and bond markets. In this context, most governments and central banks throughout the world have implemented substantial budget support and monetary easing to mitigate the impact of the health crisis on the global economic conditions and financial stability.

As far as developed countries are concerned, price losses were particularly pronounced in the categories of European and US equity UCIs. The support programme of the Japanese central bank for the stock market allowed the category of Japanese equity UCIs to end the month with less significant decreases.

Although all categories of emerging market equity UCIs also recorded significant decreases in this context, losses were particularly strong for the categories of Eastern European and Latin American equity UCIs in an environment characterised particularly by significant price losses of the main commodities and especially the oil price which fell following the disagreement between the countries exporting oil (members of the OPEC) and Russia on a limitation of their production. The drop of most of the emerging country currencies of these regions further exacerbated this decrease.

During March, the categories of equity UCIs registered a relatively large negative net capital investment, the highest net redemptions were recorded by the category of Japanese equity UCIs.

Development of equity UCIs during the month of March 2020*

* Variation in % of Net Assets in EUR as compared to the previous month

On both sides of the Atlantic, the coronavirus pandemic and its negative impacts on the global economic activity resulted in significant price losses throughout the different segments of the bond market. Corporate bonds were more affected with significant increases in risk premiums. In a context of a high risk aversion of investors and a decline in liquidity at the level of bond markets, the implementation by the Fed and the European Central Bank of substantial monetary easing measures enabled the stabilisation of bond markets and sustained also the prices of high-rated government bonds. Overall, the EUR- and USD-denominated bond UCIs recorded, in the context of these developments, sharp price falls during the month under review.

The category of emerging market bond UCIs registered a highly negative performance in a context marked by the spread of the coronavirus and the increased risk aversion of investors, resulting in the capital outflow from emerging countries, the increase in risk premiums and the accentuated depreciation of most of the emerging currencies.

In March the category of fixed-income UCIs registered an overall negative net capital investment. The categories of high yield and emerging market bond UCIs recorded the largest net redemptions, whereas the categories of EUR money market UCIs and global market money market UCIs were the only UCI categories which registered net subscriptions during the month under review.

Development of fixed-income UCIs during the month of March 2020*

* Variation in % of Net Assets in EUR as compared to the previous month

Diversified income UCIs and funds of funds have also experienced strong price losses in this context. The development of net assets of these UCIs is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of March 2020*

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following 14 undertakings for collective investment have been registered on the official list:

1) UCITS Part I 2010 Law:

- ABERDEEN STANDARD SICAV IV, 35A, avenue J-F Kennedy, L-1855 Luxembourg

- LAROUTE MANAGED OPPORTUNITIES, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- UNIINSTITUTIONAL GLOBAL CONVERTIBLES DYNAMIC, 308, route d’Esch, L-1471 Luxembourg

- UNINACHHALTIG UNTERNEHMENSANLEIHEN, 308, route d’Esch, L-1471 Luxembourg

2) UCIs Part II 2010 Law:

- HAMILTON LANE GLOBAL PRIVATE ASSETS FUND, 9, allée Scheffer, L-2520 Luxembourg

3) SIFs:

- CATELLA EUROPEAN RESIDENTIAL FUND III SCS SICAV-SIF, 14, rue Edward Steichen, L-2540 Luxembourg

- CBRE GLOBAL ALPHA QFPF PARALLEL FUND FCP-SIF, 177, rue de Luxembourg, L-8077 Bertrange

- FONDACO GLOBAL PRIVATE MARKETS FUND, 146, boulevard de la Pétrusse, L-2330 Luxembourg

- HEALTHCARE PROPERTY FUND EUROPE S.C.A., SICAV-SIF, 10, rue Edward Steichen, L-2540 Luxembourg

- LOGISTIS LUXEMBOURG INVESTMENTS S.A., 5, allée Scheffer, L-2520 Luxembourg

- MERCER PRIVATE INVESTMENT PARTNERS VI SICAV-SIF, 15, boulevard F.W. Raiffeisen, L-2411 Luxembourg

- QUATTRO STELLE SA, SICAV-SIF, 5, allée Scheffer, L-2520 Luxembourg

- SND S.C.A., SICAV-SIF, 111, route d’Arlon, L-8009 Strassen

- VER CAPITAL CREDIT PARTNERS SMES VII SA SICAV-SIF, 28-32, place de la Gare, L-1616 Luxembourg

4) SICARs:

- –

The following 26 undertakings for collective investment have been deregistered from the official list during the month under review:

1) UCITS Part I 2010 Law:

- BEST CHOICE, 1, rue du Potager, L-2347 Luxembourg

- DELTA FONDS GROUP, 6, rue Gabriel Lippmann, L-5365 Munsbach

- IFM-FLEXIBILITY, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- PAN-HOLDING, 19, rue de Bitbourg, L-1273 Luxembourg

- SCORE SPECIAL OPPORTUNITIES, 2, rue Edward Steichen, L-2540 Luxembourg

- SENTIMENT SICAV, 17, rue de Flaxweiler, L-6776 Grevenmacher

- UNIEURORENTA 5J, 308, route d’Esch, L-1471 Luxembourg

- UNIGARANT: EMERGING MARKETS (2020) II, 308, route d’Esch, L-1471 Luxembourg

- UNIGARANT: EMERGING MARKETS (2020), 308, route d’Esch, L-1471 Luxembourg

- VERMÖGENSMANAGEMENT ANLAGESTRATEGIE DEFENSIV, Bockenheimer Landstraße 42-44, D-60232 Frankfurt am Main1

2) UCIs Part II 2010 Law:

- AL INVESTMENTS, 5, allée Scheffer, L-2520 Luxembourg

- SABADELL SELECT FUND OF HEDGE FUNDS SICAV (LUXEMBOURG), 16, boulevard d’Avranches, L-1160 Luxembourg

- SCHRODER SMBC GLOBAL BOND SERIES, 5, rue Höhenhof, L-1736 Senningerberg

- TREETOP SCOLEA SICAV, 12, rue Eugène Ruppert, L-2453 Luxembourg

3) SIFs

- BGV III FEEDER 1 S.C.S., 6, rue Eugène Ruppert, L-2453 Luxembourg

- CENTRAL AMERICAN TIMBER FUND FCP-SIF, 6, route de Trèves, L-2633 Senningerberg

- COURANT SICAV-SIF, 2, boulevard de la Foire, L-1528 Luxembourg

- DB GERMAN RESIDENTIAL PROPERTIES SA, SICAV-FIS, 2, boulevard de la Foire, L-1528 Luxembourg

- EDMOND DE ROTHSCHILD O.F., 20, boulevard Emmanuel Servais, L-2535 Luxembourg

- FCS GESTION SICAV-SIF SCA, 2, boulevard de la Foire, L-1528 Luxembourg

- IBG GLOBAL FUNDS SICAV-SIF, 2, boulevard de la Foire, L-1528 Luxembourg

- LGT (LUX) AMBER ILS FUND, 5, rue Jean Monnet, L-2180 Luxembourg

- NEGENTROPY SICAV-SIF, 5, allée Scheffer, L-2520 Luxembourg

- SAVILLS IM ASIAN PROPERTY II SICAV-SIF, 10, rue C-M Spoo, L-2546 Luxembourg

- VCM GOLDING MEZZANINE SICAV II, 9A, rue Gabriel Lippmann, L-5365 Munsbach

4) SICARs:

- EDMOND DE ROTHSCHILD EUROPPORTUNITIES II S.C.A., SICAR, 20, boulevard Emmanuel Servais, L-2535 Luxembourg

1 Undertaking for collective investment for which the designated management company was authorised by the competent authorities of another Member State in accordance with Directive 2009/65/EC